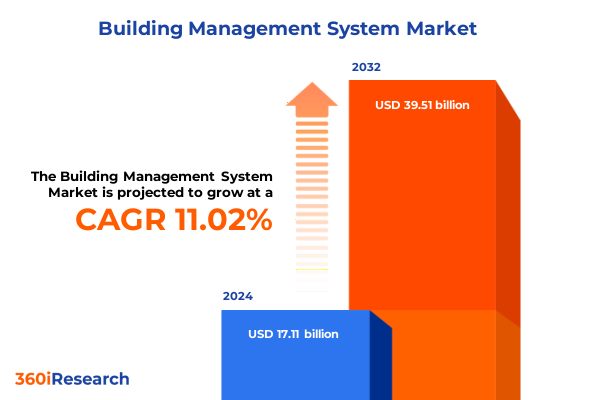

The Building Management System Market size was estimated at USD 18.98 billion in 2025 and expected to reach USD 21.06 billion in 2026, at a CAGR of 11.04% to reach USD 39.51 billion by 2032.

Unlocking the Future of Building Operations Through Intelligent Management Systems that Enhance Efficiency, Sustainability, and Occupant Comfort

Building management systems have become the cornerstone of modern facility operations, seamlessly integrating hardware, software, and services to optimize energy use, occupant comfort, and overall performance. These intelligent platforms consolidate data from actuators, controllers, and sensors to automate HVAC, lighting, security, and analytics, providing facility managers with unprecedented visibility and control over complex building infrastructures. As cloud-native architectures gain traction, remote monitoring and real-time insights are enabling organizations to respond swiftly to operational anomalies and performance deviations, ensuring continuous improvement in building efficiency and reliability.

The convergence of Internet of Things connectivity, edge computing, and advanced analytics is driving a new era of predictive maintenance and adaptive control within the built environment. By leveraging machine learning algorithms and digital twin representations of physical assets, facility managers can anticipate equipment failures, optimize energy consumption, and model what-if scenarios without risking actual operations. As regulatory pressure intensifies around carbon reduction and net-zero goals, these sophisticated building management platforms are increasingly viewed as strategic investments that deliver both sustainability benefits and cost savings over the long term.

Harnessing Digital Transformation and Sustainable Innovations to Redefine Tomorrow’s Building Management Ecosystems at Enterprise Scale

The building management landscape is undergoing a profound transformation driven by technological innovation and evolving stakeholder expectations. Cloud-native platforms now serve as the backbone of system architectures, enabling remote access, seamless scalability, and interoperability with a growing network of IoT devices. These cloud-first solutions not only simplify deployments across multi-site portfolios but also underpin advanced analytics that guide decision-making in real time.

Simultaneously, artificial intelligence and machine learning have emerged as critical enablers of predictive maintenance and operational optimization. By analyzing vast data streams from HVAC systems, lighting grids, and access controls, AI-driven applications can detect patterns of equipment degradation and forecast failures days or even weeks in advance, reducing unplanned downtime and extending asset lifecycles. Moreover, the integration of edge computing ensures that time-sensitive decisions, such as security breach responses or climate control adjustments, occur with near-zero latency, preserving occupant safety and comfort even when network connectivity is constrained.

Another transformative shift is the adoption of digital twins-virtual replicas of physical assets that provide a sandbox for testing energy-saving measures, emergency scenarios, and operational changes without disrupting live systems. As more than 500 cities worldwide embrace digital twin frameworks to manage infrastructure and sustainability challenges, building operators are leveraging this technology to fine-tune environmental controls and evaluate retrofit strategies in a risk-free environment. These advancements are complemented by an unwavering focus on sustainability, where integrated energy management modules and real-time carbon tracking drive continuous progress toward decarbonization targets.

Assessing the Widespread Consequences of Newly Imposed United States Tariffs on Import Costs, Supply Chains, and Industry Profitability in 2025

In April 2025, a sweeping set of tariffs imposed on Chinese, European, and Canadian imports reshaped the cost structure of building management system components, compelling manufacturers and integrators to recalibrate their sourcing strategies. Chinese-manufactured sensors and actuators now face duties as high as 54 percent, while European-sourced controllers incur 20 percent tariffs, and Canadian energy products attract a 10 percent levy. These measures have effectively increased the bill of materials for hardware-intensive solutions, exerting upward pressure on production expenses and compressing margins for leading providers.

The uncertainty introduced by these trade measures has also disrupted planning and procurement cycles. With input costs fluctuating, project timelines for large-scale commercial and industrial installations have experienced delays as developers reassess budgets and adjust specifications. Smaller system integrators, operating on lean financial reserves, have felt the immediate strain, leading to postponed rollouts and a cautious approach to new project commitments. Because many energy management and security platforms rely on imported electronic components, the cascading effects of tariff-induced price hikes have reverberated throughout the value chain, from contract negotiations to end-user pricing.

Despite these challenges, the tariff landscape has catalyzed several strategic opportunities. Stakeholders have accelerated investments in domestic manufacturing capabilities to mitigate dependency on high-tariff markets and capitalize on government incentives for nearshore production. Simultaneously, supply chain diversification has gained renewed emphasis, driving partnerships with suppliers in Southeast Asia and Mexico that offer more favorable trade conditions. Moreover, the shift toward software-centric energy management solutions-less reliant on physical imports-has enabled providers to partially insulate revenue streams and deliver high-value services focused on analytics and optimization rather than purely hardware-based offerings.

Unveiling Key Insights from Component, Application, and End User Perspectives to Navigate the Complexities of Building Management Segmentation

Building management systems are categorized by component type, encompassing hardware, services, and software. Hardware components, which include actuators, controllers, and sensors, serve as the physical interface with building infrastructure to monitor and regulate environmental conditions. Complementing these devices are professional services-spanning consulting, integration and deployment, support, and maintenance-that facilitate successful system implementation and ongoing operational reliability. On the software front, analytics platforms and specialized BMS applications transform raw data into actionable insights, driving continuous performance improvements across facilities.

Applications of building management systems span critical operational domains such as energy, HVAC, lighting, and security. Energy management modules leverage demand response, load management, and monitoring and analytics to align consumption with cost and carbon objectives. In HVAC management, automated control of air handling units, boilers, and chillers ensures occupant comfort while minimizing energy waste. Lighting management solutions, featuring both interior and exterior lighting controls, dynamically adjust illumination based on occupancy and ambient light levels. Finally, security and access control systems integrate access management, intrusion detection, and video surveillance to protect assets and people.

End users of these systems include diverse segments: commercial entities such as office complexes and retail spaces seeking efficiency gains and occupant satisfaction; government facilities across defense, education, and healthcare, which prioritize reliability and regulatory compliance; industrial environments in manufacturing and warehousing that demand precision control and predictive maintenance; and residential buildings-both multi-family and single-family-which increasingly adopt smart home features to enhance comfort, convenience, and energy savings.

This comprehensive research report categorizes the Building Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Application

- End User

Highlighting Regional Dynamics Shaping Building Management System Adoption Across Americas, Europe Middle East & Africa, and Asia Pacific

In the Americas, government stimulus programs and tax incentives, notably under the Inflation Reduction Act, are fueling investments in energy efficiency retrofit projects within commercial and public sector buildings. Expanded deductions for energy-saving upgrades and rebates for electrification measures have prompted building owners to accelerate upgrades of HVAC, envelope, and lighting systems to meet stringent EUI reduction targets. This policy environment has also encouraged providers to develop turnkey solutions that bundle hardware, software, and financing to simplify adoption and deliver rapid payback.

Europe, the Middle East, and Africa collectively reflect a mosaic of regulatory drivers and infrastructure priorities. In the European Union, rising mandates for carbon neutrality, such as the Energy Performance of Buildings Directive and emerging Building Passports initiative, are driving widespread BMS adoption to achieve net-zero targets. Concurrently, infrastructure development in the Gulf Cooperation Council and African urban centers is integrating smart building technologies at the planning stage to enhance resilience and resource efficiency, creating growth corridors for both established and emerging solution providers.

The Asia-Pacific region stands at the forefront of BMS innovation, propelled by rapid urbanization and ambitious smart city programs. Governments across China, India, and Southeast Asia are investing in large-scale deployments to manage the energy footprint of new and existing buildings, leveraging IoT and AI to enable real-time monitoring and predictive analytics. Despite challenges related to upfront costs and workforce skill gaps, the market’s robust technology adoption curve underscores its role as a catalyst for BMS evolution, with local and global players pursuing partnerships to capture expanding opportunities.

This comprehensive research report examines key regions that drive the evolution of the Building Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Technological Leadership Defining Top Building Management System Providers in the Global Arena

Honeywell International continues to lead through its Forge for Buildings platform, which merges edge-to-cloud data processing with embedded cybersecurity measures in controllers and gateways. By expanding its footprint in emerging markets and integrating AI-powered building controls for predictive maintenance and space utilization, the company reinforces its position as a provider of comprehensive, energy-centric solutions that address both operational efficiency and carbon reduction targets.

Siemens Smart Infrastructure leverages its Desigo CC and Xcelerator offerings to deliver modular, scalable automation that supports digital twin simulations and autonomous operations. The integration of AI and machine learning into its suite enables dynamic optimization of HVAC, lighting, and security systems, while an emphasis on interoperability and open standards ensures seamless integration of third-party devices in large, heterogeneous facilities.

Johnson Controls drives differentiation with its Metasys platform, which emphasizes adaptability across new builds and retrofit projects. Its integration of renewable energy sources and advanced control algorithms enhances building sustainability, while the company’s comprehensive portfolio-including fire protection, security, and energy storage systems-positions it as a one-stop provider for intelligent building environments.

Schneider Electric’s EcoStruxure platform binds energy management, IoT connectivity, and cloud analytics into a unified architecture. Its predictive maintenance capabilities and scalable design support both single-site applications and enterprise-scale deployments, enabling customers to optimize energy usage, reduce downtime, and achieve compliance with green building standards. The platform’s open, interoperable framework fosters ecosystem growth and innovation, underpinning Schneider Electric’s leadership in building automation and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Building Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Acuity Brands, Inc.

- Bosch Building Technologies GmbH

- Carrier Global Corporation

- Crestron Electronics, Inc.

- Delta Controls Inc.

- Emerson Electric Co.

- Honeywell International Inc.

- IBM Corporation

- Johnson Controls International plc

- Legrand SE

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens AG

- Trane Technologies Company

Delivering Actionable Strategies to Bolster Growth, Drive Innovation, and Enhance Resilience for Building Management Industry Leaders

Industry leaders should prioritize the development of domestic manufacturing partnerships and nearshore supply chains to mitigate the impact of trade policies on component costs. By diversifying sourcing across lower-tariff regions and reinforcing collaborations with regional suppliers, providers can stabilize their input expenses and ensure uninterrupted deployment schedules. Furthermore, integrating AI-driven supply chain analytics into enterprise resource planning systems will enhance forecasting accuracy and operational resilience in the face of policy shifts.

Embracing next-generation digital twin applications and edge computing architectures will empower facility managers to perform rapid scenario testing and gain real-time operational control close to the point of data generation. Investments in these technologies should be coupled with a strong cybersecurity framework to safeguard sensitive building data and maintain compliance with evolving regulations. Adopting multi-layer security protocols and continuous threat monitoring will protect both cloud and on-premise environments, ensuring the integrity of automated building operations.

In addition, forging cross-industry partnerships with smart city initiatives, utility providers, and technology innovators can unlock new service offerings and revenue models. Collaborative engagements that integrate energy management platforms with urban infrastructure projects will position organizations to participate in demand response programs, carbon credit markets, and performance-based contracting. Lastly, focusing on customer education and outcome-based service models will differentiate providers in a competitive market, enabling the delivery of measurable sustainability and efficiency outcomes that drive long-term client loyalty.

Defining Rigorous Research Methodology Integrating Primary Interviews, Secondary Data Collection, and Robust Analytical Frameworks for Credible Insights

This research initiative employs a systematic methodology designed to ensure accuracy, depth, and relevance of insights. Primary research was conducted through in-depth interviews with senior executives, facility managers, and technology experts across hardware, software, and service providers to capture firsthand perspectives on market drivers, challenges, and adoption priorities. Complementing these qualitative inputs, structured surveys were distributed to over 150 end users spanning commercial, government, industrial, and residential sectors to validate technology preferences and investment plans.

Secondary research involved a comprehensive review of publicly available regulatory documents, corporate disclosures, patent filings, and industry white papers. Trade association reports and academic studies were analyzed to map the evolution of standards related to energy performance, IoT security, and digital twin implementations. Data triangulation was performed by cross-referencing multiple sources to mitigate bias and reinforce the credibility of findings. Detailed segmentation frameworks were developed based on component type, application, end user, and geography to facilitate targeted analysis. Additionally, a proprietary analytical model was applied to assess regional dynamics and tariff impacts, ensuring robust synthesis of qualitative and quantitative inputs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Building Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Building Management System Market, by Component Type

- Building Management System Market, by Application

- Building Management System Market, by End User

- Building Management System Market, by Region

- Building Management System Market, by Group

- Building Management System Market, by Country

- United States Building Management System Market

- China Building Management System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2385 ]

Concluding Reflections Emphasizing Strategic Imperatives and Long-Term Value Creation Through Forward-Looking Building Management Practices

The convergence of cloud-native architectures, AI-driven analytics, and digital twin technologies is reshaping the future of building management systems, offering new pathways to optimize performance, sustainability, and occupant experience. As trade policies introduce cost pressures for hardware components, the industry’s pivot toward software-centric services and localized manufacturing underscores the importance of strategic agility. Regional dynamics, powered by regulatory incentives in the Americas and Europe and rapid smart city deployments in Asia-Pacific, are creating differentiated growth avenues for forward-looking providers.

Competitive leadership now hinges on the ability to deliver integrated solutions that seamlessly blend advanced control, energy optimization, and security while maintaining a strong cybersecurity posture. Actionable strategies-such as supply chain diversification, investment in edge computing, and collaborative urban infrastructure initiatives-will enable stakeholders to navigate market complexities and capture new revenue streams. Ultimately, the firms that effectively translate technological innovation into measurable sustainability and efficiency outcomes will define the next generation of smart buildings and drive long-term value creation.

Engage with Ketan Rohom to Secure Comprehensive Market Intelligence and Empower Your Strategic Decision-Making with Our Detailed Building Management Report

Engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to unlock the full depth of our comprehensive market research report and gain unparalleled strategic insights tailored to your organization’s needs. Through a personalized consultation, you will explore detailed analyses of technology trends, competitive positioning, and regional opportunities that are driving transformation in the building management system landscape. Ketan’s expertise in translating complex data into actionable intelligence ensures you can confidently navigate market dynamics and make informed investment decisions.

By partnering with Ketan, you will receive a customized briefing that highlights the segments and regions most relevant to your strategic objectives, along with targeted recommendations to accelerate innovation and optimize operations. Whether you are evaluating technology adoption, planning supply chain diversification, or setting sustainability targets, this engagement will equip you with the clarity and foresight needed to secure a competitive advantage. Reach out today to schedule your session and embark on a journey toward data-driven growth and resilience.

- How big is the Building Management System Market?

- What is the Building Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?