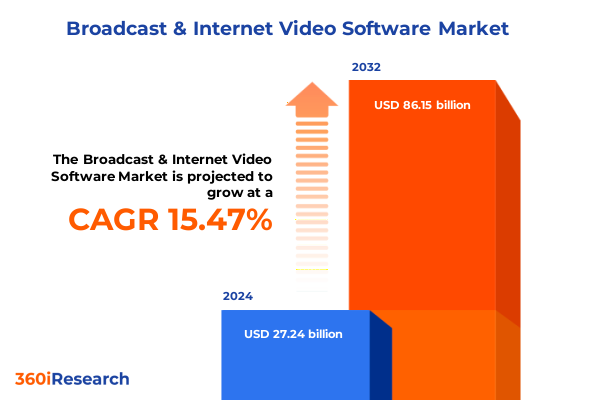

The Broadcast & Internet Video Software Market size was estimated at USD 31.16 billion in 2025 and expected to reach USD 35.65 billion in 2026, at a CAGR of 15.63% to reach USD 86.15 billion by 2032.

Uncovering the Rapidly Expanding Convergence of Broadcast and Internet Video Software in an Era of On-Demand Digital Experiences

The convergence of traditional broadcast and internet video software has ushered in a transformative era for content creators, distributors, and enterprises alike. As consumer behavior shifts decisively toward on-demand and interactive experiences, organizations are compelled to adopt agile platforms capable of delivering high-quality video across diverse formats and devices. This evolution is driven by an insatiable appetite for immersive content, underpinned by the proliferation of streaming services and the expansion of digital ecosystems.

In recent years, the demand for integrated video software solutions has surged, fueled by the needs of remote work, virtual events, and digital learning. Enterprises leverage video for internal communications and customer engagement, while educational institutions adopt interactive video platforms to support distance learning and engagement. Simultaneously, media and entertainment companies continue to innovate in OTT delivery, boasting advanced features such as personalized recommendations and dynamic ad insertion.

Technological advancements in artificial intelligence, edge computing, and high-throughput networks further catalyze market growth, enabling real-time analytics, seamless scalability, and adaptive bit-rate streaming. Video content now accounts for a majority of global internet traffic, with estimates ranging from 83% to 88% of total bandwidth usage in recent quarters. These trends underscore the critical importance of robust, flexible video software platforms capable of meeting evolving consumer and enterprise demands.

Navigating the Major Technological and Market Shifts That Are Redefining Video Software Delivery and Experience Across Platforms

The broadcast and internet video software space is undergoing a series of transformative shifts that are redefining how content is created, managed, and delivered. Central to this evolution is the integration of artificial intelligence at every stage of the workflow, from AI-driven encoding engines that optimize bit rates to intelligent metadata generation and automated content moderation. This infusion of machine learning enables platforms to offer enhanced accessibility features such as live transcription and real-time translation, marking a significant leap in inclusivity and audience reach.

Parallel to AI adoption, edge computing has emerged as a critical enabler of low-latency streaming, allowing for localized processing of video data that dramatically reduces buffering and enhances viewer experience. These capabilities are complemented by the rollout of 5G networks, which amplify mobile video consumption and support novel applications like cloud gaming and virtual events. As a result, service providers are investing heavily in distributed architectures that leverage edge nodes to deliver high-definition content with unprecedented reliability.

Moreover, the software landscape is being reshaped by a growing emphasis on modular, API-driven platforms that facilitate seamless integration with third-party tools and ecosystems. For instance, cloud-based video services now offer preview features such as AI-powered live transcription supercharged by specialized speech-to-text models and automated packaging of audio description tracks for accessibility. Additionally, recent strategic evolutions by leading vendors demonstrate a commitment to enriching user experience through AI-enabled recommendation engines and predictive buffering algorithms, underscoring a future where personalization and performance converge.

Assessing the Comprehensive Impact of Newly Implemented United States Tariffs on Video Software Services and Delivery Models

The introduction of new United States tariffs in 2025 has reverberated across the broadcast and internet video software sector, altering cost structures and prompting strategic realignments. Key measures include a 25% duty on Chinese-origin cloud computing infrastructure and SaaS platforms, alongside a 20% tariff on software licenses and intellectual property products imported from China. These policies have directly impacted major cloud providers and software vendors that rely on cross-border supply chains, leading to increased operational expenses and squeezed profit margins.

Beyond the direct imposition of duties, the tariffs have triggered ripple effects throughout the industry. Providers of software development services, especially those leveraging offshore teams in regions like India and the Philippines, now face elevated costs due to 10–15% tariffs on outsourced development work. This has accelerated the adoption of nearshoring and onshoring strategies, as companies seek to mitigate exposure to tariff‐induced price hikes and maintain competitive pricing models for clients.

Indirectly, sustained tariff measures have exerted upward pressure on infrastructure costs, prompting many video software vendors to reassess their delivery architectures and licensing agreements. Observers note that providers may pass on incremental increases to end users through adjusted subscription fees or modified support terms, while others are exploring alternative sourcing options in Eastern Europe and Southeast Asia to circumvent tariff constraints. As the market adapts, resilience and supply chain agility have become vital differentiators for video software leaders.

Deriving Actionable Insights from Multidimensional Segmentation to Understand User Needs and Solution Preferences in Video Software

Understanding the market through a segmented lens reveals critical insights into customer needs and solution preferences across diverse dimensions. In examining the component hierarchy, the differentiation between services and software solutions highlights the balance between human-driven expertise and scalable platform features. Consulting, managed, professional, and support services form the foundation of custom implementations, while video analytics, content management, encoding, hosting platforms, and monetization software underscore the technological backbone that powers end-to-end workflows.

When viewed through the prism of streaming type, the divergence between live streaming and video-on-demand (VoD) illuminates the operational and technical nuances of real-time engagement versus time-shifted consumption. Each streaming type demands specialized encoding pipelines, ultra-low latency protocols for live events, and robust content delivery networks that ensure consistent quality. Assessing deployment mode further refines this perspective by contrasting the scalability and agility of cloud-based solutions with the security and control afforded by on-premise deployments.

End-user segmentation uncovers sector-specific priorities, from corporate and enterprise clients seeking secure internal communications solutions to educational institutions prioritizing interactivity and analytics for remote learning. Government and healthcare verticals emphasize compliance, security, and accessibility, whereas media, retail, and sports industries leverage advanced monetization tools and audience engagement features to maximize ROI. Finally, an application-centric view, encompassing audience interaction, content creation, delivery, management, monetization, and security, serves as a guiding framework for aligning product roadmaps with evolving use cases.

This comprehensive research report categorizes the Broadcast & Internet Video Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Streaming Type

- Deployment Mode

- End User

- Application

Exploring Regional Market Dynamics That Influence Infrastructure, Regulations, and Adoption of Broadcast and Internet Video Software Globally

Regional dynamics play a pivotal role in shaping market direction and adoption of broadcast and internet video software. In the Americas, robust investment in cloud infrastructure, edge computing, and AI-driven personalization underpins high broadband penetration and mature consumption behaviors. North American enterprises and media companies are pioneering hybrid delivery models that blend traditional broadcast workflows with OTT platforms, while Latin America’s mobile-first audiences fuel demand for lightweight streaming clients and cost-efficient ad monetization solutions.

In Europe, Middle East & Africa, stringent data privacy regulations and licensing mandates drive operators to adopt compliant, secure video platforms with advanced DRM and localization capabilities. European broadcasters frequently collaborate on pan-regional content syndication initiatives, leveraging multilingual streaming interfaces and real-time subtitle integration to serve diverse audiences. Concurrently, Middle Eastern and African markets are witnessing rapid broadband expansion and escalating appetite for live and on-demand content, facilitated by affordable data plans and mobile infrastructure development.

Asia-Pacific stands out for its sheer diversity and scale, with East Asian markets leading in ultra-high-definition and immersive streaming experiments, supported by world-class device manufacturers. South and Southeast Asian economies, characterized by price-sensitive subscriber bases, emphasize subscription flexibility, affordable data bundles, and regional partnerships that address local content preferences. This convergence of innovation and accessibility positions Asia-Pacific as a key driver of global video software evolution, influencing standards and best practices.

This comprehensive research report examines key regions that drive the evolution of the Broadcast & Internet Video Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators and Disruptors Shaping the Future of Broadcast and Internet Video Software Through Strategic Initiatives

The broadcast and internet video software ecosystem is anchored by a core set of leading innovators and a cadre of emerging disruptors that collectively drive technological progress. Brightcove, now operating under new stewardship, is doubling down on AI-enabled features such as automated metadata enrichment, multi-language captioning, and predictive buffering, reflecting a strategic pivot toward deeper customer-centric innovation. Similarly, AWS Elemental’s suite of encoding and packaging services continues to expand, offering advanced live-stream transcription and adaptive bit-rate optimization through cloud-native APIs.

Microsoft’s Azure Media Services has introduced capabilities like live linear encoding for OTT channels and seamless integration with partner encoding and player solutions, underscoring its role as a comprehensive platform for enterprise and media workloads. IBM’s Watson Media and Kaltura provide differentiated solutions in video analytics and personalized content delivery, while Vimeo and Dacast cater to small and mid-sized organizations with user-friendly hosting and monetization options. Meanwhile, specialized developers such as JW Player, Mux, and Zype focus on modular video infrastructure, enabling customers to assemble bespoke workflows that align with niche requirements.

This competitive landscape of hyperscalers, telecom integrators, and nimble point-solution vendors fosters ongoing innovation, with collaborations and strategic partnerships accelerating time-to-market for new capabilities. As customer expectations evolve, the ability to blend platform robustness with extensible architectures remains a defining characteristic of market leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Broadcast & Internet Video Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accedo Group B.V.

- Accenture plc

- Adobe Systems Incorporated

- Akamai Technologies, Inc.

- ARRIS International PLC

- BAM Technologies, LLC

- Brightcove, Inc.

- Cisco Systems, Inc.

- Comcast Technology Solutions

- Dacast Inc.

- Ericsson AB

- Ericsson Telecom AB

- Haivision Systems, Inc.

- IBM Corporation

- Imagine Communications Corp.

- Kaltura, Inc.

- NCH Software

- StudioCoast Pty Ltd

- Telestream LLC

- Vimeo.com, Inc.

Providing Strategic Recommendations to Guide Industry Leaders in Capitalizing on Emerging Trends and Technologies in Video Software Development

To navigate this dynamic environment, industry leaders should prioritize the integration of AI and machine learning modules into core video workflows, enabling automated metadata generation, intelligent quality optimization, and enhanced accessibility features. Investing in edge-optimized architectures will further reduce latency and improve reliability, particularly for live streaming and interactive applications in regions with variable connectivity.

Moreover, organizations should adopt a modular, API-first approach to product design, which facilitates seamless integration with partner ecosystems and rapid deployment of emerging features. Engaging with regional regulators early in the development process will ensure compliance with evolving data privacy and content licensing mandates, mitigating risks associated with cross-border deployments. Finally, cultivating flexible sourcing strategies and diversifying infrastructure partners can help buffer against supply chain disruptions and tariff-related cost increases, preserving competitive pricing models.

Detailing the Rigorous Research Methodology That Underpins the Insightful Analysis of Broadcast and Internet Video Software Market Trends

This analysis is grounded in a rigorous research methodology that blends primary and secondary data sources to ensure comprehensive and credible insights. Primary research included in-depth interviews with senior executives at leading video software vendors, in addition to consultations with CIOs and technology officers across key verticals. These dialogues provided nuanced perspectives on deployment challenges, feature priorities, and emerging use cases.

Secondary research encompassed a review of public filings, press releases, regulatory announcements, and industry news from reputable sources. Where available, company blogs and technical documentation were analyzed to validate feature roll-outs and platform enhancements. Trade publications and technical whitepapers served as supplementary inputs, offering context on technological innovations such as AI-driven analytics, 5G streaming, and edge-infrastructure deployment.

Data triangulation was employed to cross-validate findings, combining quantitative traffic metrics, tariff schedules, and regional infrastructure reports with qualitative insights derived from expert interviews. Finally, all findings were peer-reviewed by an internal panel of subject-matter experts to ensure accuracy, relevance, and alignment with market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Broadcast & Internet Video Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Broadcast & Internet Video Software Market, by Component

- Broadcast & Internet Video Software Market, by Streaming Type

- Broadcast & Internet Video Software Market, by Deployment Mode

- Broadcast & Internet Video Software Market, by End User

- Broadcast & Internet Video Software Market, by Application

- Broadcast & Internet Video Software Market, by Region

- Broadcast & Internet Video Software Market, by Group

- Broadcast & Internet Video Software Market, by Country

- United States Broadcast & Internet Video Software Market

- China Broadcast & Internet Video Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing the Key Findings and Reflecting on the Future Trajectory of the Broadcast and Internet Video Software Industry Landscape

In summary, the broadcast and internet video software market is witnessing accelerated innovation driven by AI, edge computing, and next-generation network capabilities. Despite the challenges posed by new tariff regimes and evolving regulatory landscapes, leading providers and disruptors continue to enhance platform functionality, focusing on personalization, accessibility, and performance.

Segmentation and regional analyses reveal a heterogeneous landscape, where tailored solutions address specific needs across industries, deployment modes, and content delivery preferences. By leveraging modular architectures and strategic partnerships, organizations can navigate cost pressures and capitalize on growth opportunities in high-adoption regions.

Looking ahead, the fusion of real-time analytics, immersive video formats, and automated workflow orchestration will remain central to competitive differentiation. As market leaders refine their roadmaps and embrace actionable insights, the industry is poised to deliver increasingly sophisticated video experiences that resonate with diverse audiences and drive sustainable value.

Secure Your Competitive Advantage Today by Engaging Directly to Access the Comprehensive Market Research Report on Video Software Trends

Ready to gain unparalleled visibility into the evolving broadcast and internet video software market and translate insights into strategic growth, Ketan Rohom invites you to explore the comprehensive research report that delivers deep analysis of competitive dynamics, technological breakthroughs, and regional opportunities. With tailored recommendations and detailed segmentation intelligence, this report serves as an indispensable tool for executives and decision-makers looking to optimize product roadmaps, refine go-to-market strategies, and accelerate innovation. Connect with Associate Director, Sales & Marketing Ketan Rohom to secure your copy of the report and position your organization at the forefront of the video software revolution.

- How big is the Broadcast & Internet Video Software Market?

- What is the Broadcast & Internet Video Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?