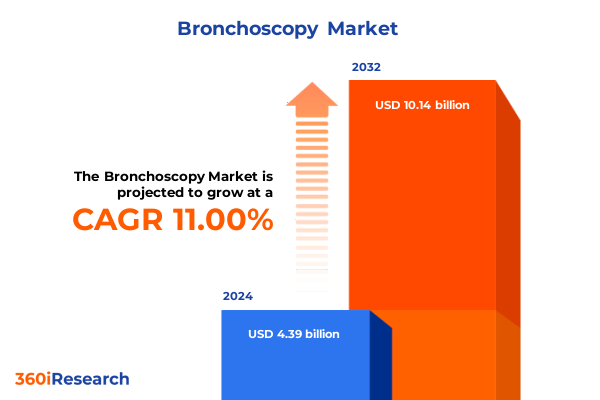

The Bronchoscopy Market size was estimated at USD 4.87 billion in 2025 and expected to reach USD 5.41 billion in 2026, at a CAGR of 11.01% to reach USD 10.14 billion by 2032.

Unlocking the Critical Role of Innovative Bronchoscopy Techniques and Emerging Clinical Protocols in Shaping the Future of Respiratory Healthcare Delivery

The landscape of respiratory healthcare has undergone profound evolution in recent years, with bronchoscopy emerging as a cornerstone of minimally invasive diagnosis and treatment. Driven by escalating incidence of chronic lung diseases and a heightened focus on patient safety, bronchoscopy has advanced from a basic optical procedure to a sophisticated platform integrating high-definition imaging and precision guidance. As clinicians grapple with complex pathologies-from early-stage lung cancer to persistent airway infections-the demand for enhanced visualization and real-time intervention is more critical than ever. Furthermore, growing concerns over hospital-acquired infections have accelerated the shift toward single-use bronchoscopes, underscoring the dual imperatives of clinical efficacy and sterility.

Against this backdrop, the industry is witnessing a convergence of engineering ingenuity and clinical insight. Robotic-assisted bronchoscopy platforms are redefining reach and stability, enabling access to peripheral lung lesions once considered inaccessible. Simultaneously, the incorporation of artificial intelligence into image interpretation is laying the groundwork for predictive diagnostics, promising earlier detection of malignancies and improved patient outcomes. Consequently, stakeholders across healthcare settings-from ambulatory surgical centers to tertiary hospitals-are reexamining workflows, procurement strategies, and clinical protocols. This introduction sets the stage for a comprehensive exploration of the transformative shifts shaping bronchoscopy today, charting a course for decision-makers to harness innovation and mitigate emerging challenges.

Exploring the Pivotal Technological and Clinical Breakthroughs That Are Redefining Bronchoscopy Practice Worldwide

Technological innovation and clinical imperatives have converged to reshape bronchoscopy practice over the past year. First, the widespread integration of high-definition video and narrow-band imaging has profoundly enhanced the clarity of airway visualization, allowing clinicians to identify subtle mucosal lesions and vascular patterns with unprecedented precision. Building on this foundation, the advent of robotic-assisted bronchoscopy systems has doubled global installations in just two years, delivering unparalleled stability and reach into peripheral lung segments, thereby expanding the scope of biopsy and localized therapy.

Moreover, the rapid transition from reusable to single-use bronchoscopes is emblematic of the broader healthcare emphasis on infection control. With hospital-acquired infections affecting one in ten patients worldwide, the adoption of disposable instruments has gained momentum, particularly in intensive care and emergency settings where cross-contamination risks are highest. Alongside these shifts, the convergence of robotics, artificial intelligence, and advanced imaging is driving next-level innovation in bronchial biopsy tools. Recent patent filings have focused on sensor-equipped biopsy devices designed to deliver near-real-time tissue characterization, while clinical pilots suggest a 2–5% improvement in early-stage cancer detection rates, pointing toward a future of precision-guided interventions.

These cumulative breakthroughs are catalyzing new procedural protocols and training requirements, compelling healthcare providers to invest in specialized infrastructure and multidisciplinary teams. As the field advances, industry stakeholders must remain agile-balancing early adoption of cutting-edge technologies with rigorous evaluation of clinical outcomes and cost impacts.

Assessing the Ripple Effects of Recent U.S. Import Tariff Policies on Bronchoscopy Device Supply Chains and Operational Dynamics

The initiation of broad-based U.S. tariffs in early 2025 has reverberated across global medical device supply chains, significantly affecting bronchoscope manufacture and distribution. The Trump administration imposed a 10% duty on Chinese imports and a 25% duty on products from Mexico and Canada, directly exposing medical devices-many of which depend on components sourced from these countries-to increased costs. Compounding these measures, the restoration of 25% tariffs on steel and aluminum derivatives in March has further escalated production expenses for bronchoscope manufacturers that rely on these metals for device components.

In response, leading companies are navigating a complex environment of higher landed costs and elongated lead times. Some manufacturers have absorbed a portion of the tariff burden to maintain pricing stability, while others have instituted selective price adjustments, potentially passing increased expenses to healthcare providers in the form of higher procedure fees. Industry associations such as AdvaMed and the American Hospital Association have petitioned for medical device exemptions, warning that continued levies could curtail essential equipment availability and stifle research and development investment.

As a result, supply chain resilience has ascended to a top strategic priority. Firms are exploring diversified sourcing-shifting critical component manufacturing to tariff-exempt regions and expanding domestic assembly operations. Concurrently, providers are reassessing inventory management, increasing buffer stocks of single-use bronchoscopes, and fostering group purchasing alliances. Although immediate disruptions have been mitigated by existing contractual commitments and buffer inventories, healthcare systems anticipate that sustained tariffs will translate into incremental cost pressures and potential procedural delays unless policy relief or supply chain realignments are enacted.

Unraveling Market Dynamics Through a Deep Dive into Bronchoscopy Segmentation Across Device Types, Technologies, and Applications

A nuanced understanding of bronchoscopy market segmentation reveals the strategic levers that drive adoption and innovation. Based on the type of bronchoscope, flexible scopes command wide clinical acceptance due to their maneuverability within complex airway anatomies, while rigid scopes retain a role in specific interventional procedures, and capsule devices emerge as noninvasive alternatives for patient comfort. Segmentation by reusability underscores a fundamental dichotomy: reusable bronchoscopes offer long-term value for high-volume centers but introduce sterilization challenges, whereas single-use systems are gaining traction for their immediacy and infection control benefits. Technology segmentation differentiates between traditional fiber optic illumination systems, prized for established reliability, and next-generation video platforms that deliver enhanced resolution and integrated image processing.

Application-based segmentation further refines market insights. Diagnostic procedures-including biopsy, bronchoalveolar lavage, and endobronchial ultrasound-have leveraged imaging and sampling enhancements to elevate diagnostic yield, particularly in early-stage lung cancer detection. Therapeutic interventions such as bronchial thermoplasty, foreign body removal, laser therapy, and tumor ablation are increasingly complemented by robotic navigational guidance and sensor-enabled catheters. Airway clearance applications continue to expand with innovations in bronchial hygiene devices and integrated suction-port enhancements. The end-user dimension encompasses hospitals as primary adopters of advanced bronchoscopic platforms, ambulatory surgical centers optimizing throughput with disposable scopes, and clinics leveraging streamlined systems for routine diagnostic exams. Distribution channels range from direct procurement models that facilitate bespoke service agreements to indirect partnerships that extend reach through third-party distributors. Finally, patient age segmentation highlights the divergence in device design and procedural protocols between adult and pediatric populations, driving specialized instrument development and tailored clinical training.

This comprehensive research report categorizes the Bronchoscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Bronchoscope Type

- Reusability

- Technology

- Distribution Channel

- Application

- End User

Mapping Regional Variations in Bronchoscopy Adoption and Infrastructure to Reveal Growth Opportunities and Strategic Hotspots

Regional differences in clinical practice patterns, regulatory pathways, and healthcare funding models shape bronchoscopy adoption across major markets. In the Americas, robust reimbursement frameworks and advanced hospital networks have spurred rapid uptake of single-use bronchoscopes, with U.S. providers particularly focused on minimizing cross-contamination and procedural downtime. Canada’s market benefits from centralized procurement policies that favor large-scale purchasing agreements, driving competitive pricing for disposable systems and accelerating adoption in academic hospitals.

Across Europe, Middle East & Africa, regulatory harmonization remains a double-edged sword: unified CE marking expedites market access yet imposes stringent performance validation for emerging technologies. Western European nations lead in integrating robotic bronchoscopy for complex interventions, while healthcare systems in the Middle East are expanding capacity through public–private partnerships aimed at upgrading endoscopy suites. In Africa, infrastructure constraints and variable reimbursement models necessitate versatile scope designs and bundled service offerings that include training and maintenance.

Asia-Pacific presents some of the most dynamic growth opportunities, driven by rising prevalence of chronic respiratory conditions and significant investments in healthcare infrastructure. Countries such as China, Japan, and India are cultivating domestic manufacturing capabilities to capture regional demand, supported by favorable tax incentives and streamlined regulatory pathways for digital health integrations. Outpatient respiratory care settings in Australia and South Korea increasingly adopt video-based bronchoscopes to optimize procedural efficiency. Across the region, demographic shifts toward aging populations are elevating the clinical imperative for minimally invasive diagnostic and therapeutic solutions, positioning bronchoscopy at the forefront of respiratory care modernization.

This comprehensive research report examines key regions that drive the evolution of the Bronchoscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Trends Among Leading Bronchoscopy Device Manufacturers and Emerging Players

Leading players in the bronchoscopy domain are advancing differentiated strategies to capture market share and drive innovation. Boston Scientific has expanded its single-use bronchoscope portfolio, emphasizing scope ergonomics and imaging clarity to meet the demands of high-volume clinical settings while forging partnerships with respiratory therapy networks to streamline product uptake. Olympus, leveraging its global endoscopy footprint, integrated the EVIS X1 Endoscopy System to introduce two new bronchoscope models in May 2024, embedding advanced light source technologies and digital diagnostic tools to enhance lesion detection accuracy. Ambu A/S continues to pioneer disposable flexible bronchoscopes, emphasizing cross-contamination mitigation and simplified workflow integration for ambulatory facilities.

PENTAX Medical and Karl Storz have deepened their focus on fiber optic and hybrid video platforms, respectively, balancing legacy reliability with incremental feature enhancements. FUJIFILM has invested in artificial intelligence modules that augment image interpretation, collaborating with academic centers to validate AI-driven diagnostic algorithms. Teleflex Incorporated and Innovex Medical have targeted emerging markets through localized manufacturing arrangements, reducing lead times and tariffs exposure. Meanwhile, venture-backed companies such as NeoScope and Verathon are carving niche positions by introducing sensor-integrated biopsy tools and multi-lumen catheter designs, challenging incumbents to accelerate next-gen product roadmaps.

Across the competitive landscape, mergers and acquisitions have emerged as a key vector for capability expansion. Boston Scientific’s acquisition of Baylis platforms illustrates the convergence of structural heart and bronchial intervention modalities, while strategic alliances between device makers and software developers underscore the growing emphasis on digital and robotic-enabled respiratory care solutions. These collective efforts underscore an industry in flux, where technological differentiation and strategic collaborations define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bronchoscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advin Health Care

- Ambu A/S

- Boston Scientific Corporation

- ConMed Corporation

- Fujifilm Holdings Corporation

- GE Healthcare

- Henke Sass Wolf Group

- HOVERLABS

- HOYA Corporation

- Johnson & Johnson Services, Inc.

- Karl Storz SE & Co. KG

- Medtronic plc

- NeoScope Inc.

- Olympus Corporation

- Ottomed

- PENTAX Medical

- Pro Scope Systems

- Richard Wolf GmbH

- Smith & Nephew plc

Strategic Imperatives for Industry Stakeholders to Capitalize on Evolving Bronchoscopy Trends and Navigate Emerging Challenges

To thrive in the evolving bronchoscopy environment, industry leaders must embrace a strategic triad of innovation, operational resilience, and stakeholder collaboration. First, investing in disposable bronchoscopy platforms can address the twin challenges of infection control and procedural efficiency, but success hinges on seamless integration into existing clinical workflows and reimbursement models. Therefore, forging partnerships with group purchasing organizations and payers can facilitate adoption by aligning economic incentives with patient safety objectives. Secondly, accelerating the development of AI-driven imaging and sensor technologies demands close collaboration with academic and clinical research institutions. By co-designing validation studies and leveraging real-world evidence, device manufacturers can substantiate clinical and economic value, expediting regulatory approvals and payer coverage.

Simultaneously, supply chain optimization must move beyond cost containment to embrace geographic diversification. Establishing dual-source agreements in tariff-exempt regions and investing in flexible domestic assembly capabilities can buffer against policy volatility and reduce lead times. Equally important is the cultivation of end-user engagement through comprehensive training programs and digital support platforms, ensuring clinicians extract maximum value from advanced bronchoscopy systems. Lastly, industry stakeholders should proactively engage with regulatory bodies and trade associations to advocate for targeted tariff exemptions, presenting data-driven analyses that underscore the essential nature of bronchoscopy devices in safeguarding public health. By uniting innovation with collaborative market-shaping initiatives, companies can solidify their competitive positions while contributing to sustainable, patient-centric respiratory care.

Detailing the Rigorous Research Approach Integrating Primary Expert Insights and Comprehensive Secondary Data for Bronchoscopy Analysis

This market analysis employs a robust research framework integrating primary and secondary methodologies to ensure comprehensive insights. The primary research phase involved in-depth interviews with interventional pulmonologists, thoracic surgeons, and industry executives across diverse geographies. These discussions illuminated real-world procedural challenges, technology preferences, and adoption barriers. Supplementing expert interviews, surveys of hospital procurement managers and ambulatory center administrators provided quantitative perspectives on purchasing criteria, scope utilization patterns, and tariff-driven cost pressures.

Secondary research encompassed rigorous review of academic literature, patent filings, regulatory documents, and corporate disclosures to map technological developments and competitive landscapes. Trade journal articles and conference proceedings were scrutinized to capture emerging clinical protocols and device roadmaps. Additionally, policy documents and trade analyses-including government tariff schedules and industry association white papers-were evaluated to assess supply chain and regulatory dynamics. The triangulation of primary and secondary data was reinforced through data validation workshops with key opinion leaders, ensuring consistency and reliability of findings.

This structured approach ensures that insights into segmentation, regional nuances, and company strategies are grounded in empirical evidence and subject-matter expertise. Methodological rigor and transparent documentation underpin the credibility of the analysis, equipping stakeholders with actionable intelligence to inform strategic decisions in the dynamic bronchoscopy arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bronchoscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bronchoscopy Market, by Bronchoscope Type

- Bronchoscopy Market, by Reusability

- Bronchoscopy Market, by Technology

- Bronchoscopy Market, by Distribution Channel

- Bronchoscopy Market, by Application

- Bronchoscopy Market, by End User

- Bronchoscopy Market, by Region

- Bronchoscopy Market, by Group

- Bronchoscopy Market, by Country

- United States Bronchoscopy Market

- China Bronchoscopy Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights to Illuminate the Future Trajectory and Strategic Imperatives within the Bronchoscopy Landscape

The evolution of bronchoscopy has reached an inflection point where technological prowess and clinical pragmatism converge to redefine respiratory care. From the widespread adoption of single-use bronchoscopes addressing infection control imperatives to the pioneering integration of robotics and artificial intelligence in diagnostic and therapeutic procedures, the momentum is undeniable. However, industry dynamics are equally shaped by external pressures-most notably, escalating U.S. tariffs that have disrupted supply chains and compelled strategic recalibrations across manufacturing and procurement functions.

Looking ahead, market leaders will differentiate through their ability to orchestrate cross-functional collaborations-aligning R&D with clinical validation, supply chain diversification with policy advocacy, and digital innovation with customer engagement. Regional markets will continue to diverge based on regulatory landscapes and healthcare infrastructure, underscoring the need for tailored approaches that respect local nuances while leveraging global best practices. Segmentation insights will guide resource allocation, ensuring that investments in device type, technology, and application areas align with clinical demand and reimbursement trajectories.

Ultimately, success in the bronchoscopy domain will hinge on the agility to anticipate clinical needs, the foresight to navigate policy headwinds, and the commitment to delivering solutions that enhance patient outcomes and operational efficiency. By synthesizing market intelligence with strategic foresight, stakeholders can chart a course toward sustained growth and shape the future of respiratory healthcare.

Engage with Ketan Rohom to Secure Definitive Bronchoscopy Market Research and Drive Strategic Growth

Are you ready to gain unparalleled visibility into the dynamic forces shaping the bronchoscopy market and secure a competitive edge that drives strategic decision-making and sustainable growth? Reach out to Ketan Rohom, the Associate Director of Sales & Marketing, to obtain the definitive market research report tailored to your organization’s needs. Discover in-depth analysis, actionable insights, and expert-driven recommendations that empower you to navigate regulatory shifts, technological innovations, and evolving clinical demands with confidence and foresight. Contact Ketan now to transform intelligence into impact and ensure your leadership in the future of bronchoscopy.

- How big is the Bronchoscopy Market?

- What is the Bronchoscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?