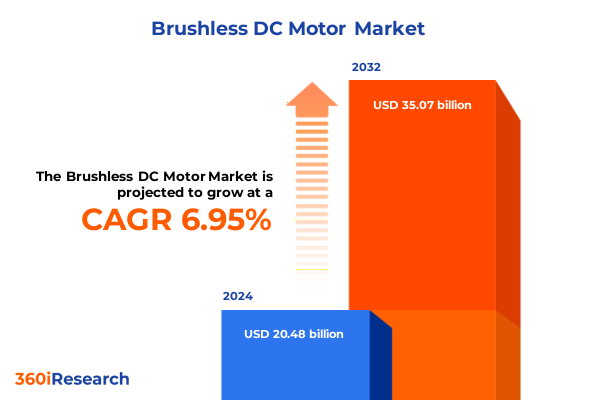

The Brushless DC Motor Market size was estimated at USD 21.75 billion in 2025 and expected to reach USD 23.09 billion in 2026, at a CAGR of 7.06% to reach USD 35.07 billion by 2032.

Exploring the rise of brushless DC motors as the driving force behind electrification, automation, and energy efficiency across critical industries

The brushless DC motor has emerged as a foundational technology powering the rapid electrification of transportation, the automation of manufacturing processes, and the energy-efficient operation of consumer electronics. In the automotive sector, the pivot toward electric vehicles has driven widespread adoption of brushless DC motors in propulsion systems, cooling fans, and auxiliary functions, reflecting over 45% integration across new EV platforms due to their superior torque-to-weight ratio and reduced maintenance needs. Simultaneously, in the aerospace and unmanned aerial vehicle segments, innovations in magnetic materials and stator–rotor configurations have pushed power-to-weight ratios beyond 3 kW/kg, extending flight endurance while supporting heavier payloads.

Beyond transportation and UAVs, brushless DC motors are pivotal in robotic applications, where over 60% of modern systems rely on their precise motion control capabilities to enhance manufacturing flexibility and throughput. Moreover, the consumer appliance sector is embracing these motors for their quiet operation and extended lifecycle, meeting escalating regulatory demands for energy efficiency and low noise emissions.

How advancements in connectivity, materials innovation, and regulatory mandates are revolutionizing brushless DC motor applications and design paradigms

Recent years have witnessed a seismic shift in how brushless DC motors are designed, connected, and controlled. The integration of smart motor controllers with real-time monitoring capabilities now enables adaptive control algorithms that optimize performance across varying load conditions, reducing energy consumption and enhancing reliability in autonomous applications. Concurrently, the convergence of IoT platforms and advanced analytics facilitates predictive maintenance strategies, minimizing unplanned downtime by enabling condition-based servicing before component failures occur.

Materials innovation has further accelerated this transformation. The adoption of nanocrystalline magnetic cores and high-strength composite windings has yielded motors that are both lighter and more efficient, addressing miniaturization requirements in urban air mobility and compact robotics. These advancements are complemented by R&D investments in advanced cooling solutions-such as phase-change materials and integrated liquid cooling-that manage thermal loads more effectively, ensuring high continuous power density without sacrificing longevity.

Simultaneously, tightening global regulations on energy consumption and carbon emissions have compelled manufacturers to refine motor architectures for maximal efficiency under diverse operating regimes. This regulatory push has catalyzed the deployment of sensorless and field-oriented control techniques, bolstering the performance of brushless DC motors in HVAC systems, appliances, and electric powertrains alike.

Assessing the cumulative effects of new US tariffs on brushless DC motor supply chains, component costs, and domestic manufacturing resilience in 2025

The implementation of new Section 301 tariffs has reshaped the landscape for brushless DC motor supply chains and component sourcing. Tariffs on critical raw materials and components-including permanent magnets, steel, aluminum, and non-lithium electric motor batteries-have increased to 25% as of January 1, 2025, imposing elevated input costs and compliance complexities for OEMs relying on Chinese imports. Additionally, the reinstatement of duties on select pandemic-related exclusions has introduced supply uncertainties, prompting companies to reassess global procurement strategies.

These cumulative measures have driven a strategic shift toward nearshoring and diversification of suppliers, as manufacturers seek to mitigate tariff exposure and bolster domestic production capabilities. While initial cost pressures have weighed on aftermarket pricing and replacement part availability, many industry players are leveraging tariff exclusions for certain DC motor subcategories-extended through mid-2025-to maintain operational continuity during the transition to reshored manufacturing.

Looking ahead, the prospect of incremental tariff adjustments and evolving geopolitical tensions underscores the need for agile supply chain management. Companies are increasingly investing in localized assembly, establishing regional magnet and core material processing centers, and forging strategic partnerships with metal refiners to secure tariff-resilient supply sources and sustain long-term competitiveness.

Uncovering the nuanced segmentation of the brushless DC motor market across diverse end-use industries, product types, voltage classes, and sales channels

The brushless DC motor ecosystem spans a breadth of end-use industries, each presenting distinct design requirements and regulatory considerations. In aerospace and defense, designers prioritize reliability under extreme environmental stresses for satellite systems and unmanned aerial vehicles. The automotive segment encompasses both commercial vehicles and passenger cars, where efficiency and power density directly influence vehicle range and performance. Meanwhile, medical instruments and rehabilitation devices demand ultra-precise, low-noise drives, and household appliances require motors that deliver quiet, energy-efficient operation over extended service intervals. Industrial equipment applications-from CNC machinery to robotic automation-call for robust, high-torque solutions capable of continuous duty cycles without frequent maintenance.

Product configurations further underscore market diversity, with inrunner motors favored for high-speed, precision demands, while outrunner variants excel where high torque at low rpm is essential. Voltage classes span low-voltage designs for consumer devices, medium-voltage systems for industrial automation, and high-voltage architectures supporting rapid EV charging and high-power e-mobility applications. Sales channels also vary, as OEM partnerships ensure integration during initial manufacturing, and aftermarket distribution via both traditional distributors and e-commerce platforms caters to replacement and retrofit demand. These segmentation dimensions collectively shape investment priorities, R&D roadmaps, and go-to-market strategies among brushless DC motor suppliers.

This comprehensive research report categorizes the Brushless DC Motor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Voltage

- End Use Industry

- Sales Channel

Illuminating the distinctive regional dynamics of brushless DC motor adoption and innovation across the Americas, EMEA, and Asia-Pacific markets

Regional dynamics play a pivotal role in defining competitive advantages and investment patterns for brushless DC motors. In the Americas, the United States leads with a robust automotive and aerospace supply base supported by stringent emissions standards and incentives for electric mobility. Brazil and Canada are leveraging energy efficiency mandates and industrial modernization programs to drive adoption in HVAC and manufacturing automation.

Within Europe, the Middle East, and Africa, regulatory frameworks such as the EU Ecodesign Directive and regional decarbonization targets are accelerating deployment in building automation and renewable energy systems. Germany, France, and the U.K. remain hotspots for industrial robotics and precision engineering, while the U.A.E. and Saudi Arabia are investing in smart infrastructure initiatives that incorporate brushless DC-driven solutions for energy-efficient building services.

In the Asia-Pacific region, manufacturing hubs across China, India, Japan, and South Korea dominate production and R&D, supported by aggressive local content requirements and rapidly growing domestic demand for consumer electronics, two-wheel EVs, and automated logistics. Southeast Asian nations are emerging as key assembly centers, offering competitive labor costs and favorable trade agreements that reinforce their status in global supply chains.

This comprehensive research report examines key regions that drive the evolution of the Brushless DC Motor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating strategic collaborations, product innovations, and competitive positioning among leading brushless DC motor manufacturers shaping industry evolution

Leading brushless DC motor manufacturers are advancing the industry through strategic collaborations and targeted innovations. Nidec’s partnership with AIR to develop a bespoke eVTOL motor for the AIR ONE production model exemplifies the convergence of automotive-grade manufacturing and aerospace performance requirements, paving the way for long-range personal flight applications. In the commercial vehicle sector, Nidec’s collaboration with Ashok Leyland to create next-generation E-Drive systems highlights the global shift toward sustainable transport solutions and localized supply chains in key emerging markets.

On the manufacturing front, Ningbo NIDE Tech’s strategic alliance with SMC empowers the development of intelligent, green production lines for new energy motors, integrating advanced pneumatic components and IoT-enabled automation to reduce carbon emissions and optimize throughput in factory environments. Bosch continues to push technological boundaries through investments in silicon carbide wafer fabs and the launch of 800-volt inverter and 460 kW motor platforms, addressing the next wave of high-voltage EV architectures and performance demands.

Precision drive specialist Maxon remains at the forefront of niche applications, showcasing its ECX10 micro BLDC motor and high-efficiency robot joints for medical robotics, as well as presenting precision propulsion systems for satellites and Mars rover missions at the Farnborough Airshow. These efforts underscore the company’s commitment to delivering customized, high-reliability solutions for aerospace, medical, and robotics customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Brushless DC Motor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Allied Motion Technologies, Inc.

- AMETEK, Inc.

- Dr. Fritz Faulhaber GmbH & Co. KG

- Johnson Electric Holdings Limited

- Maxon Motor AG

- MinebeaMitsumi Inc.

- Moog Inc.

- Nidec Corporation

- Portescap SA

- Robert Bosch GmbH

- Siemens AG

- Yaskawa Electric Corporation

Actionable strategies for industry leaders to navigate evolving market conditions, enhance operational agility, and capitalize on emerging opportunities in the brushless DC motor sector

Industry leaders should prioritize investment in next-generation motor control platforms that integrate machine learning capabilities for adaptive performance optimization and predictive maintenance. By harnessing real-time data from smart controllers, organizations can reduce lifecycle costs and extend service intervals, mitigating risks associated with unplanned downtime.

To counteract tariff-driven supply chain disruptions, companies are advised to diversify sourcing strategies by establishing partnerships with regional raw material processors and investing in localized magnet and core component production. This approach not only insulates operations from future duty escalations but also aligns with broader nearshoring trends that enhance responsiveness to market fluctuations.

Finally, expanding product portfolios to include high-voltage and medium-voltage motor offerings, alongside improved aftermarket and e-commerce channels, can unlock new customer segments and support retrofit opportunities. Embracing modular, scalable motor architectures enables rapid product customization that meets evolving end-use requirements across automotive, robotics, and consumer applications.

Detailed overview of the rigorous research methodology, data sources, and analytical frameworks employed to deliver comprehensive insights into the brushless DC motor market

This research draws upon a comprehensive methodology integrating secondary research, primary interviews, and expert validation. Secondary data sources included industry publications, technical standards, and regulatory filings, which provided foundational insights into technological trends and tariff developments. Primary research involved structured interviews with C-level executives, R&D directors, and supply chain managers from leading motor manufacturers, OEMs, and regulatory bodies.

Quantitative data were triangulated against import–export statistics, trade association reports, and customs filings to assess the impact of Section 301 measures and regional investment policies. Qualitative inputs from workshop sessions and advisory council reviews ensured the analysis accurately reflects market realities and future trajectories. All findings were subject to rigorous peer review and alignment with current industry benchmarks to deliver a robust, actionable intelligence platform.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Brushless DC Motor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Brushless DC Motor Market, by Product Type

- Brushless DC Motor Market, by Voltage

- Brushless DC Motor Market, by End Use Industry

- Brushless DC Motor Market, by Sales Channel

- Brushless DC Motor Market, by Region

- Brushless DC Motor Market, by Group

- Brushless DC Motor Market, by Country

- United States Brushless DC Motor Market

- China Brushless DC Motor Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing key insights on technological shifts, tariff impacts, segmentation trends, and regional variations to guide strategic decision-making in the brushless DC motor market

The evolution of brushless DC motors continues to be shaped by technological breakthroughs in connectivity, materials science, and digital control systems, positioning the industry at the crux of electrification and automation transformations. Concurrently, the reinstatement and expansion of US tariff measures in 2025 have underscored the critical need for diversified supply chains and regional manufacturing resilience.

Segmentation analysis reveals a complex landscape of end-use industries, voltage classifications, and sales channels, each demanding tailored motor solutions that meet stringent performance, efficiency, and reliability standards. Regional insights highlight the Americas’ leadership in EV and aerospace applications, EMEA’s regulatory-driven adoption in automation and building systems, and APAC’s dominance as a manufacturing and consumption powerhouse.

Through targeted collaborations and strategic investments in smart control technologies, leading companies are charting a path toward next-generation brushless DC applications across automotive, robotics, medical, and aerospace sectors. These combined developments underscore a dynamic market poised for continued innovation and global expansion.

Secure your competitive edge with comprehensive brushless DC motor market intelligence—contact Ketan Rohom, Associate Director of Sales & Marketing for access to the full report today

To gain a deeper understanding of the transformative shifts, regional nuances, and strategic opportunities within the brushless DC motor market, we invite you to secure full access to our comprehensive research report. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to unlock detailed analyses, actionable recommendations, and exclusive competitive insights that will empower your organization to navigate and lead in this dynamic landscape.

- How big is the Brushless DC Motor Market?

- What is the Brushless DC Motor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?