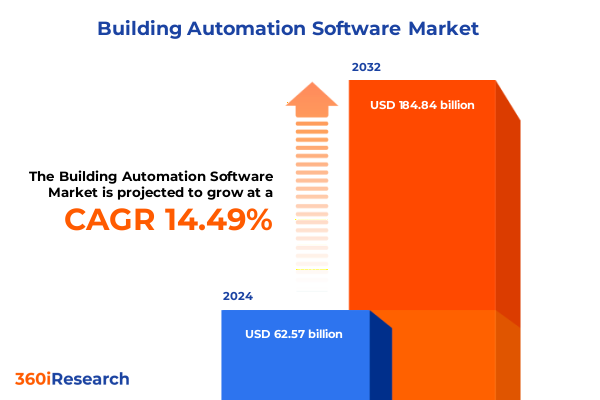

The Building Automation Software Market size was estimated at USD 71.34 billion in 2025 and expected to reach USD 81.33 billion in 2026, at a CAGR of 14.56% to reach USD 184.84 billion by 2032.

Unveiling the Critical Role of Advanced Automation Software as the Cornerstone for Intelligent, Efficient, and Sustainable Building Management

The advent of sophisticated building automation software marks a pivotal evolution in the way modern facilities operate, bringing unprecedented integration of systems with a clear focus on performance and sustainability. From the early days of standalone controls to today’s interconnected ecosystems, the sector has been driven by the imperative to harness real-time data and analytics for optimized decision-making. As digital transformation sweeps across industries, the building automation landscape stands at the intersection of Internet of Things (IoT) connectivity, cloud computing, and artificial intelligence, enabling stakeholders to move beyond reactive maintenance into proactive and predictive operations.

In recent years, smart building platforms have demonstrated their ability to yield significant energy savings, streamline maintenance workflows, and improve occupant comfort. A commissioned study by Forrester Consulting on Johnson Controls’ OpenBlue platform found organizations could achieve up to a 155% return on investment over three years, driven by near real-time data visibility and AI-enabled recommendations for energy efficiency and maintenance reduction. This underscores how visionary software architectures are transforming facilities into intelligent assets that align operational goals with sustainability commitments.

Exploring the Disruptive Technologies and Strategic Imperatives Driving the Future of Intelligent Building Automation Software Platforms

The building automation software sector has been reshaped by several transformative forces that collectively define the industry’s trajectory. First, the proliferation of IoT devices-from HVAC sensors to lighting controls-has created a surge in data volume, driving the demand for advanced analytics and machine learning tools to interpret performance metrics. In parallel, companies like Schneider Electric have pioneered universal automation software that functions as an application marketplace, enabling seamless integration of heterogeneous systems without escalating budgetary or timeline pressures. These platforms are breaking down traditional silos and setting new benchmarks for interoperability.

Simultaneously, the transition to cloud and hybrid deployment models has granted facility managers unprecedented flexibility in scale and accessibility. Native cloud connectivity, exemplified by Siemens’ Desigo CC V6 integration with the Building X cloud platform, allows stakeholders to oversee multiple sites from a single pane of glass, reducing the need for onsite interventions and accelerating response times. This cloud-centric approach has also catalyzed the adoption of generative AI, as evidenced by Honeywell’s partnership with Google to integrate Gemini AI with its Forge platform, which automates complex tasks and enhances decision-support capabilities across building portfolios.

Moreover, growing concerns around cybersecurity have propelled the implementation of zero-trust frameworks and advanced encryption protocols to safeguard critical infrastructure. As regulatory mandates tighten and data privacy expectations rise, software vendors are embedding security features at every layer of their solutions. Together, these shifts underscore a new paradigm: building automation software is no longer an operational convenience but an integral component of enterprise risk management and sustainability strategy.

Assessing the Comprehensive Effects of Evolving United States Tariff Policies on the Building Automation Software Industry Landscape in 2025

U.S. trade policy developments in 2025 have had significant repercussions for the building automation software industry, as tariff measures imposed under various legislations have influenced cost structures, supply chain dynamics, and strategic planning. Average applied tariffs in the U.S. have risen from under 3% pre-2017 to approximately 20% in recent years, marking the highest levels since the mid-20th century and placing additional pressure on imported electronic and mechanical components critical to automation systems. In particular, Section 301 duties on Chinese-origin goods, which increased in scope and depth, have directly affected sensor modules, PLC hardware, and control panels.

In response to these headwinds, leading industrial technology firms have extensively ramped up local production. ABB, for example, committed $120 million to expand low-voltage electrical equipment manufacturing in Tennessee and Mississippi, aiming to produce over 90% of its U.S. sales domestically to mitigate future tariff volatility. This trend underscores the critical role of reshoring strategies and regionalized manufacturing hubs in fostering supply chain resilience.

Moreover, the cumulative impact of tariff uncertainty has led many integrators and end users to adopt software-centric solutions that rely less on hardware imports. Cloud-based analytics and remote services are being prioritized to preserve project timelines and control costs amid ongoing trade negotiations. While tariff measures continue to evolve, the sector’s focus on diversified sourcing and value-added software services is poised to shape competitive differentiation throughout 2025 and beyond.

Deriving Actionable Insights from a Multi-Dimensional Segmentation Approach to Uncover Nuanced Opportunities in Building Automation

Delving into component type segmentation reveals a nuanced landscape where hardware components coexist with a robust array of services and software offerings. Devices such as controllers, sensors, and actuators form the hardware backbone, while consulting, maintenance, and training services augment system performance and user proficiency. Software itself spans analytics modules for data-driven insights, enterprise management suites that unify disparate building systems, and integration platforms designed to streamline interoperability across device ecosystems.

The end user segmentation underscores distinct adoption patterns across sectors. Commercial buildings-including healthcare campuses, office towers, and retail complexes-prioritize occupant wellbeing and energy performance, whereas industrial environments in energy and utilities or manufacturing demand rigorous uptime guarantees and safety protocols. Institutional users such as schools and government facilities focus on compliance and community safety, and the residential segment emphasizes user experience and ease of integration with home automation networks.

Application segmentation paints a picture of specialized use cases, from energy management systems that enable demand response and detailed analytics to HVAC optimization platforms that dynamically adjust environmental conditions. Lighting control solutions enhance occupant comfort and reduce energy waste, while safety and fire protection software delivers real-time hazard monitoring. Security and access control platforms, often integrated with building management systems, ensure secure entry and asset protection.

Finally, deployment models vary from cloud-first architectures offering rapid scalability, to on-premise installations with stringent data sovereignty controls, and hybrid environments that balance the advantages of both. This layered segmentation framework provides industry stakeholders with a comprehensive roadmap to identify priority areas for innovation, investment, and market entry.

This comprehensive research report categorizes the Building Automation Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- End User Type

- Application

- Deployment Model

Uncovering Regional Dynamics and Growth Drivers Shaping the Demand for Building Automation Software Across Global Markets

Examining regional dynamics exposes divergent drivers and challenges across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, retrofit activity and infrastructure modernization programs are galvanizing demand, with regulatory incentives for energy efficiency spurring investment in advanced analytics and control platforms. Collaborations between private enterprises and public agencies are accelerating the adoption of integrated building management systems to meet sustainability targets.

Meanwhile, Europe, the Middle East & Africa are characterized by stringent energy performance directives and aggressive decarbonization agendas. The EU’s stringent carbon reduction targets have heightened demand for predictive energy optimization software and solutions that facilitate compliance with directives such as the Energy Performance of Buildings Directive (EPBD). In the Middle East, landmark developments in smart cities and sustainable urban planning, notably in the Gulf Cooperation Council (GCC) states, are driving large-scale deployments of connected building technologies.

In Asia-Pacific, rapid urbanization and smart city initiatives in China, India, and Southeast Asian economies are fostering a fertile environment for building automation innovation. National mandates for green building certifications and investments in digital infrastructure underpin a growing willingness to adopt advanced software tools. Across each of these regions, local partnerships, regulatory ecosystems, and infrastructure readiness play a pivotal role in shaping market entry strategies and collaboration models.

This comprehensive research report examines key regions that drive the evolution of the Building Automation Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leaders and Their Strategic Initiatives Driving Innovation and Competitive Advantage in Building Automation Software

Leading industry players have articulated distinct value propositions to capture the burgeoning opportunities in building automation software. Johnson Controls, through its OpenBlue platform, has integrated AI-driven energy-saving recommendations and autonomous controls, enabling customers to achieve up to a 155% ROI over three years as validated by a Forrester study. The platform’s expanded generative AI capabilities underscore a strategic emphasis on combining equipment upgrades with digital services to deliver measurable sustainability outcomes.

Siemens, with its Desigo CC V6, has fortified native cloud connectivity to the Building X Operations Manager, allowing secure, 24/7 monitoring and management of distributed sites. Enhanced support for BACnet Secure Connect and IEC 62443 cybersecurity standards reflects Siemens’ commitment to safeguarding complex infrastructures while promoting remote accessibility and operational efficiency.

Schneider Electric has leveraged its EcoStruxure Automation Expert Platform to pioneer open, software-defined automation, including an AI-enabled Copilot developed in collaboration with Microsoft. This integration accelerates code development, optimizes control logic, and facilitates real-time support for engineers, thereby addressing the skills gap and boosting project deployment speed.

Honeywell’s Connected Solutions platform consolidates critical building software and devices into a single interface underpinned by advanced encryption, predictive maintenance prompts, and remote diagnostics. Early adopters like Verizon and Vanderbilt University have demonstrated reduced installation times and operational cost savings, signaling market appetite for unified, AI-powered building management ecosystems. These differentiated strategies illustrate how the sector’s leaders are harnessing software innovation, partnerships, and cloud technologies to secure competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Building Automation Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Acuity Brands, Inc.

- Carrier Global Corporation

- Cisco Systems, Inc.

- Honeywell International Inc.

- Johnson Controls International plc

- Legrand S.A.

- Schneider Electric SE

- Siemens AG

- Trane Technologies Company

Providing Pragmatic and Forward-Looking Recommendations to Empower Industry Leaders to Navigate Challenges and Capitalize on Emerging Trends

Industry leaders must prioritize a strategic roadmap that balances technology adoption with risk mitigation. First, investing in digital infrastructure-such as cloud-native platforms and edge computing-will facilitate rapid scalability and remote operational continuity. Organizations should conduct comprehensive audits of existing systems, followed by phased migrations that minimize business disruption and cultivate internal expertise.

Second, supply chain diversification and localized manufacturing partnerships can safeguard against trade policy fluctuations. Developing strong, resilient relationships with regional suppliers and evaluating alternative sourcing strategies will reduce exposure to tariff-induced cost pressures and logistical bottlenecks.

Third, embedding cybersecurity by design is non-negotiable. Adopting zero-trust architectures, regular vulnerability assessments, and robust incident response plans will build stakeholder confidence and comply with evolving regulatory frameworks. Collaboration with specialized cybersecurity service providers can accelerate the integration of industry-leading protections.

Fourth, leadership should champion sustainability and ESG alignment across automation initiatives. Implementing advanced energy analytics and demand response software will generate quantifiable carbon reduction metrics, supporting corporate net-zero pledges and enhancing brand reputation.

Finally, investing in workforce development-through targeted training programs, partnerships with academic institutions, and leveraging AI-enabled copilot tools-will ensure that technical teams possess the skills necessary to manage increasingly intelligent, autonomous building environments.

Detailing a Comprehensive Research Methodology Incorporating Multi-Tier Primary and Secondary Data Sources with Rigorous Analytical Frameworks

The research underpinning this report combined a multi-tier primary and secondary methodology to ensure comprehensive and reliable insights. Primary data collection comprised in-depth interviews with C-level executives and facility managers across commercial, industrial, and institutional segments. These discussions were supplemented by an online survey targeting integration partners and technology vendors, yielding quantitative data on adoption patterns and technology preferences.

Secondary research involved an exhaustive review of publicly available sources, including regulatory publications, corporate white papers, and technical standards such as BACnet and ISO 50001. Market intelligence was further enriched by examining press releases, financial filings, and industry announcements to capture the latest product launches and strategic partnerships.

Data were triangulated through validation workshops with a panel of subject matter experts to reconcile discrepancies and refine thematic findings. Both qualitative and quantitative analyses were applied, leveraging statistical models to identify growth drivers and regression techniques to understand the impact of tariff fluctuations. This rigorous framework ensures that insights are grounded in factual evidence and industry realities, providing decision-makers with a robust foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Building Automation Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Building Automation Software Market, by Component Type

- Building Automation Software Market, by End User Type

- Building Automation Software Market, by Application

- Building Automation Software Market, by Deployment Model

- Building Automation Software Market, by Region

- Building Automation Software Market, by Group

- Building Automation Software Market, by Country

- United States Building Automation Software Market

- China Building Automation Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Present a Cohesive Outlook on the Future Trajectory of Building Automation Software

The convergence of cloud computing, AI-driven analytics, and cybersecurity imperatives has firmly established building automation software as a strategic lever for operational excellence and sustainability. Market leaders are differentiating through open architectures, software-defined automation, and integrated service offerings that deliver measurable ROI. Concurrently, evolving trade policies and tariff regimes underscore the importance of supply chain resilience and localized production strategies.

Segmentation analysis has highlighted high-value opportunities across hardware, services, and specialized software applications, while regional insights point to differentiated growth trajectories shaped by regulatory landscapes and infrastructure investments. In particular, energy management and HVAC optimization have emerged as priority areas for innovation, driven by stringent carbon reduction targets and the imperative to enhance occupant comfort.

Actionable recommendations center on accelerated digital transformation, strategic partnerships, and workforce development to harness emerging technologies without compromising security or compliance. As the industry moves forward, the ability to dynamically integrate new data sources, deploy autonomous controls, and respond to market shifts will define competitive winners. By synthesizing robust methodology with practical insights, this report offers a cohesive outlook on future challenges and pathways for success in the building automation software ecosystem.

Engage with Ketan Rohom to Unlock Tailored Insights and Secure Your Access to the Definitive Market Research Report on Building Automation Software

Ready to transform your building management strategy? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discover how this comprehensive market research report can equip you with the competitive intelligence and strategic direction needed to accelerate growth. Engage directly with Ketan to explore tailored insights across segmentation, regional dynamics, and emerging technologies in building automation software, ensuring your investment decisions are backed by a robust, data-driven roadmap. Secure your access today and position your organization at the forefront of innovation, efficiency, and sustainability in the intelligent building ecosystem.

- How big is the Building Automation Software Market?

- What is the Building Automation Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?