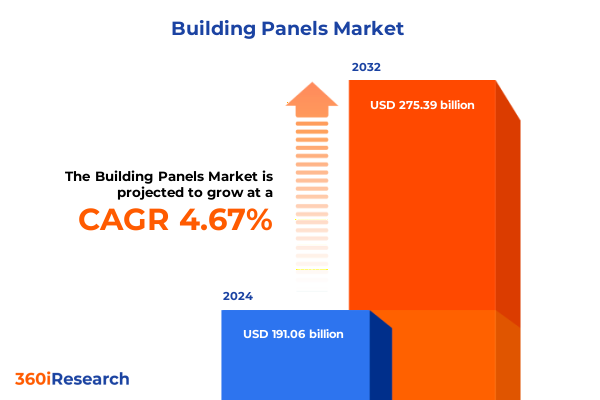

The Building Panels Market size was estimated at USD 200.01 billion in 2025 and expected to reach USD 208.72 billion in 2026, at a CAGR of 4.67% to reach USD 275.39 billion by 2032.

Setting the Stage for the Future of Smart Device Innovation by Uniting Connectivity, Functionality, and Consumer Empowerment

The global consumer electronics landscape has never been more dynamic, with smartphones and wearables redefining how people connect, work, and stay healthy. This environment is characterized by rapid technological advancements, shifting consumer expectations, and an ever-evolving competitive landscape. Understanding these forces is crucial for executives seeking to navigate complexities and drive growth.

This executive summary distills critical findings from an in-depth market research report, offering a concise yet comprehensive overview of the transformative shifts, tariff impacts, segmentation patterns, regional variations, and competitive strategies shaping the smartphone and wearable technology spheres. It sets the stage for a deeper exploration of insights that will inform strategic decisions and unlock new avenues for innovation and market expansion.

Igniting Technological Revolutions with Expansive 5G Connectivity and On-Device Artificial Intelligence Enabling Next-Generation User Experiences

A powerful catalyst for market transformation has been the rollout of fifth-generation (5G) networks, which promise to dramatically increase device performance, reduce latency, and enable new use cases across both smartphones and wearables. As of mid-2025, global 5G connections have surged past two billion, representing a significant share of total mobile subscriptions, while network coverage is poised to extend to three-quarters of the global population within the same timeframe. These developments facilitate seamless streaming, real-time data synchronization, and enhanced user experiences, setting a new standard for device interoperability.

Concurrently, artificial intelligence (AI) has become integral to differentiating product offerings, with on-device machine learning powering advanced photography, predictive health analytics, and personalized user interfaces. By 2025, devices incorporating AI capabilities account for over 40% of all smartphones, while AI-driven wearables are growing rapidly thanks to improved sensor fusion and real-time data interpretation. These innovations are enabling proactive health monitoring, adaptive power management, and context-aware assistance that raise consumer expectations across the broader mobile ecosystem.

Moreover, the convergence of connectivity and intelligence is driving a paradigm shift in how devices support health and wellness initiatives. Wearables now offer advanced metrics such as continuous ECG, stress detection, and glucose monitoring in certain models, reflecting a growing industry focus on preventive care and personalized insights. These transformative shifts underscore the imperative for companies to leverage emerging technologies while maintaining agility in product development and ecosystem partnerships.

Understanding How U.S. Trade Policies Have Reshaped Consumer Electronics Costs and Global Supply Chains Through 2025 Tariff Adjustments

Since early 2025, U.S. trade policies have undergone several revisions that directly affect the consumer electronics industry, particularly smartphones and wearables. Expanded tariffs, including a 145% levy on Chinese-origin goods and variable rates for other trading partners, have increased production costs for devices and components. Although temporary exemptions have shielded finished electronics from some duties, manufacturers now face heightened uncertainty regarding long-term sourcing strategies, with price increases projected to materialize by mid-2025.

These tariff adjustments have had a cascading effect on global supply chains. Key components such as semiconductors, display panels, and precision sensors have seen cost markups between 20% and 35%, compelling many OEMs to reassess manufacturing footprints and accelerate diversification initiatives. Companies are exploring alternative production hubs in Southeast Asia and Latin America while negotiating rebate programs and volume-based incentives with suppliers. Despite these efforts, lead times have extended by up to 30% in certain segments, challenging just-in-time inventory models and driving a renewed emphasis on buffer stock strategies.

Looking ahead, industry stakeholders anticipate that the interplay between trade policy and competitive dynamics will continue to shape pricing, innovation, and consumer adoption patterns. Firms that proactively adapt their supply chain networks and leverage strategic partnerships stand to mitigate cost pressures, preserve margin integrity, and sustain product roadmaps that align with evolving demand.

Unlocking Market Dynamics by Exploring Consumer Behaviors, Channel Preferences, and Pricing Tiers Across Diverse Device and User Segments

Analysis of market segments reveals nuanced insights across product types, channels, user profiles, applications, technologies, and price tiers, shedding light on emerging consumer preferences and commercial imperatives. Smartphones, spanning entry-level to flagship models, coexist with wearables that range from basic fitness bands to feature-rich smartwatches, each attracting distinct user cohorts and usage patterns. This holistic view of the product spectrum underscores the need for tailored strategies across device portfolios.

Distribution channels vary in their impact on brand perception and sales velocity, with offline environments such as hypermarkets and specialty stores offering hands-on experiences, while online platforms prioritize convenience and rapid fulfillment. Within this landscape, consumer adoption by individuals contrasts with enterprise deployments, where large organizations demand robust security, integration capabilities, and service-level commitments. Applications extend from core communication features to health-oriented metrics like fitness tracking, illuminating how functionality drives value propositions.

Moreover, technological differentiation, demonstrated by LCD versus OLED displays, intersects with strategic pricing decisions. Products positioned in the high tier, often branded as premium, compete on advanced features and build quality, whereas low-tier offerings aim to capture budget-conscious segments. Understanding these intertwined factors enables stakeholders to align product development, marketing, and distribution tactics with the specific expectations and behaviors of each target audience.

This comprehensive research report categorizes the Building Panels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Distribution Channel

- End User

- Application

Revealing Regional Variations in Device Adoption, Consumer Preferences, and Growth Opportunities Across the Global Market Landscape

Regional analysis highlights distinct growth drivers and challenges that shape the competitive environment in the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In North America, high consumer purchasing power and early adoption of premium devices drive sustained demand for flagship smartphones and multifunctional wearables. Regulatory shifts and incentives supporting domestic component manufacturing further influence corporate strategies and partnerships.

Within Europe, Middle East & Africa, a diverse array of economic conditions and regulatory frameworks creates a complex tapestry of opportunity. Western European markets emphasize data privacy standards and interoperability, while emerging economies in the Middle East and Africa display rapid uptake of cost-effective devices, propelled by investments in digital infrastructure and growing health awareness.

The Asia-Pacific region leads in manufacturing scale and innovation, benefiting from economies of scale, government R&D support, and extensive OEM investments. From advanced markets like Japan and South Korea to populous nations such as India and China, consumer preferences range from feature-rich, high-end offerings to affordable models tailored for mass adoption. These regional distinctions underscore the importance of localized strategies that address unique regulatory, economic, and cultural dynamics.

This comprehensive research report examines key regions that drive the evolution of the Building Panels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Leadership Among Major Players Shaping the Smartphone and Wearable Technology Ecosystem

Leading enterprises are deploying distinct competitive strategies to capture share and redefine value in the smartphone and wearable sectors. An American tech giant maintains its dominance through seamless hardware-software integration, ecosystem lock-in, and premium branding, while a South Korean manufacturer leverages aggressive innovation cycles and strategic partnerships to challenge market leaders. Additionally, Chinese OEMs are expanding their footprint by offering high-specification devices at competitive price points, supported by strong domestic manufacturing capabilities.

Meanwhile, specialized players in the fitness and enterprise segments have carved niches through differentiated service offerings, such as advanced biometric sensors and enterprise-grade security protocols. Collaboration between technology providers and healthcare companies is yielding new growth avenues, as data-driven insights and remote monitoring solutions become central to user engagement.

Collectively, these competitive dynamics illustrate the critical role of continuous innovation, flexible supply chain architectures, and strategic alliances. Organizations that can anticipate shifts in consumer expectations while optimizing operational efficiency will be well-positioned to lead in this fast-evolving market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Building Panels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3A Composites Holding AG

- Alcoa Corporation

- Arconic Corporation

- Armstrong World Industries, Inc.

- ASSA ABLOY AB

- Atlas Roofing Corporation

- Butler Manufacturing Company

- Cornerstone Building Brands, Inc.

- Georgia-Pacific LLC

- Hunter Douglas NV

- James Hardie Industries plc

- JELD-WEN Holding, Inc.

- Kingspan Group PLC

- Lindab International AB

- LIXIL Group Corporation

- Louisiana-Pacific Corporation

- Masco Corporation

- Mitsubishi Electric Corporation

- Nucor Corporation

- Owens Corning

- Panasonic Corporation

- Pella Corporation

- Saint-Gobain S.A.

- Tata Steel Limited

- USG Corporation

Guiding Industry Leaders with Strategic Moves to Navigate Regulatory Pressures, Enhance Innovation, and Strengthen Market Position

Industry leaders should prioritize a multifaceted approach to mitigate risk, capitalize on emerging trends, and reinforce their market positions. Strengthening local manufacturing capabilities and forging partnerships with strategic suppliers can reduce exposure to geopolitical disruptions and tariff volatility. Complementarily, companies should invest in R&D that harnesses AI and 5G to create differentiated user experiences, ensuring offerings are both compelling and defensible.

To enhance consumer loyalty and long-term engagement, stakeholders must develop services that transcend hardware, such as subscription ecosystems, fitness and wellness platforms, and enterprise device management solutions. Embracing sustainability through eco-friendly materials and circular economy practices will resonate with environmentally conscious consumers and align with evolving regulatory standards.

Finally, leveraging data analytics to derive actionable insights from user behavior and market indicators will be indispensable. By adopting agile product development methodologies and data-driven decision-making, organizations can respond swiftly to competitive pressures and steer their strategies with clarity and conviction.

Ensuring Analytical Rigor Through a Robust Research Framework Combining Quantitative and Qualitative Approaches for Market Clarity

This market research report employs a rigorous methodology that integrates both comprehensive secondary research and targeted primary investigations. Secondary sources include industry publications, company filings, regulatory documents, and reputable news outlets, ensuring a robust foundation of publicly available information. This data is meticulously cross-verified to maintain accuracy and relevance.

Primary research encompasses in-depth interviews with key industry stakeholders, including device manufacturers, component suppliers, distribution channel executives, and end-user organizations. Insights from these conversations are synthesized with quantitative survey data to capture a holistic view of market dynamics and stakeholder priorities. Data triangulation techniques are applied to align findings across diverse sources.

Expert advisory panels provide ongoing validation of analytical frameworks and emerging hypotheses, while iterative reviews ensure methodological transparency. This structured approach yields a reliable and insightful perspective on the smartphone and wearable markets, equipping decision-makers with credible analyses and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Building Panels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Building Panels Market, by Product Type

- Building Panels Market, by Technology

- Building Panels Market, by Distribution Channel

- Building Panels Market, by End User

- Building Panels Market, by Application

- Building Panels Market, by Region

- Building Panels Market, by Group

- Building Panels Market, by Country

- United States Building Panels Market

- China Building Panels Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Embracing a Transformative Era of Smart Devices by Integrating Innovation, Policy Insights, and Consumer-Centric Strategies

In summary, the smartphone and wearable markets are entering a transformative phase driven by advanced connectivity, artificial intelligence, and shifting trade policies. Companies that navigate these changes with strategic foresight-embracing technological innovation, diversifying supply chains, and tailoring offerings to segment-specific needs-will secure enduring competitive advantage.

Regional and segment-level insights underscore the importance of localized execution and nuanced product positioning. By integrating data-driven intelligence with agile operational practices, organizations can anticipate consumer demands and adapt to regulatory fluctuations. This holistic perspective fosters resilience and paves the way for sustained growth in an increasingly interconnected digital economy.

Looking forward, partnerships across the technology, healthcare, and telecommunications sectors will catalyze new value propositions, while commitment to sustainability and user-centric design will define market leadership. The collective imperative is clear: embrace change proactively and chart a course toward long-term success.

Take the Next Step Toward Market Leadership by Engaging with Our Associate Director of Sales and Marketing for Exclusive Insights

Engaging with Ketan Rohom, the Associate Director of Sales & Marketing, will ensure your organization secures unparalleled access to detailed analyses, proprietary competitive intelligence, and forward-looking insights tailored to the evolving smartphone and wearable market. By partnering directly, you gain the benefit of personalized guidance on how to interpret critical trends, address your unique strategic challenges, and capitalize on emerging opportunities.

Taking action today means arming your decision-making teams with a robust framework to outpace competitors, anticipate regulatory shifts, and refine go-to-market approaches. Seize this opportunity to invest in a comprehensive market research report that aligns with your business objectives and drives sustainable growth. Reach out to Ketan Rohom to initiate your purchase and embark on a journey toward market leadership and innovation.

- How big is the Building Panels Market?

- What is the Building Panels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?