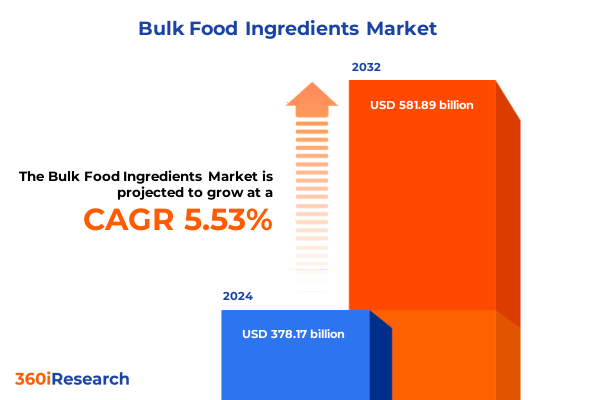

The Bulk Food Ingredients Market size was estimated at USD 399.15 billion in 2025 and expected to reach USD 419.44 billion in 2026, at a CAGR of 5.53% to reach USD 581.89 billion by 2032.

Navigating the Complex Bulk Food Ingredients Landscape: Unveiling Key Drivers, Challenges, and Opportunities in a Rapidly Evolving Global Market

The bulk food ingredients sector serves as the backbone of large-scale food production, underpinning the manufacturing of packaged goods ranging from beverages to snacks and bakery items. As consumer lifestyles become increasingly fast-paced, demand for convenient, ready-to-eat, and functional foods continues to escalate. In response, manufacturers are sourcing ingredients in bulk to achieve economies of scale while navigating the complexities of ingredient quality, shelf life, and regulatory compliance. Moreover, the industry is witnessing a heightened focus on sustainability, with organizations integrating eco-friendly sourcing practices and low-impact packaging to meet growing environmental expectations and reduce carbon footprints.

Amid these evolving drivers, the market landscape has become more intricate due to shifting global trade dynamics and supply chain disruptions. Stakeholders must now manage multi-tiered supplier networks, ensure stringent traceability from farm to factory, and adapt to new food safety standards and labeling regulations. Technological advancements such as blockchain-enabled provenance tracking, automation in material handling, and real-time analytics are emerging as critical enablers for operational resilience and transparency. These innovations, combined with strategic risk management and collaborative partnerships, are redefining best practices and setting new benchmarks in the bulk food ingredients space.

From Sustainability and Plant-Based Demand to Digital Innovation: Transformative Shifts Reshaping Bulk Food Ingredient Sourcing, Production, and Consumption

The bulk food ingredients industry is experiencing a profound transformation driven by converging trends in consumer preferences, sustainability imperatives, and digital innovation. A rise in health-conscious consumption has propelled demand for plant-based proteins and functional ingredients, while clean-label priorities have led to a surge in natural sweeteners, minimally processed starches, and organic emulsifiers. Simultaneously, sustainability commitments are reshaping sourcing strategies, with companies investing in regenerative agriculture and circular packaging solutions to minimize environmental impact and meet stringent ESG requirements.

In parallel, digitalization is unlocking new efficiencies across the supply chain, from AI-driven demand forecasting to sensor-enabled quality monitoring during transport and storage. These technological breakthroughs are not only reducing waste and operational costs but also enhancing product consistency and safety. Furthermore, the democratization of data through cloud platforms and advanced analytics is empowering stakeholders to make real-time, evidence-based decisions. As a result, companies that embrace both sustainable practices and smart manufacturing are differentiating themselves in a market characterized by heightened competition and evolving regulatory landscapes.

Assessing the Multifaceted Impacts of 2025 United States Tariff Policies on Bulk Food Ingredient Costs, Supply Chains, Sourcing, and Operational Strategies

In 2025, comprehensive tariff adjustments implemented by the United States have significantly altered the economics and logistics of importing essential bulk food ingredients. Under the revised structure, a universal 10% levy applies to most food and agricultural imports, with reciprocal duties ranging as high as 49% for key commodities such as tropical oils, spices, and nuts. These measures have driven immediate cost increases across categories, compelling manufacturers to recalibrate sourcing strategies and absorb higher input prices or pass them on to end consumers.

The cumulative effect of these tariffs has extended beyond price inflation, triggering a strategic reorientation of supply chains. Organizations are diversifying supplier bases to include low-duty jurisdictions, initiating product reformulations to reduce reliance on highly taxed imports, and ramping up domestic production capacities through vertical integration. At the same time, the unpredictability of tariff policies has heightened volatility in procurement planning, leading to the adoption of advanced inventory management systems and scenario-based risk assessments. While short-term disruptions have been pronounced, industry leaders view these adaptations as an opportunity to bolster supply chain resilience and secure more stable, cost-effective long-term sourcing arrangements.

Deciphering Critical Segmentation Insights Driving Bulk Food Ingredients Market Dynamics Across Types, Applications, Forms, Industries, Channels, and Certifications

The bulk food ingredients market is characterized by a complex mosaic of product types, application segments, physical forms, end-use industries, distribution channels, and certification preferences. Within the type category, the industry ranges from acidulants-spanning citric and lactic acids-to emulsifiers like lecithin and mono diglycerides, as well as flavor and colorants available in artificial and natural variants, and functional segments including leavening agents, lipids, proteins, starches, and sweeteners. Each ingredient subclass presents distinct production processes, quality specifications, and cost structures that influence procurement decisions and product formulations.

Equally diverse are the application areas, which encompass bakery and confectionery goods, beverages, dairy products, infant nutrition, meat and poultry items, sauces and dressings, and savory snacks. The physical form of ingredients-whether gel, granule, liquid, or powder-further dictates handling requirements and processing efficiencies. Beyond end-use in food and beverage, bulk ingredients also serve feed, personal care, and pharmaceutical markets, reflecting their multifunctional properties. Distribution channels span direct sales agreements, third-party distributors, and online platforms, each offering unique logistical advantages and customer reach. Finally, certification trends-from conventional benchmarks to non-GMO and organic credentials-shape supplier selection and command price premiums, reinforcing the critical role that segmentation plays in driving market dynamics and competitive differentiation.

This comprehensive research report categorizes the Bulk Food Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Certification

- Application

- End Use Industry

- Distribution Channel

Unveiling Regional Dynamics Shaping Bulk Food Ingredients with Deep Insights into the Americas, EMEA, and Asia-Pacific Growth Drivers and Market Characteristics

Regional disparities in consumer tastes, regulatory frameworks, and production capacities are shaping the global bulk food ingredients arena. In the Americas, the United States leads with a strong preference for clean-label formulations and functional ingredients such as plant-based proteins and nutritive fibers. The region’s sophisticated distribution infrastructure and robust regulatory oversight foster innovation in product development and enable rapid commercialization of new ingredient technologies.

Conversely, Europe, the Middle East, and Africa (EMEA) exhibit a dual focus on sustainability and traditional culinary heritage, driving demand for organic starches, specialty lipids, and regional flavor extracts. Stricter environmental regulations and consumer activism in this region have accelerated the adoption of eco-friendly sourcing and comprehensive traceability solutions. Meanwhile, in the Asia-Pacific, rapid urbanization and rising disposable incomes are fueling growth in convenience foods and ready-to-eat meal kits, creating robust opportunities for bulk starches, sweeteners, and emulsifiers. Additionally, government initiatives supporting local agriculture and food self-sufficiency are encouraging the expansion of domestic ingredient production capabilities across major markets like China, India, and Australia.

This comprehensive research report examines key regions that drive the evolution of the Bulk Food Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation, Sustainability, and Competitive Advantage in the Global Bulk Food Ingredients Industry Landscape

Key players in the bulk food ingredients sector are differentiating themselves through strategic investments in research and development, sustainability initiatives, and digital capabilities. Leading agribusiness firms such as Archer Daniels Midland and Cargill are expanding their portfolios with protein isolates and specialty starches developed via precision processing technologies. These companies are also harnessing blockchain and IoT platforms to enhance supply chain transparency and reduce food safety risks.

Ingredion and Tate & Lyle are focusing on natural and functional ingredient lines, responding to consumer demand for clean-label and organic options. Their collaboration with technology providers has enabled advanced formulation tools that optimize ingredient performance and reduce waste. Meanwhile, companies like Olam and McCormick are forging partnerships to source sustainably produced spices and flavor extracts, aligning product assortments with global sustainability targets. Collectively, these market leaders are leveraging scale, innovation, and strategic alliances to maintain competitive advantage and drive forward the evolution of the bulk food ingredients industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bulk Food Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co., Inc.

- Archer-Daniels-Midland Company

- Associated British Foods plc

- BASF SE

- Bunge Limited

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- Corbion N.V.

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Givaudan SA

- Grain Processing Corporation

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Louis Dreyfus Company B.V.

- Olam Group Limited

- Sensient Technologies Corporation

- Südzucker AG

- Tate & Lyle PLC

- Tereos S.A.

- Wilmar International Limited

Strategic Roadmap for Industry Leaders: Actionable Recommendations to Harness Emerging Trends and Overcome Challenges in the Bulk Food Ingredients Sector

Industry leaders should prioritize the integration of advanced sourcing strategies to mitigate tariff impacts and supply chain disruptions. By establishing relationships in diverse low-duty regions and enhancing local production capabilities, organizations can stabilize input costs and improve responsiveness to regulatory shifts. Simultaneously, investing in robust traceability mechanisms-powered by blockchain and real-time monitoring-will elevate transparency, ensure compliance with evolving food safety standards, and strengthen brand credibility in a trust-driven market environment.

Furthermore, companies must accelerate the development of clean-label and functional ingredient portfolios, capitalizing on the growing consumer emphasis on health, wellness, and sustainability. Collaboration with ingredient innovators and technology partners can yield proprietary solutions that differentiate product offerings. Finally, embracing data-driven decision-making through AI-enabled demand forecasting and adaptive inventory management will optimize operational efficiency and support agile responses to market fluctuations. Collectively, these strategic imperatives will position industry stakeholders to capitalize on emerging opportunities and navigate the complexities of the global bulk food ingredients sector.

Methodological Blueprint Underpinning the Bulk Food Ingredients Analysis: Comprehensive Research Design, Data Collection, and Analytical Approaches

This research employs a comprehensive methodology combining primary and secondary data sources to ensure rigorous analysis and robust insights. Primary research involved in-depth interviews with senior executives across ingredient suppliers, manufacturers, distributors, and end-users, capturing qualitative perspectives on market trends, operational challenges, and strategic priorities. Secondary research encompassed an extensive review of industry publications, regulatory documents, news articles, and corporate reports to validate quantitative data points and contextualize market drivers.

Data triangulation techniques were applied to reconcile information from multiple sources, enhancing the reliability of findings. Analytical frameworks such as Porter’s Five Forces and SWOT analysis provided structured evaluation of competitive dynamics and growth enablers. Segmentation analysis was conducted using detailed categorizations of ingredient types, applications, forms, end-use industries, distribution channels, and certification standards. Geographic insights were derived from regional trade data and consumption patterns. Throughout the research process, rigorous quality checks and peer reviews were implemented to maintain accuracy, neutrality, and methodological transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bulk Food Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bulk Food Ingredients Market, by Type

- Bulk Food Ingredients Market, by Form

- Bulk Food Ingredients Market, by Certification

- Bulk Food Ingredients Market, by Application

- Bulk Food Ingredients Market, by End Use Industry

- Bulk Food Ingredients Market, by Distribution Channel

- Bulk Food Ingredients Market, by Region

- Bulk Food Ingredients Market, by Group

- Bulk Food Ingredients Market, by Country

- United States Bulk Food Ingredients Market

- China Bulk Food Ingredients Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesis of Key Findings and Strategic Implications: Conclusive Insights and Future Outlook for Stakeholders in the Bulk Food Ingredients Market

The convergence of health and wellness preferences, sustainability imperatives, and digitalization is reshaping the bulk food ingredients market, creating both challenges and pathways to growth. Companies that adapt their sourcing strategies, embrace traceability technologies, and innovate around clean-label and functional ingredients are best positioned to succeed. Regional variations underscore the importance of tailored approaches, whether addressing clean-label demand in the Americas, eco-driven sourcing in EMEA, or convenience-led growth in Asia-Pacific.

Looking ahead, the industry’s trajectory will be defined by the ability to balance cost pressures-heightened by tariff policies and supply chain complexities-with investments in innovation and sustainable practices. By leveraging advanced analytics, forging strategic partnerships, and maintaining agility in operations, stakeholders can secure resilient supply chains and differentiated product portfolios. Ultimately, those who proactively align with evolving consumer and regulatory demands will emerge as leaders in the dynamic bulk food ingredients landscape.

Initiate Your Informed Decision-Making Today by Connecting with Ketan Rohom for Access to the Definitive Bulk Food Ingredients Market Research Report

To secure comprehensive, data-driven insights that will inform strategic decisions and drive competitive advantage in the bulk food ingredients sector, we invite you to purchase the full market research report. Our associate director of sales and marketing, Ketan Rohom, is ready to provide personalized guidance and a detailed overview of how this analysis can be tailored to your specific business needs. Reach out today to access exclusive industry intelligence, actionable data, and expert recommendations designed to support your growth objectives and refine your market approach.

- How big is the Bulk Food Ingredients Market?

- What is the Bulk Food Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?