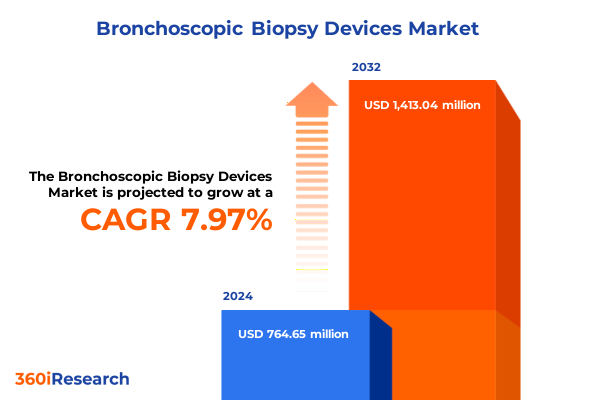

The Bronchoscopic Biopsy Devices Market size was estimated at USD 822.15 million in 2025 and expected to reach USD 884.88 million in 2026, at a CAGR of 8.04% to reach USD 1,413.04 million by 2032.

Discover how bronchoscopic biopsy devices are redefining pulmonary lesion diagnosis through innovation, precision navigation, and patient-centric advancements

Bronchoscopic biopsy devices have become the cornerstone of modern pulmonary diagnostics, empowering clinicians to obtain high-quality tissue samples with unparalleled precision and safety. Over the past decade, advancements in device design, imaging integration, and navigation technology have converged to transform how endoscopic lung biopsies are conducted. As a result, interventional pulmonologists and thoracic surgeons can now target central, mediastinal, and peripheral lesions with greater confidence and reduced complication rates.

This surge in technological sophistication has been driven by a relentless focus on patient-centric procedural improvements. Slimmer scopes reduce patient discomfort and procedural time, while enhanced imaging modalities facilitate real-time visualization of vascular and airway structures. Meanwhile, navigation systems that leverage electromagnetic tracking and virtual bronchoscopic pathways enable clinicians to chart optimal trajectories through complex bronchial trees. These innovations not only elevate diagnostic yield but also streamline clinical workflows, thereby reducing overall procedure costs and improving hospital throughput.

Looking ahead, the bronchoscopic biopsy devices landscape is poised to expand further as emerging technologies such as robotic-assisted navigation, real-time histopathology analysis, and artificial intelligence-driven image interpretation move closer to clinical adoption. In parallel, shifting healthcare reimbursement models and evolving regulatory landscapes are reshaping procurement strategies and driving device manufacturers to prioritize safety, efficacy, and cost-effectiveness. Consequently, the path forward demands an integrated approach that balances clinical innovation with strategic market positioning, enabling stakeholders to capitalize on new opportunities in pulmonary oncology and beyond.

Explore the transformative shifts reshaping bronchoscopic biopsy device technology as navigation systems imaging enhancements and AI integration drive new clinical standards

In recent years, the bronchoscopic biopsy devices landscape has experienced transformative shifts, fueled by breakthroughs in imaging resolution and navigation precision. Electromagnetic navigation systems have transitioned from early-stage concepts to mainstream clinical tools, allowing real-time tracking of biopsy instruments within complex airway networks. Simultaneously, radial endobronchial ultrasound probes have evolved to provide clearer peripheral lesion imaging, granting the ability to visualize nodules as small as a few millimeters in diameter. These converging improvements have collectively enhanced diagnostic accuracy and reduced the need for repeat procedures.

Another significant shift has arisen from the integration of artificial intelligence into procedural planning and image interpretation. Machine learning algorithms can now assist clinicians in differentiating malignant from benign lesions during live procedures, flagging areas of interest and predicting sampling adequacy. Furthermore, AI-driven workflow optimization tools help minimize procedure times by automating device calibration and image registration, thereby improving throughput in high-volume centers.

Beyond technical enhancements, industry dynamics have also transformed as strategic partnerships between device manufacturers and technology startups proliferate. Collaborations aimed at merging robotic-assisted catheter placement with advanced navigation platforms herald the next wave of minimally invasive biopsy techniques. As a result, stakeholders must remain vigilant about emerging alliances that could redefine competitive landscapes, while also adopting flexible product roadmaps to integrate successive waves of innovation seamlessly into clinical practice.

Analyze the cumulative effects of 2025 United States tariffs on bronchoscopic biopsy device supply chains cost structures and manufacturer strategic adaptations

The imposition of United States tariffs in 2025 has introduced a new set of challenges and strategic considerations for bronchoscopic biopsy device manufacturers and healthcare providers alike. With duties applied to a broad range of imported endoscopic and imaging components, supply chain costs have risen significantly, prompting many vendors to reevaluate sourcing strategies. Manufacturers are now exploring nearshoring and domestic assembly options to mitigate tariff impacts and ensure reliable delivery timelines.

These cost pressures have reverberated downstream, influencing procurement decisions among hospital operating rooms and specialized cancer centers. Amid tighter capital budgets, healthcare administrators are demanding greater transparency around total cost of ownership, driving device suppliers to bundle service contracts, training programs, and technology upgrades into compelling value packages. In parallel, some providers have deferred nonurgent equipment refresh cycles or shifted toward ultrathin disposable scopes to lower upfront expenditures.

Despite these headwinds, the tariff environment has also spurred increased investment in local manufacturing capabilities. By establishing production facilities within the United States, several leading companies aim to shield themselves from future trade policy fluctuations while capitalizing on incentives tied to reshoring initiatives. Over time, these shifts are expected to stabilize component pricing and foster a more resilient supply chain, though device developers must carefully navigate regulatory requirements and qualify domestic suppliers to maintain product quality and consistency.

Uncover critical segmentation insights by technology product type application end user and procedure type illuminating diverse market dynamics

A nuanced examination of market segmentation reveals five distinct dimensions shaping bronchoscopic biopsy device dynamics. Based on technology, the field encompasses convex probe EBUS systems favored for mediastinal staging, electromagnetic navigation platforms prized for peripheral lesion targeting, and radial EBUS solutions that balance image clarity with scope flexibility. In terms of product type, the landscape includes dual-channel devices engineered for simultaneous visualization and sampling, single-channel offerings that prioritize minimal invasiveness, and ultrathin scopes designed to access distal airways and reduce patient discomfort.

When viewed through the lens of clinical application, bronchoscopic biopsy devices serve central lesion diagnosis protocols as well as sophisticated mediastinal staging procedures, the latter subdividing into conventional transbronchial needle aspiration and EBUS-guided TBNA approaches. Peripheral lesion diagnosis further stratifies into direct sampling without navigation, electromagnetic navigated sampling techniques, and fully guided virtual bronchoscopy navigation workflows. With respect to end users, both ambulatory surgical centers-whether corporate-owned or physician-owned-and hospital operating rooms in private and public settings play pivotal roles, alongside high-volume specialized cancer centers that demand integrated biopsy solutions.

Finally, by procedure type, diagnostic biopsy operations represent the bulk of device utilization, while a growing subset of therapeutic intervention applications underscores the expanding procedural versatility of modern endoscopic platforms. Across each of these segmentation dimensions, device developers and health systems alike must align strategic roadmaps with specific clinical requirements and operational constraints to maximize the impact of bronchoscopic biopsy technologies.

This comprehensive research report categorizes the Bronchoscopic Biopsy Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Procedure Type

- Application

- End User

Examine key regional insights highlighting how the Americas Europe Middle East Africa and Asia Pacific regions differ in demand regulation and adoption

Regional dynamics in the bronchoscopic biopsy device market diverge significantly across the Americas, EMEA, and Asia-Pacific regions, each presenting unique opportunities and challenges. In the Americas, rigorous reimbursement frameworks and high procedural volumes underpin strong demand for advanced navigation and imaging-enabled devices. Leading institutions are early adopters of cutting-edge platforms, driving rapid uptake of integrated EBUS and EMN solutions to support expanding lung cancer screening programs.

In Europe, Middle East, and Africa, regulatory harmonization under European Medical Device Regulation has imposed stringent safety and performance standards, increasing time-to-market for novel systems but also ensuring device reliability. Regional disparities in healthcare infrastructure result in a wide gulf between Western European centers of excellence and emerging Middle Eastern markets, where access to specialty care and capital investment vary widely. Nonetheless, pan-EMEA collaborations on multi-center clinical trials are fostering knowledge exchange and accelerating evidence generation around emerging biopsy technologies.

Within the Asia-Pacific arena, surging incidences of lung cancer driven by demographic trends and environmental factors are fueling robust demand for minimally invasive diagnostic platforms. Local manufacturing hubs in China and South Korea are enhancing price competitiveness, prompting global players to forge strategic partnerships or licensing agreements to maintain regional market share. Across all territories, the interplay between regulatory pathways, reimbursement environments, and clinical practice patterns dictates the pace at which new bronchoscopic biopsy innovations reach patients.

This comprehensive research report examines key regions that drive the evolution of the Bronchoscopic Biopsy Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluate the strategies competitive positioning and innovation pipelines of leading bronchoscopic biopsy device companies influencing market evolution and partnerships

Leading companies in the bronchoscopic biopsy devices arena are executing multifaceted strategies to capture market share and establish long-term competitive moats. Strategic partnerships between established medical device corporations and emerging tech innovators have become commonplace, allowing incumbents to access proprietary navigation algorithms while startups benefit from established distribution networks. Meanwhile, mergers and acquisitions are consolidating the supplier base, with several mid-sized firms acquired to strengthen EBUS portfolios or to integrate advanced imaging modules into existing platforms.

Innovation pipelines also play a critical role in defining company trajectories. Development of single-use ultrathin scopes promises to address infection control concerns while reducing sterilization logistics. Concurrently, modulable EBUS consoles that accommodate both convex probe and radial imaging attachments are gaining traction, offering end users the flexibility to tailor procedural capabilities on a single platform. Companies investing in cloud-based procedural analytics are carving out new service revenue streams, enabling remote monitoring of device performance and enabling predictive maintenance models.

To sustain growth amidst tariff-driven cost pressures, major players are increasingly localizing component fabrication and final assembly. By establishing manufacturing footprints in key geographies-particularly in the United States and Europe-device suppliers aim to optimize lead times and qualify for government reshoring incentives. As the competitive landscape continues to evolve, market leadership will hinge on the ability to merge technological excellence with agile supply chain strategies and value-based commercial models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bronchoscopic Biopsy Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambu A/S

- Becton, Dickinson, and Company

- Body Vision Medical Inc.

- Boston Scientific Corporation

- CONMED Corporation

- Cook Group Incorporated

- Erbe Elektromedizin GmbH

- FUJIFILM Holdings Corporation

- Johnson & Johnson Services, Inc.

- KARL STORZ SE & Co. KG

- Medi-Globe GmbH

- Medtronic PLC

- Merit Medical Systems, Inc.

- Micro-Tech (Nanjing) Co., Ltd

- Olympus Corporation

- Richard Wolf GmbH

- Shanghai Aohua Photoelectricity Endoscope Co.,Ltd.

- Teleflex Incorporated

Implement actionable recommendations empowering industry leaders to optimize R&D regulatory navigation supply chain resilience and stakeholder collaboration

Industry leaders seeking to strengthen their position in the evolving bronchoscopic biopsy market must pursue a suite of targeted actions. First, investing proactively in next-generation navigation technologies-particularly those that incorporate AI-assisted lesion detection-will deliver meaningful differentiation and support premium pricing models. Equally important is the expansion of domestic manufacturing capabilities to hedge against trade policy fluctuations, ensuring uninterrupted supply and fostering favorable working relationships with regulatory authorities.

Establishing collaborative research partnerships with leading academic medical centers can accelerate evidence generation, facilitating earlier reimbursement approvals and clinician buy-in. By co-developing multicenter clinical studies, device manufacturers can demonstrate procedural efficacy across diverse patient cohorts and integrate real-world performance data into iterative design improvements. Furthermore, commercial teams must refine value-based propositions by quantifying total cost savings associated with reduced procedure times, lower complication rates, and shorter hospital stays.

Finally, adopting a hybrid service model that combines remote monitoring, preventative maintenance, and procedural analytics can create recurring revenue streams while enhancing customer loyalty. Through data-driven insights on device utilization and performance, stakeholders can align product roadmaps with evolving clinical needs, thereby driving sustainable growth in a competitive and rapidly innovating field.

Understand the rigorous research methodology combining in depth primary interviews secondary data and expert validation ensuring comprehensive insights into the biopsy devices landscape

This market research is underpinned by a robust, multi-tiered methodology designed to ensure the accuracy and relevance of findings. The process began with exhaustive secondary research, including analysis of peer-reviewed journals, clinical trial registries, regulatory databases, and public financial filings to map industry structure, technology maturity, and historical adoption trends. Key opinion leaders in interventional pulmonology and thoracic surgery were identified through professional association directories and invited to validate preliminary insights.

In the primary research phase, in-depth interviews were conducted with over 40 stakeholders, encompassing device developers, healthcare providers, purchasing managers, and reimbursement specialists across major markets. These discussions provided nuanced perspectives on clinical decision criteria, purchasing frameworks, and operational challenges unique to different end users. To further triangulate insights, site visits to ambulatory surgical centers and hospital operating rooms in North America, Western Europe, and Asia-Pacific allowed direct observation of device utilization and procedural workflows.

Finally, data synthesis employed a framework-based approach, structuring insights across segmentation dimensions, regional markets, and company strategies. Iterative validation workshops with internal industry experts refined key themes and ensured alignment with real-world clinical experiences. This rigorous methodology guarantees that the conclusions and recommendations presented reflect both quantitative evidence and qualitative expert judgment across the global bronchoscopic biopsy devices landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bronchoscopic Biopsy Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bronchoscopic Biopsy Devices Market, by Technology

- Bronchoscopic Biopsy Devices Market, by Product Type

- Bronchoscopic Biopsy Devices Market, by Procedure Type

- Bronchoscopic Biopsy Devices Market, by Application

- Bronchoscopic Biopsy Devices Market, by End User

- Bronchoscopic Biopsy Devices Market, by Region

- Bronchoscopic Biopsy Devices Market, by Group

- Bronchoscopic Biopsy Devices Market, by Country

- United States Bronchoscopic Biopsy Devices Market

- China Bronchoscopic Biopsy Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesize the overarching conclusions that underscore market trajectories technological imperatives and strategic directions for bronchoscopic biopsy stakeholders

In summary, the bronchoscopic biopsy devices market is undergoing a profound transformation driven by technological innovation, shifting trade policies, and evolving clinical paradigms. Navigation enhancements, ultrathin scope designs, and AI-powered imaging tools are converging to improve diagnostic accuracy and procedural safety. At the same time, the introduction of tariffs in 2025 has catalyzed supply chain realignment and heightened the strategic importance of domestic manufacturing capabilities.

Segmentation analysis underscores the diverse clinical applications-from central lesion diagnosis to complex mediastinal staging-and the varied end user environments ranging from ambulatory surgical centers to specialized oncology institutions. Regional dynamics reflect a tapestry of regulatory frameworks and reimbursement models, with high-income markets leading in advanced technology adoption while emerging markets drive volume growth through cost-competitive local manufacturing.

Ultimately, market leaders will succeed by integrating innovative R&D portfolios, resilient supply chain infrastructures, and data-driven service models. By forging strategic alliances, investing in clinical evidence generation, and articulating compelling value propositions, stakeholders can navigate uncertainty and capitalize on the expanding role of bronchoscopic biopsy devices in pulmonary healthcare.

Engage with Ketan Rohom Associate Director Sales and Marketing to Access the Definitive Bronchoscopic Biopsy Devices Market Research Report

For a comprehensive exploration of these pivotal market insights, direct inquiries to Ketan Rohom Associate Director Sales and Marketing at 360iResearch who can provide detailed report packages tailored to organizational needs. Engage with an expert to discover customized research solutions, gain immediate access to proprietary data tables, and unlock executive-guided strategic briefings that will support informed decision-making. Contact Ketan Rohom today to secure your definitive bronchoscopic biopsy devices market research report and accelerate your competitive advantage within this rapidly evolving landscape

- How big is the Bronchoscopic Biopsy Devices Market?

- What is the Bronchoscopic Biopsy Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?