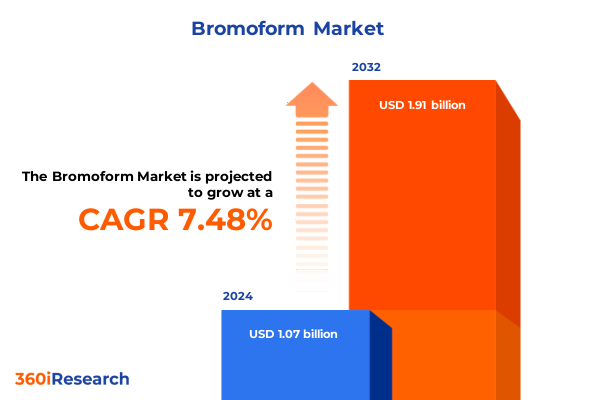

The Bromoform Market size was estimated at USD 1.14 billion in 2025 and expected to reach USD 1.22 billion in 2026, at a CAGR of 7.59% to reach USD 1.91 billion by 2032.

Unveiling the Strategic Significance and Emerging Dynamics of Bromoform Across Industrial, Research, Pharmaceutical, and Environmental Applications

The multifaceted role of bromoform across diverse industries underscores its strategic importance in modern supply chains and innovative research applications. As a highly brominated methane derivative, bromoform’s unique physicochemical properties have facilitated its adoption in flame retardant formulations, analytical chemistry workflows, pharmaceutical intermediates, and advanced water treatment processes. These avenues have converged to elevate bromoform from a niche specialty chemical to a critical component in emerging high-performance and sustainability-driven applications.

Recent shifts in global production capacities and evolving regulatory landscapes have placed bromoform at the intersection of opportunity and challenge. Stakeholders must navigate increasingly stringent environmental protocols while leveraging advancements in purification and synthesis technologies. Meanwhile, an intensified focus on green chemistry and circular economy principles has spurred the development of alternative brominated compounds and process optimizations aimed at minimizing environmental footprints. In this context, a holistic understanding of bromoform’s market dynamics, supply chain intricacies, and value creation pathways is essential for informed decision makers seeking to balance compliance with competitive differentiation

Adapting to Sustainability Requirements, Technological Advances, and Regulatory Pressures Is Redefining the Bromoform Industry Landscape and Value Chain

The bromoform market is undergoing a period of profound transformation driven by converging forces of sustainability mandates, technological innovation, and heightened regulatory oversight. In response to global commitments on persistent organic pollutants, manufacturers have accelerated efforts to refine synthesis routes and implement closed-loop recovery systems to curtail emissions and mitigate disposal risks. Prioritizing eco-efficiency, leading organizations have introduced advanced catalytic processes and in-situ monitoring solutions that enhance yield while reducing hazardous byproducts.

Simultaneously, breakthroughs in digitalization have redefined supply chain transparency and responsiveness, enabling real-time tracking of chemical shipments and predictive analytics for demand forecasting. These capabilities have empowered procurement and logistics teams to optimize inventory buffers and adapt swiftly to disruptions. At the same time, advancements in high-throughput screening and computational modeling have expanded bromoform’s role as a critical reagent in emerging life sciences applications, including specialized extraction procedures and analytical protocols. Together, these trends are reshaping the competitive landscape by fostering collaboration between chemical producers, research institutions, and end-user organizations.

Evaluating the Far-Reaching Effects of 2025 United States Tariff Measures on Bromoform Supply Chains, Production Economics, and Strategic Sourcing

Throughout 2025, a complex tapestry of United States trade measures has compounded cost pressures and reshaped sourcing strategies for bromoform importers and processors. Fundamental to this realignment is the enduring application of Section 301 tariffs on imports from the People’s Republic of China, which imposes an additional 25 percent rate atop the underlying Harmonized Tariff Schedule duty, elevating landed costs across the supply chain. This surcharge has prompted buyers to reevaluate supplier portfolios and explore alternative origins to mitigate tariff exposure.

In parallel, the extension of Section 301 product exclusions through August 31, 2025 provided temporary relief for certain chemical categories but left most brominated derivatives, including bromoform, outside the exemption scope. Furthermore, the February 2025 suspension of de minimis exemptions for shipments from China, Canada, and Mexico eradicated a frequent workaround for small-volume imports, inadvertently increasing administrative burdens and customs duties for specialized laboratories and small-scale users. As a result, end-user organizations have adopted strategic inventory aggregation, multi-origin procurement, and tariff engineering techniques to absorb cost volatility and maintain production continuity.

Collectively, these measures have not only elevated unit costs but have also accelerated nearshoring initiatives and long-term supply chain diversification. Firms with integrated manufacturing capabilities have strengthened internal capabilities for high-purity bromoform synthesis, while contract research organizations have forged partnerships with domestic producers to secure reliable reagent access. This recalibration underscores the critical interplay between trade policy and operational resilience in the evolving bromoform landscape.

Uncovering Market Nuances Through Application, Type, Distribution, and Grade Segmentation That Illuminate Unique Value Pathways for Bromoform Stakeholders

The bromoform market unfolds along multiple analytical dimensions, each shedding light on distinct value drivers and competitive contours. From an application perspective, bromoform’s utility spans chemical manufacturing, where it contributes to flame retardants and pesticide formulations; pharmaceuticals, serving as both a reaction intermediate and raw material; research laboratories, underpinning analytical chemistry methods and extraction procedures; and water treatment applications, where it supports both industrial and municipal purification processes.

Examining the market by product type reveals divergent demand pockets for liquid and solid bromoform. Liquid grades, whether high purity or technical grade, cater to precision chemical syntheses and advanced laboratory workflows, while crystalline and powder forms of solid bromoform find traction in bulk production and formulation blending. Shifting to end-user industries, the chemicals sector leverages bromoform in paints, coatings, and plastics, whereas environmental concerns drive adoption by pollution control agencies and water testing laboratories. In healthcare, hospitals and research institutions rely on reagent-grade bromoform for diagnostic and investigative purposes.

Further segmentation by purity level distinguishes bromoform grades above 99 percent purity-critical for pharmaceutical and analytical use-from technical grades optimized for more generalized industrial applications. Usage contexts vary accordingly, ranging from large-scale manufacturing processes in industrial settings to small-scale experiments and R&D activities in laboratory environments. Finally, distribution channels split between traditional offline networks, including direct suppliers and specialty chemical stores, and online platforms, encompassing company websites and third-party e-commerce, each offering different service levels, lead times, and logistical support. Grade segmentation delineates industrial, reagent, and technical classifications, aligning quality specifications with commercial, scientific, and general utility requirements respectively.

This comprehensive research report categorizes the Bromoform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Purity Level

- Usage

- Grade

- Application

- Distribution Channel

- End-User Industry

Exploring Regional Dynamics and Demand Drivers Shaping Bromoform Consumption Patterns Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional market dynamics for bromoform reflect a mosaic of demand drivers shaped by varying regulatory frameworks, industrial strengths, and environmental imperatives. In the Americas, robust chemical manufacturing hubs in the United States and Canada are complemented by advanced research infrastructures in academic and private laboratories, driving steady uptake in both technical and high-purity segments. The prevalence of stringent environmental guidelines has also spurred investments in water treatment applications, where bromoform serves as a key reagent in advanced oxidation processes.

In Europe, Middle East & Africa, evolving EU regulations governing persistent organic pollutants have heightened scrutiny on brominated compounds, incentivizing producers to develop greener synthesis pathways and closed-loop recovery systems. Mature end-user industries in paints, coatings, and pharmaceuticals continue to rely on consistent bromoform supply, while emerging markets in water-stressed regions of Africa and the Middle East are beginning to adopt it for municipal water treatment solutions.

Asia-Pacific stands out as the fastest-growing region, underpinned by expanding pharmaceutical manufacturing, accelerating environmental testing protocols, and the rising prominence of high-tech electronics fabrication, which harnesses specialized chemicals in precision cleaning and etching processes. Domestic production capacities in China, India, and South Korea are scaling up, yet tariff pressures and geopolitical considerations have prompted regional buyers to secure diversified import channels and strengthen relationships with local producers.

This comprehensive research report examines key regions that drive the evolution of the Bromoform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global and Emerging Players Demonstrating Innovation, Sustainability, and Strategic Growth Initiatives in the Bromoform Supply Chain

Leading chemical conglomerates and specialized reagent suppliers have consolidated their positions in the bromoform market through capacity expansions, strategic partnerships, and targeted investments in innovation. Global majors have leveraged integrated production assets to deliver consistent quality and competitive pricing, while prioritizing sustainability initiatives that reduce environmental footprints and ensure regulatory compliance. At the same time, emerging niche players have differentiated themselves by offering ultra-high-purity grades, custom packaging solutions, and agile customer support tailored to specialized research needs.

Key participants are forging collaborative R&D alliances with academic institutions and technology providers to explore novel applications and enhance process efficiencies. This cooperative landscape has accelerated the adoption of advanced analytics for predictive maintenance in production facilities and real-time impurity monitoring. Meanwhile, distributors and e-commerce platforms are refining logistics networks to meet the rapid turnaround expectations of laboratory customers, integrating digital order tracking and localized warehousing strategies to bolster reliability and service excellence.

Overall, the competitive arena is characterized by dynamic interplay between scale economies and nimble innovation, with established players harnessing breadth of portfolio and emerging entrants focusing on differentiated technical capabilities and customer intimacy. This balanced landscape fosters a continuous cycle of product enhancement, process optimization, and market expansion.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bromoform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aldon Corporation

- Ataman Kimya

- Central Drug House (P) Ltd.

- Ennore India Chemicals

- Henan Tianfu Chemical Co., Ltd.

- HiMedia Laboratories LLC

- Ing. Petr Švec - PENTA s.r.o.

- Joshi Agrochem Pharma

- LOBA CHEMIE PVT. LTD.

- Merck KGaA

- Omkar Speciality Chemicals Ltd.

- Otto Chemie Pvt. Ltd.

- Shanghai Theorem Chemical Technology Co., Ltd.

- Shri Rajaram Chemicals & Engg

- Sisco Research Laboratories Pvt. Ltd.

- Sonal Plasrub Industries Pvt. Ltd.

- Sontara Organo Industries

- Spectrum Laboratory Products, Inc.

- The Good Scents Company

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Vizag Chemicals

- WeylChem International GmbH

- Yancheng Longshen Chemical Co., Ltd.

Implementing Strategic Measures to Strengthen Resilience, Drive Efficiency, and Capitalize on Emerging Opportunities Within the Bromoform Industry Ecosystem

Industry leaders can strengthen their competitive positioning by undertaking a multifaceted approach to resilience and growth. First, diversifying raw material sources and augmenting domestic synthesis capabilities can mitigate tariff-driven cost volatility and secure supply continuity. At the same time, investing in on-site purification and closed-loop recovery infrastructure will enhance operational flexibility and reduce waste management liabilities.

To capitalize on shifting end-user requirements, organizations should develop tailored product portfolios that span high-purity and technical grades, aligning specifications with evolving laboratory and industrial process needs. Engaging proactively with regulatory authorities and participating in standards-setting forums will enable early adaptation to new compliance requirements and shape favorable policy outcomes. Additionally, deploying digital supply chain platforms that integrate real-time demand signals, inventory analytics, and predictive logistics can unlock efficiency gains and strengthen customer service levels.

Collaboration across the value chain remains critical; forming strategic partnerships with research institutions and technology innovators can yield breakthrough processes and applications. By fostering a culture of continuous improvement and leveraging data-driven decision-making, industry players can navigate uncertainty, anticipate emerging trends, and seize new growth opportunities in the evolving bromoform landscape.

Outlining a Rigorous, Multidimensional Research Methodology That Underpins Insights Into Bromoform Market Dynamics, Supply Chains, and Stakeholder Perspectives

This analysis draws upon a comprehensive, multistage research methodology designed to deliver robust, actionable insights. Primary research involved in-depth interviews with key stakeholders across the bromoform value chain, including producers, distributors, end-users, and regulatory experts. These dialogues provided qualitative perspectives on supply chain dynamics, market challenges, and innovation trajectories.

Secondary research encompassed a systematic review of publicly available regulatory documents, trade publications, patents, and technical white papers to map evolving product specifications and synthesis technologies. Harmonized Tariff Schedule data, government announcements on Section 301 measures, and industry association reports were meticulously analyzed to quantify trade policy impacts and regional trade flows. Advanced data triangulation techniques were applied to ensure consistency and validate findings across multiple sources.

The synthesis of primary and secondary inputs was further enriched by expert workshops and scenario modeling to stress-test strategic hypotheses under varying regulatory and economic conditions. This rigorous approach underpins the credibility and relevance of the insights, equipping decision makers with a nuanced understanding of the bromoform market’s present state and future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bromoform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bromoform Market, by Type

- Bromoform Market, by Purity Level

- Bromoform Market, by Usage

- Bromoform Market, by Grade

- Bromoform Market, by Application

- Bromoform Market, by Distribution Channel

- Bromoform Market, by End-User Industry

- Bromoform Market, by Region

- Bromoform Market, by Group

- Bromoform Market, by Country

- United States Bromoform Market

- China Bromoform Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3339 ]

Synthesizing Critical Findings and Strategic Imperatives to Empower Informed Decision Making Among Stakeholders Engaged in the Bromoform Market

The evolving landscape for bromoform is shaped by the interplay of regulatory pressures, trade policy developments, and innovation imperatives. Stakeholders must balance compliance with environmental mandates against the imperative for operational efficiency, while also navigating elevated tariffs and shifting regional demand patterns. Success in this environment requires a strategic blend of supply chain diversification, targeted product differentiation, and proactive engagement with policy frameworks.

Leading organizations that have embraced digital supply chain solutions, invested in advanced purification capabilities, and forged collaborative R&D partnerships are well-positioned to capture emerging opportunities. Meanwhile, new entrants offering specialized technical grades and agile service models continue to redefine customer expectations. Across the board, the ability to translate market intelligence into decisive action will determine the pace at which companies can adapt to change and secure long-term competitiveness.

Ultimately, the insights presented herein highlight the critical need for a dynamic strategy that aligns operational excellence with sustainability goals and responsive market engagement. By adopting the recommended measures and leveraging the detailed segmentation, regional, and company analyses, stakeholders can navigate uncertainty with confidence and chart a clear path toward value creation in the bromoform market.

Take the Next Step Toward Market Leadership by Engaging with Ketan Rohom for Expert Guidance and Exclusive Access to the Bromoform Industry Research Report

For tailored insights that align with your strategic priorities and empower decisive action in the Bromoform market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His deep understanding of industry drivers and challenges can guide you toward optimized sourcing, risk mitigation, and growth opportunities. Secure exclusive access to the comprehensive report today and unlock a roadmap for sustainable competitiveness in an evolving regulatory and economic landscape. Partner with Ketan to transform data into actionable strategies that will future-proof your operations and enhance stakeholder value.

- How big is the Bromoform Market?

- What is the Bromoform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?