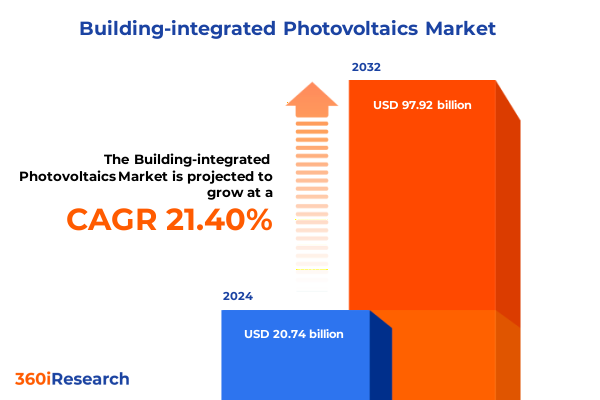

The Building-integrated Photovoltaics Market size was estimated at USD 25.11 billion in 2025 and expected to reach USD 30.40 billion in 2026, at a CAGR of 21.45% to reach USD 97.92 billion by 2032.

Unlocking the Potential of Building-Integrated Photovoltaics to Revolutionize Sustainable Construction and Energy-Generating Architecture

Building-integrated photovoltaics represent a paradigm shift in how structures generate and consume energy, seamlessly embedding solar technologies into the very fabric of buildings. Once a niche concept, the integration of photovoltaic materials into roofs, façades, and glazing systems has evolved into a cornerstone of sustainable architecture and urban resilience. As global priorities pivot toward decarbonization and ambitious net-zero targets, building owners and developers are seeking innovative solutions that combine energy generation with aesthetic appeal, reducing reliance on grid electricity while showcasing environmental stewardship.

Technological advancements have propelled efficiencies and design flexibility, enabling solar modules to mimic conventional building materials in form and function. From lightweight thin-film laminates that conform to curved surfaces to high-efficiency crystalline modules integrated into load-bearing façades, the spectrum of available options continues to expand. Coupled with improved power electronics and smart energy management systems, these solutions are no longer limited by performance compromises, making them viable across a broad range of climates and use cases. Consequently, integration strategies are shifting from after-market add-ons to foundational elements in building design, marking a critical inflection point for both the construction and renewable energy industries.

How Technological Innovations and Policy Drivers Are Reshaping the Building-Integrated Photovoltaics Market Landscape Globally in 2025

Recent years have witnessed transformative shifts driven by breakthroughs in photovoltaic materials and intensified policy support for clean energy. Perovskite and organic photovoltaic technologies have matured, offering the promise of ultra-lightweight, semi-transparent modules that cater to innovative façade and glazing applications. Simultaneously, developments in bifacial and tandem cell architectures boost energy yields by capturing reflected and diffuse light, further enhancing the appeal of integrated solutions on multifaceted building envelopes. These material innovations are complemented by digital design tools that enable architects to simulate energy performance during the early stages of planning, ensuring that solar strategies are optimized for orientation, shading, and aesthetic integration without compromising structural integrity.

Parallel to technological leaps, global policy frameworks have accelerated adoption by embedding renewable energy requirements into building codes and sustainability certification criteria. Incentive programs such as tax credits, accelerated depreciation, and green financing mechanisms have reduced upfront costs and catalyzed pilot projects in urban centers worldwide. Meanwhile, regulatory mandates on embodied carbon and energy efficiency are compelling stakeholders to view photovoltaic integration not as an optional feature, but as a strategic imperative. This convergence of innovation and regulation has collectively reshaped project workflows, driving collaborative ecosystems between PV manufacturers, construction firms, and architectural practices.

Assessing the Far-Reaching Effects of Layered 2025 United States Tariffs on the Building-Integrated Photovoltaics Value Chain and Costs

The United States entered 2025 with a layered tariff regime that has substantially influenced material sourcing and cost structures for building-integrated photovoltaic systems. Beginning January 1, the administration doubled tariffs on polysilicon and wafer imports from China, increasing duties from 25% to 50% as part of efforts to strengthen domestic manufacturing and address labor concerns in international supply chains. In parallel, universal reciprocal tariffs were introduced under a new policy framework, applying an additional 10% to a broad range of imported goods, including solar cells and modules from multiple countries. These reciprocal duties can stack with existing Section 201, Section 301, and antidumping/countervailing (AD/CVD) tariffs, resulting in effective duty rates as high as 30% on top of baseline tariffs.

Consulting analyses indicate that sustained high-tariff scenarios could reduce overall U.S. solar deployment by nearly 9% through 2035, as increased equipment costs dampen project economics and complicate supply chain planning. For building-integrated applications, where module costs represent a significant component of system pricing, these measures have prompted manufacturers and developers to re-evaluate procurement strategies, accelerate domestic production investments, and explore alternative material pathways. Despite short-term price pressures, the tariff environment has also galvanized federal incentive alignment, reinforcing programs under the Inflation Reduction Act to support American cell and module fabrication capacity and mitigate near-term market disruptions.

Comprehensive Segmentation Insights Revealing Diverse Product Technologies Integration Modes Application Verticals and Construction Stages Driving BIPV Growth

A granular examination of product types reveals that crystalline silicon remains the backbone of building-integrated photovoltaic offerings, with monocrystalline silicon commanding attention for its superior efficiency and sleek appearance, while polycrystalline variants deliver cost advantages for large-area installations. Complementing this dominant segment, emerging photovoltaic technologies such as organic photovoltaic (OPV) and perovskite have attracted notable investment due to their potential for seamless integration into flexible substrates, glass façades, and geometrically complex surfaces. Thin-film modules based on amorphous silicon, cadmium telluride, and copper indium gallium selenide continue to hold a strategic position in applications where low-light performance and reduced weight are paramount, particularly in retrofit scenarios where structural constraints limit module mass.

Integration modes further diversify the landscape by addressing specific building envelope needs. Façade cladding systems transform exterior walls into power-generating skins, capitalizing on vertical real estate with lightweight panel solutions. Glazing and skylight integrations marry solar generation with natural light transmission, offering a dual benefit of daylighting and energy production without compromising occupant comfort. Roof-integrated tiles and solar shingles blend photovoltaic functionality with roofing materials, providing an aesthetically coherent option for both residential developments and commercial structures. Each integration path aligns with distinct application segments-commercial, industrial, institutional, and residential-while construction stage considerations differentiate turnkey opportunities in new builds from retrofit programs aimed at modernizing existing facilities.

This comprehensive research report categorizes the Building-integrated Photovoltaics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Integration Mode

- Construction Stage

- Application

Regional Dynamics Uncovered Highlighting Strategic Opportunities and Challenges Across Americas Europe Middle East Africa and Asia-Pacific BIPV Markets

Regional dynamics play a pivotal role in shaping the trajectory of building-integrated photovoltaics. In the Americas, policy instruments under the Inflation Reduction Act have galvanized domestic manufacturing ambitions, with U.S. module capacity expanding to meet growing demand for façade and roof-mounted applications. Canada has followed suit with provincial mandates and incentive programs targeting net-zero buildings, fueling pilot deployments in key markets such as Ontario’s high-rise developments and Quebec’s institutional campuses. Cross-border collaborations between North American developers and technology providers are emerging to address the tariff-induced supply constraints and to leverage value-added U.S. production capacities.

Across Europe, the Middle East, and Africa, a mosaic of regulatory frameworks is driving BIPV adoption. The European Green Deal’s stringent energy performance standards have compelled developers to integrate photovoltaics into new and renovated structures, while innovative financing models-such as green mortgages and sustainability-linked loans-have unlocked capital for large-scale façade projects. In the Middle East, where solar irradiation peaks, building-integrated PV is increasingly utilized for shading and cooling, mitigating thermal loads in ultramodern complexes and heritage site adaptations. Africa’s nascent BIPV market is characterized by pilot initiatives in institutional buildings and microgrids, underscoring the technology’s versatility in regions with limited grid reliability.

Asia-Pacific remains the global manufacturing powerhouse, with China’s extensive production infrastructure enabling cost-competitive module exports and advanced R&D in emerging PV chemistries. Japan has prioritized transparent PV glazing integrated into smart city developments, while Australia’s high-solar-insolation environment drives residential and commercial rooftop innovations. South Korea is advancing BIPV through government-led pilot projects on public buildings, reinforcing the regional emphasis on energy self-sufficiency and architectural integration.

This comprehensive research report examines key regions that drive the evolution of the Building-integrated Photovoltaics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players Driving Innovation and Competitive Strategies in the Building-Integrated Photovoltaics Sector to Capture Growth Opportunities

Industry leaders continue to shape the building-integrated photovoltaic sector through targeted innovation, strategic partnerships, and vertical integration. First Solar has distinguished itself by advancing cadmium telluride thin-film technology, focusing on large-format panels that align with industrial façade applications and warehouse retrofits. Tesla’s Solar Roof division has driven public awareness with proprietary solar shingle solutions, leveraging its broader energy ecosystem of battery storage and electric vehicle integration to offer end-to-end electrification packages for residential customers.

Specialized BIPV providers like Kingspan and Onyx Solar have collaborated with architectural firms to deliver custom glazing and curtain wall systems that blend photovoltaic generation with high-performance building envelopes. Emerging players, such as Heliatek, are pioneering organic photovoltaic films that promise ultra-low-weight integration on curved surfaces and dynamic façades. Meanwhile, established module manufacturers and engineering firms, including SunPower and Ubiquitous Energy, are investing in next-generation high-efficiency cells and semi-transparent coatings to expand their BIPV portfolios. These competitive strategies underscore a broader industry transition toward convergent solutions that meet both energy and architectural objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Building-integrated Photovoltaics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Acciona SA

- AGC Group

- Altus Power, Inc.

- Belectric GmbH

- Canadian Solar Inc.

- Ertex Solartechnik GmbH

- GreatCell Solar Limited

- GreenBrilliance Renewable Energy LLP

- Hanergy Holding Group Ltd.

- Hanwha Group

- Heliatek GmbH

- JA Solar Technology Co.,Ltd.

- JinkoSolar Holding Co., Ltd.

- Kaneka Corporation

- Kyocera Corporation

- Onyx Solar Energy S.L.

- Panasonic Corporation

- Renesola Co. Ltd.

- Risen Energy Co., Ltd.

- Sharp Corporation

- Solaria Corporation

- SolarWindow Technologies, Inc.

- Sphelar Power Corporation

- SunPower Corporation

Actionable Strategies for Industry Leaders to Navigate Market Volatility Enhance Competitive Advantage and Accelerate Adoption of Integrated Photovoltaic Solutions

To navigate the evolving landscape of building-integrated photovoltaics, industry leaders should prioritize supply chain resilience by diversifying material and component sourcing. By establishing strategic partnerships with domestic cell and module manufacturers, organizations can mitigate tariff exposure and ensure continuity of supply. Simultaneously, investing in research and development of emerging photovoltaic chemistries will position firms at the forefront of next-generation integration, offering differentiated products that meet stringent aesthetic and performance requirements.

Engagement with regulatory stakeholders and participation in code-development forums are essential to shaping supportive building standards and incentive structures. Aligning product roadmaps with evolving policy frameworks-such as embodied carbon regulations and net-zero mandates-will enhance market access and customer value propositions. Additionally, leveraging digital design platforms and energy modeling tools will streamline collaboration across architectural and engineering teams, accelerating project delivery and optimizing system performance. Finally, exploring innovative financing mechanisms tailored to BIPV-such as power purchase agreements, sustainable leasing models, and green bonds-can lower adoption barriers and unlock new revenue streams across commercial, institutional, and residential segments.

Rigorous Research Methodology Outlining Data Sources Analytical Frameworks and Validation Techniques for Building-Integrated Photovoltaics Market Analysis

This analysis is underpinned by a rigorous research methodology combining both primary and secondary data sources. Extensive desk research was conducted on trade and tariff datasets, policy archives, patent filings, and industry white papers to establish an accurate historical context and identify emerging trends. In parallel, primary interviews were held with senior executives from module manufacturers, architectural firms, developers, and technology innovators to capture firsthand perspectives on market dynamics, technological hurdles, and strategic priorities.

Market segmentation and competitive analyses were structured using established frameworks, including PESTEL to evaluate macroenvironmental drivers, Porter’s Five Forces to assess sector attractiveness, and SWOT to pinpoint organizational strengths and vulnerabilities. Technology readiness levels were employed to categorize emerging PV chemistries, while regional opportunity matrices were developed to align regulatory landscapes with growth potential. Data validation included cross-referencing proprietary installation databases with industry surveys, expert panel reviews, and peer benchmarking, ensuring that conclusions and recommendations reflect a robust and balanced understanding of the building-integrated photovoltaic market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Building-integrated Photovoltaics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Building-integrated Photovoltaics Market, by Product Type

- Building-integrated Photovoltaics Market, by Integration Mode

- Building-integrated Photovoltaics Market, by Construction Stage

- Building-integrated Photovoltaics Market, by Application

- Building-integrated Photovoltaics Market, by Region

- Building-integrated Photovoltaics Market, by Group

- Building-integrated Photovoltaics Market, by Country

- United States Building-integrated Photovoltaics Market

- China Building-integrated Photovoltaics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Strategic Conclusion Synthesizing Market Dynamics Competitive Forces and Future Outlook for Sustainable Growth in Building-Integrated Photovoltaics

As the convergence of architectural design and renewable energy continues to accelerate, building-integrated photovoltaics are positioned to play a pivotal role in the global energy transition. Technological advancements in material science and module efficiency are broadening the scope of viable integration strategies, while policy imperatives are reinforcing the value proposition of on-site energy generation. The interplay of tariff dynamics and domestic manufacturing initiatives has introduced complexity into supply chains, yet these challenges also present opportunities to strengthen local production and foster innovation in alternative PV technologies.

Segmentation insights reveal multiple avenues for growth across product types, integration modes, application segments, and construction stages, enabling stakeholders to tailor offerings to specific market needs. Regional analyses underscore the importance of adapting strategies to divergent regulatory environments and consumer preferences, while key industry players continue to invest in differentiated solutions and collaborative ventures. By adhering to the actionable recommendations outlined herein-spanning supply chain diversification, regulatory engagement, and innovative financing-industry leaders can secure a competitive edge and drive sustainable expansion in the building-integrated photovoltaics sector.

Partner with Ketan Rohom to Secure Comprehensive Insights and Drive Strategic Decisions in the Building-Integrated Photovoltaics Market Today

Engaging with the comprehensive market research report on building-integrated photovoltaics provides industry leaders with unparalleled clarity into evolving technologies, policy shifts, and competitive dynamics. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through our findings and tailor insights to your strategic needs. His expertise ensures that your organization can leverage segmentation analyses, tariff impact assessments, and regional trends to inform high-impact decisions and maximize growth potential.

To secure your copy of the report and gain direct access to Ketan Rohom’s consultative support, reach out today. By partnering with him, you will not only obtain critical data but also benefit from actionable recommendations and methodological transparency that empower you to navigate market volatility and accelerate your building-integrated photovoltaic initiatives.

- How big is the Building-integrated Photovoltaics Market?

- What is the Building-integrated Photovoltaics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?