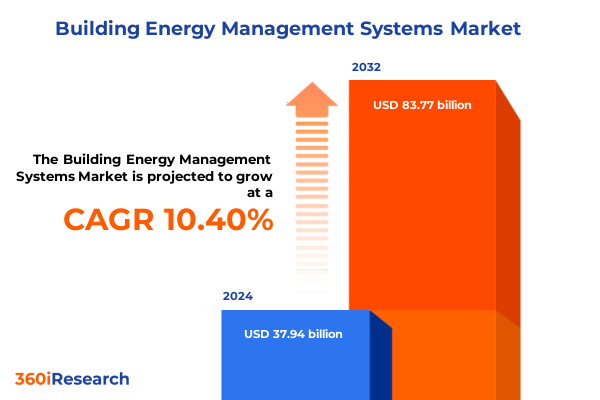

The Building Energy Management Systems Market size was estimated at USD 41.82 billion in 2025 and expected to reach USD 46.10 billion in 2026, at a CAGR of 10.43% to reach USD 83.77 billion by 2032.

Laying the Foundation for Sustainable Building Operations with Advanced Energy Management Strategies in a Rapidly Evolving Ecosystem

As the global demand for energy efficiency intensifies, building energy management systems have emerged as critical enablers of sustainability and operational resilience. Organizations across commercial, industrial, institutional, and residential sectors are seeking integrated solutions that optimize energy consumption, reduce carbon footprints, and streamline building operations. Against this backdrop, the convergence of digital technologies and heightened regulatory scrutiny has accelerated the adoption of advanced platforms designed to monitor, analyze, and control energy flows with unprecedented granularity.

Drawing on a dynamic mix of hardware, software, and services, these systems are rapidly evolving to meet complex stakeholder requirements. Hardware components such as sensors, controllers, and actuators serve as the foundational elements that capture real-time data and execute automated interventions. Simultaneously, sophisticated software modules for energy analytics, fault detection, diagnostics, and optimization enable organizations to translate raw data into actionable insights. Complementing these digital capabilities, consulting, implementation, integration, maintenance, and support services ensure seamless deployment and sustained performance across diverse building typologies.

In this environment, decision-makers must navigate shifting market forces-from emerging sustainability mandates to the integration of distributed energy resources-while balancing capital constraints and performance objectives. This executive summary introduces the essential themes and strategic considerations that define the current building energy management landscape, setting the stage for deeper analysis of transformative trends, tariff impacts, segmentation insights, regional dynamics, company positioning, and recommended actions.

Transformative Shifts Reshaping Building Energy Management Driven by Digital Convergence, Growing Sustainability Demands, and Smart Integration Strategies

The building energy management sector has undergone a profound evolution in recent years, characterized by the integration of Internet of Things (IoT) devices, artificial intelligence algorithms, and cloud-native platforms. This digital convergence has elevated the role of real-time monitoring and predictive analytics, empowering facility managers to preemptively address inefficiencies and system anomalies before they escalate into costly disruptions. At the same time, the proliferation of edge computing architectures has enabled localized decision-making, reducing latency and ensuring uninterrupted control even when cloud connectivity is limited.

Meanwhile, a growing emphasis on sustainability and decarbonization has spurred regulatory bodies to enact stringent energy codes and performance benchmarks. These policies have created new imperatives for building owners to demonstrate measurable reductions in greenhouse gas emissions and energy intensity. In response, leading technology providers are embedding renewable energy integration, demand response capabilities, and carbon accounting features within their platforms. Such enhancements facilitate seamless collaboration with utilities, grid operators, and on-site renewable generation assets.

Moreover, the imperative to fortify cybersecurity and data privacy has emerged as a central consideration. As building systems become more interconnected, the potential attack surface expands, necessitating robust encryption protocols, access controls, and threat detection mechanisms. Consequently, the latest generation of management solutions emphasizes holistic risk management frameworks that safeguard both operational integrity and occupant well-being. Together, these transformative shifts are redefining the parameters of energy management, positioning smart, secure, and sustainable solutions at the forefront of industry adoption.

Assessing the Cumulative Impact of 2025 United States Tariffs on Building Energy Management Systems Supply Chains, Costs, and Industry Dynamics

In early 2025, the United States escalated tariff measures on a range of imported building automation components, including sensors, controllers, and actuators. These levies introduced a layer of cost pressure across global supply chains, compelling solution providers to reassess sourcing strategies and accelerate diversification efforts. Many firms responded by exploring alternative manufacturing hubs and forging new partnerships with domestic and nontraditional overseas suppliers to mitigate exposure to punitive duties.

Simultaneously, the tariff-induced uptick in procurement expenses has heightened the importance of value-added services and long-term maintenance contracts. Service revenues and integrated offerings have become vital levers for technology vendors seeking to offset upfront hardware surcharges. By bundling advanced analytics, fault detection, and optimization modules within subscription-based frameworks, providers are delivering predictable returns on investment for end users, thereby insulating project economics from tariff volatility.

Furthermore, the ripple effects of these policy measures have permeated pricing negotiations and capital planning cycles. Building owners and facility managers are increasingly adopting phased deployment approaches, prioritizing critical subsystems before committing to full-scale rollouts. This incremental methodology enables stakeholders to validate performance benefits and secure internal funding approvals while safeguarding against sudden cost escalations. As a result, organizations that proactively integrate tariff awareness into procurement roadmaps can maintain project momentum and capitalize on emerging opportunities in the revitalized market environment.

Unlocking Market Dimensions Through Component, System, Building Type, Deployment, Application, and End User Segmentation Insights for Strategic Decision Making

Unlocking market dimensions requires a deep dive into multilevel segmentation that reveals nuanced adoption patterns and strategic imperatives. From a component standpoint, the ecosystem encompasses hardware, services, and software pillars. The hardware tier is anchored by sensors, controllers, and actuators that form the physical interface to building assets. Service offerings span consulting, implementation, integration, maintenance, and support-ensuring that each installed solution delivers sustained performance. Meanwhile, software modules for energy analytics, fault detection, diagnostics, and optimization provide the intelligence layer that transforms raw data into actionable guidance.

When viewed through the lens of system classification, the spectrum ranges from traditional building management and energy management systems to specialized HVAC control, lighting control, and security and access control architectures. Each system category addresses distinct operational objectives, yet they are increasingly converging within unified platforms to deliver holistic oversight. In parallel, the analysis of building types-from education and healthcare to hospitality, office, and retail environments-highlights tailored solution configurations calibrated to specific occupancy patterns and regulatory requirements.

The narrative of deployment modality further enriches this picture. Cloud-based, on-premises, and hybrid architectures offer differentiated trade-offs in terms of data residency, scalability, and integration complexity. Similarly, end use applications spanning fire and safety, HVAC control, lighting management, and security reinforce the multifaceted role of energy management systems in supporting building resilience. Ultimately, end user segmentation across commercial, industrial, institutional, and residential verticals underscores the universal relevance of these solutions, while spotlighting the distinct drivers and constraints that shape adoption within each category.

This comprehensive research report categorizes the Building Energy Management Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System

- Building Type

- Deployment Type

- End Use Application

- End User

Analyzing Regional Adoption Patterns and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific Energy Management Ecosystems

Regional dynamics are pivotal in shaping adoption trajectories and innovation pathways across the building energy management landscape. In the Americas, stringent energy codes and incentive programs in the United States and Canada have fueled demand for integrated platforms that deliver verifiable efficiency gains. Additionally, an expanding wave of retrofits in Latin American commercial and institutional properties is catalyzing interest in scalable, subscription-based service models that lower entry barriers for end users.

Conversely, the Europe, Middle East, and Africa region presents a heterogeneous tapestry of market drivers. Within the European Union, aggressive decarbonization targets and the rollout of smart city initiatives have created fertile ground for advanced energy management solutions that integrate distributed energy resources and support carbon reporting. Middle Eastern nations, in parallel, are investing heavily in large-scale infrastructure projects and mixed-use developments, embedding energy management as a core design component. Meanwhile, North African markets are increasingly prioritizing energy security and sustainability amidst shifting economic landscapes, presenting nascent opportunities for technology providers with adaptable platforms.

In the Asia Pacific, the growth narrative is dominated by emerging economies and mature urban centers alike. China’s commitment to peak carbon emissions by 2030 has accelerated the deployment of AI-driven analytics and digital twins within commercial high-rises and industrial complexes. Japan’s modular construction and IoT ecosystems continue to refine building efficiency standards, while Australia’s stringent environmental regulations have spurred adoption of cloud-based monitoring solutions. Through these region-specific initiatives, stakeholders are forging differentiated strategies that align with local policy frameworks, infrastructure capacities, and investment climates.

This comprehensive research report examines key regions that drive the evolution of the Building Energy Management Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Landscape Dynamics Through Key Players’ Strategic Innovations, Collaborations, and Market Positioning in Building Energy Management

The competitive terrain of building energy management is defined by a blend of established conglomerates and agile challengers, each forging unique paths to capture market share. Global leaders have intensified their focus on platform interoperability, strategic acquisitions, and cross-industry partnerships. By integrating emerging software startups into their portfolios, these seasoned players are enriching core offerings with advanced analytics, machine learning capabilities, and digital twin technologies.

At the same time, specialized providers are carving out niches through domain-specific expertise and rapid innovation cycles. These firms often target end-to-end service delivery within focused verticals, leveraging deep sector know-how to address the precise needs of healthcare campuses, higher education institutions, or logistics warehouses. Their agility enables swift adaptation to evolving regulatory mandates and customer performance requirements.

Partnership ecosystems further delineate the competitive landscape. Collaboration between original equipment manufacturers, cloud service operators, and energy consultancy firms has given rise to comprehensive solution stacks that reduce implementation complexity. Meanwhile, forward-leaning entrants are harnessing software-as-a-service business models to accelerate time-to-value and foster ongoing client engagement. As technology convergence continues, the interplay between scale, specialization, and service innovation will determine which organizations emerge as frontrunners in the next wave of energy management adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Building Energy Management Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Accenture PLC

- Accruent, LLC by Fortive Corporation

- Acuity Brands, Inc.

- Airedale International Air Conditioning Ltd. by Modine Manufacturing Company

- Azbil Corporation

- Buildings IOT

- C3.ai, Inc.

- Carma Corporation

- Cisco Systems, Inc.

- Daikin Industries, Ltd.

- Danfoss A/S

- Delta Group

- Eaton Corporation PLC

- Emerson Electric Co.

- General Electric Company

- GridPoint by Twenty First Century Utilities

- Hitachi, Ltd.

- Honeywell International Inc.

- International Business Machines Corporation

- Johnson Controls International PLC

- Kollmorgen Corporation

- Legrand Group

- mCloud Technologies Corp.

- Mitsubishi Heavy Industries, Ltd.,

- MRI Software LLC

- Neptune India Limited

- Optimum Energy LLC

- Robert Bosch GmbH

- Rockwell Automation Inc

- Schneider Electric SE

- Siemens AG

- Spacewell Spain S.L.

- Technovator International Limited.

- Tuya Global Inc.

Empowering Industry Leaders with Actionable Recommendations to Navigate Emerging Energy Challenges, Enhance Operational Efficiency, and Drive Sustainable Growth

To thrive in this dynamic environment, industry leaders must embrace a multifaceted strategy that prioritizes both technological agility and operational resilience. First, organizations should invest in open, interoperable platforms that support seamless integration of IoT sensors, third-party analytics, and distributed energy resources. By leveraging standards-based architectures, stakeholders can avoid vendor lock-in and rapidly incorporate emerging innovations.

Next, deploying artificial intelligence and machine learning capabilities is crucial for unlocking predictive maintenance, automated fault detection, and continuous optimization. Embedding these advanced algorithms within edge computing frameworks ensures that actionable insights are delivered with minimal latency, safeguarding critical functions even during network disruptions. In parallel, fostering robust partnerships with local and regional suppliers will mitigate supply chain risks, especially in the wake of tariff fluctuations and geopolitical uncertainties.

Lastly, leaders must cultivate a culture of sustainability by aligning energy management initiatives with broader ESG objectives. This involves establishing clear performance metrics, incentivizing operational teams through outcome-based contracts, and engaging occupants with real-time energy usage feedback. Through these measures, organizations will not only realize cost savings and emission reductions but also demonstrate tangible progress toward corporate responsibility goals.

Robust Research Methodology Incorporating Multi-Source Data Analysis, Expert Interviews, and Rigorous Validation for Credible Energy Management Insights

This study employs a rigorous, multi-stage research methodology to ensure the integrity and relevance of its findings. The secondary research phase involved the systematic review of industry whitepapers, regulatory filings, and peer-reviewed journals to map out existing technological frameworks, policy landscapes, and competitive benchmarks. This foundation was complemented by an extensive primary research effort, consisting of in-depth interviews with senior executives, facility managers, and energy consultants representing the full spectrum of end users.

Data triangulation techniques were applied to reconcile insights from multiple sources, enhancing the robustness of segmentation matrices and regional assessments. Quantitative data on technology adoption rates, deployment models, and end use applications were analyzed alongside qualitative perspectives to uncover emerging patterns and strategic imperatives. Furthermore, a dedicated expert panel engaged in iterative validation workshops to refine key assumptions, challenge preliminary conclusions, and ensure actionable clarity.

Throughout the process, stringent validation protocols were observed to eliminate biases and confirm the reliability of all inputs. Ethical guidelines and data privacy standards were rigorously upheld, guaranteeing that stakeholder contributions remain anonymized and that proprietary information is protected. This comprehensive approach underpins the credibility of the study’s recommendations and the strategic roadmap it provides for navigating the evolving building energy management landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Building Energy Management Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Building Energy Management Systems Market, by Component

- Building Energy Management Systems Market, by System

- Building Energy Management Systems Market, by Building Type

- Building Energy Management Systems Market, by Deployment Type

- Building Energy Management Systems Market, by End Use Application

- Building Energy Management Systems Market, by End User

- Building Energy Management Systems Market, by Region

- Building Energy Management Systems Market, by Group

- Building Energy Management Systems Market, by Country

- United States Building Energy Management Systems Market

- China Building Energy Management Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding the Strategic Synthesis of Core Insights on Building Energy Management Trends, Challenges, and Opportunities for Informed Stakeholder Decision Making

The analysis presented herein underscores the pivotal role that advanced energy management systems play in driving operational excellence, cost efficiency, and sustainability outcomes across diverse building environments. Key transformative forces-from digital convergence and AI-driven analytics to the integration of renewable energy assets-are collectively redefining the parameters of system design and deployment. At the same time, policy interventions such as the 2025 tariff adjustments have introduced new cost considerations that can be effectively managed through strategic sourcing and service-based revenue models.

Segmentation insights reveal that success hinges on a granular understanding of component configurations, system integrations, deployment preferences, application requirements, and end user dynamics. Equally, regional nuances-from the mature regulatory frameworks of North America and Europe to the rapid urbanization trends in Asia Pacific-demand tailored engagement strategies and product roadmaps. Competitive analysis further highlights how leading firms leverage partnerships, acquisitions, and SaaS models to differentiate their offerings and capture emerging opportunities.

Ultimately, the strategic synthesis of these insights illuminates a clear pathway for stakeholders: embrace open architectures, harness predictive intelligence, fortify supply chains, and align energy management initiatives with broader environmental and governance imperatives. By doing so, organizations will secure both immediate performance gains and enduring competitive advantage.

Take Immediate Action by Engaging with Ketan Rohom to Secure Tailored Market Intelligence and Propel Your Building Energy Management Strategies Forward

The intricate insights detailed throughout this comprehensive analysis lay the groundwork for informed decision-making, yet the full breadth of strategic perspectives, data-driven evaluations, and nuanced regional and company-specific profiles remain exclusively within the complete market research report. To transform these insights into actionable initiatives and gain a competitive edge, engagement with a dedicated expert is essential.

To secure access to the complete findings, including in-depth segmentation matrices, tariff impact models, and proprietary scenario analyses, please connect with Ketan Rohom, Associate Director of Sales & Marketing. By partnering directly, you can tailor the insights to your organization’s objectives, unlock bespoke recommendations, and expedite your path to achieving sustainable building energy management excellence.

- How big is the Building Energy Management Systems Market?

- What is the Building Energy Management Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?