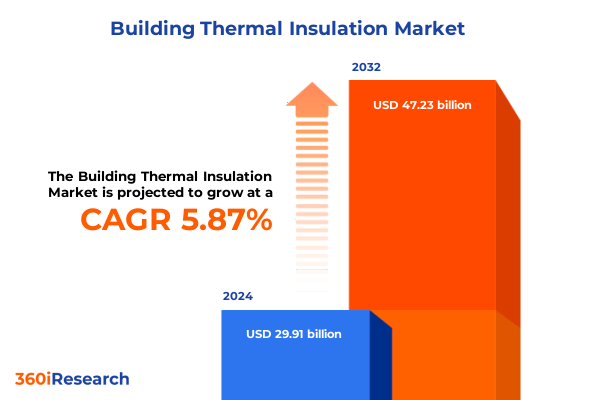

The Building Thermal Insulation Market size was estimated at USD 31.61 billion in 2025 and expected to reach USD 33.41 billion in 2026, at a CAGR of 5.90% to reach USD 47.23 billion by 2032.

Introduction to the Evolving Imperative of Advanced Thermal Insulation in Building Construction for Achieving Energy Efficiency and Sustainability

Global energy efficiency progress has stagnated in recent years, underscoring the critical role that building thermal insulation must play in driving down carbon emissions and operational costs. According to the latest analysis from the International Energy Agency, improvements in primary energy intensity are set to linger at just 1% in 2024, half the average growth achieved during the 2010–19 period. This pace falls far short of what is needed to meet net-zero targets, with buildings accounting for nearly 30% of global energy consumption and a similar share of carbon dioxide emissions. The underperformance of the buildings sector highlights an urgent need to scale up energy-efficient envelope solutions to deliver immediate and long-term sustainability gains.

Emerging Disruptions and Innovative Breakthroughs Reshaping the Building Thermal Insulation Landscape Across Global Construction Markets

Material innovation is redefining performance expectations for building envelopes, with breakthroughs in super insulating products offering unprecedented thermal resistance within minimal thickness. Research into vacuum insulation panels and silica aerogel composites has demonstrated up to five times greater efficiency than traditional solutions, unlocking new retrofit opportunities in space-constrained environments. Demand for these advanced materials is rising as architects and engineers pursue aggressive thermal targets, leveraging the extended lifespan of building envelope components to deliver sustained energy savings over decades.

Analyzing the Cumulative Effects of 2025 United States Tariff Policies on Imported Insulation Products Across Supply Chains and Pricing Structures

The United States Trade Representative’s decision to extend certain exclusions from Section 301 tariffs on Chinese imports through August 31, 2025 has provided temporary relief for various industrial inputs, yet many categories vital to insulation manufacturing no longer qualify for exemptions. As exclusions expire, products ranging from fiberglass fibers to high-performance polymers are subject to a 25% duty under the original Section 301 levy.

Deep Dive into Segmentation Insights Revealing Diverse Product Types Materials Applications Installation Types End-Use and Rich Distribution Channels

Analysis of market segmentation reveals how performance requirements and end-user demands shape product innovation, installation practices, and distribution strategies. In the realm of product type, manufacturers tailor solutions from blanket and batt systems to rigid board and panel formats, loose-fill applications, and high-expansion spray foams, each engineered for specific thermal and acoustic targets. Material choices span cellular glass for moisture-sensitive environments, cost-effective fiberglass, mineral wool deriving from rock and slag, phenolic foam for high-temperature stability, polystyrene offerings subdivided into expanded and extruded forms, and versatile polyurethane formulations. Application contexts include floor, roof, and wall systems, where climatic conditions and structural constraints influence rapid adoption of either prefabricated or on-site installed insulation. The distinction between new construction and retrofit installation types drives product design, with pre-engineered components prioritized for greenfield projects and adaptable formulations optimized for minimal downtime in renovation scenarios. End-use sectors range from high-density commercial complexes and heavy industrial facilities to diverse residential landscapes, each with unique performance, aesthetic, and regulatory requirements. Distribution channels bifurcate between offline networks-comprising manufacturer direct sales and third-party distributors-and online platforms, where e-commerce marketplaces and manufacturer-owned websites increasingly facilitate rapid procurement and custom specification services.

This comprehensive research report categorizes the Building Thermal Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- Installation Type

- End-Use

- Distribution Channel

Uncovering Regional Dynamics Driving Demand and Innovation Across the Americas Europe Middle East Africa and Asia Pacific Building Insulation Markets

In the Americas, energy code enhancements at federal and state levels are elevating demand for high-performance insulation across both retrofit and new construction markets. Incentives under programs like the U.S. Inflation Reduction Act are channeling investment into residential and commercial efficiency projects, accelerating uptake of spray foam and rigid board solutions in cold-climate zones. Meanwhile, the Europe, Middle East & Africa region is distinguished by stringent carbon reduction targets and evolving legislative frameworks such as the European Union’s revision of its Energy Performance of Buildings Directive. This regulatory environment is stimulating innovation in recycled-content mineral wool and phenolic panels, particularly within retrofit initiatives for heritage buildings that must balance conservation with energy upgrades. The Asia-Pacific market is undergoing rapid urbanization, fueling robust growth in thermal insulation demand across emerging economies. Governments in China, India, and Southeast Asia are strengthening building codes and supporting local production to reduce reliance on imports, while also exploring next-generation materials like bio-based foams and vacuum-insulated panels to meet the dual objectives of sustainability and thermal excellence.

This comprehensive research report examines key regions that drive the evolution of the Building Thermal Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Moves and Competitive Positioning Among Leading Companies Shaping the Future of Thermal Insulation in Construction

Leading industry players are shaping the market through strategic investments, product diversification, and sustainability commitments. Owens Corning has expanded its portfolio by integrating bio-based binders and sensor-enabled batt systems to monitor in-service performance. Saint-Gobain is leveraging its global footprint to standardize high-efficiency panel offerings, while accelerating capacity expansions in key growth corridors. Kingspan has positioned itself at the forefront of vacuum panel commercialization, applying proprietary core materials to reduce thickness without compromising U-values. Rockwool continues to innovate in stone wool applications for fire-resistant assemblies, targeting commercial high-rise and industrial process facilities. Johns Manville is differentiating through turnkey façade insulation systems that combine mineral wool and polymeric facers, focused on speed of installation and airtightness. Armacell’s emphasis on flexible foam solutions for mechanical insulation underscores the rising importance of vapor control and condensation prevention in HVAC applications. Collectively, these companies are navigating supply chain pressures by localizing production, diversifying raw material sources, and embracing digital marketing platforms to reach architects, specifiers, and installers directly.

This comprehensive research report delivers an in-depth overview of the principal market players in the Building Thermal Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Altana AG

- Aspen Aerogels, Inc.

- BASF SE

- Cellofoam North America, Inc.

- Compagnie de Saint-Gobain S.A.

- Concept Group LLC

- DuPont de Nemours, Inc.

- Evonik AG

- GAF Materials Corporation

- Johns Manville Corporation

- Kingspan Group PLC

- Knauf Digital GmbH

- Lloyd Insulations (India) Limited

- LyondellBasell Industries N.V.

- Neo Thermal Insulation (India) Pvt. Ltd.

- Nichias Corporation

- Owens Corning

- Recticel SA

- Rockwool International A/S

- Sika Group AG

- Solvay SA

- Sumitomo Corporation

- The Dow Chemical Company

- Ursa Insulation SA

Actionable Recommendations Empowering Industry Leaders to Capitalize on Sustainability Digitalization and Supply Chain Resilience in Thermal Insulation

To capitalize on the momentum toward net-zero construction, industry leaders should prioritize partnerships with material science innovators to co-develop next-generation super insulation products. Investing in modular manufacturing techniques can reduce lead times and enhance quality control for board, panel, and prefabricated façade solutions. Aligning product roadmaps with evolving building codes and incentive programs will enable organizations to offer turnkey retrofit packages that bundle insulation with complementary systems such as heat pumps and envelope monitoring technologies. Strengthening e-commerce capabilities and digital specification tools will empower distributors and contractors to streamline ordering, customization, and project tracking. Supply chain resilience can be fortified through strategic stockpiling of critical polymers and fibers, while expanding supplier networks across North America and Europe to mitigate tariff and logistics risks. Finally, embedding circularity principles-such as take-back schemes for post-consumer insulation and closed-loop manufacturing-will appeal to sustainability-driven stakeholders and reduce end-of-life environmental impacts.

Comprehensive Research Methodology Integrating Primary Secondary and Analytical Approaches to Ensure Robust Building Insulation Market Insights

This report synthesizes findings derived from a robust three-tiered research methodology. Secondary research encompassed analysis of regulatory frameworks, energy code revisions, trade data, and patent filings from public sources and industry associations. Primary insights were obtained through in-depth interviews with insulation manufacturers, distributors, design engineers, and government officials, capturing firsthand perspectives on market drivers and impediments. Quantitative data was triangulated with macroeconomic indicators and construction activity forecasts to validate thematic trends. Expert panels comprising academicians, materials scientists, and policy specialists were convened to challenge assumptions, refine segment definitions, and endorse actionable recommendations. Throughout the process, continual cross-validation against peer-reviewed literature and real-time supply chain snapshots ensured the credibility and timeliness of conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Building Thermal Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Building Thermal Insulation Market, by Product Type

- Building Thermal Insulation Market, by Material

- Building Thermal Insulation Market, by Application

- Building Thermal Insulation Market, by Installation Type

- Building Thermal Insulation Market, by End-Use

- Building Thermal Insulation Market, by Distribution Channel

- Building Thermal Insulation Market, by Region

- Building Thermal Insulation Market, by Group

- Building Thermal Insulation Market, by Country

- United States Building Thermal Insulation Market

- China Building Thermal Insulation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Provide a Cohesive Conclusion on the Current State and Future Trajectory of the Building Thermal Insulation Industry

The convergence of regulatory imperatives, material innovation, and shifting trade dynamics underscores the transformative trajectory of the building thermal insulation market. Advances in envelope technologies are poised to deliver substantial energy savings and carbon reductions, but the success of these solutions hinges on navigating complex tariff environments, adapting to diverse regional policy landscapes, and responding to nuanced end-use requirements. Strategic segmentation analysis reveals that tailored product portfolios-ranging from high-performance spray foams to eco-friendly biosourced panels-will be essential for capturing value across new construction and retrofit sectors. Leading companies are already recalibrating supply chains and forging collaborative ecosystems to accelerate product development and expand market penetration. By aligning research-driven insights with agile execution, stakeholders can position themselves to meet escalating efficiency standards, capitalize on digital procurement channels, and lead the industry toward a net-zero future.

Engage with the Associate Director to Access In-Depth Insights and Accelerate Strategic Decisions for Thermal Insulation Solutions

For further exploration of comprehensive market intelligence, direct your inquiries to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He stands ready to guide you through the nuances of this report, tailoring insights to your organization’s strategic objectives. Engage with him today to secure access to the full market research report, unlocking critical intelligence that will empower your decision-making, drive innovation in insulation solutions, and position your enterprise at the forefront of industry advancement. Seize this opportunity to harness actionable data and expert analysis that will accelerate your competitive edge in the dynamic landscape of building thermal insulation.

- How big is the Building Thermal Insulation Market?

- What is the Building Thermal Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?