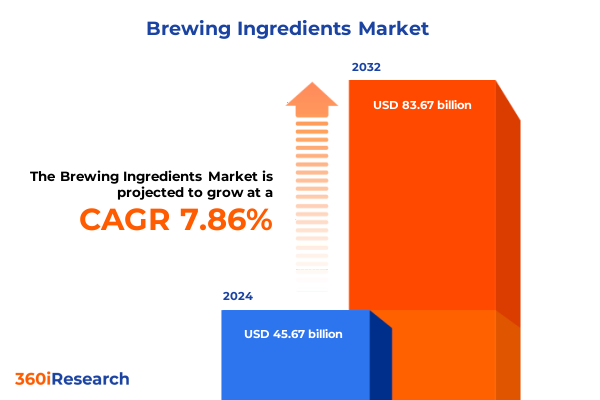

The Brewing Ingredients Market size was estimated at USD 48.43 billion in 2025 and expected to reach USD 51.36 billion in 2026, at a CAGR of 8.12% to reach USD 83.67 billion by 2032.

Comprehensive Exploration of Brewing Ingredient Trends and Market Dynamics Shaping the Future of Flavor Innovation and Quality Standards

In recent years, the brewing industry has undergone a profound evolution driven by consumer demand for unique flavor experiences, sustainability credentials, and product differentiation. At the heart of this transformation are the fundamental ingredients-malt, hops, yeast, adjuncts, and water treatment chemicals-that define beverage quality and operational efficiency. By examining these components in tandem, stakeholders can gain a holistic perspective on how ingredient innovations, evolving regulations, and shifting consumer preferences converge to shape competitive strategies.

Moreover, this report aims to illuminate the critical intersection of innovation and regulation, providing readers with actionable insights to navigate the increasingly complex market environment. The analysis explores macro trends such as the rise of craft and specialty brewing, the accelerating push for clean label and natural ingredient formulations, and the integration of advanced digital and analytical tools across the supply chain. Through this lens, decision-makers can appreciate the nuanced roles each ingredient category plays in delivering differentiated products while maintaining cost and quality targets.

By establishing a clear understanding of current drivers and challenges, this introduction sets the stage for an in-depth assessment of transformative shifts, the impact of recent trade policies, and the segmentation and regional profiles that define the global brewing ingredient landscape. The following sections provide both strategic context and tactical recommendations to empower brewers, ingredient suppliers, and investors in their pursuit of sustainable growth and market leadership.

Uncovering the Revolutionary Shifts Driving Ingredient Innovation Sustainability and Digital Transformation in Brewing Operations

Today’s brewing landscape is characterized by a wave of transformative shifts that are redefining ingredient innovation, operational efficiency, and consumer engagement. As sustainability imperatives intensify, brewers are increasingly sourcing raw materials with transparent traceability, reducing carbon footprints through local sourcing of base and specialty malts, and embracing circular economy practices for spent grains. Furthermore, demand for clean label solutions has catalyzed research into natural flavor adjuncts and the substitution of artificial additives with authentic fruit extracts and botanical spices.

Parallel to these sustainability initiatives, the digital revolution has permeated ingredient management, enabling real-time monitoring of mash viscosity, hop utilization rates, and fermentation kinetics. Brewers leverage IoT-enabled sensors and data analytics to optimize milling, mashing, and hopping processes, thereby enhancing consistency across production batches. In response to evolving consumer palates, innovative yeast strains-ranging from hybrid and wild cultures to specialized ale and lager blends-are engineered to deliver nuanced flavor profiles, faster maturation cycles, and enhanced stability.

Moreover, the surge in alternative and low-alcohol beverages is spurring collaboration between ingredient suppliers and craft brewers to develop novel grain varieties, including heritage and hybrid barleys, that offer functional benefits such as lower glycemic impact. This convergence of sustainability, digital transformation, and product innovation underscores a dynamic environment where agile ingredient strategies drive competitive differentiation and pave the way for the next generation of brewing excellence.

Analyzing How 2025 US Tariff Adjustments Are Reshaping Supply Chains Pricing Structures and Strategic Sourcing Decisions for Brewing Ingredients

In 2025, adjustments to U.S. tariff policies have exerted significant pressure on brewing ingredient supply chains and pricing frameworks. Increased duties on imported barley and malt from European and Canadian producers elevated raw material costs, prompting brewers to reassess sourcing strategies and accelerate investments in domestic malting capacity. As a result, many organizations pursued partnerships with local farmers to secure base malt varieties such as pale, pilsner, and Vienna malts grown under controlled agronomic conditions.

Meanwhile, higher tariffs on certain hop imports heightened demand for pelletized and extract forms produced domestically, driving consolidation among large-scale pellet producers and incentivizing technology upgrades for efficient pelletization and extract recovery. In contrast, yeast cultures-predominantly cultivated within the United States-remained insulated from tariff impacts, reinforcing the strategic value of domestically developed hybrid and wild strains. However, duty increases on imported adjunct extracts, fruits, and spices reshaped formulation practices by encouraging the use of domestically sourced natural flavors and in-house fruit processing.

These tariff-driven shifts have had a cumulative impact on contract negotiations, prompting brewers to adopt longer-term procurement agreements and implement hedging mechanisms to mitigate price volatility. Additionally, supply chain resilience initiatives, including diversified supplier portfolios and increased inventory buffers, have emerged as critical responses to evolving trade barriers. Collectively, the 2025 tariff environment has accelerated strategic sourcing transformations, compelling stakeholders to balance cost management with ingredient quality and innovation imperatives.

Deep Dive into Ingredient Segmentation Revealing Distinctive Roles of Malt Varieties Hops Forms Yeast Strains and Adjunct Innovations

A nuanced understanding of ingredient segmentation reveals distinct drivers and opportunities across the brewing supply chain. Malt, the backbone of beer production, is categorized into base varieties and specialty options. Base malts, including pale, pilsner, and Vienna, deliver essential fermentable sugars and enzymatic profiles that underpin both classic and innovative beer styles. Specialty malts such as caramel, chocolate, and roasted variants contribute color, body, and complex Maillard-derived flavor notes, enabling brewers to craft rich, nuanced beers from amber ales to imperial stouts.

Hops represent another critical segment with functionality spanning bittering, flavoring, and aroma contributions. Extract forms facilitate precise alpha acid dosing for consistent bitterness, while pelletized hops offer storage stability and efficient utilization rates. Whole cone hops, prized for their intact lupulin glands, remain the choice for artisanal brewers seeking authentic aroma nuances in dry hopping applications.

Yeast segmentation encompasses ale, hybrid, lager, and wild strains, each delivering unique fermentation kinetics and flavor expressions. Ale yeasts are renowned for robust ester profiles, hybrid strains blend ale and lager characteristics for versatile production workflows, lager yeasts ensure clean, crisp finishes at lower temperatures, and wild yeasts introduce complex phenolic and sour notes in specialty fermentations.

Adjuncts extend beyond fermentable sugars to include both artificial and natural flavors, a spectrum of fruit categories from berries and citrus to stone fruits, as well as innovative spice blends. These ingredients enable brewers to pivot quickly in response to seasonal demands and novel flavor trends. Finally, water treatment chemistries-spanning clarifiers, mineral additives, and pH adjusters-ensure consistent ion profiles and optimal mash conditions, thereby preserving product integrity and enabling style-specific water benchmarks.

This comprehensive research report categorizes the Brewing Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Form And Format

- Application

- End User

Navigating Regional Dynamics Reveals Varied Demand Profiles Regulatory Landscapes and Innovation Drivers Across the Global Brewing Ingredient Market

Regional dynamics profoundly influence ingredient selection, production methods, and regulatory compliance. In the Americas, a mature craft beer culture has driven continuous innovation in base and specialty malts, with a strong emphasis on locally sourced grains that reinforce brand authenticity. Brewers benefit from ample hop acreage across the Pacific Northwest, enabling broad access to pellet and whole cone varieties, while yeast manufacturers collaborate closely with local breweries to tailor strain portfolios that match evolving style demands.

Transitioning to Europe, the Middle East & Africa, ingredient stakeholders face a multifaceted environment shaped by stringent labeling requirements and sustainability regulations. European producers leverage established malting traditions, refining base malt profiles to accommodate both traditional lager production and burgeoning craft segments. In regions of the Middle East & Africa, stringent import controls and limited domestic hop cultivation encourage reliance on extract and pellet forms, while yeast and adjunct suppliers innovate portable, shelf-stable formulations to meet diverse festival-driven consumption patterns.

In the Asia-Pacific, rapid market expansion and rising disposable incomes fuel demand for flavored and low-alcohol variants. Local maltsters are exploring hybrid barley cultivars to optimize yield under tropical climates, whereas hop importers prioritize extract and pellet formats to minimize logistics costs. Adjuncts featuring indigenous fruits and spices cater to regional taste preferences, while water treatment providers adapt modular clarifier and pH adjustment systems for variable water sources across geographically dispersed brewing operations.

This comprehensive research report examines key regions that drive the evolution of the Brewing Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Ingredient Suppliers Illuminates Strategic Partnerships Innovation Highlights and Competitive Strategies Shaping Industry Leadership

Leading ingredient suppliers are forging strategic alliances, investing in research and development, and driving supply chain integration to secure competitive advantage. Major malt producers have expanded domestic capacity through acquisitions of regional malt houses and partnerships with agricultural cooperatives, accelerating the availability of specialty malts and fortified base malts tailored for evolving beer styles. Simultaneously, leading hop suppliers have scaled pelletization and extract technologies to meet precision dosing requirements and support sustainability initiatives through carbon-efficient processing facilities.

Yeast companies distinguish themselves by cultivating proprietary strain libraries that address fermentation efficiency, flavor nuance, and stress tolerance. Collaborative programs with craft breweries have yielded hybrid and wild yeast offerings that reduce maturation timelines and introduce unique sensory experiences. In tandem, adjunct and flavor suppliers leverage advanced extraction platforms to deliver both artificial and natural flavor systems, as well as freeze-dried and purified fruit components, enabling brewers to innovate with minimal process disruption.

Water treatment providers round out the competitive landscape by supplying clarifiers, mineral additives, and pH adjusters designed for both continuous and batch-based operations. Integrated service models offer on-site water profiling and treatment regimen optimization, ensuring consistency across regional operations while adhering to local regulatory standards. Collectively, these strategic initiatives underscore how leading firms are aligning their portfolios to address cost pressures, sustainability mandates, and the relentless pursuit of product differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brewing Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Angel Yeast Co., Ltd.

- BarthHaas GmbH & Co. KG

- Boortmalt NV

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- Crisp Malt Limited

- GrainCorp Limited

- Groupe Soufflet

- Kerry Group plc

- Lallemand Inc.

- Lesaffre SA

- Malteurop SA

- Rahr Corporation

- Viking Malt Oy

- Yakima Chief Hops, LLC

Implementing Tactical Recommendations Enables Brewing Ingredient Stakeholders to Enhance Resilience Drive Innovation and Capitalize on Emerging Opportunities

To thrive amid evolving ingredient complexities and regulatory pressures, industry leaders must adopt multi-faceted strategies that balance innovation with supply chain resilience. First, securing diversified sourcing channels for base and specialty malts mitigates exposure to tariff fluctuations and agricultural variability. By establishing direct partnerships with multiple regional growers, brewers can ensure consistent quality and foster co-branding opportunities that reinforce authenticity.

Simultaneously, investing in advanced digital platforms for ingredient traceability and process analytics empowers decision-makers to optimize hop utilization, monitor fermentation performance, and adjust water treatment parameters in real time. Collaboration with yeast suppliers on customized strain development can accelerate time-to-market for novel beer styles while enhancing production efficiency.

Furthermore, integrating sustainable adjunct solutions-ranging from natural flavor extracts to in-house fruit processing-enables rapid response to consumer flavor trends without reliance on high-tariff imports. Complementing these efforts with targeted water management protocols reduces operational waste and supports environmental stewardship commitments. By implementing these recommendations, brewing industry leaders can unlock new avenues for cost optimization, product innovation, and long-term competitive differentiation.

Detailed Overview of Research Methodology Emphasizes Rigorous Data Collection Validation and Triangulation Approaches Ensuring Comprehensive Insights

This report synthesizes qualitative and quantitative research methodologies to ensure robust and reliable insights. Primary research involved in-depth interviews with senior executives across brewing operations, ingredient suppliers, and industry consultants. These conversations provided firsthand perspectives on supply chain dynamics, innovation priorities, and regulatory impacts.

Complementing primary inputs, a comprehensive review of secondary sources-including trade association publications, ingredient patent filings, and peer-reviewed journals-established a foundational understanding of emerging trends and technological advancements. Researchers corroborated data points through cross-verification with customs and import statistics, supplier price lists, and independent cost models to validate tariff impact assessments.

To reinforce analytical integrity, the study employed triangulation techniques, integrating qualitative observations with quantitative proxies for ingredient utilization and procurement patterns. A structured peer review process involving domain experts further refined key findings and ensured methodological rigor. This multi-layered approach delivers a balanced, evidence-based analysis that underpins the strategic recommendations presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brewing Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brewing Ingredients Market, by Ingredient Type

- Brewing Ingredients Market, by Form And Format

- Brewing Ingredients Market, by Application

- Brewing Ingredients Market, by End User

- Brewing Ingredients Market, by Region

- Brewing Ingredients Market, by Group

- Brewing Ingredients Market, by Country

- United States Brewing Ingredients Market

- China Brewing Ingredients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Summarizing Key Findings Highlights Industry Impact and Future Directions for Brewing Ingredients Emphasizing Strategic Imperatives for Stakeholders

This study underscores the pivotal role of ingredient innovation, regulatory influences, and strategic sourcing in shaping the competitive brewing landscape. From the growing emphasis on sustainability and digital transformation to the tangible effects of the 2025 U.S. tariff adjustments, brewing stakeholders face a complex interplay of cost, quality, and consumer-driven imperatives that demand agile responses.

Segmentation analysis highlights how distinct ingredient categories-from pale and specialty malts to diverse yeast strains and custom adjunct systems-offer differentiated pathways for product development and operational optimization. Meanwhile, regional insights reveal the importance of aligning ingredient portfolios with local regulations, consumer preferences, and logistical realities across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

As leading suppliers continue to innovate and expand their capabilities, industry participants must adopt a holistic approach that integrates supply chain resilience, targeted R&D partnerships, and advanced analytics. By applying the actionable recommendations outlined herein, brewing organizations are well positioned to navigate tariff volatility, seize emerging market niches, and deliver sustainable growth. Future success hinges on a relentless focus on ingredient excellence, strategic foresight, and collaborative innovation.

Engage with Associate Director Ketan Rohom to Access Exclusive Market Intelligence and Secure Your Comprehensive Brewing Ingredient Report Today

For an in-depth exploration of brewing ingredient dynamics covering tariff impacts, segmentation nuances, and regional and competitive analyses, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can guide you through comprehensive insights on malt variety innovations, hops form preferences, yeast strain developments, adjunct applications, and advanced water treatment solutions. By partnering with Ketan, you’ll obtain tailored intelligence to optimize sourcing strategies, mitigate tariff-driven risks, and capitalize on emerging opportunities within each region’s regulatory and consumer landscape. Secure access to expert-driven recommendations, actionable roadmaps, and methodological rigor that empower decision-makers to drive sustainable growth and competitive differentiation in the brewing industry. Contact Ketan Rohom today to purchase the full market research report and transform your understanding of the brewing ingredients sector into strategic advantage.

- How big is the Brewing Ingredients Market?

- What is the Brewing Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?