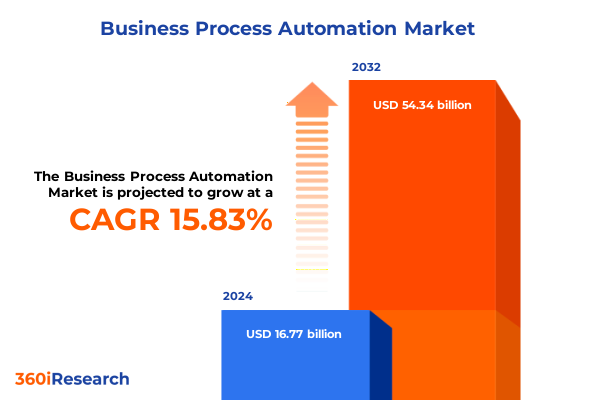

The Business Process Automation Market size was estimated at USD 19.40 billion in 2025 and expected to reach USD 22.45 billion in 2026, at a CAGR of 15.84% to reach USD 54.34 billion by 2032.

Unveiling the Fundamentals of Business Process Automation as a Catalyst for Operational Resilience Efficiency and Enduring Competitive Differentiation

Business process automation has emerged as a foundational element in the modern digital transformation journey. Rooted in the convergence of advanced software solutions, robotics, and intelligent workflow orchestration, it transcends the boundaries of traditional task management. By embedding automation deeply into critical operations, organizations can eliminate repetitive manual tasks and mitigate the risk of human error, enabling teams to focus on strategic, value-added activities.

As market forces continue to evolve and regulatory demands intensify, automation provides a robust framework for resilience and scalability. Beyond achieving efficiency gains, organizations leverage automated processes to accelerate decision making, enforce governance, and maintain comprehensive audit trails. Furthermore, automated workflows generate rich data streams that fuel continuous improvement initiatives, creating a virtuous cycle of optimization. This introduction sets the scene for exploring the technological inflections, policy impacts, segment-specific insights, and regional dynamics that will define the future trajectory of business process automation.

Examining the Pivotal Technological Convergence and Process Innovation Transformations That Are Redefining Business Process Automation Practices Globally

Recent years have witnessed a remarkable convergence of digital innovations that are redefining the business process automation landscape. Artificial intelligence and machine learning have advanced to the point where they can autonomously interpret complex unstructured data, ushering in a new era of cognitive automation. Concurrently, low-code and no-code platforms are democratizing the development of automated workflows, empowering business users to design and deploy solutions that address specific operational pain points, thereby reducing reliance on centralized IT resources.

Moreover, cloud-based integration platforms are enabling seamless connectivity among legacy systems, new digital tools, and third-party applications. Hyperautomation strategies, which layer complementary technologies such as robotic process automation, natural language processing, and advanced analytics, are delivering end-to-end process orchestration and predictive insights. These transformative shifts are driving organizations to reevaluate legacy architectures and adopt unified automation frameworks that enhance agility, scalability, and governance.

Furthermore, the emphasis on user-centric design within automated workflows is improving adoption rates by incorporating real-time feedback mechanisms and intuitive interfaces. This holistic approach not only accelerates time to value but also ensures that automation initiatives remain aligned with evolving business objectives and employee needs.

Assessing the Compounding Effects of the 2025 United States Tariff Regime on Supply Chain Efficiency Cost Structures and Automation Adoption Dynamics

The introduction of new tariff measures by the United States in 2025 has exerted compounding pressures on the cost structures and supply chain dynamics that underpin business process automation deployments. Hardware components such as industrial robots, sensors, and edge devices have become subject to higher import duties, prompting organizations to reassess procurement strategies and supplier diversification plans. Consequently, many enterprises are exploring domestic sourcing and strategic stockpiling to mitigate potential disruptions.

At the same time, elevated tariffs on software licenses and cloud infrastructure services have influenced the total cost of ownership calculations for automation solutions. In response, organizations are prioritizing modular architectures and favoring subscription models with predictable expenditure profiles. This shift underscores the importance of flexibility in contracting and vendor management as companies navigate evolving trade policies.

Furthermore, the instability introduced by tariff fluctuations has accelerated commitments to end-to-end automation as a risk mitigation strategy. Automated inventory management, predictive maintenance, and rule-based decision engines are being deployed to enhance supply chain visibility and responsiveness. As a result, organizations that combine strategic sourcing adjustments with process automation are better positioned to maintain continuity and deliver consistent operational outcomes.

Uncovering Strategic Insights Across Diverse Component Organization Size Deployment Application and Function Segments to inform Targeted Automation Initiatives

A granular examination of business process automation across component categories reveals distinct value propositions for hardware, services, and software offerings. Hardware investments deliver the physical capabilities to execute repetitive tasks, while services ensure that implementation, integration, and ongoing optimization align with organizational objectives. Software solutions, encompassing both enterprise-grade platforms and specialized tools, orchestrate the logical flow and decision logic behind automated processes.

When considering organization size, large enterprises typically pursue comprehensive automation roadmaps with centralized governance structures and multi-business-unit deployments, whereas small and medium enterprises often focus on targeted use cases that deliver quick wins and rapid return on investment. Deployment type further shapes strategic considerations, with cloud-based models offering scalability and lower upfront costs, and on-premises solutions providing greater control over sensitive data and system configurations.

Application areas such as analytics and monitoring, document management-with specialized sub-capabilities in capture, retrieval, and storage-robotic process automation, and workflow management each cater to unique operational challenges. Likewise, mapping automation initiatives to business functions such as customer service, finance and accounting, human resources, and procurement and supply chain ensures that process improvements are tightly aligned with functional priorities.

Lastly, end-user industries, from banking and finance through healthcare, information technology and telecom, manufacturing, and retail and e-commerce, exhibit differentiated adoption patterns driven by regulatory environments, customer engagement models, and operational complexity requirements. This multidimensional segmentation framework equips decision makers to target high-impact areas and tailor solutions to specific organizational contexts.

This comprehensive research report categorizes the Business Process Automation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- Business Function

- Application

- End User Industry

- Deployment Type

Examining Regional Dynamics and Drivers Across the Americas Europe Middle East Africa and Asia Pacific to Guide Geographically Informed Automation Strategies

Regional dynamics play a pivotal role in shaping the trajectory of business process automation adoption. In the Americas, established technology ecosystems and robust digital infrastructure have fostered early mainstream acceptance of automation across both mature and emerging sectors. Legislative incentives and public-private partnerships are further catalyzing investments in advanced process technologies.

In Europe, Middle East, and Africa, regulatory drivers such as data protection frameworks and industry-specific compliance standards are creating strong demand for automated governance and audit capabilities. Organizations in these markets are often balancing innovation with stringent privacy requirements, leading to differentiated strategies for cloud versus local data processing and varied adoption rates across regions.

Asia-Pacific continues to exhibit one of the fastest growth trajectories in automation, fueled by government-sponsored digitalization initiatives, an expanding base of technology service providers, and a rising emphasis on smart manufacturing. The region’s diverse economic landscapes drive a spectrum of automation use cases, from high-volume production environments to agile service delivery models.

Understanding these regional insights enables stakeholders to calibrate their market entry strategies, establish strategic partnerships with local providers, and tailor deployment roadmaps that align with regional regulations, cultural norms, and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Business Process Automation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Innovative Market Leaders and Emerging Challengers Pioneering Next Generation Business Process Automation Solutions with Strategic Alliances

Leading players in the business process automation space are distinguished by their strategic investments in technology innovation, partnerships, and ecosystem development. Several established vendors have broadened their portfolios to encompass end-to-end automation suites, integrating capabilities such as advanced analytics, intelligent document processing, and unified orchestration dashboards to deliver cohesive user experiences.

Emerging challengers are carving out niches by specializing in targeted vertical solutions or by leveraging open architectures that facilitate rapid customization and third-party integrations. Strategic alliances between technology providers, consulting firms, and system integrators are deepening the breadth and depth of service offerings, allowing end users to access turnkey automation journeys backed by robust change management and post-implementation support.

Moreover, technology acquisitions and platform consolidations are redefining competitive dynamics, as vendors seek to accelerate time to market for new capabilities and enter high-growth segments. This consolidation trend underscores the importance of evaluating partner ecosystems and product roadmaps when selecting automation solutions.

Ultimately, organizations that align with vendors demonstrating a clear innovation roadmap, strong ecosystem partnerships, and proven transformation methodologies are well positioned to unlock sustained value from their automation investments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Business Process Automation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Appian Corporation

- Automation Anywhere Inc.

- Blue Prism Limited

- Emerson Electric Co.

- International Business Machines Corporation

- Kofax Inc.

- Microsoft Corporation

- NICE Ltd.

- Pegasystems Inc.

- Robert Bosch GmbH

- SAP SE

- UiPath Inc.

Delivering Actionable Strategic Recommendations to Empower Industry Leaders to Accelerate Automation Adoption Enhance ROI and Sustain Competitive Edge

To harness the full potential of business process automation, industry leaders should begin by establishing a clear governance framework that aligns automation initiatives with strategic objectives. Executive sponsorship and cross-functional steering committees serve as critical mechanisms for prioritizing use cases and securing necessary resources, ensuring that projects deliver measurable outcomes.

Next, organizations should invest in comprehensive process discovery and mapping exercises that leverage both qualitative insights and data-driven analysis. By identifying bottlenecks, decision points, and high-volume transaction flows, stakeholders can target automation efforts toward areas with the greatest potential impact. Concurrently, adopting modular automation architectures supports iterative deployments, enabling rapid pilot testing and incremental scaling.

Effective change management is essential for driving user adoption. This involves tailored training programs, ongoing performance monitoring, and feedback loops that allow teams to refine automated workflows based on real-time metrics. Furthermore, establishing clear performance indicators and success criteria ensures continual alignment with business objectives and facilitates transparent reporting to senior leadership.

Finally, forging strategic partnerships with technology vendors and system integrators can accelerate implementation timelines and mitigate risk. By leveraging external expertise and best practice frameworks, organizations position themselves to navigate complexity and sustain continuous improvement long after the initial deployment.

Explaining the Rigorous Research Methodology Employed to Ensure Data Integrity Analytical Rigor and Insight Validity in Business Process Automation Study

This study employed a multi-phase research methodology designed to ensure analytical rigor, data validity, and comprehensive market coverage. The process began with extensive secondary research, drawing upon publicly available industry publications, regulatory filings, white papers, and technology provider documentation to establish a foundational understanding of market dynamics.

Primary research was then conducted through structured interviews with senior executives, process owners, and technology specialists across key regions. These conversations provided firsthand perspectives on implementation challenges, technology preferences, and strategic priorities. Survey instruments complemented qualitative insights by capturing quantitative data on adoption drivers, investment criteria, and technology maturity across industry segments.

Data triangulation techniques were applied to reconcile conflicting inputs and validate findings. Cross-referencing primary and secondary information enabled the identification of consistent trends and emergent opportunities. An iterative review process, including expert panel validation and peer review checkpoints, ensured that final insights were robust, objective, and actionable.

Throughout the methodology, strict confidentiality protocols protected respondent anonymity and sensitive information. This rigorous approach underpins the credibility of the insights shared in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Business Process Automation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Business Process Automation Market, by Component

- Business Process Automation Market, by Organization Size

- Business Process Automation Market, by Business Function

- Business Process Automation Market, by Application

- Business Process Automation Market, by End User Industry

- Business Process Automation Market, by Deployment Type

- Business Process Automation Market, by Region

- Business Process Automation Market, by Group

- Business Process Automation Market, by Country

- United States Business Process Automation Market

- China Business Process Automation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Future Trajectory and Strategic Imperatives Shaping Business Process Automation Transformation and Organizational Resilience

As business process automation continues to mature, organizations must navigate a complex interplay of technological advances, regulatory shifts, and evolving market expectations. The insights presented in this report highlight the necessity of adopting an integrated automation strategy that balances innovation with governance and aligns with broader digital transformation objectives.

Looking ahead, the convergence of artificial intelligence, cloud-native architectures, and citizen development paradigms will drive further democratization of automation capabilities. Organizations that proactively embrace these inflections, invest in change management, and cultivate data-driven cultures will secure enduring competitive advantages. Moreover, the evolving policy environment, including tariff considerations and data sovereignty regulations, will require adaptable sourcing and deployment models.

In conclusion, the future success of automation initiatives rests on strategic alignment, robust operational frameworks, and continuous improvement mindsets. By synthesizing technological capabilities with clear business objectives, enterprise leaders can unlock new levels of efficiency, resilience, and innovation in a rapidly changing global environment.

Take Action Now to Secure Your Competitive Advantage Through Comprehensive Business Process Automation Insights from an Industry Sales and Marketing Leader

We invite you to elevate your strategic decision making by securing access to the full market research report on business process automation. Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, will ensure you receive personalized guidance on how to leverage insights tailored to your organization’s unique challenges and objectives. His expertise in translating complex data into actionable strategies will help you identify high-impact opportunities and mitigate implementation risks.

By partnering with this sales and marketing leader, you can align automation investments with your strategic priorities and accelerate your journey toward operational excellence. Reach out today to explore how this comprehensive research can inform your roadmap, drive sustainable growth, and position you at the forefront of process innovation without delay.

- How big is the Business Process Automation Market?

- What is the Business Process Automation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?