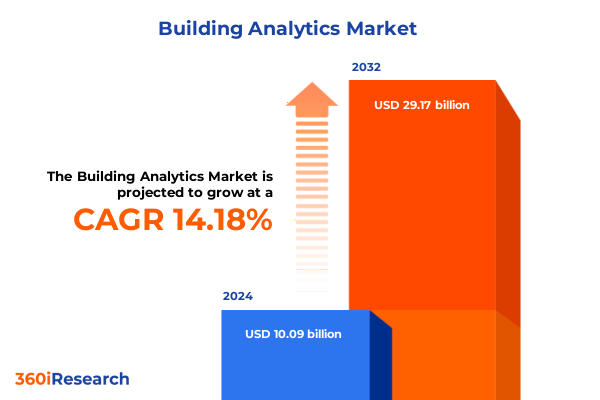

The Building Analytics Market size was estimated at USD 11.49 billion in 2025 and expected to reach USD 13.09 billion in 2026, at a CAGR of 14.22% to reach USD 29.17 billion by 2032.

Exploring the Evolution of Building Analytics with Insights into Technological Drivers, Market Dynamics, and Strategic Priorities for Intelligent Infrastructure

Building analytics has emerged as a cornerstone of intelligent infrastructure management, enabling stakeholders to harness data-driven insights for optimizing operational efficiency, energy utilization, and occupant experience. As digital transformation accelerates across commercial, industrial, and residential environments, the integration of advanced sensors, connectivity protocols, and analytics platforms has become imperative for organizations seeking to improve sustainability performance and reduce lifecycle costs. The convergence of IoT-enabled devices with cloud and on-premises platforms provides a unified view of building health metrics, fostering proactive decision-making and bolstering resilience against operational disruptions.

Moreover, the maturation of descriptive, predictive, and prescriptive analytics frameworks has elevated building analytics from retrospective reporting to real-time orchestration of systems. Decision-makers can now anticipate maintenance needs, streamline energy consumption patterns, and respond swiftly to occupancy fluctuations. As pressure mounts to comply with stringent environmental regulations and corporate sustainability pledges, the deployment of robust analytics solutions is no longer a luxury but a strategic necessity. This introduction sets the stage for a comprehensive exploration of the transformative forces reshaping the building analytics landscape and the critical pathways for organizations to unlock maximum value from their data assets.

Understanding the Key Transformations Shaping Building Analytics from Edge Integration to AI-Driven Intelligence with Ecosystem Convergence

The building analytics domain is undergoing rapid metamorphosis driven by the proliferation of edge computing and the infusion of artificial intelligence into core operations. Edge integration enables data to be processed closer to the source, reducing latency and network dependency while ensuring critical insights are available even under bandwidth constraints. In parallel, AI-driven intelligence automates anomaly detection, fault diagnosis, and energy optimization, propelling operational agility and delivering contextualized recommendations that transcend traditional threshold-based alerts.

In addition, ecosystem convergence is fostering deeper collaboration among technology vendors, service providers, and end-user organizations. Open standards for data ingestion and sensor interoperability are becoming mainstream, enabling seamless integration of wired and wireless protocols such as Bluetooth, LoRaWAN, Wi-Fi, and ZigBee. As platforms unify disparate data streams, the emphasis shifts from isolated silos to comprehensive solutions that deliver holistic visibility across HVAC, security, energy management, and predictive maintenance applications. These transformative shifts underscore the imperative for stakeholders to adapt their strategies to capitalize on emerging paradigms in intelligent building management.

Evaluating the Far-Reaching Cumulative Consequences of 2025 United States Tariffs on Building Analytics Supply Chains and Technology Adoption Patterns

The introduction of new United States tariffs in 2025 has substantially influenced the cost and availability of critical components within building analytics supply chains. Devices such as sensors for humidity, motion, occupancy, temperature, and vibration, as well as specialized connectivity modules, have experienced upward pressure on procurement costs. This environment has prompted many solution providers and end users to reevaluate sourcing strategies, accelerate diversification of supplier portfolios, and negotiate longer-term agreements to stabilize pricing and maintain continuity of service.

Simultaneously, the tariffs have catalyzed a shift toward localized manufacturing and onshore assembly for hardware components, especially in regions with robust industrial bases. While this trend supports domestic job creation and supply chain resilience, it also demands greater investment in compliance, quality assurance, and workforce training. Moreover, software and cloud platform vendors are adjusting licensing models and service level agreements to accommodate increased infrastructural expenses, reinforcing the need for transparent cost-benefit analyses and dynamically scaled deployment plans.

Uncovering Critical Segment Dynamics Across Components, Applications, Deployment Modes, and End Users Driving Customized Solutions in Building Analytics

Examining segment dynamics by component reveals that analytics software continues to evolve, with descriptive analytics serving as the foundation for historical performance monitoring, while predictive and prescriptive modules drive scenario planning and automated control actions. Connectivity solutions span wired architectures for mission-critical environments alongside wireless protocols, where Bluetooth and Wi-Fi dominate short-range communications and LoRaWAN and ZigBee address low-power, long-range requirements. Cloud platforms offer scalability and remote access, whereas on-premise deployments appeal to organizations with stringent data sovereignty or latency demands. Sensor innovations emphasize miniaturization and self-diagnostics, enabling seamless integration into HVAC systems, security networks, and energy meters, while services-including implementation and ongoing support-have become differentiators in customer satisfaction and long-term ROI.

From an application perspective, energy management platforms are increasingly intertwined with HVAC optimization routines to deliver both comfort and efficiency. Predictive maintenance has emerged as a critical use case, with tailored algorithms for automotive facilities, energy utilities, manufacturing plants, and oil and gas operations. These domain-specific solutions leverage real-time and historical machine telemetry to extend asset lifecycles and diminish unplanned downtime. Deployment strategies range from pure cloud models, which deliver rapid time to value, to hybrid architectures that balance performance with data governance, and on-premise options that ensure full control over mission-critical systems.

End-user segmentation encompasses commercial, industrial, and residential verticals. Within commercial real estate, hospitality, office, and retail operators prioritize occupant wellbeing and cost efficiency in parallel. Industrial environments across energy utilities, manufacturing, and oil and gas focus on regulatory compliance, asset reliability, and process optimization. Meanwhile, residential analytics solutions are gaining ground through smarter energy management and security surveillance offerings tailored to homeowner expectations for convenience and connectivity.

This comprehensive research report categorizes the Building Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Deployment

- End User

Analyzing Diverse Regional Landscapes in the Americas, Europe Middle East and Africa, and Asia-Pacific to Identify Strategic Opportunities in Building Analytics

In the Americas, rapid digital infrastructure investments and progressive sustainability mandates have positioned North American markets at the forefront of advanced building analytics adoption. Organizations in the U.S. and Canada have championed green building certifications and embraced data-driven energy reduction initiatives, spurring demand for integrated platforms that offer end-to-end visibility. Meanwhile, Latin American markets are selectively deploying cloud-based offerings to bridge infrastructure gaps and realize cost-effective energy and security monitoring solutions.

Across Europe, the Middle East, and Africa, stringent regulatory frameworks pertaining to carbon emissions and energy efficiency have driven a wave of deployments focused on HVAC optimization and predictive maintenance within commercial and industrial sites. Western Europe benefits from robust smart city programs that leverage municipal building analytics for public infrastructure, while growth in the Middle East is propelled by ambitious construction projects integrating connectivity at scale. In Africa, decentralized solar and microgrid installations for remote facilities are increasingly managed through lightweight analytics dashboards that optimize performance and maintenance scheduling.

The Asia-Pacific region exhibits a pronounced appetite for technological advancements, with rapid urbanization fueling smart building initiatives across markets such as China, India, Japan, and Southeast Asia. High-density commercial hubs are implementing hybrid architectures to manage complex ecosystems of sensors, platforms, and services. Authorities in several markets are incentivizing energy management systems through subsidies, further driving innovation in platform interoperability and edge analytics capabilities.

This comprehensive research report examines key regions that drive the evolution of the Building Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Initiatives Shaping Innovation, Partnerships, Competitive Differentiation in the Building Analytics

Leading technology providers have pursued strategic partnerships and acquisitions to expand their analytics portfolios and enhance interoperability across building systems. Several major firms have integrated specialized startups with expertise in prescriptive AI to bolster automated control capabilities, while others have forged alliances with connectivity vendors to ensure seamless data ingestion from next-generation sensors. As a result, the competitive environment has shifted toward solution ecosystems that encompass hardware, software, and professional services, enabling more cohesive customer experiences and streamlined implementation cycles.

At the same time, midsize and emerging companies are differentiating by focusing on niche applications such as advanced predictive maintenance for manufacturing operations or occupant behavior analytics for retail environments. These specialized offerings often leverage modular architectures that can be rapidly deployed across cloud, hybrid, or on-premise infrastructures. By emphasizing domain expertise and flexible licensing models, these challengers are carving out valuable positions alongside established incumbents, creating a dynamic marketplace where innovation and collaboration drive sustained growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Building Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- BuildingIQ Pty Ltd

- Cisco Systems, Inc.

- Honeywell International Inc.

- IBM Corporation

- ICONICS, Inc.

- Johnson Controls International plc

- Schneider Electric SE

- Siemens AG

- SkyFoundry LLC

Empowering Industry Leaders with Targeted Strategic Recommendations to Accelerate Adoption, Optimize Operations, and Enhance ROI in Building Analytics Projects

Industry leaders should prioritize investments in hybrid analytics architectures that blend edge processing with cloud-native scalability to balance performance, cost, and data governance requirements. By adopting open APIs and adherence to interoperability standards, organizations can future-proof their infrastructure against vendor lock-in and rapidly integrate emerging sensor technologies without extensive reengineering. Furthermore, aligning analytics roadmaps with sustainability objectives can unlock stakeholder buy-in and support long-term value creation through measurable energy savings and reduced carbon footprints.

Simultaneously, executive teams must cultivate strategic partnerships that bridge domain expertise, software development, and service delivery. Collaborating with specialized providers in areas like AI-based anomaly detection or occupancy modeling can accelerate time to insight, while co-innovation programs with connectivity vendors can yield differentiated offerings tailored to specific verticals. Finally, embedding a culture of continuous optimization-underpinned by cross-functional data governance and change management frameworks-will ensure that analytical insights translate into operational improvements and tangible returns on investment.

Detailing the Comprehensive Research Methodology Employed Including Data Collection, Validation, and Multilayered Analysis Techniques Underpinning the Study

This study integrates a multifaceted research methodology combining comprehensive secondary research with extensive primary interviews. Initial data collection encompassed industry reports, white papers, and regulatory publications to establish foundational insights into component technologies and regional dynamics. Concurrently, dozens of in-depth interviews were conducted with industry executives, solution architects, and end-user practitioners to validate trends and capture nuanced perspectives on adoption barriers and success factors.

Quantitative data was synthesized through a segmentation analysis that dissected components, applications, deployment modes, and end-user profiles to ensure balanced coverage of market realities. Qualitative insights were corroborated via roundtable discussions and expert reviews, while a rigorous data validation process cross-checked sources for consistency and accuracy. Throughout the study, a structured framework guided the interpretation of findings, ensuring transparency in assumptions and replicability of analytical pathways.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Building Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Building Analytics Market, by Component

- Building Analytics Market, by Application

- Building Analytics Market, by Deployment

- Building Analytics Market, by End User

- Building Analytics Market, by Region

- Building Analytics Market, by Group

- Building Analytics Market, by Country

- United States Building Analytics Market

- China Building Analytics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Summarizing Key Takeaways Highlighting Strategic Imperatives and Future Pathways for Stakeholders to Maximize Value from Building Analytics Investments

The confluence of advanced analytics software, diverse connectivity protocols, and scalable platforms has irrevocably transformed building management paradigms. Stakeholders across sectors are harnessing descriptive, predictive, and prescriptive insights to drive operational excellence and sustainability outcomes. At the same time, regional regulatory imperatives and evolving end-user expectations continually reconfigure the competitive landscape, necessitating agile strategies and proactive innovation.

By understanding the cumulative impact of trade policies, leveraging segmentation insights, and benchmarking against leading providers, organizations can chart a clear course toward optimized resource utilization and enhanced occupant experiences. The future of building analytics hinges on the ability to integrate heterogeneous data sources, maintain resilient supply chains, and foster collaborative ecosystems that accelerate digital transformation and deliver measurable value.

Discover How to Secure Comprehensive Market Insights and Tailored Advisory Support by Connecting with Ketan Rohom to Access the Full Building Analytics Report

To explore this comprehensive market research report in depth or to discuss how it can be tailored to address your strategic priorities, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the premium offerings, supplemental advisory services, and bespoke data solutions available to support your decision-making processes and competitive positioning. By connecting with Ketan, you gain direct access to the full scope of analysis and personalized engagement necessary to transform insights into impactful actions.

- How big is the Building Analytics Market?

- What is the Building Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?