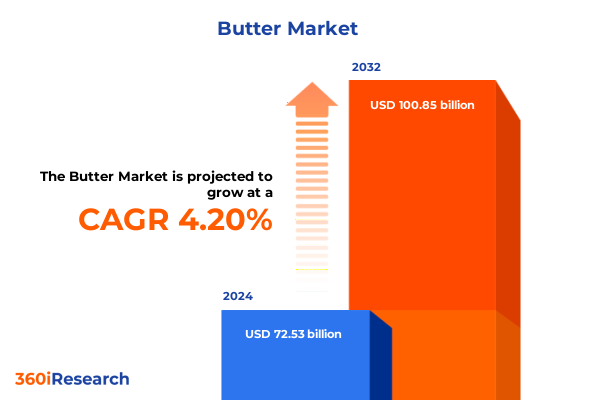

The Butter Market size was estimated at USD 75.65 billion in 2025 and expected to reach USD 78.50 billion in 2026, at a CAGR of 4.19% to reach USD 100.85 billion by 2032.

Unveiling the Complex Dynamics Shaping the Butter Industry: Consumer Trends, Competitive Forces, and Regulatory Impacts Across Global and U.S. Markets

The evolving butter market is experiencing unprecedented dynamics influenced by shifting consumer preferences, policy interventions, and supply chain complexities. Recent data indicate that Americans consumed a record average of 6.5 pounds of butter per person in 2023, matching all-time highs and underscoring butter’s enduring appeal in the U.S. diet. Across the European Union, per capita consumption registered approximately 4.17 kilograms in 2023, reflecting a stable yet sophisticated market characterized by premium and artisanal offerings. Meanwhile, global production forecasts for 2025 have been revised upward, driven by expanding dairy cow inventories and slightly higher yields per cow, which collectively support sustained butter output amid growing demand.

Amid these consumption milestones, industry stakeholders are navigating a landscape shaped by evolving health and sustainability imperatives. Consumers are increasingly drawn to functional and gut-health benefits offered by dairy products, prompting innovation in probiotic-enriched and minimally processed formulations. At the same time, the rise of plant-based butter alternatives, which now account for a notable share of the retail dairy aisle, is compelling traditional dairy processors to reassess product lines and positioning to maintain market relevance.

How Health and Sustainability Imperatives Are Redefining Butter Production, Distribution, and Consumption Patterns Worldwide

The butter industry is undergoing transformative shifts driven by complementary forces of health and environmental sustainability. On the dairy side, the resurgence of traditional butter has been powered by renewed consumer recognition of its high protein content, gut-friendly attributes, and minimal processing. Organic dairy offerings grew nearly ten percent in 2024, with novel products-such as probiotic ice cream and fermented butter varieties-emerging to meet discerning consumer demands. Concurrently, dairy processors have pledged commitments to carbon neutrality, improved animal welfare practices, and more transparent sourcing, responding to heightened scrutiny of the environmental footprint of dairy farming.

In parallel, plant-based butter alternatives have matured from niche innovations into mainstream retail staples. Foodservice establishments are increasingly incorporating vegan butters made from ingredients like coconut or olive oil to cater to flexitarian and vegan clientele, signaling an industry pivot toward greater inclusivity in menus. Brands are also differentiating through eco-friendly packaging solutions-ranging from biodegradable wrappers to recyclable aluminum tins-to resonate with sustainability-minded shoppers. Clean-label credentials have become paramount, with over eighty-percent of consumers indicating that ingredient transparency is a vital purchasing criterion. These parallel trends illustrate the industry’s adaptive response to both enduring dairy loyalties and the accelerating demand for plant-based, ethically produced alternatives.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariff Measures on Domestic Butter Supply Chains and Consumer Prices

In 2025, U.S. import tariffs implemented to address broader trade imbalances have had a pronounced effect on butter supply chains and pricing. The imposition of additional duties on key import sources, coupled with retaliatory levies from Canada, the European Union, and China, has contributed to domestic dairy product cost increases. A recent Yale Budget Lab analysis warns that average American households may incur nearly $4,900 more in grocery expenses due to higher tariffs, with food costs projected to rise by 2.6 percent, driven substantially by dairy and sugar-related products. The USDA estimates that home food expenditures could climb by 2.2 percent in 2025, underlining the sensitivity of household budgets to changing trade policies.

Beyond consumer impact, dairy economists have highlighted potential profit erosions within the industry. Retaliatory tariffs of 25 percent on U.S. exports to Canada, Mexico, and China could reduce farm and processor earnings by an estimated $6 billion over a four-year window, underscoring the vulnerability of export-dependent sectors to geopolitical disputes. Even as U.S. authorities have temporarily suspended certain import duties on select dairy products, Canada’s burdensome levies on butter, cheese, and whey remain in force, constraining export volumes and dampening international competitiveness. Market participants must therefore navigate a complex matrix of tariffs and countermeasures, balancing domestic supply priorities with the imperative to maintain access to critical export markets.

Deep Dive into Butter Market Segmentation Reveals Critical Nuances in Source, Form, Packaging, Type, Application, and Distribution

A rigorous examination of market segmentation reveals nuanced insights across source materials, product formulations, and consumer applications. Butter’s origins span both animal-derived fats and plant-based alternatives, reflecting a bifurcation in sourcing strategies that caters to divergent dietary and ethical preferences. In terms of physical presentation, the market encompasses solid block butter, liquid variants, powdered formulations, and spreadable textures designed for ease of use in both professional kitchens and retail kitchens.

Packaging formats further differentiate offerings, with flexible pouches appealing to convenience seekers, conventional wrapped blocks aligning with traditional shoppers, and tub formats-available in both small and large sizes-serving bulk and foodservice requirements. Product type segmentation includes clarified butter (ghee), cultured butters infused with fermented notes, and flavored options featuring garlic, herb, and honey infusions, alongside standard salted and unsalted profiles.

Applications for butter span a wide culinary spectrum: precision baking of cakes, cookies, and pastries leverages its flavor-building properties; confectionery and candy formulations integrate butter’s richness for mouthfeel; cooking techniques from sautéing to emulsification draw on its thermal behavior; and table-top spreads deliver direct sensory enjoyment. Finally, the distribution channel landscape bifurcates into offline channels-such as supermarkets, specialty food stores, and foodservice-and online platforms, where direct-to-consumer offerings and subscription models have gained traction.

This comprehensive research report categorizes the Butter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Packaging

- Product Type

- Application

- Distribution Channel

Illuminating Regional Variations in Butter Demand and Production Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in the butter market diverge meaningfully across the Americas, EMEA, and Asia-Pacific, each shaped by cultural traditions, economic factors, and evolving consumer tastes. In the Americas, the United States stands out with record-high per capita consumption of 6.5 pounds in 2023, supported by robust household demand and a strong foodservice sector that values butter’s functional and flavor attributes. Canada similarly demonstrates healthy consumption levels, buoyed by local dairy production and a strong preference for premium and grass-fed butters.

Within Europe, Middle East & Africa, the European Union remains a critical stronghold for butter, with per capita usage around 4.17 kilograms in 2023, driven by deep-rooted culinary traditions and a mature market for both commodity and specialty butters. Premium segments, including cultured and organic butters, command particular attention in Western Europe, while emerging markets in the Middle East and North Africa increasingly adopt butter in bakery and confectionery applications.

Asia-Pacific presents a diverse tableau: New Zealand leads global per capita consumption at roughly 37 kilograms per person, reflecting the country’s status as a major dairy exporter and a domestic affinity for artisanal dairy goods. Australia follows with moderate but stable butter use, while markets in South Korea, Japan, and China exhibit growing interest in both traditional dairy and plant-based alternatives, driven by urbanization, evolving foodservice trends, and a burgeoning middle class.

This comprehensive research report examines key regions that drive the evolution of the Butter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Butter Industry Players: Strategies, Innovations, and Competitive Positioning Driving Market Evolution

Global butter market leadership is concentrated among cooperatives and corporates that combine extensive scale, integrated supply chains, and brand influence. Fonterra Co-operative Group, headquartered in New Zealand, processes over 30 percent of the world’s dairy exports and recorded revenues of NZ$22.82 billion in 2024, underpinning its role as a foundational global supplier of both bulk and branded butter products.

Arla Foods, a European dairy cooperative owned by some 7,600 farmers, reported revenues of €13.8 billion in 2024 and anticipates further growth driven by elevated dairy prices and robust global demand for high-quality butter varieties. In North America, Land O’Lakes leverages its cooperative structure and 12 billion-pound annual milk intake to supply mainstream and value-added butter lines, supported by a diversified portfolio that extends across animal nutrition and crop protection.

Dairy Farmers of America, ranking third among global dairy companies by revenue, reported dairy product revenues of US$21.7 billion in FY2023, emphasizing its expansive distribution network and capacity to deliver consistent butter volumes across retail and foodservice channels. On the Indian subcontinent, the Gujarat Co-operative Milk Marketing Federation-marketing under the Amul brand-registered a turnover of ₹65,911 crore (approximately US$8.0 billion) in FY2024-25 and processed over 12 billion liters of milk annually, reflecting its cooperative scale and penetration in urban and rural markets alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Butter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agropur Cooperative

- Almarai Company

- Arla Foods amba

- Dairy Farmers of America Inc.

- Danone S.A.

- Fonterra Co-operative Group

- FrieslandCampina N.V.

- Froneri International Limited

- Grupo Lala

- Gujarat Co-operative Milk Marketing Federation Ltd.

- Kerry Group plc

- Lactalis

- Land O'Lakes Inc.

- Meiji Holdings Co., Ltd.

- Mengniu Dairy

- Müller Group

- Nestlé S.A.

- Ornua Co-operative Ltd.

- Saputo Inc.

- Savencia Fromage & Dairy

- Schreiber Foods

- Sodiaal Union

- Unilever plc

- Yili Group

Strategic Imperatives for Butter Industry Leaders to Capitalize on Emerging Trends and Navigate Trade Headwinds Effectively

To thrive amid evolving consumer demands and geopolitical uncertainties, industry leaders must embrace agile strategies that reinforce resilience and foster innovation. First, accelerating investment in plant-based butter research and development will ensure product portfolios align with shifting dietary preferences toward vegan and flexitarian lifestyles; collaborations with specialty ingredient suppliers can enhance textural and sensory performance. Second, commitment to sustainable packaging solutions-such as compostable wrappers, recyclable aluminum tins, and reduced-film pouches-will resonate with eco-conscious consumers and preempt regulatory shifts on single-use plastics.

Third, strengthening digital distribution capabilities through direct-to-consumer platforms, e-commerce partnerships, and subscription models will capture value from premium segments and enhance consumer data insights. Fourth, proactive engagement with trade policymakers and participation in multilateral forums can help shape tariff negotiations and mitigate the impact of retaliatory duties on butter exports. Fifth, forging cross-sector alliances with bakery, confectionery, and foodservice operators can drive collaborative innovations in application development, from plant-infused butters to functional formulations enriched with probiotics or plant proteins.

Lastly, embedding robust ESG metrics-spanning carbon footprint reduction, animal welfare certifications, and community support for dairy farming-will strengthen brand trust and unlock access to purpose-driven investment channels. By executing these recommendations in concert, butter industry stakeholders can navigate a fluid landscape while capitalizing on emergent growth opportunities.

Comprehensive Research Framework Underpinning the Butter Market Analysis Integrating Primary Insights and Secondary Data Validation

This analysis synthesizes a comprehensive research methodology integrating both primary and secondary approaches. Primary research encompassed in-depth interviews with senior executives at leading dairy cooperatives, butter processors, and foodservice operators to capture real-time perspectives on production challenges, consumer dynamics, and trade policy impacts. These insights were supplemented by quantitative surveys of retail buyers and distributors to gauge shifting purchase patterns and emerging product requirements.

Secondary research involved rigorous review of authoritative government data sources, including World Agricultural Supply and Demand Estimates (WASDE) and USDA Price Forecasts, as well as trade statistics published by the World Trade Organization. Industry publications, academic studies, and sustainability reports provided context on emerging health, environmental, and packaging trends. A robust validation process engaged an expert advisory panel-comprising dairy economists, supply chain specialists, and R&D leaders-to vet findings and refine strategic implications.

Data triangulation was employed throughout to ensure accuracy, combining disparate sources to cross-validate production figures, consumption metrics, and policy analyses. This multi-layered framework ensures that the conclusions and recommendations offer a reliable foundation for decision-makers seeking to understand and act upon the latest developments in the global butter market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Butter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Butter Market, by Source

- Butter Market, by Form

- Butter Market, by Packaging

- Butter Market, by Product Type

- Butter Market, by Application

- Butter Market, by Distribution Channel

- Butter Market, by Region

- Butter Market, by Group

- Butter Market, by Country

- United States Butter Market

- China Butter Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarizing Key Findings and Outlook Considerations to Guide Stakeholders in the Evolving Butter Market Ecosystem

The butter industry stands at a pivotal juncture where tradition and innovation converge. Sustained consumer enthusiasm for butter’s culinary attributes-evidenced by record consumption levels in key markets-coexists with emergent demands for health-forward, plant-based alternatives and heightened sustainability commitments. Geopolitical shifts, including the imposition and reprisal of trade tariffs, underscore the critical need for stakeholders to adopt adaptive strategies that protect domestic supply chains while safeguarding export competitiveness.

Segmentation analysis reveals the value of nuanced product differentiation across source materials, physical forms, packaging formats, flavor profiles, and distribution channels. Regional insights highlight the importance of customizing approaches to mature Western markets, growth-oriented Asia-Pacific economies, and the diverse contexts of the Americas. Leading cooperatives and corporate processors exemplify the scale and integration required to thrive, while innovative entrants and challenger brands signal the ongoing potential for disruption.

Ultimately, the convergence of these factors points to a future in which agility, collaboration, and commitment to consumer and planetary well-being will determine market leadership. Stakeholders who proactively embrace sustainable practices, invest in product innovation, and engage with policymakers will be best positioned to navigate uncertainties and capture the next wave of opportunities in the global butter market.

Secure Exclusive Insights by Engaging Ketan Rohom to Acquire the Comprehensive Butter Market Research Report

For a deep dive into these critical findings and to equip your organization with strategic foresight, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the report’s comprehensive insights, discuss tailored solutions aligned with your business objectives, and facilitate access to exclusive data that can drive your competitive advantage. Reach out to Ketan to secure your copy today and position your team at the forefront of the evolving butter market landscape.

- How big is the Butter Market?

- What is the Butter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?