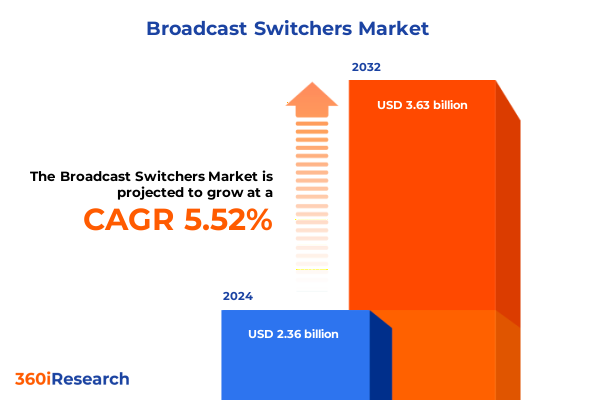

The Broadcast Switchers Market size was estimated at USD 2.49 billion in 2025 and expected to reach USD 2.63 billion in 2026, at a CAGR of 5.53% to reach USD 3.63 billion by 2032.

Setting the Stage for Broadcast Switchers in a Rapidly Evolving Media Landscape With Unprecedented Technological and Regulatory Influences

Broadcast switchers lie at the heart of modern media production, orchestrating seamless transitions between multiple video sources in live, on-demand, and recorded content. As audiences demand increasingly sophisticated visual experiences across television, online streaming, and hybrid events, switcher technology has evolved from analog matrices to fully software-driven platforms integrated with cloud workflows. Today’s systems support high-definition and ultra-high-definition formats with multi-view monitoring, dynamic graphics insertion, and automated control functions that were unimaginable a decade ago. Moreover, broadcast switchers now play a pivotal role in enabling live production workflows for virtual and augmented reality applications, reinforcing their centrality within any forward-looking production ecosystem.

Against this backdrop, industry stakeholders-from major network broadcasters to agile post-production facilities-must comprehend how technological advancements, supply chain dynamics, and policy shifts converge to redefine competitive landscapes. This introduction sets the stage for a deep dive into how transformative forces are reshaping broadcast switcher development, deployment, and adoption. By unpacking the interplay between innovation drivers and market realities, readers will gain a clear understanding of why broadcast switchers remain indispensable to media operations and how strategic planning must adapt to sustain operational efficiency and creative ambition.

Exploring the Key Technological Innovations and Market Drivers Reshaping the Broadcast Switcher Industry and Redefining Competitive Dynamics Globally

Over the past few years, the broadcast switcher landscape has undergone seismic shifts driven by advancements in IP-based networking, cloud-native architectures, and artificial intelligence. Traditional hardware-centric models have ceded ground to hybrid approaches that blend integrated hardware frames with modular expansion capabilities, granting broadcasters unprecedented flexibility to scale operations on demand. Concurrently, software-based switchers have surged in prominence, with cloud-enabled platforms facilitating remote production and collaborative workflows across geographically dispersed teams. These innovations have dismantled legacy barriers, enabling cost-effective deployments in emerging markets while simultaneously fostering new revenue streams through virtualized production services.

At the same time, the rise of China-based manufacturers, aggressive patenting by established incumbents, and strategic partnerships between technology vendors and systems integrators have altered competitive dynamics. Leading global players have embarked on joint ventures to co-develop AI-driven automation features that streamline camera switching and optimize audio mixing, reshaping feature roadmaps. Furthermore, the convergence of broadcast and IT infrastructures has compelled organizations to reassess procurement strategies, driving demand for interoperable solutions that align with software-defined network protocols. In this era of rapid transformation, understanding these technological and market drivers is essential for any stakeholder seeking to harness the full potential of next-generation broadcast switching systems.

Analyzing the Layered Effects of United States 2025 Tariff Adjustments on Broadcast Switcher Supply Chains and Cost Structures Across Critical Markets

In early 2025, the United States implemented revised tariffs on imported broadcast switcher components that have reverberated throughout global supply chains. The sweeping tariff adjustments apply to semiconductor processors, FPGA cards, and specialized chassis assemblies, necessitating cost recalibrations by both domestic and international vendors. As manufacturers respond, some have absorbed the additional duties to preserve price stability for end users, while others have shifted sourcing to tariff-exempt jurisdictions or accelerated component localization initiatives. These reactive measures underscore the interconnected nature of broadcast switcher ecosystems and the delicate balance between cost efficiency and performance reliability.

The cumulative effects extend beyond production costs, as distributors and systems integrators now factor tariff-induced lead times into project timelines. In parallel, forward-thinking developers have explored nearshoring strategies, establishing assembly lines in Mexico and Eastern Europe to mitigate duty impacts. Yet despite these efforts, certain high-performance modules remain subject to extended customs checks, creating sporadic availability challenges in critical markets. Taken together, the 2025 tariff landscape has prompted a reengineering of procurement and manufacturing playbooks, compelling organizations to integrate geopolitical risk assessments into their technology roadmaps more systematically than ever before.

Uncovering Nuanced Market Behaviors Through Comprehensive Segmentation Analysis Across Product, Distribution, End Users, and Application Spheres

A nuanced segmentation analysis reveals divergent adoption patterns and growth drivers across product types, distribution channels, end users, and applications. Hardware-based systems can be categorized into integrated frames offering turnkey functionality and modular architectures that allow bespoke configurations. Meanwhile, software-based switchers bifurcate into cloud-enabled platforms optimized for remote production and on-premise deployments tailored for secure, low-latency environments. Distribution channels encompass direct sales efforts by manufacturers, partnerships with value-added distributors, digital storefronts operated by e-tailers, and original equipment manufacturer alliances, each fulfilling unique role in extending market reach and after-sales support.

The end-user landscape is equally varied, spanning traditional broadcast stations that prioritize reliability and multi-format flexibility, post-production studios demanding advanced editing integration, production houses focused on live event coverage, and rental and staging companies seeking rapid deployment. Applications range from corporate messaging events and large-scale live concerts to 24/7 news broadcasting and high-octane sports production, which in turn shape feature prioritization and service models. Within this complex matrix, industry participants must tailor their offerings to precisely align with customer workflows, blending product innovation and go-to-market strategies in ways that meet the distinct needs of each segment.

This comprehensive research report categorizes the Broadcast Switchers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Video Resolution Support

- Signal Format

- Form Factor

- Application

- End User

Delving Into Regional Broadcast Switcher Adoption Trends and Growth Patterns Across Americas, Europe Middle East Africa, and Dynamic Asia Pacific Markets

Geographical dynamics play a pivotal role in shaping broadcast switcher adoption and innovation trajectories. The Americas region continues to be defined by North American leadership in technology R&D and a mature broadcast infrastructure that underpins strong demand for upgrade cycles and value-added cloud services. Latin America, by contrast, is marked by gradual digital transformation initiatives and cost-sensitive procurement strategies, opening doors for software-based switchers and flexible financing models.

In Europe, the Middle East, and Africa, regulatory certification standards and multilingual support requirements drive customization efforts among switcher vendors. The digital migration wave across Middle Eastern broadcasters and an expanding events economy in Eastern Europe have collectively spurred investments in both hardware and cloud-based solutions. Moving eastward, the Asia-Pacific region exhibits the fastest growth trajectory, led by large-scale sports and entertainment markets in China, Japan, and Australia, alongside burgeoning media sectors in Southeast Asia. Here, the interplay of high-bandwidth internet infrastructure and government incentives for digital media transformation accelerates the uptake of IP-native, remote production architectures.

This comprehensive research report examines key regions that drive the evolution of the Broadcast Switchers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Movements and Collaborative Initiatives Among Leading Broadcast Switcher Manufacturers Driving Innovation and Market Leadership Momentum

An examination of leading industry players highlights diverse strategic approaches to innovation, partnerships, and market expansion. Legacy switcher manufacturers continue to invest heavily in R&D, focusing on feature-rich, high-throughput hardware frames that cater to flagship broadcasting clients. Meanwhile, agile software-centric entrants are forging alliances with cloud service providers to embed orchestration tools directly within platform-as-a-service offerings, thereby capturing emerging remote production demand.

On the distribution front, several firms have established dedicated channel programs with systems integrators to deliver turnkey solutions, including onsite training and 24/7 support. Other market participants pursue joint ventures targeting new verticals such as esports and virtual events, deploying modular switcher packages that integrate seamlessly with popular streaming platforms. This blend of organic growth via product enhancements, inorganic expansion through strategic acquisitions, and cross-industry collaborations underscores a competitive environment where market leadership is defined by both technological prowess and ecosystem connectivity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Broadcast Switchers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blackmagic Design Pty Ltd

- Evertz Microsystems Limited

- EVS Broadcast Equipment SA

- FOR-A Company Limited

- Grass Valley USA LLC

- Ikegami Tsushinki Co., Ltd.

- Imagine Communications Corp.

- NewTek, Inc.

- Panasonic Holdings Corporation

- Ross Video Ltd

- Sony Group Corporation

- Utah Scientific, Inc.

Formulating Strategic Imperatives for Industry Leaders to Leverage Emerging Broadcast Switching Technologies and Navigate Evolving Market and Regulatory Environments

Industry leaders must adopt a multi-faceted strategy to navigate the accelerating pace of change in broadcast switching. First, prioritizing modular architectures will allow organizations to scale system capabilities on demand while minimizing upfront capital expenditure. Additionally, integrating AI-driven control features and predictive maintenance analytics can reduce operational complexity and downtime, bolstering overall system reliability. Embracing cloud-based orchestration services will further enable remote production models, reducing on-site staffing requirements and facilitating global collaboration.

Furthermore, stakeholders should invest in supplier diversification to mitigate risks associated with tariff fluctuations and component shortages. Cultivating partnerships across the entire value chain-including semiconductor vendors, system integrators, and cloud platform providers-will enhance resilience against geopolitical and supply disruptions. Finally, ongoing training programs designed to upskill technical teams on IP networking standards and software-defined video workflows will ensure that organizations can fully leverage next-generation switcher capabilities and maintain competitive differentiation.

Detailing the Rigorous Research Framework Employed to Gather, Validate, and Analyze Data on Broadcast Switcher Market Dynamics Through Multi-Source Integration

The research underpinning this report follows a rigorous framework that combines primary stakeholder interviews, secondary data triangulation, and systematic vendor benchmarking. Key decision-makers across broadcaster, production, and rental segments were engaged to capture firsthand insights into purchasing criteria, workflow challenges, and future technology priorities. Secondary sources, including trade association publications, regulatory filings, and industry whitepapers, were analyzed to validate market trends and cross-reference competitive landscape dynamics.

Vendor benchmarking involved performance trials of representative switcher solutions under real-world conditions, assessing factors such as switching latency, throughput capacity, and integration with ancillary systems. Data integrity was ensured through a multi-layered validation process encompassing data cleansing, outlier analysis, and peer review by subject-matter experts. This comprehensive methodology provides stakeholders with a transparent and dependable basis for informed decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Broadcast Switchers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Broadcast Switchers Market, by Product Type

- Broadcast Switchers Market, by Video Resolution Support

- Broadcast Switchers Market, by Signal Format

- Broadcast Switchers Market, by Form Factor

- Broadcast Switchers Market, by Application

- Broadcast Switchers Market, by End User

- Broadcast Switchers Market, by Region

- Broadcast Switchers Market, by Group

- Broadcast Switchers Market, by Country

- United States Broadcast Switchers Market

- China Broadcast Switchers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Synthesizing Core Findings and Forward-Looking Perspectives to Inform Strategic Decision Making in the Broadcast Switcher Market Landscape

This executive summary has distilled the most critical insights on technological advancements, tariff implications, segmentation dynamics, and regional growth patterns within the broadcast switcher domain. As the industry transitions toward more software-centric and cloud-enabled paradigms, organizations must adapt procurement strategies and operational workflows accordingly. The strategic landscape is characterized by both legacy hardware innovation and the rapid emergence of virtualized solutions, creating opportunities for differentiation through modular design, AI-driven automation, and remote production capabilities.

Looking ahead, stakeholders should remain vigilant of evolving regulatory frameworks and potential supply chain disruptions, integrating risk assessments into their technology roadmaps. By aligning product development, partner ecosystems, and workforce skill sets with these emerging realities, decision-makers can position their operations for sustained success in a market defined by relentless innovation and global interconnection.

Engaging with Associate Director Ketan Rohom to Unlock Actionable Insights and Secure Exclusive Access to the Comprehensive Broadcast Switcher Market Research Report

For organizations committed to staying at the forefront of broadcast switching innovation, now is the moment to act. To explore the full breadth of market intelligence, gain detailed competitive benchmarking, and tailor strategies that capitalize on emerging opportunities, please connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Through a personalized consultation, you’ll receive guidance on how this comprehensive report can inform your decision making, mitigate risk, and accelerate growth in dynamic broadcast environments. Engage today to secure exclusive access to the insights that will shape your strategic initiatives for the coming years.

- How big is the Broadcast Switchers Market?

- What is the Broadcast Switchers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?