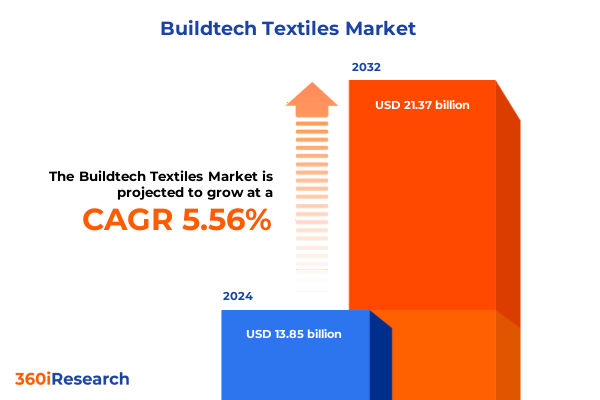

The Buildtech Textiles Market size was estimated at USD 14.54 billion in 2025 and expected to reach USD 15.27 billion in 2026, at a CAGR of 5.65% to reach USD 21.37 billion by 2032.

Setting the Stage with an In-Depth Overview of the Buildtech Textiles Sector and Its Critical Role in Modern Construction Practices

Over recent years, buildtech textiles have evolved from niche specialty materials into indispensable components of modern construction practices. These engineered fabrics, which include knit, woven, and nonwoven variants, now underpin critical applications where performance, durability, and sustainability converge. As architects and engineers increasingly demand solutions that balance structural integrity with environmental considerations, these high-tech textiles are redefining conventional approaches to insulation, flooring, roofing, and beyond.

Driven by innovations in fiber technology and advanced manufacturing processes, the sector has seen a rapid expansion of product offerings that deliver enhanced thermal resistance, sound dampening, and moisture control. Meanwhile, regulatory pressures and green building certifications have elevated the importance of recyclable and low-carbon footprint materials. This dual imperative for performance and ecological responsibility has positioned buildtech textiles as a strategic enabler of next-generation infrastructure.

This executive summary provides a concise yet thorough primer on the current market landscape. It highlights transformative trends reshaping stakeholder priorities, examines the evolving impact of 2025 United States tariff policies, and delivers segmentation and regional insights alongside profiles of key participants. Actionable recommendations and a transparent research methodology round out this document, ensuring industry leaders obtain the clarity needed to align strategy with emerging opportunities and risks.

Exploring the Major Transformative Shifts Redefining the Buildtech Textiles Landscape from Innovation to Sustainability and Supply Chain Resilience

Construction markets worldwide are experiencing a paradigm shift as buildtech textiles transition from cost-competitive alternatives to high-value performance enablers. Advances in fiber science have led to the emergence of fibers with enhanced tensile strength, fire retardancy, and chemical resistance. The integration of nanotechnology and smart coatings is broadening functional horizons, enabling self-cleaning, antimicrobial, and energy-harvesting façades. These innovations are fostering unprecedented design freedoms and lifecycle efficiencies.

Simultaneously, sustainability has become a central tenet guiding procurement decisions. Recycled and bio-based fibers are gaining traction as architects and developers pursue circular economy objectives. This green imperative is compelling manufacturers to revamp supply chains and validate environmental credentials through certifications such as LEED and BREEAM. Moreover, the digital transformation of supply chain management through blockchain and IoT-enabled traceability is enhancing transparency and reinforcing brand trust.

As climate risks intensify and regulatory frameworks tighten, resilience is prioritized alongside sustainability. Industry players are reengineering their operations to withstand geopolitical disruptions, logistical bottlenecks, and raw material price volatility. The confluence of these forces is reshaping competitive dynamics, creating new alliances across the construction and textile ecosystems.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Buildtech Textiles and Strategies to Navigate Cost and Compliance Challenges

In 2025, United States tariffs on key textile inputs have exerted multifaceted pressures throughout the buildtech textiles supply chain. Increased duties on synthetic fibers and nonwoven raw materials have elevated landed costs, prompting end-users to revisit sourcing strategies. While some manufacturers have sought tariff exemptions and pursued alternative suppliers in lower-cost jurisdictions, these adjustments have introduced lead time uncertainties and quality control challenges.

The tariff environment has accelerated vertical integration efforts, with several buildtech textile producers investing in upstream polymer production to capture greater cost predictability. At the same time, downstream fabricators have explored near-shoring to mitigate trade frictions and maintain just-in-time inventory models. Despite the initial cost burden, this realignment is strengthening supply chain visibility and reducing exposure to abrupt policy shifts.

Crucially, the cumulative effect of these tariffs is reshaping competitive positioning. Companies with the financial capacity to absorb short-term margin compression are locking in long-term contracts, securing stable production volumes. Conversely, smaller players are innovating through lean manufacturing and modular production to preserve agility. As the regulatory landscape continues to evolve, stakeholders must remain vigilant in monitoring policy developments and adapting procurement frameworks accordingly.

Deriving Key Segmentation Insights by Type, Product Composition, Raw Material, Application, and End Use to Illuminate Market Dynamics

A nuanced segmentation analysis reveals how material attributes and end-use demands intersect to drive strategic priorities. Based on type, the market encompasses knitted buildtech textiles renowned for flexibility and contouring, woven variants prized for tensile strength, and nonwoven formats that excel in filtration and insulation. When viewed through the lens of product type, fabrics lead adoption in façade and flooring systems, while yarns provide structural reinforcement and fibers underpin core functionalities. Within this product type segmentation, fibers further subdivide into natural yarn-precursors such as cotton and wool, valued for comfort and sustainability, and synthetic constructs like polyamide and polyester which deliver durability and moisture resistance.

Raw material segmentation underscores the dominance of polyamide, polyester, and polypropylene in industrial-grade applications where chemical stability and cost efficiency are paramount. Application-based evaluation highlights flooring, roofing, and insulation as primary end markets, each demanding distinct performance profiles. Flooring installations prioritize dimensional stability and wear resistance, roofing textiles focus on UV resilience and waterproofing, and insulation components emphasize thermal retention and fire retardancy. Finally, end-use segmentation sheds light on commercial, industrial, and residential channels, illustrating how diverging project specifications shape procurement criteria and value perceptions.

This comprehensive research report categorizes the Buildtech Textiles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Type

- Raw Material

- Application

- End Use

Uncovering Key Regional Insights Spanning the Americas, Europe Middle East & Africa, and Asia-Pacific to Highlight Local Market Influencers

Regional dynamics in buildtech textiles reveal divergent growth trajectories and strategic imperatives. In the Americas, especially North America, increasing investment in infrastructure renewal and green building initiatives is fueling demand for high-performance insulation and roofing textiles. Manufacturers in this region are prioritizing localized production to optimize lead times and cater to stringent environmental regulations.

In the Europe, Middle East & Africa cluster, sustainability mandates and urbanization pressures intertwine to create a robust market for recycled and bio-based fibers. The regulatory environment in Western Europe drives innovation in eco-friendly finishes, while the Middle Eastern focus on energy efficiency is accelerating uptake of solar-reflective roofing membranes. Africa’s emerging economies present nascent opportunities, though challenges such as inconsistent power supply and raw material accessibility persist.

Asia-Pacific continues to lead in manufacturing capacity and export volumes, with rapid industrialization and commercial construction fuelling growth. Here, cost-competitiveness is balanced by rising environmental oversight in countries such as Japan and Australia. Collaborative R&D between regional textile giants and academic institutions is advancing next-generation fiber chemistries, setting the stage for continued innovation.

This comprehensive research report examines key regions that drive the evolution of the Buildtech Textiles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants to Reveal Strategic Collaborations Product Innovations and Competitive Differentiators in Buildtech Textiles

The competitive landscape is characterized by established conglomerates, specialized fabricators, and emerging innovators. Leading entities are leveraging strategic collaborations to expand product portfolios and geographic reach, frequently entering joint ventures to integrate polymer manufacturing with high-performance textile production. Investments in digital printing and automated weaving technologies are delivering rapid prototyping capabilities and bespoke design solutions.

Rising companies are differentiating through sustainability credentials, securing third-party certifications and pioneering circular recycling programs to reclaim end-of-life textiles. Strategic partnerships with construction firms are forging co-development pipelines for tailored roofing and insulation systems. Meanwhile, M&A activity is consolidating regional niche players under global platforms, enabling economies of scale in raw material procurement and logistics.

To maintain competitive advantage, companies are increasingly embracing open innovation models. By collaborating with startups and material science research centers, leading participants are accelerating the commercialization of disruptive technologies such as phase-change textiles and self-healing membranes. This ecosystem approach is fostering a vibrant innovation landscape and setting new performance benchmarks across the buildtech textiles value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Buildtech Textiles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ahlstrom-Munksjö Oyj

- Asahi Kasei Corporation

- Carlisle Companies Incorporated

- DuPont de Nemours, Inc.

- Freudenberg Group

- HUESKER Synthetic GmbH

- Hyosung Corporation

- Johns Manville Corporation

- Kimberly-Clark Corporation

- Knauf Insulation GmbH

- Owens Corning Inc.

- Owens Corning LLC

- Rockwool International A/S

- Ruyi Technology Group Co., Ltd.

- SAINT-GOBAIN S.A.

- Saint-Gobain S.A.

- Shandong Weiqiao Pioneering Group Co., Ltd.

- Shanghai Textile (Group) Co., Ltd.

- Sika AG

- SKAPS Industries, Inc.

- Sunshine Textile Machinery Co., Ltd.

- TenCate Protective Fabrics B.V.

- TORAY Industries, Inc.

Formulating Actionable Recommendations for Industry Leaders to Accelerate Growth Strengthen Resilience and Capitalize on Emerging Opportunities

To navigate the evolving buildtech textiles environment, industry leaders should prioritize supply chain diversification by identifying secondary sourcing hubs for critical polymers and reinforcing relationships with specialized textile converters. By adopting digital supply chain tools, organizations can gain real-time visibility into inventory levels, logistics bottlenecks, and compliance status, enabling proactive risk mitigation.

Investing in sustainable product development is crucial. Formulating blends that incorporate recycled or bio-based fibers with minimal performance compromise can unlock new segments tied to green building certifications. Pilot programs integrating advanced coatings for self-cleaning or antimicrobial properties should be conducted in collaboration with construction partners to validate real-world performance and refine formulations.

Strategic alliances with research institutions will accelerate access to breakthrough technologies. Dedicated innovation labs that co-locate material scientists, process engineers, and design teams foster rapid iteration and efficient scale-up. Finally, engaging directly with end-use customers through technical workshops and joint demonstration projects will solidify market positioning and preempt competitive incursions.

Defining a Robust Research Methodology Combining Primary and Secondary Intelligence to Ensure Data Integrity and Analytical Rigor

This research integrates qualitative insights from executive interviews with supply chain managers, architects, and sustainability officers, complemented by quantitative data collected from industry associations, customs databases, and proprietary market intelligence platforms. Primary interviews were conducted across major geographic markets to validate regional nuances and capture emerging end-use requirements.

Secondary research encompassed a review of technical white papers, regulatory filings, patent databases, and industry periodicals to contextualize innovation trajectories and policy impacts. Data triangulation ensured consistency between tariff schedules, import-export figures, and corporate financial disclosures. Analytical rigor was maintained through cross-validation of sources and iterative peer reviews, while statistical techniques such as cluster analysis and correlation mapping illuminated segmentation overlaps and regional performance differentials.

The resulting dataset provides a robust foundation for strategic planning, combining empirical evidence with expert interpretation to deliver actionable market intelligence. Any assumptions and limitations have been documented to support transparent decision-making and ongoing methodological refinement.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Buildtech Textiles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Buildtech Textiles Market, by Type

- Buildtech Textiles Market, by Product Type

- Buildtech Textiles Market, by Raw Material

- Buildtech Textiles Market, by Application

- Buildtech Textiles Market, by End Use

- Buildtech Textiles Market, by Region

- Buildtech Textiles Market, by Group

- Buildtech Textiles Market, by Country

- United States Buildtech Textiles Market

- China Buildtech Textiles Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings to Deliver a Concise Conclusion That Connects Market Trends with Strategic Imperatives for Stakeholders

The buildtech textiles sector is at an inflection point where technological innovation, policy shifts, and sustainability imperatives converge. Throughout this report, we have dissected transformative trends from advanced fiber functionalities to green supply chain practices. The ripple effects of 2025 United States tariffs have underscored the importance of flexible sourcing strategies and resilient operational models.

Segmentation and regional analyses reveal how differentiated material attributes and local market dynamics will shape growth trajectories. Leading participants are capitalizing on strategic collaborations and open innovation to accelerate R&D, while actionable recommendations outline clear pathways for enhancing supply chain visibility, driving sustainable product development, and strengthening end-user engagement.

This executive summary crystallizes the pivotal insights needed to guide investment, product strategy, and competitive positioning in an environment defined by rapid change and heightened regulatory scrutiny. Stakeholders who align with these findings will be best positioned to navigate uncertainties and capitalize on the substantial opportunities within buildtech textiles.

Prompting Direct Engagement with Associate Director of Sales & Marketing to Secure Access to the Comprehensive Buildtech Textiles Research Report

For a deeper exploration of the comprehensive market landscape and to secure the full research report with exhaustive data and strategic insights, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide you through tailored licensing options and ensure you receive the most relevant analysis to support your decision-making in buildtech textiles.

- How big is the Buildtech Textiles Market?

- What is the Buildtech Textiles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?