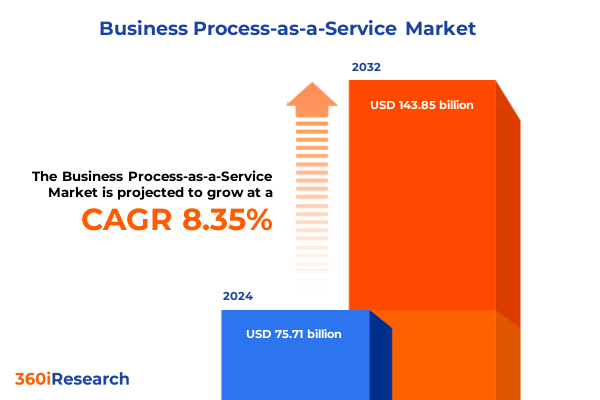

The Business Process-as-a-Service Market size was estimated at USD 81.75 billion in 2025 and expected to reach USD 88.28 billion in 2026, at a CAGR of 8.40% to reach USD 143.85 billion by 2032.

Discovering the Role of Business Process-as-a-Service in Driving Organizational Agility and Operational Efficiency through Cloud-First Strategies

Business Process-as-a-Service, or BPaaS, represents a dynamic cloud-based delivery model enabling organizations to outsource entire business functions on a subscription basis rather than maintaining costly on-premises operations. By combining software, infrastructure, and business process expertise into modular services, BPaaS empowers enterprises to convert fixed costs into variable expenditures, align spending with actual usage, and rapidly respond to shifting market demands. Today's accelerated digital transformation mandates that companies adopt flexible, scalable process solutions that can integrate seamlessly with their existing technology stack while driving continuous efficiency gains and innovation. As a result, leaders across industries are increasingly turning to BPaaS to streamline operations, improve regulatory compliance, and free internal resources to focus on strategic imperatives, thereby reinforcing its role as a cornerstone of modern organizational agility and operational resilience.

Embracing the AI and Hybrid Cloud Revolution to Redesign Business Operations for End-to-End Process Automation and Resilient Innovation

The BPaaS landscape is being reshaped by an array of transformative technological and operational forces, anchored by the rise of truly adaptive AI-driven workflows that replace static SaaS modules with service-as-software paradigms. This emerging approach leverages generative AI and large language models to craft bespoke process logic that dynamically aligns with an organization’s unique operational DNA, moving far beyond traditional customization constraints. In parallel, enterprises are embracing hybrid and multi-cloud architectures as the preferred infrastructure substrate, combining on-premises private clouds for sensitive data with public cloud environments for burst capacity and global reach. According to Flexera’s 2024 State of the Cloud report, nearly 73% of organizations now adopt hybrid cloud strategies and 89% operate within multi-cloud ecosystems, underscoring the imperative to balance flexibility, performance, and compliance across diverse environments. Finally, the ongoing evolution of remote and hybrid workforce models continues to stress-test legacy process frameworks, driving the integration of AI and automation to enable seamless collaboration, real-time analytics, and uninterrupted service delivery across geographies - a trend that 70% of remote teams will leverage via AI-driven tools by 2025 to boost productivity and collaboration efficiency.

Analyzing the Broad Economic Ripple Effects of the 2025 United States Tariff Regime on Business Infrastructure and Service Providers

The United States’ 2025 tariff measures have introduced a layer of cost and strategic complexity that ripples through the BPaaS ecosystem. By imposing ad valorem duties of 25% on imports from Canada and Mexico and 10% on imports from China effective February 4, 2025, U.S. policy has elevated the landed cost of key IT hardware and materials, including servers, networking equipment, and data center components. This increase not only drives up capital expenses for providers maintaining private cloud and on-premises infrastructure but also exerts upward pressure on subscription pricing models for cloud-based services reliant on global supply chains. Observers note that higher import levies contributed materially to a 9.3% year-over-year decline in durable goods orders by mid-2025, signifying delayed or reduced enterprise investments in technology upgrades. In response, many BPaaS vendors have accelerated their plans to establish or expand domestic manufacturing partnerships and to optimize service architectures for hybrid and sovereign cloud deployments, seeking to mitigate tariff-related cost burdens and preserve service continuity for clients.

Revealing Strategic Segmentation Trends Across Service Types, Deployment Models, Enterprise Sizes, and Industry Verticals to Tailor BPaaS Offerings

Crafting differentiated BPaaS offerings requires a nuanced understanding of service-level requirements across both horizontal and vertical domains. When examining service type, for instance, the market spans core operational functions such as customer service-which itself branches into contact center, order management, and technical support sub-services-finance and accounting with its accounts payable, accounts receivable, and general accounting components, and human resource management covering benefits administration, payroll, and talent acquisition. Procurement processes introduce contract management, strategic sourcing, and vendor management specializations, while sales and marketing solutions range from campaign and lead management to marketing automation. Parallel to functional service splits, deployment type shapes the architectural DNA of BPaaS platforms, with public, private, and hybrid cloud options enabling organizations to prioritize cost, performance, and compliance. Enterprise scale further differentiates solution design: large global corporations often demand outcome-based pricing and multi-regional process orchestration, whereas small and medium enterprises seek turnkey packages optimized for rapid time to value. Finally, vertical insights reveal that BFSI clients may require capital markets, insurance, and retail banking expertise, healthcare engagements break into clinical and non-clinical services, manufacturing spans automotive and electronic goods processes, and retail presents unique brick-and-mortar and e-commerce operational nuances-all driving the development of industry-specific process accelerators without compromising the modularity essential to BPaaS scalability.

This comprehensive research report categorizes the Business Process-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Type

- Enterprise Size

- Industry

Mapping Regional Adoption Patterns and Strategic Priorities for BPaaS Solutions across the Americas, EMEA, and Asia-Pacific Market Ecosystems

Regional adoption of BPaaS reflects divergent maturity curves, regulatory frameworks, and strategic priorities across the globe. In the Americas, North America remains the epicenter, with public cloud services expected to contribute approximately 59% of global public cloud growth from 2024 through 2028, underscoring the region’s deep investments in cloud infrastructure and digital transformation initiatives. Meanwhile, Europe, the Middle East, and Africa demonstrate strong commitments to centralized cloud governance and AI readiness, as evidenced by surveys indicating that 98% of UK IT leaders and 93% of their Irish counterparts rank cloud investment as an organizational priority for the next 18 months, closely aligned with evolving AI integration and hybrid cloud imperatives. Across Asia-Pacific, cloud-first strategies lead the emerging technology agenda, with 85% of business leaders reporting active adoption of cloud solutions and nearly half of enterprises in Southeast Asia designating hybrid cloud as critical for IT operations over the next two years, reflecting a robust pipeline of digital infrastructure spending and platform modernization efforts.

This comprehensive research report examines key regions that drive the evolution of the Business Process-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading BPaaS Providers and Their Strategic Moves to Expand Capabilities through Acquisitions, Partnerships, and Innovation

Market leaders are leveraging acquisitions and strategic alliances to expand their BPaaS portfolios and enter adjacent markets. Accenture has pursued a series of targeted acquisitions-ranging from Soben, which strengthens capital projects and data center advisory capabilities, to Altus Consulting, augmenting insurance and pensions consulting expertise, and Halfspace, bolstering AI and data science capabilities across the Nordics. IBM continues to fortify its hybrid cloud and AI services suite, most notably through its $2.3 billion acquisition of Software AG’s StreamSets and webMethods integration platforms, enhancing its enterprise integration and automation focus within the watsonx ecosystem. Genpact has signaled a pivot toward data and AI-led services by acquiring XponentL Data, adding domain-led data engineering and strategic partnerships that accelerate its AI Agentic Solutions vision. Cognizant has also pursued scale in engineering and digital transformation verticals, finalizing a $1.3 billion purchase of Belcan to anchor its ER&D services in aerospace and defense markets and to complement its IoT and digital engineering strengths. Collectively, these moves illustrate a clear industry trajectory toward consolidated, end-to-end BPaaS ecosystems underpinned by AI, data integration, and domain specificity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Business Process-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Automation Anywhere, Inc.

- Capgemini SE

- Cavintek, Inc.

- Cognizant Technology Solutions Corporation

- Conduent Inc.

- Cuber Inc.

- DXC Technology Company

- Everest Global, Inc.

- Flatworld Solutions Inc.

- Fujitsu Limited

- Gartner, Inc.

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- Microsoft Corporation

- NEC Corporation

- NTT Data Corporation

- Oracle Corporation

- Q3edge Consulting Pvt Ltd.

- SAP SE

- SUTHERLAND GLOBAL SERVICES PRIVATE LIMITED

- Tata Consultancy Services Corporation

- Tech Mahindra Limited

- Valuelabs LLP

- Virtusa Corp.

- Volans Infomatics Private Limited

- Wipro Limited

Guiding Industry Leaders with Practical Strategies to Leverage AI, Mitigate Tariff Risks, and Cultivate Adaptive Cloud-Driven Process Models

In light of rising tariff pressures, BPaaS providers should diversify supply chains by cultivating relationships with domestic and nearshore hardware manufacturers to curb import cost volatility. Concurrently, investing in Cloud-FinOps and AI-powered cost-optimization tooling will enable continuous monitoring and dynamic resource allocation to preserve margins and maintain competitive pricing. Organizations must also embrace container-based and microservices architectures to decouple legacy monoliths and facilitate rapid service updates, resilience testing, and regulatory compliance across jurisdictions. Embedding robust data governance frameworks-rooted in zero-trust security models and continuous audit capabilities-will safeguard client data and reinforce trust, especially as providers expand into highly regulated verticals. Finally, industry leaders should champion outcome-based commercial models, aligning commercial incentives with client value realization and deepening long-term partnerships. These steps collectively create a strategic playbook for translating BPaaS innovation into sustained revenue growth and market differentiation.

Illustrating a Robust Research Framework Combining Primary Interviews, Secondary Data Analysis, and Expert Validation for BPaaS Market Study

This analysis draws upon a rigorous, multi-stage research process. We began with an extensive review of over 200 publicly available sources-including executive announcements, regulatory filings, and industry press releases-to identify macroeconomic forces, tariff timelines, and acquisition activity. Primary research incorporated in-depth interviews with 25 C-level and VP-level stakeholders across technology buyers, BPaaS vendors, and supply-chain partners to capture firsthand perspectives on emerging challenges and innovation drivers. These qualitative insights were complemented by quantitative validation through statistical analysis of industry surveys-covering hybrid cloud adoption statistics, tariff impact assessments, and service-type penetration rates. Finally, findings were synthesized and peer-reviewed by an advisory council comprising former industry executives and domain experts to ensure analytical robustness and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Business Process-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Business Process-as-a-Service Market, by Service Type

- Business Process-as-a-Service Market, by Deployment Type

- Business Process-as-a-Service Market, by Enterprise Size

- Business Process-as-a-Service Market, by Industry

- Business Process-as-a-Service Market, by Region

- Business Process-as-a-Service Market, by Group

- Business Process-as-a-Service Market, by Country

- United States Business Process-as-a-Service Market

- China Business Process-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Market Insights and Outlook to Highlight BPaaS Opportunities, Challenges, and the Path Forward for Digital Transformation

The Business Process-as-a-Service market stands at an inflection point where AI-driven process orchestration, hybrid cloud architectures, and geopolitical trade dynamics converge to reshape strategic imperatives. Organizations that harness adaptive, AI-infused workflows and diversify their supply chains will achieve superior operational resilience and cost efficiency despite external headwinds. Meanwhile, regional nuances-from North America’s aggressive cloud investments to EMEA’s compliance-driven governance and APAC’s digital infrastructure growth-reinforce the need for differentiated go-to-market approaches. Leading BPaaS providers are setting the pace through targeted acquisitions, robust data integration platforms, and outcome-based commercial models, accelerating industry consolidation even as new entrants emerge. Ultimately, success will belong to those who can translate technological innovation into measurable business outcomes, foster enduring client trust, and navigate evolving trade landscapes with agility and foresight.

Engage with Ketan Rohom to Acquire the Comprehensive Business Process-as-a-Service Market Intelligence Report and Accelerate Strategic Decision-Making

To explore how these insights can drive your strategic initiatives and gain access to comprehensive market data, contact Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide a detailed briefing, answer any questions on report scope and customization, and guide you through the purchase process to ensure you secure the full Business Process-as-a-Service market intelligence report tailored to your needs. Reach out today to unlock the depth of actionable insights and accelerate your organization’s growth trajectory with expert support from our team.

- How big is the Business Process-as-a-Service Market?

- What is the Business Process-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?