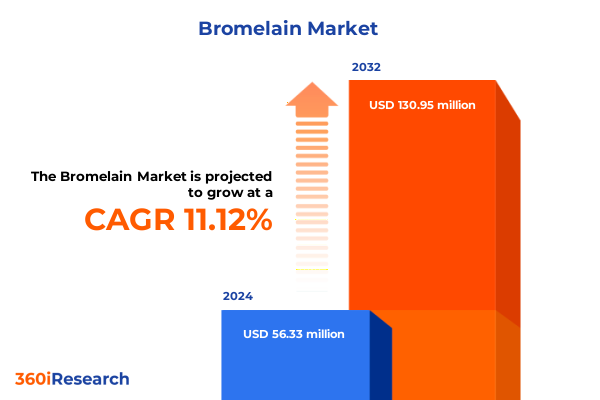

The Bromelain Market size was estimated at USD 62.48 million in 2025 and expected to reach USD 74.53 million in 2026, at a CAGR of 11.14% to reach USD 130.94 million by 2032.

Discover the Transformative Power of Bromelain as a Versatile Bioactive Enzyme Revolutionizing Health, Beauty, Food, and Pharma Innovations

Bromelain, a naturally occurring proteolytic enzyme primarily extracted from pineapple stems and fruit, has garnered significant attention for its multifaceted applications across diverse industries. Initially identified for its digestive properties, bromelain’s capacity to break down proteins has been harnessed in pharmaceutical and nutraceutical formulations, offering therapeutic benefits that range from promoting digestive health to reducing inflammation. Over the past decade, advancements in extraction and purification techniques have enhanced enzyme stability and potency, elevating bromelain from a niche ingredient to a mainstream bioactive compound with extensive commercial potential.

In the realm of healthcare, bromelain’s anti-inflammatory and analgesic properties have driven its integration into over-the-counter and prescription formulations, where it is often combined with other enzymes and nutrients to address sports injuries, post-operative swelling, and osteoarthritis symptoms. Meanwhile, dietary supplement manufacturers have embraced bromelain for its gentle proteolytic action, marketing capsule, tablet, and powder formats that cater to consumer demands for convenience and efficacy. Concurrently, food and beverage innovators have explored its protease activity to improve meat tenderness in the bakery sector and optimize protein breakdown in dairy applications, underscoring the enzyme’s versatility in formulation engineering.

Transitioning from functional foods to personal care, bromelain has emerged as a go-to ingredient in hair care products for its ability to promote scalp health and enhance hair sheen, while oral care brands leverage its antimicrobial and debriding effects for advanced plaque removal. In skin care, gentle exfoliation supported by bromelain’s proteolytic action offers a natural alternative to harsh chemical peels, appealing to consumers seeking plant-derived actives. This introduction sets the stage for a deeper exploration of the transformative shifts, tariff impacts, segmentation dynamics, and regional nuances that collectively define bromelain’s evolving market landscape.

Examining the Paradigm Shift in Bromelain Production and Application Fueled by Technological Advances and Evolving Regulatory Landscapes

Over recent years, the bromelain landscape has undergone a profound metamorphosis driven by breakthroughs in biotechnological extraction, sustainable sourcing, and regulatory refinement. Innovative membrane filtration and chromatography techniques now enable the production of high-purity enzyme fractions, surpassing crude grades in both activity and shelf stability. Such advancements have not only elevated product quality but have also unlocked novel formulation opportunities, allowing integrators to deliver precise enzyme dosages in liquid serums, powdered supplements, and encapsulated therapies-a marked shift from the one-size-fits-all approaches of the past.

Concurrently, consumer predilections for clean-label and plant-based actives have intensified, prompting manufacturers to highlight ethically sourced bromelain derived from pineapple heart and stem by-products. This realignment toward circular economy principles aligns with broader sustainability mandates, reinforcing brand value and driving premium pricing. Regulatory corridors have simultaneously evolved; health authorities across major markets have introduced clearer guidelines for protease use in ingestible products, streamlining approval pathways and mitigating compliance risks. As a result, companies are expanding research and development pipelines, exploring synergistic enzyme cocktails that enhance digestion, wound healing, and dermal performance.

In parallel, digital transformation has reshaped go-to-market strategies: direct-to-consumer platforms leverage e-commerce analytics to personalize formulations, while B2B suppliers deploy real-time demand forecasting to optimize inventory and reduce lead times. This confluence of technological, regulatory, and consumer forces has ushered in an era of tailored bromelain solutions, setting the stage for industry leaders to harness enzyme innovation as a core competitive differentiator.

Assessing How the Introduction of United States 2025 Tariffs Is Reshaping Supply Chains Pricing Strategies and Sourcing Dynamics for Bromelain

The implementation of new United States tariffs on imported bromelain in 2025 represents a pivotal moment for global supply chains and pricing frameworks. By imposing additional duties on enzyme shipments primarily originating from traditional pineapple-producing regions, the tariffs have pressured raw material sourcing and reshaped cost structures across manufacturing corridors. Organizations with vertically integrated procurement have fared better, while those reliant on spot purchases have experienced notable margin compression and inventory volatility, prompting urgent reassessment of sourcing strategies in light of fiscal headwinds.

As domestic distributors and contract manufacturers grapple with increased import costs, end-product prices for dietary supplements and topical formulations have adjusted upward, impacting both B2B and consumer channels. To counterbalance these hikes, many firms are diversifying supplier portfolios, tapping emerging production hubs in Latin America and Southeast Asia that offer competitive extraction facilities and preferential trade agreements. Strategic partnerships and forward-buy contracts have emerged as key tactics, affording procurement teams greater hedging capabilities while locking in fixed enzyme rates against further tariff escalations.

Moreover, the tariffs have accelerated investments in local extraction infrastructure, where aqueous and solvent-based methods are being optimized for cost-efficiency and environmental compliance. This domestic ramp-up not only mitigates import exposure but also strengthens resilience against geopolitical shifts. In the wake of these developments, industry players are realigning their distribution networks, favoring online and retail channels that can absorb incremental costs more effectively than institutional procurement, thereby safeguarding market share and ensuring steady product availability despite tariff uncertainties.

Unraveling Deep Segmentation Layers to Reveal How Applications Forms Sources and Distribution Play a Critical Role in the Bromelain Market

A nuanced examination of the bromelain market reveals that application diversity is a foundational driver of growth, with cosmetics harnessing enzyme efficacy across hair care, oral care, and skin care, dietary supplements leveraging capsule, powder, and tablet formats for targeted health benefits, and the food and beverage sector applying proteolytic action to enhance bakery textures, beverage clarity, and dairy consistency. Pharmaceuticals integrate bromelain in capsule, liquid, and tablet preparations where its proteolytic properties act synergistically with other active ingredients to improve bioavailability and therapeutic outcomes. Across these segments, product developers balance efficacy with consumer convenience, crafting formulations that resonate with evolving wellness narratives.

Form considerations further influence market dynamics, as liquid enzyme concentrates enable precise dosing in skincare serums and functional beverages, while powdered grades offer ease of blending into nutritional products and baking applications. Source differentiation-from fruit-derived extracts prized for gentle activity to heart and stem fractions engineered for elevated protease concentration-provides formulators with multiple options to align ingredient provenance with performance claims. Purity grade segmentation distinguishes between crude extracts for mass-market cost efficiency, semi-purified grades suited for mid-tier nutraceuticals, and highly refined purified fractions that command premium positioning in advanced therapeutic and cosmeceutical applications.

Distribution channels split between institutional sales, online platforms, and traditional retail, each catering to distinct buyer personas: bulk purchasers in contract manufacturing settings, digitally engaged small-batch producers, and retail brands seeking shelf-ready solutions. Extraction methodologies-from water-based techniques and solvent-extraction processes to high-precision chromatography-further define cost structures and environmental footprints, empowering stakeholders to select enzyme preparations that best align with corporate sustainability objectives and product innovation goals.

This comprehensive research report categorizes the Bromelain market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Purity Grade

- Extraction Method

- Application

- Distribution Channel

Investigating Regional Dynamics to Highlight How The Americas EMEA and Asia Pacific Drive Unique Opportunities and Challenges in Bromelain Adoption

Geographic nuances play a pivotal role in bromelain consumption and production patterns, with the Americas leading global demand thanks to well-established nutraceutical markets and proximity to key pineapple cultivation regions. In North and Central America, strong consumer affinity for plant-based wellness products has fueled robust uptake in dietary supplements and functional food applications, while Latin American extraction facilities benefit from shorter logistics chains and favorable agricultural conditions, supporting competitive cost models.

Across Europe, the Middle East, and Africa, regulatory frameworks for proteolytic enzymes have become increasingly streamlined, yet regional variation in labeling standards and import regulations necessitates agile compliance strategies. European formulators often prioritize high-purity grades and certified organic sourcing, driving demand for chromatography-refined fractions, while Middle Eastern markets exhibit growing interest in dermatological applications that leverage bromelain’s exfoliating and anti-aging benefits. African production corridors, still nascent, are attracting investment for integrated pineapple processing and enzyme extraction facilities, signaling future expansion potential.

In the Asia-Pacific region, dynamic growth trajectories are underscored by rising disposable incomes and burgeoning health-aware consumer segments. Local manufacturers in Southeast Asia and Oceania are scaling up aqueous and solvent extraction operations, capitalizing on abundant pineapple feedstock to serve domestic markets and export hubs. Meanwhile, East Asian cosmetic giants are formulating novel bromelain-infused personal care products, integrating advanced delivery systems that enhance skin penetration and enzymatic stability. These regional dynamics collectively shape demand drivers, competitive landscapes, and strategic priorities across the global bromelain ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Bromelain market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Market Participants and Highlighting Strategic Alliances Innovations and Competitive Tactics Shaping Bromelain’s Growth Trajectory

Leading ingredient suppliers and enzyme specialists have intensified research collaborations and cross-industry partnerships to secure market advantage, deploying expanded R&D capabilities to refine extraction workflows and enhance enzyme activity profiles. Strategic alliances between biotechnology firms and contract manufacturing organizations are facilitating scale-up of chromatography-based purification, while joint ventures in pineapple-growing regions aim to stabilize raw material supply and adhere to ethical sourcing standards. These cooperative efforts underscore the industry’s commitment to innovation and sustainability.

At the same time, agile start-ups focusing on high-purity bromelain fractions have entered the competitive fray, leveraging proprietary solvent-extraction techniques to deliver enzyme preparations tailored for sensitive applications in wound healing and advanced cosmeceuticals. Larger incumbents have responded by expanding their global production footprints, establishing new extraction facilities in Latin America and Asia-Pacific to mitigate tariff impacts and reduce lead times. Investment in automation and process analytics has further differentiated leading players, enabling real-time quality monitoring and consistent enzyme potency.

Competitive tactics also include targeted acquisitions of regional enzyme specialists, broadening portfolios to encompass complementary proteases and multi-enzyme blends. This horizontal integration strategy not only diversifies product offerings but also enhances cross-selling opportunities across pharmaceutical, nutraceutical, and personal care divisions. Collectively, these company strategies highlight an ecosystem in which collaboration, technological adoption, and strategic expansion coalesce to shape bromelain’s evolving competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bromelain market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvaCare Pharma

- Advanced Enzyme Technologies Limited

- Bio-gen Extracts Pvt. Ltd.

- Challenge Bioproducts Co., Ltd.

- Changsha Natureway Co., Ltd.

- Creative Enzymes

- Creative Enzymes

- Enzybel Group

- Enzyme Development Corporation

- Enzyme Technologies

- Great Food Group of Companies

- Guangxi Nanning Javely Biological Products Co. Ltd.

- Gynemed GmbH & Co. KG

- Holland & Barrett Limited

- Hong Mao Biochemicals Co., Ltd.

- Houston Nutraceuticals, Inc.

- Krishna Enzytech Pvt. Ltd.

- Leeford Healthcare Limited

- Merck KGaA

- Mitushi Biopharma

- Source Naturals, Inc.

- URSAPHARM Arzneimittel GmbH

- Xena Bio Herbals Pvt. Ltd.

Providing Actionable Strategies for Industry Leaders to Capitalize on Bromelain’s Rising Demand While Enhancing Operational Resilience and Innovation Capacity

Industry leaders seeking to capitalize on bromelain’s upward trajectory should prioritize investment in high-purity extraction technologies, as the premium segment continues to deliver substantial margins and brand differentiation. By integrating advanced chromatography systems and implementing rigorous process control, manufacturers can ensure consistent enzyme performance, meeting stringent quality standards demanded by pharmaceutical and cosmeceutical formulators. Simultaneously, sourcing strategies should diversify across fruit, heart, and stem fractions to maintain supply resilience and align with evolving clean-label regulations.

Further, organizations are encouraged to strengthen their digital engagement by leveraging e-commerce analytics and targeted digital marketing to educate end consumers about bromelain’s health and beauty benefits. Establishing direct-to-consumer channels can enhance brand loyalty and capture higher value per unit. On the B2B side, deploying predictive demand forecasting and collaborative planning tools with key distributors and contract manufacturers will reduce stockouts and minimize tariff-induced cost spikes.

To foster innovation, cross-functional teams should explore synergy opportunities between bromelain and other bioactive compounds, developing novel enzyme blends for specialized applications such as advanced wound care, targeted digestive support, and next-generation exfoliants. Lastly, companies must engage proactively with regulatory stakeholders to anticipate policy shifts and secure approvals expediently, transforming compliance from a potential bottleneck into a competitive advantage.

Detailing the Robust Research Framework Employing Primary Interviews Secondary Intelligence and Rigorous Data Triangulation to Ensure Trusted Bromelain Insights

This analysis is underpinned by a robust research framework that integrates primary insights from in-depth interviews with enzyme technologists, procurement executives, and formulation scientists, supplemented by secondary intelligence encompassing peer-reviewed journals, industry white papers, and regulatory disclosures. A mix of qualitative and quantitative data collection methods ensured a comprehensive perspective on production costs, technological adoption rates, and consumer trends across key markets.

Data triangulation protocols were rigorously applied, cross-validating findings from supplier financials, trade databases, and import-export records to ensure reliability. Market segmentation analyses were derived from a standardized taxonomy covering application verticals, form factors, source differentiation, purity tiers, distribution channels, and extraction methodologies. Regional demand patterns were assessed using macroeconomic indicators and localized expert feedback to capture growth drivers and compliance environments.

Throughout the research process, methodological best practices were observed, including iterative peer reviews, consistent data normalization procedures, and adherence to ethical sourcing guidelines for proprietary field interviews. This disciplined approach provides stakeholders with confidence in the accuracy and relevance of the insights presented, equipping decision-makers to navigate the complex bromelain landscape with clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bromelain market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bromelain Market, by Form

- Bromelain Market, by Source

- Bromelain Market, by Purity Grade

- Bromelain Market, by Extraction Method

- Bromelain Market, by Application

- Bromelain Market, by Distribution Channel

- Bromelain Market, by Region

- Bromelain Market, by Group

- Bromelain Market, by Country

- United States Bromelain Market

- China Bromelain Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Drawing Together Core Insights to Present a Concise Overview of Bromelain’s Strategic Imperatives Future Pathways and Industry Relevance

Throughout this executive summary, the multifaceted nature of the bromelain market has been illuminated-from technological disruptions in extraction and purification to the realignment of supply chains in response to 2025 US tariffs. Key segmentation layers underscore how applications in cosmetics, dietary supplements, food and beverage, and pharmaceuticals each demand tailored enzyme grades and delivery forms, while regional dynamics in the Americas, EMEA, and Asia-Pacific reveal diverse regulatory and consumer landscapes.

Strategic alliances, M&A activity, and investments in automation differentiate leading companies, as they vie for market share through high-purity fractions and innovative enzyme blends. Actionable recommendations highlight the importance of targeted investments in advanced extraction platforms, digital engagement strategies, and proactive regulatory collaboration. Methodologically, the insights presented draw upon rigorous primary and secondary research, ensuring that findings are both reliable and actionable.

As the bromelain industry continues to evolve, stakeholders equipped with nuanced market intelligence and clear strategic roadmaps will be best positioned to harness emerging opportunities and mitigate risks. This concise overview serves as a foundation for informed decision-making, guiding industry participants toward sustainable growth and innovation in an increasingly competitive enzyme landscape.

Take the Next Step to Unlock Premium Bromelain Market Insights Engage with Ketan Rohom to Secure the Comprehensive Report That Drives Your Strategic Decisions

Unlock unparalleled clarity into the bromelain market by partnering with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a wealth of expertise in bioactive enzyme research and customer acquisition strategies, ensuring you receive the precise data and actionable intelligence needed to outpace competitors. By securing this comprehensive market research report, you gain immediate access to deep-dive analyses, strategic insights, and customized guidance tailored to your organization’s unique objectives. Don’t let emerging trends and shifting tariffs catch you unprepared-reach out to Ketan today to transform insight into competitive advantage and accelerate your decision-making with confidence.

- How big is the Bromelain Market?

- What is the Bromelain Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?