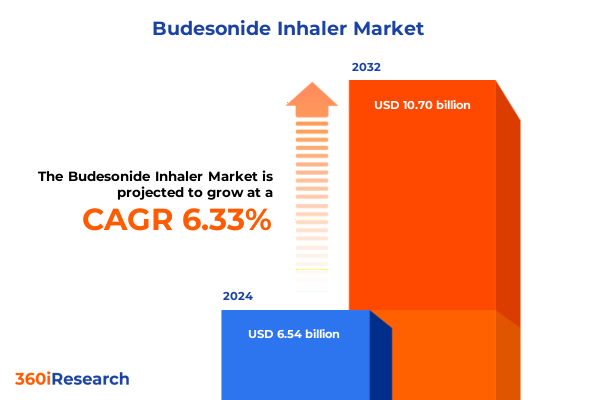

The Budesonide Inhaler Market size was estimated at USD 6.90 billion in 2025 and expected to reach USD 7.28 billion in 2026, at a CAGR of 6.45% to reach USD 10.70 billion by 2032.

Understanding the Evolving Dynamics of the Budesonide Inhaler Market From Innovation to Patient Outcomes in Contemporary Respiratory Care and Commercial Implications

Asthma remains one of the most prevalent noncommunicable diseases worldwide, affecting an estimated 262 million people and contributing to over 450 000 deaths annually. Inhaled corticosteroids are foundational for controlling airway inflammation, and among these, budesonide inhalers hold a central position due to their proven efficacy and safety profile in both maintenance therapy and acute management contexts. Over the past several decades, budesonide delivered via metered‐dose inhalers and dry powder inhalers has evolved alongside device innovations to improve patient adherence, reduce exacerbations, and enhance overall respiratory health.

Against a backdrop of shifting treatment guidelines and emerging digital technologies, this executive summary synthesizes current trends, regulatory influences, supply chain considerations, and strategic company initiatives that are reshaping how budesonide inhalers are developed, marketed, and prescribed. By examining transformative landscape changes, tariff impacts, rigorous segmentation analysis, and actionable recommendations, this report offers industry leaders a clear roadmap to optimize commercial performance and patient outcomes.

Exploring the Transformative Innovations and Paradigm Shifts Redefining the Budesonide Inhaler Landscape for Enhanced Patient Engagement

The budesonide inhaler arena is experiencing a paradigm shift propelled by digital health integrations that deliver real‐time insights into patient usage patterns. The FDA’s clearance of the Hailie Smartinhaler for use with AstraZeneca’s Airsupra and Breztri inhalation devices has unleashed new opportunities for clinicians and patients to monitor adherence, technique, and clinical responses through connected platforms. As a result, treatment regimens can be dynamically adjusted based on granular usage data, marking a departure from traditional episodic care models. Concurrently, Propeller Health’s digital sensor compatibility with the Symbicort inhaler underscores a broader industry commitment to leveraging technology for improved disease management and outcome tracking.

In tandem with digital advancements, therapeutic guidelines have been rewritten to reflect evolving understandings of asthma and COPD management. The 2023 Global Initiative for Asthma (GINA) report endorses combination short‐acting beta‐agonist/inhaled corticosteroid therapy as a rescue option, a departure from traditional SABA‐only rescue approaches. This shift underscores a growing focus on early anti‐inflammatory intervention to reduce exacerbation risks and long‐term airway remodeling. Additionally, novel combination formulations such as AIRSUPRA (albuterol/budesonide) have emerged to translate these guidelines into practice, offering patients an integrated symptom control and prevention strategy.

Environmental imperatives are also transforming the budesonide inhaler landscape. Under the Kigali Amendment to the Montreal Protocol and evolving EU regulations, pharmaceutical companies face increasing pressure to reduce hydrofluorocarbon propellant usage in metered‐dose inhalers. Industry leaders are proactively developing next‐generation propellants and transitioning to dry powder platforms to achieve substantial greenhouse gas reductions while maintaining therapeutic efficacy.

Collectively, these innovations-spanning digital health, guideline evolution, and environmental sustainability-reflect a cohesive movement toward more personalized, effective, and responsible respiratory care. Industry stakeholders must adapt to these transformative forces to sustain competitive advantage and meet rising patient and regulatory expectations.

Assessing the Comprehensive Cumulative Consequences of United States Tariff Policies on Budesonide Inhaler Supply Chains and Market Viability

The implementation of United States tariffs in 2025 has introduced a new layer of complexity for the budesonide inhaler supply chain. Beginning in April, a 10 percent global tariff on imported goods, along with escalated levies of up to 245 percent on active pharmaceutical ingredients sourced from China, has increased the cost base for manufacturers dependent on foreign API suppliers. These measures aim to stimulate domestic production but have strained established procurement strategies that rely on cost‐effective global sourcing.

Budesonide APIs are predominantly produced in China, where the new 245 percent tariff has prompted many companies to evaluate alternative suppliers or invest in U.S. manufacturing capacity. However, the lead time, regulatory approvals, and capital requirements for reshoring API production present significant operational hurdles. For device components, particularly propellant canisters and plastic housings often manufactured abroad, the blanket 10 percent tariff has also elevated production expenses and encouraged vertical integration initiatives among inhaler developers.

In response to tariff‐driven cost pressures, several multinational pharmaceutical companies have announced substantial investments in U.S. facilities. Notably, AstraZeneca’s recent $50 billion commitment to expand research, development, and manufacturing operations across multiple states exemplifies an industry‐wide trend toward onshore capacity building as a hedge against geopolitical risks and trade policy volatility. By localizing critical manufacturing steps, companies aim to mitigate future tariff exposures and ensure continuity of supply for essential respiratory therapies.

Nonetheless, generic inhaler producers face unique challenges. Operating on razor‐thin margins, many generic manufacturers find it difficult to absorb increased input costs without compromising product affordability or market presence. As a result, some firms have signaled intentions to exit specific inhaler markets, raising concerns about potential supply disruptions for lower‐cost therapeutic options. The resulting market consolidation underscores the delicate balance between national trade policy objectives and patient access to affordable respiratory care.

Illuminating Critical Segmentation Insights That Reveal Distinctive Therapeutic Demographic and Distribution Dynamics Shaping the Budesonide Inhaler Market

When examining the market through the lens of therapeutic area segmentation, it is evident that asthma remains the primary indication for budesonide inhalers, with specialized formulations designed for pediatric patients giving way to adult‐focused combination therapies for chronic disease management. COPD applications, most notably those incorporating budesonide alongside long‐acting bronchodilators, are gaining traction among older patients who require sustained maintenance therapy to reduce exacerbations and hospitalization events.

From an end‐use perspective, adult patients benefit from the full spectrum of inhaler devices, including digital‐enabled platforms that capture usage metrics, while pediatric formulations-both inhaled and orally dispersed-continue to address the unique adherence and dosing challenges in younger age groups. Notably, the FDA’s approval of oral budesonide formulations for eosinophilic esophagitis in patients aged 11 and above highlights the evolving treatment landscape for younger cohorts and showcases the versatility of budesonide across delivery modalities.

The transition from metered‐dose inhalers to dry powder inhalers represents a critical shift in delivery route dynamics. Dry powder options are increasingly favored for their reduced environmental footprint and simplified device mechanics, a trend reinforced by the discontinuation of select digital metered‐dose products such as ProAir Digihaler and AirDuo Digihaler metered powder inhalers earlier in 2024, which underscored the need for streamlined, patient‐centric designs that integrate both performance and sustainability considerations.

Branded products continue to leverage proprietary device engineering, digital connectivity, and combination molecules to differentiate in a crowded space, while generic offerings focus on cost optimization and broad distribution reach. Tariff‐induced cost inflation challenges generic producers particularly, emphasizing the strategic importance of scalable manufacturing and robust supply networks for economical product delivery.

Finally, distribution channel segmentation reveals the nuanced interplay between hospital pharmacies, online platforms, and traditional retail networks. Government hospital systems are pivotal channels for high‐acuity COPD regimens, while private hospitals and chain pharmacies drive volume uptake for maintenance inhalers. Concurrently, online pharmacies have emerged as a critical growth engine, offering direct‐to‐consumer delivery models that bypass conventional supply constraints and meet the evolving expectations of digitally empowered patients. Dosage strength differentiation-ranging from low dose for mild symptom control to high dose for severe exacerbation prevention, with medium dose occupying the core maintenance segment-further refines therapeutic positioning and guides formulary decisions.

This comprehensive research report categorizes the Budesonide Inhaler market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Area

- Route

- Product

- Dosage Strength

- End Use

- Distribution Channel

Analyzing Key Regional Market Dynamics Across Americas Europe Middle East Africa and Asia Pacific Impacting Budesonide Inhaler Adoption

In the Americas, the United States leads with a well‐established reimbursement environment and advanced digital infrastructure that support both branded and generic budesonide inhaler adoption. However, the imposition of tariffs has amplified cost considerations, prompting domestic manufacturers and importers to reassess sourcing strategies and seek collaborative ventures to sustain competitive pricing and supply reliability. Canada, with its single‐payer system, emphasizes evidence‐based formulary inclusion, driving utilization of cost‐effective generics in outpatient and hospital settings while encouraging local API production.

Across Europe, the Middle East, and Africa, environmental regulations under the Kigali Amendment and EU propellant phase‐out mandates have accelerated the shift toward dry powder inhalers. Countries in Northern and Western Europe have implemented stringent carbon reduction targets, incentivizing manufacturers to fast‐track green inhaler portfolios. Meanwhile, emerging markets in Africa and the Middle East are focused on improving access to essential respiratory medicines through centralized procurement programs, often leveraging generic budesonide formulations to expand treatment coverage under universal health initiatives.

In the Asia-Pacific region, rapid urbanization and rising air pollution levels have fueled an increased prevalence of asthma and COPD, particularly in China and India. Local pharmaceutical manufacturers are scaling up production of both APIs and finished inhaler products, supported by government incentives to bolster domestic healthcare industries. At the same time, markets such as Japan and Australia continue to adopt novel combination therapies and digital inhaler platforms, reflecting a dual focus on innovation and self‐management of chronic respiratory conditions. Together, these regional dynamics underscore the importance of tailored market strategies that account for regulatory nuances, infrastructure maturity, and evolving patient expectations.

This comprehensive research report examines key regions that drive the evolution of the Budesonide Inhaler market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Company Initiatives Unveiling Competitive Advantages and Collaborative Strategies Driving Growth in the Budesonide Inhaler Sector

AstraZeneca has emerged as a frontrunner in the budesonide inhaler segment by coupling product innovation with significant U.S. investments in manufacturing and R&D infrastructure. Their introduction of AIRSUPRA and Breztri, combined with strategic alliances for digital sensor integration, reflects a multifaceted approach to market leadership and resilience against trade policy fluctuations.

Teva’s portfolio adjustments-namely the discontinuation of certain metered powder inhalers like ProAir Digihaler and AirDuo Digihaler-signal a recalibration toward streamlined device offerings and efficient resource allocation. By prioritizing core products and scaling back lower‐volume SKUs, Teva is positioning itself to optimize operational costs and reinforce its role as a leading generic inhaler supplier.

Digital health pioneers Adherium and Propeller Health have fortified their market presence through FDA clearances and partnerships with major pharmaceutical companies. The FDA’s authorization of Propeller’s sensor for Symbicort and Adherium’s Smartinhaler with Airsupra and Breztri underscores the critical value of real‐world adherence data in driving product differentiation and clinical decision support.

Meanwhile, Sandoz and other generic drug divisions continue to highlight the necessity of maintaining affordability amid cost pressures. Their public warnings about patient impacts under proposed tariff regimes underscore the balance required between commercial viability and access to essential inhaled therapies for vulnerable populations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Budesonide Inhaler market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amneal Pharmaceuticals, Inc.

- AstraZeneca plc

- Boehringer Ingelheim International GmbH

- Chiesi Farmaceutici S.p.A.

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- GSK plc

- Lupin Limited

- Novartis AG

- Orion Corporation

- Pfizer Inc.

- Sandoz International GmbH

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Zydus Lifesciences Ltd.

Formulating Actionable Recommendations to Enhance Supply Chain Resilience Digital Integration and Regulatory Alignment for Budesonide Inhaler Stakeholders

To navigate the confluence of regulatory, environmental, and trade policy shifts, industry leaders should accelerate investments in domestic API and device production capabilities. By establishing redundant manufacturing sites across diverse geographies, companies can safeguard against tariff‐induced supply chain disruptions and maintain cost‐competitive positioning.

In parallel, continued expansion of digital inhaler integrations-via partnerships or in‐house development-will be critical for capturing real‐world usage data that informs product refinements, enhances patient adherence, and strengthens payer value propositions. Digital ecosystems should integrate seamlessly with electronic health records to support data‐driven care pathways.

Furthermore, portfolio diversification toward dry powder inhalers and environmentally progressive propellant alternatives is essential to meet evolving regulatory mandates and corporate sustainability goals. Aligning product roadmaps with carbon reduction targets can mitigate compliance risks and appeal to environmentally conscious stakeholders.

Lastly, engaging in proactive policy advocacy and collaborating with government agencies can help shape balanced trade measures that preserve patient access and industry viability. Transparent dialogue regarding tariff pass‐through effects and strategic co-investment programs can foster a regulatory environment that supports both national economic objectives and public health priorities.

Detailing a Robust Research Methodology Incorporating Primary Expertise Secondary Analysis and Data Validation for Budesonide Inhaler Market Insights

This analysis synthesizes insights from a multi-tiered research approach integrating both primary and secondary methodologies. In the primary phase, in-depth interviews were conducted with key opinion leaders in pulmonology, respiratory therapy, and pharmaceutical manufacturing to capture nuanced perspectives on treatment patterns, device innovations, and supply chain dynamics. These qualitative inputs were complemented by interactions with procurement and distribution executives to understand real-world operational challenges.

The secondary research component involved rigorous review of published literature, regulatory filings, patent databases, and digital health platform clearance dossiers. Trade policy developments and tariff schedules were mapped using governmental announcements and validated through specialist trade policy consultancies to ensure comprehensive coverage of economic impacts. Corporate investment disclosures, press releases, and environmental regulation updates provided further granularity on company strategies and sustainability initiatives.

All data sources underwent triangulation and cross-validation processes to reconcile discrepancies and affirm the accuracy of key findings. Quantitative metrics, although excluded from this summary, were benchmarked against independent market surveys and public health statistics to establish a reliable contextual framework. The combined methodology ensures that the insights presented are robust, current, and actionable for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Budesonide Inhaler market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Budesonide Inhaler Market, by Therapeutic Area

- Budesonide Inhaler Market, by Route

- Budesonide Inhaler Market, by Product

- Budesonide Inhaler Market, by Dosage Strength

- Budesonide Inhaler Market, by End Use

- Budesonide Inhaler Market, by Distribution Channel

- Budesonide Inhaler Market, by Region

- Budesonide Inhaler Market, by Group

- Budesonide Inhaler Market, by Country

- United States Budesonide Inhaler Market

- China Budesonide Inhaler Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Strategic Perspectives Highlighting Emerging Challenges Opportunities and Imperatives for Budesonide Inhaler Market Leadership

The budesonide inhaler market stands at a pivotal juncture defined by technological innovation, shifting clinical paradigms, and complex trade environments. Digital connectivity and real-time adherence monitoring are converging with evolving guidelines to transform therapeutic approaches and patient engagement models. At the same time, environmental regulations and tariff policies are driving structural changes in manufacturing footprints and cost architectures.

Competitive positioning will increasingly hinge on the ability to integrate these multifaceted drivers into cohesive strategies that balance innovation, sustainability, affordability, and regulatory compliance. Companies that proactively optimize supply chains, fortify domestic production, and harness digital analytics will be best positioned to navigate uncertainty and secure long-term leadership in the respiratory care arena.

By aligning operational investments with patient-centric care models and global policy trajectories, industry stakeholders can unlock new growth opportunities, enhance therapeutic outcomes, and ensure resilient access to life-saving budesonide inhaler therapies.

Engage with Ketan Rohom Associate Director Sales and Marketing to Unlock Comprehensive Budesonide Inhaler Market Research Insights and Drive Strategic Decisions

For a deeper dive into the comprehensive analysis, exclusive data sets, and strategic frameworks that can empower your organization to navigate the complexities of the budesonide inhaler landscape, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. By partnering with Ketan, you’ll gain personalized guidance on how to leverage the report’s insights to drive product portfolio optimization, supply chain resilience, and market expansion. Connect now to secure your copy of the full research report and turn these insights into actionable strategies that deliver measurable business impact.

- How big is the Budesonide Inhaler Market?

- What is the Budesonide Inhaler Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?