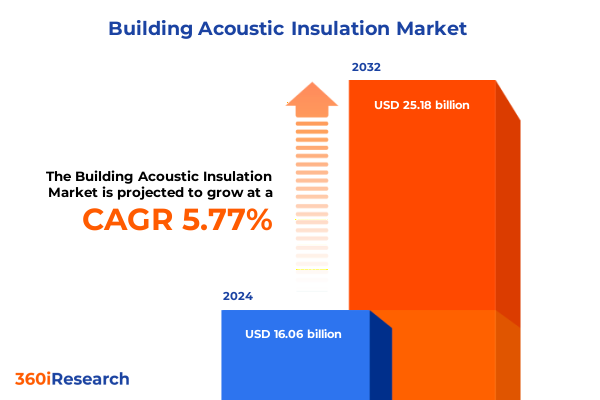

The Building Acoustic Insulation Market size was estimated at USD 16.98 billion in 2025 and expected to reach USD 17.95 billion in 2026, at a CAGR of 5.79% to reach USD 25.18 billion by 2032.

Pioneering Soundproofing Strategies Revealing the Critical Role of Acoustic Insulation in Modern Construction Environments Elevating Safety and Comfort

Introduction

In an era where building performance and occupant well-being command unprecedented attention, acoustic insulation has emerged as a cornerstone of modern construction practices. Rising expectations for indoor environmental quality, coupled with stringent regulatory mandates on noise control, have elevated soundproofing far beyond a mere add-on feature. As urban density increases and multi-purpose spaces become more common, developers and facility managers must navigate a complex interplay of performance criteria, cost considerations, and sustainability goals.

This summary explores the multifaceted world of acoustic insulation, charting its critical role across commercial towers, industrial facilities, and residential communities. By examining the latest material innovations, regulatory catalysts, and evolving stakeholder priorities, we reveal how noise management strategies are transforming. Throughout this document, readers will discover the strategic pathways that industry leaders are adopting to deliver high-performance, eco-friendly soundproofing solutions.

How Emerging Technologies and Sustainability Imperatives Are Redefining Acoustic Insulation Solutions Across Construction and Industrial Applications

Transformative Shifts in the Landscape

The acoustic insulation segment is undergoing a profound metamorphosis driven by converging technological, environmental, and operational imperatives. Emerging digital design tools, including advanced simulation platforms, empower architects and engineers to model sound transmission with unprecedented precision, enabling tailored solutions that optimize material usage and performance. Concurrently, the rise of smart building technologies is fostering the integration of noise monitoring systems with real-time analytics, allowing proactive adjustments to environmental controls, and fostering adaptive comfort in dynamic indoor spaces.

Sustainability mandates and circular economy principles are reshaping raw material selection and end-of-life strategies. Manufacturers are increasingly sourcing bio-based cellulose and recycled mineral wool to reduce embodied carbon, while developing end-of-use recycling programs that close the material loop. As energy efficiency and acoustic performance converge, hybrid products that deliver both thermal and sound insulation benefits are gaining traction. This integration of multi-functional attributes reflects a broader industry trend toward holistic building system optimization, where acoustic considerations are no longer siloed but woven into the fabric of sustainable design.

Assessing the Multifaceted Consequences of 2025 United States Tariff Measures on Acoustic Insulation Manufacturing Supply Chains and Costs

Cumulative Impact of United States Tariffs 2025

The United States’ tariff adjustments in 2025 have imparted significant reverberations across the acoustic insulation supply chain, reshaping procurement strategies and cost structures. Import levies on key raw materials such as phenolic foam precursors and mineral fibers have elevated landed costs for manufacturers reliant on international suppliers. In response, several leading producers have initiated strategic stockpiling and negotiated long-term contracts to mitigate price volatility, while others have explored near-shoring options to shorten lead times and reduce exposure to fluctuating duties.

These tariff dynamics have also catalyzed innovation in material science as companies seek alternative feedstocks and manufacturing methods. Domestic production capacities for fiberglass and engineered foams have attracted investment, enabling a partial decoupling from global trade tensions. However, smaller regional players continue to grapple with margin compression as duty-induced cost increases challenge their competitive positioning. In this evolving landscape, stakeholder collaboration spanning suppliers, contractors, and policymakers will be critical to sustaining supply continuity and ensuring that acoustic performance standards remain uncompromised.

Uncovering Distinct Market Dynamics Through Comprehensive Analysis of Material End Use Application Installation and Distribution Channel Segmentation

Key Segmentation Insights

A detailed examination of the acoustic insulation market through the lens of material type reveals distinct performance and cost paradigms. Cellulose stands out for its eco-friendly credentials, appealing to projects prioritizing green building certifications. Fiberglass solutions, available as blanket or loose fill, dominate legacy applications where established installation practices and regulatory approvals create a high barrier to entry. Foam offerings-spanning phenolic variants prized for fire resistance, lightweight polyethylene modules suited for retrofits, and high-performance polyurethane formulations-address specialized use cases such as HVAC duct lining and constrained environments. Meanwhile, rock mineral wool’s dual formats of loose fill and slab combine robust thermal insulation with excellent sound absorption, particularly in high-temperature industrial settings.

When evaluating end uses, the commercial sector leverages soundproofing to enhance guest experience in hospitality venues, improve productivity in office buildings, and curate atmosphere in retail environments. Industrial segments demand tailored noise mitigation for automotive assembly lines, energy and utilities infrastructure, and manufacturing plants where machinery noise threatens operator safety and regulatory compliance. Infrastructure applications in oil and gas installations, rail and metro systems, and broader transportation networks call for resilient insulation that endures harsh environmental conditions. In residential markets, multi-family developments emphasize cross-unit privacy, while single-family homes prioritize occupant comfort and design flexibility.

Application-based insights underscore the nuanced requirements of each building component. Ceilings incorporate constrained layer damping technologies and suspended systems to strike a balance between acoustic isolation and architectural design. External facades integrate insulation with weatherproofing layers to streamline construction workflows. Floors utilize floating floors and underfloor insulation to attenuate impact noise in multi-story structures. Pipes and ducts rely on specialized wraps and lining products to suppress vibration. Walls, whether external or internal, serve as primary sound barriers, demanding solutions that blend fire safety, moisture resistance, and acoustic performance.

Installation type bifurcates market dynamics between new construction, where integrated envelope strategies drive early specification of insulation materials, and retrofit projects, which value ease of access and minimal operational disruption. Distribution channels further delineate market pathways: direct sales empower large-scale construction firms to source bespoke solutions; distributors and wholesalers provide broad reach for regional contractors; online platforms, including major e-commerce marketplaces and manufacturer websites, cater to small-scale installers and DIY enthusiasts; and retail outlets-from home improvement superstores to specialty acoustics shops-serve end users seeking off-the-shelf products.

This comprehensive research report categorizes the Building Acoustic Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Installation Type

- Distribution Channel

- Application

- End Use

Mapping Regional Opportunities and Challenges by Exploring Market Variations Across Americas Europe Middle East Africa and Asia Pacific Territories

Key Regional Insights

In the Americas, robust infrastructure investment and stringent building codes have stimulated demand for advanced acoustic insulation products. North American projects often emphasize energy and noise reduction in tandem, reflecting a regional priority on sustainability. Regulatory frameworks in Canada and the United States mandate minimum sound transmission class ratings in multi-family and commercial structures, prompting architects to specify certified mineral wool and advanced foam composites. South American markets, while more cost-sensitive, show increasing interest in retrofit solutions to address urban noise pollution challenges prevalent in major cities.

Europe, Middle East & Africa present a mosaic of opportunities shaped by diverse regulatory landscapes and development trajectories. Western Europe leads in adopting bio-based cellulose insulation and integrated façade systems, driven by aggressive decarbonization targets. The Middle East’s rapid urbanization and luxury hospitality boom generate significant demand for high-performance acoustic solutions that withstand extreme temperature variations. Meanwhile, emerging economies in Africa are beginning to incorporate noise-control measures in infrastructure expansion, although supply chain limitations and price sensitivity remain key considerations for market entrants.

Asia-Pacific encompasses both mature and nascent acoustic insulation markets, underpinned by a wide spectrum of construction typologies. Japan and Australia maintain rigorous acoustic standards, fueling innovation in hybrid materials that satisfy thermal and soundproofing requirements. Southeast Asian metropolitan areas, grappling with rising population density and construction growth, are increasingly specifying retrofit-friendly loose-fill and panelized insulation. In China, government stimulus for sustainable buildings has catalyzed domestic production of fiberglass and mineral wool, boosting capacity and reducing reliance on imports.

This comprehensive research report examines key regions that drive the evolution of the Building Acoustic Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Influential Industry Leaders Driving Innovation Investment and Competitive Advantage in the Evolving Acoustic Insulation Marketplace

Key Companies Insights

Leading manufacturers are differentiating through vertical integration, sustainability credentials, and technology partnerships. Owens Corning continues to leverage its global manufacturing footprint and extensive R&D capabilities to introduce products with enhanced recycled content and reduced installation times. Rockwool International’s emphasis on circularity and product stewardship has resonated with green building consultants, particularly in Europe, where the company’s take-back programs for end-of-life material establish a model for closed-loop supply chains. Saint-Gobain’s broad building materials portfolio enables cross-selling of acoustic insulation within comprehensive façade and roofing systems, strengthening project-level value propositions.

Johns Manville has doubled down on digital customer engagement, deploying online configurators that guide specifiers through noise-control requirements and material options. Huber Engineered Woods integrates its proprietary wood fiber insulation with moisture management solutions, targeting both residential remodels and commercial office refits. Knauf’s strategic investments in phenolic foam capacity in North America address growing demand for high-performance insulation in retrofit applications, while Kingspan’s focus on premium PIR panels reflects its ambition to capture share in high-end commercial and industrial projects. These competitive moves underscore a broader industry push toward differentiated products and seamless customer experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Building Acoustic Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arabian Fiberglass Insulation Company Ltd.

- Armacell International S.A.

- Autex Industries Limited

- BASF SE

- Boulder Developments Ltd.

- Cellecta Ltd

- Compagnie de Saint-Gobain S.A.

- Fletcher Building Group

- GAF Materials Corporation

- Hira Technologies Pvt. Ltd.

- Huntsman Corporation

- Hush Acoustics Ltd.

- Johns Manville

- Kinetics Noise Control Inc.

- Kingspan Group PLC

- Knauf Insulation

- L'ISOLANTE K-FLEX S.p.A.

- Lloyd Insulations (India) Limited

- Owens Corning

- Paroc Group Oy

- Paul Bauder GmbH & Co. KG

- ROCKWOOL International A/S

- Sheth Insulations Private Limited

- Soprema Group

- The Holcim Group

- Trelleborg AB

Transformative Strategic Imperatives for Industry Stakeholders to Enhance Acoustic Insulation Implementation Risk Mitigation and Long Term Performance Outcomes

Actionable Recommendations for Industry Leaders

To thrive in an increasingly complex acoustic insulation environment, companies should prioritize research into bio-derived and recycled materials while accelerating the development of hybrid insulation products that deliver both thermal and acoustic performance. Strengthening supply chain resilience through diversified sourcing and collaborative procurement agreements will be essential to mitigate the impact of future trade policy shifts. By forming strategic alliances with software developers, manufacturers can embed predictive acoustic modeling tools into their offering, empowering end users and specifiers to simulate performance outcomes with confidence.

Organizations must also invest in educational initiatives for contractors and installers, ensuring that best practices in material handling and installation translate into optimized in-field performance. Engaging regulatory bodies and industry associations will facilitate the adoption of updated standards that reflect evolving material capabilities. Finally, orchestrating targeted marketing campaigns that showcase real-world case studies and quantifiable benefits will accelerate stakeholder buy-in, positioning companies as thought leaders in noise control and sustainable building design.

Leveraging Robust Qualitative and Quantitative Research Approaches to Ensure Validity Reliability and Comprehensive Understanding of Acoustic Insulation Trends

Research Methodology

This study combines robust qualitative and quantitative approaches to deliver a comprehensive understanding of acoustic insulation trends. Secondary research encompassed an in-depth review of industry journals, regulatory documentation, and corporate disclosures to establish foundational context and identify emerging themes. Primary research involved expert interviews with architects, acoustical engineers, supply chain executives, and end-user procurement managers to capture nuanced perspectives on performance criteria, material preferences, and adoption barriers.

Quantitative validation was achieved through the analysis of proprietary shipment and installation data obtained from industry associations and market aggregators. Triangulation across multiple data sources ensured reliability and minimized bias, while site visits to key manufacturing facilities provided firsthand insights into production innovations and quality control measures. This rigorous methodology underpins the credibility of the findings and supports strategic decision-making for stakeholders across the acoustic insulation value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Building Acoustic Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Building Acoustic Insulation Market, by Material Type

- Building Acoustic Insulation Market, by Installation Type

- Building Acoustic Insulation Market, by Distribution Channel

- Building Acoustic Insulation Market, by Application

- Building Acoustic Insulation Market, by End Use

- Building Acoustic Insulation Market, by Region

- Building Acoustic Insulation Market, by Group

- Building Acoustic Insulation Market, by Country

- United States Building Acoustic Insulation Market

- China Building Acoustic Insulation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Core Insights and Outlook to Emphasize Strategic Imperatives and Future Directions for Acoustic Insulation Stakeholders

Conclusion

The acoustic insulation landscape is at an inflection point, shaped by technological advances, sustainability imperatives, and shifting economic policies. Material innovators are pushing the boundaries of performance, integrating noise control with thermal management and environmental credentials. Simultaneously, policy interventions and trade measures continue to influence supply chain configurations and cost structures, underscoring the need for agile procurement and diversified sourcing strategies.

Regional dynamics reveal a spectrum of maturity levels and regulatory intensities, offering both challenges and opportunities for market participants. As leading companies differentiate through vertical integration, digital engagement, and closed-loop systems, the bar for value creation continues to rise. For industry stakeholders, success will hinge on combining cutting-edge research, strategic partnerships, and educational outreach to maximize acoustic comfort, sustainability, and operational efficiency in built environments.

Engage with Ketan Rohom to Unlock Comprehensive Acoustic Insulation Insights and Propel Your Business Forward with the Definitive Market Research Report

To secure this essential research dossier and gain unparalleled insights into acoustic insulation trends, reach out to Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through the tailored benefits of the report. Engaging with Ketan ensures you receive personalized support to align the findings with your strategic objectives and market entry plans. His expertise in translating complex market intelligence into actionable sales and marketing initiatives will accelerate your decision-making process and optimize your time to value. Contact him today to unlock the full potential of this comprehensive acoustic insulation study and propel your organization’s soundproofing initiatives to new heights.

- How big is the Building Acoustic Insulation Market?

- What is the Building Acoustic Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?