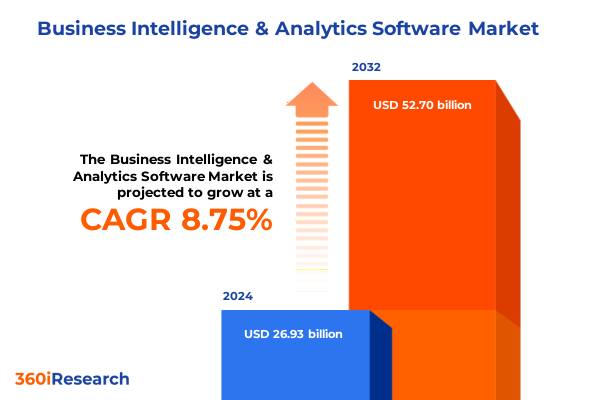

The Business Intelligence & Analytics Software Market size was estimated at USD 29.25 billion in 2025 and expected to reach USD 31.77 billion in 2026, at a CAGR of 8.77% to reach USD 52.70 billion by 2032.

Exploring the Strategic Imperative of Business Intelligence and Analytics Platforms Amidst Accelerating Data Proliferation and Digital Transformation

Organizations across industries increasingly recognize that data has transcended its traditional role to become a strategic asset driving every facet of decision-making. As we embark on an era characterized by exponential growth in data volume and complexity, the ability to derive actionable insights through sophisticated business intelligence and analytics platforms is no longer optional; it is imperative. This report provides a panoramic view of the current state of the business intelligence and analytics software landscape, exploring how advanced analytics, cloud computing, and artificial intelligence converge to empower enterprises to transform raw data into predictive foresight.

Against the backdrop of digital transformation, this analysis delves into the pivotal technologies and market dynamics reshaping the environment. It highlights how on-premise and cloud-based delivery models support diverse organizational sizes and industry-specific applications. By integrating data governance frameworks with user-friendly visualization and reporting tools, enterprises can foster a culture of data-driven decision-making that fuels innovation and operational efficiency. Through a meticulous examination of tariff influences, segmentation nuances, regional developments, and competitive strategies, this executive summary establishes the foundational context for stakeholders seeking to navigate the complexities of the business intelligence and analytics domain.

Examining the Convergence of AI-Driven Analytics, Hybrid Cloud Architectures, and Self-Service Visualization That Is Redefining Enterprise Intelligence

The landscape of business intelligence and analytics is experiencing transformative shifts driven by the integration of artificial intelligence and machine learning into core platforms. Where traditional analytics provided descriptive insights, modern solutions now deliver prescriptive and predictive capabilities that guide proactive business decisions. Seamlessly blending algorithmic recommendations with real-time dashboards, organizations can anticipate market shifts and optimize resource allocation more effectively than ever before.

Concurrent with these advances is the pervasive adoption of cloud infrastructures. Hybrid architectures enable enterprises to leverage the flexibility and scalability of public and private clouds while maintaining critical on-premise operations for sensitive workloads. This shift has elevated the importance of data governance, security protocols, and automated compliance checks, ensuring that the democratization of analytics does not compromise regulatory requirements.

Furthermore, the growing emphasis on self-service analytics is empowering non-technical stakeholders to explore data through intuitive visualization and drag-and-drop interfaces. By simplifying complex queries, these capabilities enhance data literacy across functions and accelerate time-to-insight. As organizations continue to harness Internet of Things streams and unstructured data sources, the confluence of AI-driven analytics, hybrid cloud models, and user-centric design methodologies is fundamentally redefining the competitive landscape.

Analyzing How 2025 Tariff Adjustments on Imports Are Reshaping Technology Procurement, Cloud Migration, and Domestic Analytics Investments

In 2025, the imposition of tariffs on imported hardware components and software licensing has introduced new cost variables into technology procurement cycles. Equipment essential for high-performance analytics workloads, including specialized servers and networking devices, has seen incremental cost increases that ripple through both service pricing and capital expenditure budgets. These adjustments have prompted many organizations to reevaluate supplier contracts, negotiate longer-term agreements, and explore alternative sourcing strategies to mitigate budgetary pressures.

Such tariff-driven cost escalations have also influenced decisions around delivery modes, accelerating the migration of analytics workloads to cloud service providers who can leverage global infrastructure efficiencies to offer more predictable pricing. Enterprises with hybrid deployments have rebalanced their on-premise investments, increasingly relying on cloud-based analytics to circumvent tariff-related import costs. Additionally, the disruption in supply chains has stimulated renewed interest in reusable software frameworks and open-source analytics solutions, as businesses seek to maintain innovation momentum while containing costs.

Despite these headwinds, many organizations view the tariff environment as an opportunity to strengthen domestic partnerships and foster local development of analytics infrastructure. By investing in domestic data center expansions and nurturing indigenous software ecosystems, stakeholders aim to build resilient analytics pipelines that are less susceptible to international trade fluctuations.

Delving into How Component, Delivery Mode, Organizational Scale, Application, Function, and Industry Diversity Drive Analytics Adoption Patterns

Insights derived from component segmentation reveal that while software platforms continue to dominate investment portfolios, demand for managed services has surged as enterprises seek expertise in deploying and optimizing analytics solutions. Delivery mode analysis indicates that cloud-centric deployments have outpaced on-premise implementations, with hybrid and private cloud frameworks gaining traction among organizations prioritizing security and compliance. The proliferation of sophisticated analytics use cases has diversified adoption across large enterprises and nimble mid-market firms, each leveraging scalable architectures to tailor implementations that align with their operational scale.

Application-focused analysis highlights that the convergence of reporting and analysis functions with interactive dashboards and data visualization modules is driving end-user engagement. Advanced data mining techniques are being embedded directly within workflow applications to deliver actionable intelligence at the point of decision. Evaluating business functions, finance teams lead early adoption, harnessing predictive analytics for revenue forecasting and risk management, while sales and marketing units increasingly deploy real-time analytics for customer segmentation and campaign optimization. Supply chain and operations teams are leveraging analytics to enhance demand planning and inventory visibility.

Industry-driven segmentation underlines that the banking, financial services, and insurance sector remains at the forefront of analytics maturity, propelled by intensive regulatory reporting requirements and risk analytics. Government agencies and healthcare organizations are accelerating analytics deployments to improve citizen services and patient outcomes, while manufacturing and retail enterprises focus on operational efficiency and personalized customer experiences. Each vertical exhibits distinct deployment patterns that reflect both regulatory frameworks and sector-specific data availability.

This comprehensive research report categorizes the Business Intelligence & Analytics Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Delivery Mode

- Organization Size

- Application

- Business Function

- Industry

Understanding How Distinct Regulatory Environments and Infrastructure Investments Shape Analytics Initiatives in Americas, EMEA, and Asia-Pacific

Regional dynamics are influencing the trajectory of business intelligence and analytics adoption in distinct ways across the Americas, Europe, the Middle East & Africa, and Asia-Pacific. In the Americas, robust digital infrastructure investments and a mature cloud ecosystem have fostered widespread adoption across industry verticals. Local regulatory environments focused on data privacy have encouraged the integration of comprehensive governance controls into analytics workflows.

Across Europe, the Middle East & Africa, heightened regulatory scrutiny around data security and cross-border data flows has led organizations to prioritize secure private cloud deployments and regional data centers. Government and defense entities in this region are leveraging advanced analytics to enhance national security operations and public service delivery, while financial institutions invest heavily in risk and compliance analytics.

In Asia-Pacific, rapid economic growth and expanding digital literacy rates are catalyzing analytics deployments across manufacturing, e-commerce, and telecommunications. Emerging markets are leapfrogging traditional on-premise models, favoring cloud-first strategies to accelerate innovation. Regional partnerships between local technology providers and global analytics vendors are driving tailored solutions that address unique market challenges, from logistical optimization in retail to predictive maintenance in heavy industry.

This comprehensive research report examines key regions that drive the evolution of the Business Intelligence & Analytics Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Partnerships, AI-Augmented Offerings, and Evolving Licensing Models Driving Competitive Differentiation

Market consolidation within the business intelligence and analytics sector reflects a strategic emphasis on integrated platform offerings and artificial intelligence augmentation. Leading software vendors are differentiating through the introduction of advanced natural language processing capabilities, enabling users to interact with datasets using conversational queries. Meanwhile, service providers specializing in domain-specific implementations are forging vertical alliances to deliver turnkey analytics solutions tailored to banking, healthcare, and manufacturing.

Strategic partnerships are proliferating as cloud hyperscalers collaborate with analytics software firms to embed analytics engines directly within infrastructure stacks. This integration simplifies deployment pipelines and offers native scalability for enterprise workloads. Additionally, mergers and acquisitions are reshaping the competitive landscape, with global expansion serving as a primary driver. Companies that demonstrate robust data governance frameworks and cross-platform interoperability have emerged as preferred partners for organizations seeking to minimize vendor lock-in while maximizing analytical agility.

Innovation in pricing and delivery models is another key theme, as software providers experiment with outcome-based pricing and consumption-based licensing to align costs with realized business value. The most forward-looking vendors are also embedding continuous improvement pathways into their offerings, leveraging telemetric feedback loops to refine algorithms and user experiences based on real-world usage patterns.

This comprehensive research report delivers an in-depth overview of the principal market players in the Business Intelligence & Analytics Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alphabet Inc.

- Caterpillar Inc.

- General Electric Company

- International Business Machines Corporation

- Microsoft Corporation

- MicroStrategy Incorporated

- Oracle Corporation

- QlikTech International AB

- Robert Bosch GmbH

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Siemens AG

- TIBCO Software Inc.

Recommending a Unified Hybrid Data Platform Strategy Combined with Enterprise-Wide Data Literacy and Outcome-Based Engagement Models

Leaders in the business intelligence and analytics domain should prioritize the development of unified data platforms that integrate streaming, batch, and embedded analytics within a single architecture. By investing in scalable hybrid cloud environments, organizations can balance the flexibility of public clouds with the control of private deployments, ensuring that data sovereignty requirements are met without forfeiting innovation velocity.

Additionally, cultivating data literacy across the enterprise remains paramount. Initiatives such as tailored training programs, cross-functional analytics champions, and embedded self-service tools can bridge the gap between IT teams and business users, fostering a culture where data-driven decisions become the norm. Investing in robust data governance and security protocols remains non-negotiable, as regulatory landscapes continue to evolve and cyber threats proliferate.

To accelerate time-to-value, industry leaders should explore modular delivery models and outcome-based engagement frameworks that align provider incentives with measurable business outcomes. Collaboration with specialized domain experts and third-party service partners can further streamline deployments, reduce risk, and infuse industry best practices into analytics solutions. Lastly, fostering strategic alliances with cloud and infrastructure providers will ensure access to next- generation capabilities, positioning organizations for sustained competitive advantage.

Detailing a Rigorous Triangulation Methodology Combining Secondary Data Analysis and Primary Expert Interviews to Ensure Analytical Accuracy

This analysis is grounded in a multifaceted research approach that synthesized extensive secondary sources alongside primary stakeholder engagements. Secondary research involved the systematic review of industry publications, regulatory filings, vendor whitepapers, and technology roadmap disclosures to construct a comprehensive view of market dynamics and emerging technology trends.

Complementing this, primary research was conducted through interviews with senior executives, solution architects, and analytics practitioners across diverse industry verticals. These discussions provided firsthand perspectives on deployment challenges, success metrics, and evolving requirements. Quantitative data was validated through cross-referencing vendor performance reports and publicly disclosed financial results, ensuring analytical rigor and accuracy.

A layered triangulation methodology was employed to reconcile disparities between differed data points, underpinning segmentation analyses by component, delivery mode, organizational scale, application, business function, and industry verticals, as well as regional frameworks. This structured approach facilitated the identification of actionable insights and corroborated strategic recommendations with real-world use cases.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Business Intelligence & Analytics Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Business Intelligence & Analytics Software Market, by Component

- Business Intelligence & Analytics Software Market, by Delivery Mode

- Business Intelligence & Analytics Software Market, by Organization Size

- Business Intelligence & Analytics Software Market, by Application

- Business Intelligence & Analytics Software Market, by Business Function

- Business Intelligence & Analytics Software Market, by Industry

- Business Intelligence & Analytics Software Market, by Region

- Business Intelligence & Analytics Software Market, by Group

- Business Intelligence & Analytics Software Market, by Country

- United States Business Intelligence & Analytics Software Market

- China Business Intelligence & Analytics Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Summarizing How AI, Hybrid Cloud Architectures, and Governance Will Drive Sustainable Competitive Advantage Through Data-Driven Strategies

In an era where data is the linchpin of strategic differentiation, business intelligence and analytics platforms have emerged as catalysts for innovation, operational efficiency, and customer-centricity. Organizations that adeptly navigate the complexities of delivery models, component integration, and regulatory imperatives will secure sustainable competitive advantage.

The convergence of artificial intelligence, cloud architectures, and self-service analytics creates an inflection point; enterprises that invest proactively in robust data governance frameworks and hybrid infrastructures will be poised to exploit predictive insights and drive transformative outcomes. As market leaders refine their deployment strategies and partnerships, the insights uncovered in this analysis serve as a guiding blueprint for navigating the evolving landscape.

Ultimately, the path to data-driven excellence demands a cohesive strategy that aligns technology investments with organizational objectives, fosters a culture of analytical curiosity, and continuously adapts to emergent trends and regulatory shifts.

Unlock Exclusive Insights and Strategic Advantage by Partnering with Our Sales Leadership to Acquire the Comprehensive Business Intelligence and Analytics Market Report

To delve deeper into these insights and equip your organization with bespoke strategic guidance, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can tailor a comprehensive business intelligence and analytics solution aligned precisely to your enterprise goals and market challenges. With Ketan’s expert assistance, you can secure immediate access to the full market research report and initiate transformative data-driven initiatives that drive sustainable growth and competitive differentiation.

- How big is the Business Intelligence & Analytics Software Market?

- What is the Business Intelligence & Analytics Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?