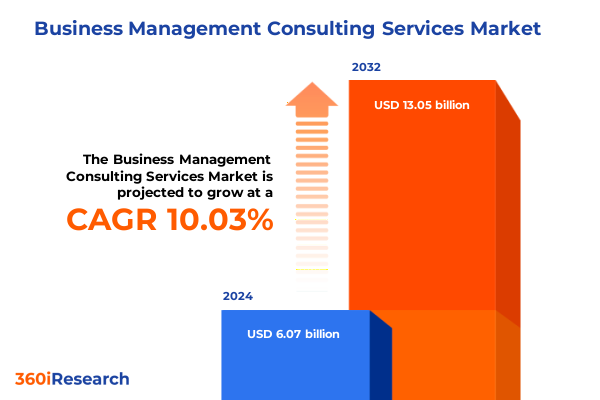

The Business Management Consulting Services Market size was estimated at USD 6.69 billion in 2025 and expected to reach USD 7.25 billion in 2026, at a CAGR of 10.01% to reach USD 13.05 billion by 2032.

Driving Organizational Agility and Sustainable Growth through Strategic Business Management Consulting in Today’s Rapidly Evolving Competitive Environment

In a business environment marked by rapid technological advances, complex regulatory landscapes, and shifting customer expectations, organizations require a new breed of advisory support to maintain momentum. Professional consulting services have evolved beyond traditional advisory roles into dynamic partnerships that facilitate strategic agility and empower firms to navigate uncertainty with confidence. As enterprises confront cost pressures, talent shortages, and the imperative of innovation, the ability to align operational processes, human capital, and digital capabilities becomes paramount.

Moreover, executive teams are increasingly seeking integrated solutions that draw on deep functional expertise while fostering cross-disciplinary collaboration. The convergence of finance, human resources, IT, operations, risk management, and strategy consulting demands a cohesive approach that transcends organizational silos. By weaving together frameworks for financial planning, organizational design, digital transformation, process optimization, compliance, and corporate strategy, leading advisors enable clients to unlock new value streams and accelerate progress toward strategic objectives.

This executive summary provides a concise yet comprehensive overview of the critical shifts and insights that define the current landscape of business management consulting services. Readers will gain an understanding of transformative market forces, targeted segmentation analysis, regional dynamics, key industry players, and actionable recommendations to inform executive decisions. The ensuing sections lay the groundwork for a thorough exploration of opportunities to strengthen resilience, enhance performance, and drive sustainable growth.

Navigating the Confluence of Digital Transformation Artificial Intelligence and Sustainability to Unlock Revolutionary Value Creation for Clients Worldwide

Over the past several years, the consulting landscape has undergone a profound transformation driven by breakthroughs in artificial intelligence, digital platforms, and heightened stakeholder expectations regarding environmental and social impact. Leading firms have harnessed data-driven methodologies to create predictive insights, automate routine tasks, and deliver hyper-personalized advisory services. Consequently, clients now demand solutions that blend cutting-edge technologies with human expertise to accelerate decision making and foster continuous innovation.

Furthermore, sustainability has emerged as a core strategic pillar, influencing everything from supply-chain resilience to talent acquisition. Firms that embed environmental, social, and governance criteria into their operating models are not only reducing risk but also unlocking new revenue streams through sustainable product and service offerings. In addition, the rise of hybrid and remote delivery models has expanded the geographical reach of consulting engagements, enabling global teams to collaborate seamlessly and deliver outcomes with greater speed and cost-effectiveness.

In light of these shifts, consulting practices are reimagining their value proposition by investing heavily in digital studios, innovation labs, and strategic alliances with technology partners. This evolution underscores a broader trend toward ecosystem-based consulting, where integrated solutions spanning finance, human resources, technology, operations, and strategy converge to address the full spectrum of client challenges.

Assessing the Broad Impact of 2025 United States Tariffs across Multinational Operations Cost Structures and Strategic Decision in Consulting Engagements

The introduction of new tariffs by the United States government in 2025 has had a cumulative effect on global supply chains, operational budgets, and strategic planning across industries. Although intended to protect domestic manufacturers and balance trade deficits, these measures have also elevated input costs for raw materials, components, and technology solutions sourced from key international partners. As a result, procurement teams and executive leadership are reevaluating sourcing strategies and exploring alternative regional suppliers to mitigate the burden of elevated duties.

Consequently, consulting engagements have increasingly centered on scenario planning and cost-impact analyses, guiding clients through trade-off decisions between price, quality, and delivery timelines. Risk advisory practices are collaborating closely with cybersecurity and compliance experts to ensure that adjustments to procurement networks adhere to evolving regulatory requirements. In parallel, finance consulting teams are recalibrating budgeting models to reflect tariff-induced cost variances, providing real-time visibility into margin implications.

Moreover, the ripple effects of these tariffs extend to broader corporate strategy, influencing decisions around reshoring, joint ventures, and cross-border partnerships. Organizations that proactively integrate tariff considerations into their strategic roadmaps are better positioned to maintain resilience and sustain profitability, even as global trade dynamics continue to evolve.

Leveraging Comprehensive Segmentation Frameworks to Deliver Precision Insights across Service Types Engagement Models Delivery Approaches and Industry Verticals

A granular segmentation approach reveals distinct pathways through which consulting services create value across diverse client needs. By focusing on service type, advisory firms tailor offerings such as financial planning and risk advisory under the finance consulting umbrella, while organization design, talent management, and training development enrich human capital initiatives. In the realm of technology, specialized practices deliver digital transformation roadmaps, IT infrastructure modernization, and seamless system integration, whereas operations experts harness lean Six Sigma, process optimization, and supply-chain enhancements to boost efficiency.

Simultaneously, risk management proficiency spans compliance, cybersecurity defenses, and enterprise risk assessments, enabling organizations to anticipate and mitigate threats before they materialize. Strategy consulting then weaves these capabilities together through corporate strategy workshops, growth planning sessions, and mergers and acquisitions advisory. Delivery models ranging from hybrid to onsite to remote allow consulting teams to adapt to client preferences and project requirements, fostering collaboration while optimizing resource allocation. Engagement structures further refine delivery, with some clients opting for managed services to achieve ongoing oversight, others commissioning one-off projects for targeted initiatives, and a growing segment preferring retainer-based arrangements for sustained partnership.

Finally, industry vertical expertise amplifies the impact of consulting solutions by addressing the unique challenges and regulatory landscapes inherent to sectors such as corporate banking, defense and public administration, hospital systems, automotive manufacturing, brick-and-mortar retail, and broadband network operations. This holistic segmentation framework ensures that advisory teams can craft highly relevant strategies that drive measurable business outcomes across every dimension of client operations.

This comprehensive research report categorizes the Business Management Consulting Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Delivery Model

- Engagement Model

- Industry Vertical

Navigating Regional Dynamics and Key Growth Drivers across the Americas Europe Middle East Africa and Asia Pacific Marketplaces

Regional dynamics exert a profound influence on consulting priorities and client engagement models across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, the emphasis is on digital finance solutions, fintech innovation, and healthcare modernization, as North American and Latin American markets seek to bridge infrastructure gaps and enhance consumer experiences. Regulatory shifts and public-sector investment in sustainable initiatives are catalyzing demand for risk management and strategy consulting services across governmental agencies and state-owned enterprises.

In Europe Middle East & Africa, stringent data protection statutes and ambitious carbon-reduction targets are driving a surge in compliance and sustainability advisory mandates. Local firms are collaborating with multinational consultancies to develop integrated roadmaps for net-zero objectives, while also streamlining procurement processes in complex markets. The rise of remote-first delivery models has unlocked new opportunities for cross-border project teams to service clients in key hubs such as London, Dubai, and Johannesburg with minimal latency.

Across Asia-Pacific, rapid urbanization and large-scale infrastructure projects are fueling demand for digital transformation, supply-chain optimization, and telecom network expansion. Governments and private enterprises alike are investing in smart city initiatives and advanced manufacturing, creating fertile ground for consulting interventions that blend lean operational methodologies with advanced analytics platforms. This regional tapestry underscores the need for adaptable service offerings that can pivot quickly in response to evolving economic conditions and technology adoption curves.

This comprehensive research report examines key regions that drive the evolution of the Business Management Consulting Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Consulting Firms Innovations Collaborative Ecosystem Partnerships and Strategic Moves Shaping the Business Management Consulting Landscape

Leading consulting firms have fortified their positions by integrating innovative capabilities, forging strategic alliances, and expanding through targeted acquisitions. Established global players continue to enhance their digital hubs and analytics centers, while mid-sized and niche consultancies differentiate through deep functional expertise in areas such as risk advisory and human capital transformation. Collaborative partnerships with technology vendors and academic institutions further augment the advisory landscape, enabling the co-creation of proprietary tools and frameworks.

Furthermore, a wave of boutique advisory firms is gaining traction by offering specialized services that address emerging themes like sustainability compliance, AI-driven decision support, and regulatory change management. These nimble competitors often deploy agile project teams and micro-consulting pods that embed directly within client organizations to accelerate time to value. In tandem, traditional consultancies are broadening their ecosystem by investing in startup incubators and innovation labs to capture nascent disruptive trends.

The resulting competitive environment demands that firms continually refine their go-to-market strategies, emphasizing outcome-based engagements and client success metrics. By balancing scale with specialization and leveraging a mix of managed services, project-based assignments, and retainer models, leading consultancies are positioned to capture the full spectrum of client opportunities across multiple industries and geographies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Business Management Consulting Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.T. Kearney Inc.

- Accenture PLC

- Alvarez & Marsal Holdings LLC

- Bain & Company Inc.

- Booz Allen Hamilton Inc.

- Boston Consulting Group Holdings LLC

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- FTI Consulting Inc.

- Huron Consulting Group Inc.

- IBM Corporation

- Infosys Limited

- KPMG International Limited

- L.E.K. Consulting LLC

- Marsh & McLennan Companies Inc.

- McKinsey & Company Inc.

- Mercer LLC

- Oliver Wyman Group

- Tata Consultancy Services Limited

- The Hackett Group Inc.

- Wipro Limited

Empowering Industry Leaders with Actionable Strategies to Optimize Consulting Engagements Drive Innovation and Maintain Competitive Advantage

To stay ahead of the curve, industry leaders should begin by strengthening digital competencies and embedding advanced analytics into core workflows. Building integrated teams that combine data scientists, process engineers, and domain experts will accelerate the deployment of predictive models and automation tools. Furthermore, cultivating strategic alliances with cloud service providers and technology innovators ensures access to best-in-class platforms without requiring extensive in-house development.

In addition, risk mitigation strategies must be updated to reflect the current trade and regulatory environment, incorporating dynamic tariff modeling and supply-chain stress tests. Organizations can enhance resilience by diversifying supplier portfolios, establishing regional sourcing hubs, and negotiating flexible contract terms. Equally important is the adoption of environmental and social governance principles as a guiding framework for project prioritization and stakeholder engagement.

Finally, talent management remains a critical differentiator. Investing in upskilling programs, cross-functional rotations, and experiential learning opportunities fosters a culture of continuous improvement. Executive teams should consider retainer-based partnerships for functions requiring ongoing oversight, while leveraging one-off projects to address specialized challenges. This balanced approach to engagement models will enable firms to maintain agility, optimize resource utilization, and sustain competitive advantage over the long term.

Detailing Rigorous Primary and Secondary Research Methodologies Data Validation Protocols and Analytical Frameworks Ensuring Unbiased and Robust Insights

The research underpinning this executive summary was conducted through a combination of primary and secondary methods designed to ensure rigor and impartiality. Expert interviews were carried out with senior executives from financial services, manufacturing, healthcare, and technology firms to capture firsthand perspectives on emerging challenges and best practices. In parallel, a series of in-depth consultations with heads of consulting practices provided insights into service delivery evolution and innovation trends.

Secondary data sources included regulatory filings, industry association reports, and peer-reviewed publications. These materials were systematically reviewed to corroborate primary findings and to contextualize shifts in regulatory policy, tariff regimes, and technology adoption. Data validation protocols involved cross-referencing disparate information sets and subjecting key insights to a peer review process by an independent panel of sector specialists.

Analytical frameworks such as SWOT assessments, scenario planning, and impact-cost modeling were applied to synthesize qualitative and quantitative inputs. The resulting analysis delivers a structured interpretation of market dynamics, segmentation rationales, regional variances, and competitive landscapes, providing stakeholders with a robust foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Business Management Consulting Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Business Management Consulting Services Market, by Service Type

- Business Management Consulting Services Market, by Delivery Model

- Business Management Consulting Services Market, by Engagement Model

- Business Management Consulting Services Market, by Industry Vertical

- Business Management Consulting Services Market, by Region

- Business Management Consulting Services Market, by Group

- Business Management Consulting Services Market, by Country

- United States Business Management Consulting Services Market

- China Business Management Consulting Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Summarizing Strategic Imperatives and Future Outlook for Business Management Consulting to Drive Resilience Growth and Sustainable Success

As organizations chart their path forward, the imperative to harmonize agility with discipline has never been clearer. Strategic imperatives-encompassing digital acceleration, operational excellence, and sustainability integration-must be woven into the very fabric of corporate agendas. Decision makers are called upon to foster cross-functional collaboration, align incentive structures with long-term goals, and continuously adapt to emerging market signals.

By embracing a holistic approach that taps into specialized consulting expertise, enterprises can convert complexity into competitive advantage. The convergence of advanced technologies, regulatory shifts, and evolving delivery models offers unprecedented opportunities for transformation. Those who proactively integrate these elements into their strategic roadmaps will secure enduring resilience, stimulate growth, and realize sustainable success.

Ultimately, the insights presented in this summary serve as a blueprint for executive action, equipping leaders with the knowledge and frameworks needed to thrive in an increasingly dynamic environment.

Transform Your Organizational Strategy Today by Partnering with Ketan Rohom for Exclusive Insights and Customized Business Management Consulting Solutions

To unlock the full potential of strategic initiatives and capitalize on emerging opportunities, reach out to Ketan Rohom, Associate Director, Sales & Marketing, who stands ready to guide your firm through a bespoke consulting engagement. His extensive experience in tailoring actionable strategies to complex business challenges ensures that your organization will benefit from a rigorous and client-centric approach. Engage with Ketan to explore how specialized expertise in areas such as digital transformation, risk mitigation, and operational excellence can be seamlessly integrated into your current priorities. Elevate your decision-making process and secure a competitive edge by obtaining the complete market research report today.

- How big is the Business Management Consulting Services Market?

- What is the Business Management Consulting Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?