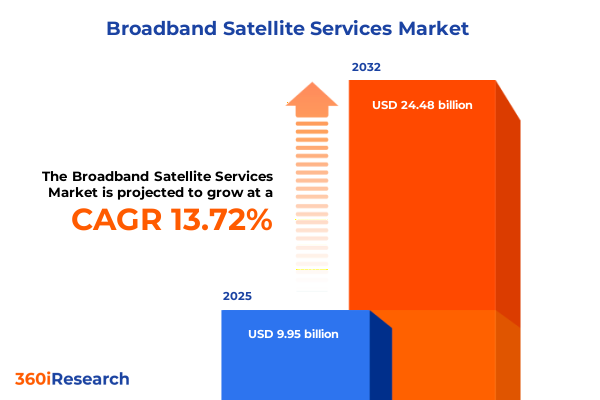

The Broadband Satellite Services Market size was estimated at USD 9.95 billion in 2025 and expected to reach USD 11.21 billion in 2026, at a CAGR of 13.72% to reach USD 24.48 billion by 2032.

Exploring the Evolving Paradigm of Broadband Satellite Services as a Catalyst for Global Connectivity and Strategic Market Differentiation

The global digital transformation has accelerated the demand for ubiquitous, high-speed connectivity, positioning broadband satellite services as a vital complement to traditional terrestrial networks. As remote work, online education, telemedicine, and streaming entertainment continue to proliferate, satellite-based broadband has emerged from niche applications to mainstream viability. Advances in satellite design, notably the advent of high-throughput payloads and software-defined architectures, have significantly reduced cost per bit while enhancing capacity and resilience. Moreover, recent innovations in low Earth orbit constellations have introduced latency profiles and coverage footprints that rival fiber-based solutions, thereby addressing long-standing challenges in rural and underserved regions.

Against this backdrop, industry stakeholders face a nuanced landscape characterized by converging technological capabilities and evolving consumer expectations. Service providers are compelled to reassess their network architectures to accommodate next-generation user demands, while equipment manufacturers seek to optimize supply chains in a dynamic geopolitical environment. This executive summary provides a structured orientation for executives, investors, and policy leaders who must evaluate emerging trends, assess regulatory impacts, and formulate strategies that harness the full potential of satellite-enabled broadband connectivity.

Assessing the Disruptive Technological and Regulatory Shifts Reshaping the Broadband Satellite Landscape in the 2020s

Broadband satellite services have undergone a series of transformative shifts driven by technological breakthroughs, regulatory reforms, and market realignments. On the technological front, the deployment of low Earth orbit constellations has dramatically reduced roundtrip latency, enabling use cases once thought exclusive to terrestrial fiber. At the same time, the integration of digital payloads and phased array antennas has unlocked adaptive beamforming, dynamic spectrum allocation, and software-based reconfiguration that optimize network efficiency in real time. These capabilities are increasingly critical as service providers contend with heterogeneous traffic profiles spanning residential broadband, enterprise networking, maritime mobility, and airborne connectivity.

Simultaneously, regulatory frameworks have adapted to accommodate the commercial ambitions of new satellite entrants, while spectrum authorities are refining allocation processes to ensure coexistence across C-band, Ku-band, and Ka-band services. In parallel, the emergence of multi-orbit hybrid networks-with geostationary high-throughput satellites operating alongside medium and low Earth orbit platforms-has fostered novel business models that leverage the strengths of each orbit class. Stakeholders are now exploring managed service bundles, customizable quality-of-service agreements, and revenue-sharing partnerships that transcend traditional capacity leasing. As a result, the market is transitioning from its legacy structure of point-to-point trunking toward flexible, software-defined ecosystems that can be rapidly scaled to meet evolving demand.

Analyzing the Aggregate Effects of United States 2025 Tariff Policies on the Broadband Satellite Equipment and Service Supply Chain

In early 2025, the United States government enacted supplementary tariff measures targeting satellite subsystem imports, component subassemblies, and ground station hardware originating from selected jurisdictions. These additional duties have elevated landed costs for key materials, including advanced electronics, antenna assemblies, and radiofrequency filters. Consequently, equipment manufacturers have faced margin compression, prompting the establishment of alternative supply chains and accelerated onshoring initiatives. Providers that previously relied on established global suppliers have initiated longer procurement lead times, restructured contracts to include tariff mitigation clauses, and explored strategic inventory buffering.

While the immediate effect of increased import costs has constrained capital expenditure on next-generation ground terminals, there has been a parallel policy response in the form of domestic incentive programs and research grants aimed at bolstering local production capabilities. These developments have catalyzed collaboration between federal agencies and private-sector consortia to accelerate the qualification of domestic foundries and specialized component fabricators. In aggregate, the 2025 tariff environment has reshaped procurement strategies, driven consolidation among smaller suppliers, and underscored the imperative for diversified, resilient supply ecosystems. As industry participants adapt, the long-term impact will hinge on the balance between protective trade measures and incentivization of indigenous manufacturing.

Unveiling Strategic Market Segmentation Insights That Illuminate Application Platforms Frequency Bands Service Types and End User Preferences

A granular examination of market segmentation yields critical insights into demand dynamics and technology adoption pathways. Application segmentation underscores that broadband access encompasses both fixed infrastructure-serving residential and enterprise endpoints-and mobile access across maritime, vehicle-mounted, and portable terminals. In broadcast media, content distributors leverage satellite backhaul to deliver linear and nonlinear programming to remote affiliates, while enterprise networking deploys dedicated links for secure, high-bandwidth connectivity in sectors such as oil and gas, emergency response, and remote campus operations.

Platform differentiation reveals a spectrum from small aperture terminals optimized for consumer and small-business use cases to very small aperture terminals that support beyond-line-of-sight mobility, all the way to VSAT architectures, which bifurcate into fixed and mobile variants. Further complexity emerges in the frequency band segmentation, where C-band offers robust weather resilience and long-haul reach, Ku-band provides balanced throughput and antenna size, and Ka-band delivers higher capacity albeit with increased rain fade sensitivity. Service type analysis highlights distinct go-to-market models: consumer offerings may adopt postpaid subscription or prepaid voucher structures, enterprise clients select between dedicated leased circuits or managed service packages, and government and defense procure high-assurance connectivity with stringent service level agreements.

Evaluating end-user verticals clarifies that aviation demands ultra-low latency for passenger connectivity and cockpit data, maritime operators require seamless handover across coverage zones, government and defense sectors prioritize secure, priority-access links, and residential subscribers focus on cost-effective, high-speed internet to support livestreaming, telehealth, and remote education. These segmentation insights inform product roadmaps, pricing frameworks, and channel strategies as market participants tailor their solutions to discrete needs across the value chain.

This comprehensive research report categorizes the Broadband Satellite Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Frequency Band

- Service Type

- Application

- End User

Deriving Pivotal Regional Perspectives Across the Americas Europe Middle East Africa and Asia Pacific Broadband Satellite Markets

Regional dynamics exert a profound influence on broadband satellite services deployment strategies and investment priorities. In the Americas, vast rural expanses and underserved communities have spurred public–private partnerships to fund last-mile connectivity via satellite linkups, while large-scale enterprises leverage hybrid fiber-satellite backhaul to optimize redundancy and performance across continental operations. Regulatory bodies in North and South America are progressively harmonizing spectrum policies, facilitating cross-border roaming arrangements, and implementing universal service mandates that include satellite-delivered broadband as an eligible technology.

Across Europe, the Middle East, and Africa, diverse economic landscapes and regulatory environments have yielded a mosaic of adoption rates. European nations converge on high-capacity Ka-band allocations to support digital transformation initiatives, whereas Middle Eastern governments prioritize satellite networks for secure government communications and energy-sector monitoring. In Africa, the digital divide remains acute in remote regions, catalyzing low-cost VSAT and very small aperture solutions to bridge gaps in education, healthcare, and agricultural services. Meanwhile, in the Asia-Pacific region, exponential growth in smart city deployments, maritime trade lanes, and island economies has driven demand for both geostationary high-throughput satellites and emergent low Earth orbit constellations to ensure ubiquitous, resilient connectivity.

This comprehensive research report examines key regions that drive the evolution of the Broadband Satellite Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positions and Competitive Dynamics of Leading Corporations Driving Innovation in Broadband Satellite Services

The competitive landscape is anchored by established and emerging players vying to define the future of broadband satellite connectivity. SpaceX’s Starlink has disrupted legacy paradigms with its expansive low Earth orbit network, delivering sub-30 millisecond latency and aggressive pricing to consumer and enterprise markets alike. OneWeb, in strategic partnership with leading satellite operators, has focused on government and connectivity bundling, leveraging medium Earth orbit nodes to complement geostationary coverage. Legacy geosynchronous high-throughput providers such as SES and Eutelsat continue to upgrade their fleets with digital payloads and flexible beam patterns to optimize spectrum utilization and support diverse applications.

In parallel, Viasat and Hughes Network Systems maintain leadership in specialized verticals, from aeronautical broadband for commercial airlines to secure, priority-based government communications platforms. Emerging initiatives-such as Amazon’s Project Kuiper and Telesat’s LEO constellation-have injected additional capital and innovation into the sector, prompting incumbent alliances and potential mergers to secure market share. Across all tiers, strategic joint ventures, multi-orbit interoperability partnerships, and reseller ecosystems have become central to scaling service footprints and accelerating time to market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Broadband Satellite Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Al Yah Satellite Communications Company

- Asia Satellite Telecommunications Company Limited

- Avanti Communications Group plc

- Eutelsat Communications S.A.

- Freedomsat by Bentley-Walker Limited

- Hughes Network Systems, LLC

- Inmarsat Global Limited by Viasat, Inc.

- Intelsat General Corporation

- Iridium Communications Inc.

- Kepler Communications Inc.

- SES S.A.

- Singapore Telecommunications Limited

- Space Exploration Technologies Corp.

- Space Norway AS

- Speedcast International Ltd.

- Telesat Corporation

- Viasat, Inc.

Actionable Strategic Recommendations to Propel Industry Leaders Toward Sustainable Growth Resilience and Competitive Advantage

Industry leaders must adopt a forward-looking posture that combines technology investment, agile partnerships, and proactive policy engagement. Prioritizing capital allocation for low Earth orbit and hybrid network architectures will be critical to unlocking new use cases that require low latency and global reach. At the same time, companies should diversify their frequency band portfolios, balancing high-capacity Ka-band services with weather-resilient C-band and mid-range Ku-band offerings to maximize operational reliability across geographies.

In terms of ecosystem development, forging alliances with terrestrial telecom operators, cloud service providers, and systems integrators will accelerate end-to-end solution delivery, while co-investment in ground infrastructure-such as next-generation ground stations and user terminals-can reduce unit costs and streamline deployment timelines. Engagement with regulatory bodies is equally essential: contributing to spectrum policy discussions, demonstrating the socioeconomic benefits of satellite broadband, and aligning with universal service objectives will enhance license certainty and expedite market entry. Finally, establishing rigorous supply chain risk management and local manufacturing partnerships can mitigate tariff-related disruptions and foster long-term resilience.

Detailing a Rigorous Research Methodology Employing Multisource Data Collection Qualitative Validation and Quantitative Triangulation

This research leverages a multifaceted methodology that integrates secondary data analysis, primary stakeholder engagements, and advanced quantitative modeling. Secondary sources include regulatory filings, corporate investor presentations, publicly available patents, industry white papers, and academic research to establish a comprehensive baseline of current and emerging technologies. These insights were triangulated against supply chain databases and spectrum allocation records to ensure that all technical and regulatory dimensions are accurately represented.

Complementing this, primary research encompassed structured interviews with senior executives from satellite operators, equipment manufacturers, system integrators, and key end users across aviation, maritime, government, and residential segments. In addition, surveys of technology decision-makers quantified priority use cases, procurement criteria, and willingness to pay under varying service configurations. Data integrity was maintained through cross-validation techniques, and all findings were subjected to rigorous internal peer review. The combined qualitative and quantitative approach ensures that the analysis reflects both market realities and future trajectories with high confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Broadband Satellite Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Broadband Satellite Services Market, by Platform

- Broadband Satellite Services Market, by Frequency Band

- Broadband Satellite Services Market, by Service Type

- Broadband Satellite Services Market, by Application

- Broadband Satellite Services Market, by End User

- Broadband Satellite Services Market, by Region

- Broadband Satellite Services Market, by Group

- Broadband Satellite Services Market, by Country

- United States Broadband Satellite Services Market

- China Broadband Satellite Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Broad Implications and Strategic Imperatives Emerging From the Broadband Satellite Services Landscape

The broadband satellite services sector stands at a critical inflection point, propelled by rapid technological progression, shifting regulatory landscapes, and evolving customer expectations. From the proliferation of low Earth orbit constellations to the refinement of digital payload architectures, each development reinforces the sector’s potential to deliver reliable, high-speed connectivity to every corner of the globe. At the same time, the cumulative impact of policy measures-including the 2025 tariff environment-underscores the importance of supply chain agility and stakeholder collaboration.

As decision-makers chart their strategic roadmaps, the insights presented herein offer a coherent framework for aligning product innovation, regional deployment strategies, and partnership models. By embracing a segmentation-driven approach, targeting high-potential regional markets, monitoring competitor dynamics, and applying the recommended strategic levers, organizations can navigate uncertainty and realize the full value proposition of broadband satellite services. The future of global connectivity will be defined by those who integrate foresight with execution, leveraging the unique strengths of satellite systems to bridge digital divides and enable the next generation of networked applications.

Connect With Ketan Rohom to Secure a Customized In-Depth Broadband Satellite Services Market Research Report and Empower Data Driven Decisions

In today’s rapidly evolving connectivity landscape, decision-makers and solution architects alike require comprehensive insights to navigate the complexities of the broadband satellite services sector. With unparalleled expertise in satellite communications research, Ketan Rohom, Associate Director, Sales & Marketing, invites you to secure a tailored market research dossier that aligns with your strategic objectives and operational imperatives.

By reaching out directly to Ketan, you can obtain a customized executive briefing, sample data extracts, and a strategic consultation that will empower your organization to capitalize on emerging opportunities. Whether you are evaluating new entry strategies, optimizing current deployments, or engaging with policymakers, this rigorous analysis will provide the actionable intelligence needed to make informed, data-driven decisions. Contact Ketan Rohom today to commence your journey toward enhanced clarity, competitive advantage, and sustained growth in the broadband satellite arena.

- How big is the Broadband Satellite Services Market?

- What is the Broadband Satellite Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?