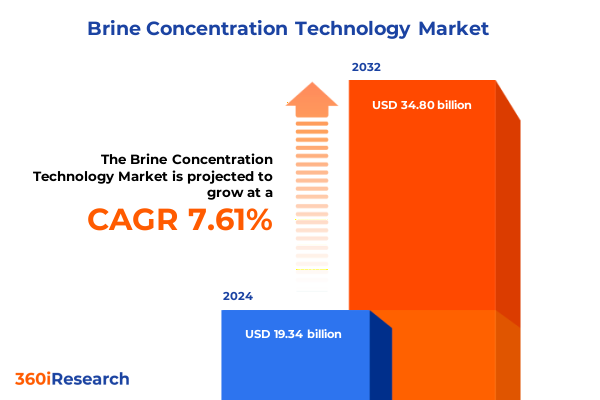

The Brine Concentration Technology Market size was estimated at USD 20.82 billion in 2025 and expected to reach USD 22.22 billion in 2026, at a CAGR of 7.61% to reach USD 34.80 billion by 2032.

Understanding the Rising Imperative of Advanced Brine Concentration Technology Amid Intensifying Global Water Scarcity and Regulatory Sustainability Pressures

The critical importance of efficient wastewater management and resource recovery has propelled brine concentration technology into the spotlight, driven by escalating water scarcity concerns and stringent environmental regulations. As industrial and municipal operators face mounting pressure to reduce discharge volumes and recover valuable byproducts, advanced concentration systems are becoming indispensable components of integrated water treatment strategies. This report’s introduction establishes a foundational understanding by examining the imperatives that underpin current market dynamics, including global water stress, regulatory stringency, and the pursuit of circular economy principles.

In recent years, heightened awareness of water reuse and zero liquid discharge has underscored the necessity of effective brine concentration solutions, fostering innovation across thermal, membrane, and hybrid approaches. The introduction delves into the evolution of these technologies, their respective strengths and limitations, and the factors influencing end-user selection criteria. By framing the discussion around key drivers-such as energy efficiency, total cost of ownership, and recovery yields-this section lays the groundwork for subsequent analyses, positioning brine concentration technology as a pivotal enabler of sustainable water and mineral management practices.

Navigating Pivotal Technological and Market Disruptions Shaping the Future of Brine Concentration Solutions Across Industries and Applications

The brine concentration landscape is experiencing transformative shifts, propelled by technological breakthroughs, cost pressures, and evolving stakeholder expectations. In the membrane sector, significant advancements in nanofiltration, reverse osmosis, and ultrafiltration membranes have boosted selectivity and throughput, driving down operational expenses. On the thermal front, innovations in multi-effect distillation, multi-stage flash, and vapor compression systems have enhanced energy integration, reducing the specific energy consumption per unit of brine processed. Furthermore, a new breed of hybrid membrane-thermal solutions has emerged, melding the high recovery characteristics of thermal processes with the low‐energy footprint of membrane operations.

Concurrently, digitalization is revolutionizing system monitoring and control, with predictive analytics and real-time data acquisition enabling proactive maintenance and optimized performance. These digital tools are facilitating remote operations and contributing to reducing unplanned downtime, thereby improving the reliability of brine concentration assets. Market participants are also responding to tightening discharge regulations by investing in modular, scalable units capable of zero liquid discharge, while research efforts focus on minimizing chemical pretreatment and scaling potential. Together, these shifts are redefining the competitive landscape, compelling stakeholders to embrace integrated, data-driven approaches to deliver higher performance and lower lifecycle costs.

Assessing the Broad Economic and Operational Consequences of Newly Implemented United States Tariffs on Brine Concentration Technology in 2025

The introduction of new United States tariffs in 2025 has had a substantial impact on the brine concentration technology supply chain and cost structures. By imposing additional duties on imported membrane elements, heat exchanger components, and proprietary pretreatment modules, these measures have elevated capital expenditures for both domestic integrators and end users. In response, project developers are grappling with higher upfront equipment costs and reassessing procurement strategies to mitigate financial risks. This section examines how the tariffs have reshaped sourcing decisions, prompting increased interest in domestic manufacturing partnerships and technology transfer agreements.

Moreover, the tariff landscape has influenced deployment timelines and project economics, as prolonged lead times for imported modules have driven operators to explore alternative suppliers or retrofit existing installations. The ripple effects extend to service providers and aftermarket vendors, who face margin pressures from escalated spare-parts costs. However, some market participants view the tariffs as a catalyst for local innovation, accelerating investments in US-based membrane research and thermal system design. This shift may ultimately strengthen the domestic brine concentration ecosystem, fostering a more resilient supply chain and stimulating competition within the national market.

Unveiling Strategic Market Segmentation Perspectives to Illuminate Distinct Technology, Industry, Source, Application, Output, and Capacity Dynamics

Market segmentation offers critical clarity into the intricate dynamics of brine concentration technology, distinguishing the roles of diverse solution types, end-user needs, feedwater origins, applications, product outputs, and scale thresholds. Technology segmentation delineates three primary categories: hybrid systems that integrate membrane and thermal processes, standalone membrane options encompassing nanofiltration, reverse osmosis, and ultrafiltration, and thermal configurations such as multi-effect distillation, multi-stage flash, and vapor compression. Each approach presents a unique trade-off between energy intensity, recovery efficiency, and operational complexity.

End-user segmentation reveals that chemicals producers, food and beverage manufacturers, mining operations, oil and gas facilities, and power generation plants each demand tailored performance profiles, with recovery rates and contaminant profiles dictating technology suitability. Brine sources-from industrial effluent streams to municipal wastewater, produced water from hydrocarbon extraction, and seawater-impose distinct pretreatment and concentrator design considerations. Application segmentation further clarifies market distinctions by separating desalination for potable reuse, mineral recovery processes, water reuse initiatives, and zero liquid discharge requirements, each influencing system configuration.

Product output segmentation distinguishes between systems designed to yield concentrated brine streams, purified fresh water, extracted minerals, or refined salt, reflecting divergent value capture strategies. Capacity range segmentation categorizes installations into large-scale centralized plants, mid-scale industrial modules, and compact small-scale units for remote or modular deployment. By mapping these intersecting dimensions, stakeholders gain nuanced insight into market corridors, enabling precise alignment of technology portfolios with customer requirements.

This comprehensive research report categorizes the Brine Concentration Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Brine Source

- Product Output

- Capacity Range

- End User Industry

- Application

Highlighting Diverse Regional Market Dynamics and Emerging Opportunities Spanning the Americas, Europe Middle East and Africa, and Asia Pacific Territories

Regional perspectives reveal heterogeneous demand drivers and investment climates across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, water-stressed regions in the southwestern United States and arid zones of Mexico are fueling demand for high-efficiency membrane and hybrid concentration solutions, while tightening discharge regulations in Canada emphasize zero liquid discharge capabilities. Public–private partnerships are emerging to address aging water infrastructure, and tax incentives are incentivizing domestic manufacturing of advanced concentrators.

In Europe Middle East and Africa, desalination initiatives in the Gulf states dominate large-scale thermal installations, while stringent nutrient and salinity limits in European Union member states are accelerating adoption of membrane and hybrid systems for industrial effluent management. African nations are beginning to invest in modular small-scale units to serve remote communities, supported by development finance and sustainability mandates. Collaborative funding models between governments and private utilities are shaping project feasibility across these diverse geographies.

Asia Pacific stands out for rapid capacity expansions in China, India, and Australia, where industrial growth and agricultural irrigation demands necessitate large-scale brine concentration deployments. Regional trade agreements and government subsidies are encouraging localized production of membranes and heat recovery equipment. The Asia Pacific market is also a hotbed for pilot projects testing next-generation materials and digital monitoring platforms, positioning the region at the forefront of technological validation and large-volume deployments.

This comprehensive research report examines key regions that drive the evolution of the Brine Concentration Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Key Players Driving Competitive Performance in the Evolving Brine Concentration Technology Market Landscape

The competitive landscape is defined by a mix of established water treatment conglomerates, specialized technology providers, and innovative start-ups. Leading international engineering and services firms have expanded their brine concentration portfolios through strategic acquisitions and technology partnerships, broadening offerings that span membrane modules to integrated thermal solutions. Meanwhile, membrane manufacturers are investing heavily in research and development to introduce higher-rejection membranes and fouling-resistant coatings, aiming to capture market share in both new and retrofit projects.

Specialist firms focusing solely on brine concentration are differentiating through modular design, digital monitoring systems, and service-based business models, enabling faster deployment and performance guarantees. Moreover, collaborative ventures between technology providers and wastewater utility operators are emerging, fostering joint innovation on zero liquid discharge solutions tailored to unique regional discharge standards. As global players scale up production capacities, regional specialists are leveraging local knowledge and agile manufacturing to address specific feedwater chemistries and regulatory requirements. This competitive interplay is driving continuous performance improvements and cost reductions across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brine Concentration Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval Corporate AB

- Andritz AG

- Desalitech Ltd.

- Doosan Enerbility Co., Ltd.

- Enviro Water Minerals Company

- Evoqua Water Technologies LLC

- GEA Group Aktiengesellschaft

- Gradiant Corporation

- H2O Innovation Inc.

- Hitachi, Ltd.

- Hyflux Ltd.

- IDE Technologies Ltd.

- Koch Separation Solutions, Inc.

- Membrane Systems Inc.

- Mitsubishi Heavy Industries, Ltd.

- Modern Water plc

- Pall Corporation

- ROPV Ltd.

- Saltworks Technologies Inc.

- SUEZ S.A.

- Toray Industries, Inc.

- Trevi Systems Inc.

- Veolia Environnement S.A.

Implementing Strategic Action Plans and Operational Best Practices to Optimize Brine Concentration Processes and Maximize Value Creation

Industry leaders seeking to strengthen their market position in brine concentration technology should prioritize collaborative research initiatives that accelerate the development of next-generation membranes and energy-efficient thermal processes. Aligning with academic and national laboratory partners can unlock breakthrough materials and process optimizations that reduce fouling potential and energy consumption. At the same time, companies are advised to explore flexible manufacturing strategies, such as localized membrane fabrication and modular system assembly, to mitigate tariff impacts and supply chain disruptions.

Operational excellence can be further enhanced by deploying advanced analytics platforms that integrate real-time sensor data with predictive maintenance algorithms, minimizing unplanned downtime and optimizing energy usage. Decision-makers should also evaluate the adoption of hybrid configurations that combine membrane pretreatment with low-temperature thermal recovery to achieve higher overall recovery ratios. Engaging proactively with regulators to anticipate future discharge standards and securing pilot-scale demonstration projects will position organizations to capture early mover advantages. Ultimately, a balanced approach that blends technology innovation, digital integration, and strategic partnerships will drive sustainable value creation in this competitive environment.

Employing Robust Research Methodology and Data Collection Approaches Ensuring Comprehensive Insights into Brine Concentration Technology Trends

This research employs a rigorous methodology combining primary and secondary approaches to ensure comprehensive and credible insights. Primary research involved structured interviews with senior executives and technical experts across leading water treatment companies, project developers, and end-user organizations to capture nuanced perspectives on technology performance, adoption hurdles, and regulatory influences. Secondary research incorporated an extensive review of regulatory filings, industry white papers, patent databases, and academic journals, providing context on emerging materials, process innovations, and policy developments.

Segmentation analyses were performed by mapping solution types, application areas, and capacity ranges against regional and end-user criteria, enabling precise market delineation. Data triangulation techniques cross-checked insights from multiple sources, ensuring consistency and reliability. Throughout the study, an expert panel comprising process engineers, environmental consultants, and supply chain specialists validated key findings and refined interpretation. This multi-layered approach assures that the report’s conclusions and recommendations rest on a solid evidentiary foundation, equipping stakeholders with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brine Concentration Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brine Concentration Technology Market, by Technology

- Brine Concentration Technology Market, by Brine Source

- Brine Concentration Technology Market, by Product Output

- Brine Concentration Technology Market, by Capacity Range

- Brine Concentration Technology Market, by End User Industry

- Brine Concentration Technology Market, by Application

- Brine Concentration Technology Market, by Region

- Brine Concentration Technology Market, by Group

- Brine Concentration Technology Market, by Country

- United States Brine Concentration Technology Market

- China Brine Concentration Technology Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Strategic Perspectives to Drive Future Growth and Sustainable Performance in the Brine Concentration Technology Ecosystem

In summary, brine concentration technology is poised to play a pivotal role in addressing critical challenges related to water scarcity, waste management, and resource recovery. By embracing diverse solution architectures-ranging from advanced membranes and thermal systems to integrated hybrid approaches-industry participants can meet evolving regulatory demands and capture emerging revenue streams from mineral recovery and water reuse. Regional variances underscore the importance of tailoring technology strategies to localized feedwater characteristics, policy landscapes, and investment climates.

Looking ahead, the interplay between tariff-induced supply chain shifts, ongoing digital transformation, and heightened sustainability imperatives will continue to shape market trajectories. Companies that invest in research collaborations, modular manufacturing models, and predictive analytics will be best positioned to unlock performance gains and cost efficiencies. As the market matures, proactive engagement with policymakers and strategic demonstration projects will be critical to securing early mover advantages. This report’s comprehensive analysis offers a blueprint for informed decision-making, empowering stakeholders to harness the full potential of brine concentration technology in an increasingly resource-constrained world.

Engaging with Ketan Rohom to Secure Your Comprehensive Market Research Report and Unlock Advanced Strategic Insights for Brine Concentration Technology

To secure a comprehensive market research report that offers in-depth strategic insights, industry leaders and decision-makers are encouraged to engage directly with Ketan Rohom. As Associate Director of Sales & Marketing, Ketan Rohom offers personalized guidance to navigate the report’s detailed findings and tailor them to specific organizational priorities. By reaching out, stakeholders can leverage a collaborative discussion to align the research deliverables with critical business objectives, ensuring that the unique challenges and opportunities within the brine concentration technology landscape are addressed effectively.

Collaborating with Ketan Rohom will facilitate an accelerated pathway to actionable intelligence, enabling market participants to capitalize on emerging trends, optimize technology selection, and refine investment strategies. This engagement also provides direct access to additional services such as custom data analysis, executive briefings, and ongoing advisory support. Organizations that partner through this call-to-action will benefit from enhanced clarity on regulatory impacts, segmentation dynamics, and competitive positioning, thereby driving more informed decision-making and sustainable growth initiatives.

To arrange a consultation and obtain the full market research report, please contact Ketan Rohom to discuss your unique requirements and receive a tailored proposal that empowers your organization to lead in the rapidly evolving brine concentration technology market.

- How big is the Brine Concentration Technology Market?

- What is the Brine Concentration Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?