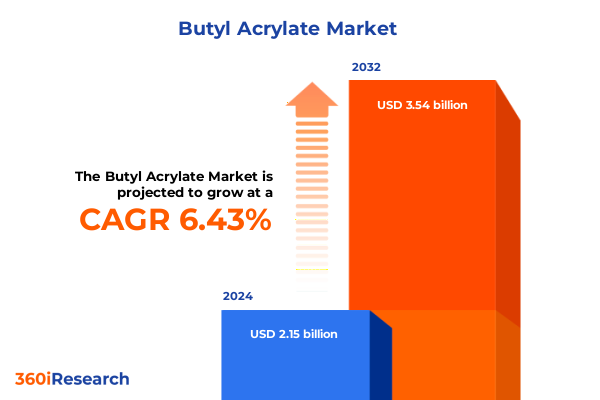

The Butyl Acrylate Market size was estimated at USD 2.26 billion in 2025 and expected to reach USD 2.39 billion in 2026, at a CAGR of 6.99% to reach USD 3.64 billion by 2032.

Unveiling the Fundamental Drivers and Strategic Importance of Butyl Acrylate as a Versatile Monomer at the Heart of Modern Industrial Applications

Butyl acrylate has emerged as a cornerstone monomer in today’s chemical industry, underpinning critical applications across coatings, adhesives, and specialty polymers. Its versatility stems from a combination of superior flexibility, excellent adhesion, and weather resistance, making it an essential building block for water-based systems that meet stringent environmental standards. As market participants seek materials capable of balancing performance with low volatile organic compound emissions, butyl acrylate continues to gain traction in both established and emerging end uses.

Beyond its traditional role in paints and adhesives, butyl acrylate’s significance is amplified by its adaptability to advanced polymerization techniques and bio-based feedstock innovations. Recent patent filings highlight a surge in research on UV-cured and self-healing acrylate compositions, reflecting the industry’s push toward high-performance, sustainable solutions. Consequently, manufacturers and formulators are prioritizing raw material strategies that align with evolving regulatory and consumer demands, elevating butyl acrylate as a vital contributor to resilient and future-proof polymer architectures.

How Sustainability Mandates and Technological Breakthroughs Are Redefining the Butyl Acrylate Production and Application Landscape

The butyl acrylate landscape is being reshaped by a confluence of sustainability mandates, environmental regulations, and production process innovations. Stricter VOC emission limits imposed by regulatory bodies in Europe and North America are accelerating the transition toward waterborne and UV-curable coating technologies that rely on butyl acrylate as a key co-monomer. In Europe, directives enforcing low-VOC thresholds for architectural coatings have prompted formulators to develop advanced acrylate emulsions with significantly reduced emission profiles, without compromising performance.

Simultaneously, an uptick in patent activity for bio-derived and low-emission acrylate formulations underscores the industry’s commitment to circular economy principles. Leading players are leveraging both emulsion and solution polymerization technologies to optimize polymer architecture, enhance durability, and reduce carbon footprints. These technological breakthroughs, paired with the rising demand for high-purity grades in sensitive applications, signal a transformative shift toward bespoke acrylate systems that cater to specialized market needs.

Assessing the Far-Reaching Effects of 2025 U.S. Tariff Measures on Butyl Acrylate Supply Chains and Cost Structures

In 2025, sweeping U.S. tariff measures have introduced new complexities to global butyl acrylate supply chains and cost structures. A baseline tariff on all imports took effect in early April, complemented by higher duties on specific trading partners. For instance, Canadian and Mexican exports now face elevated rates, albeit with temporary exemptions for USMCA-compliant goods, while Chinese imports continue under a moderate differential tariff regime. These trade actions, justified under national security and supply chain resilience frameworks, have disrupted traditional North American sourcing strategies for acrylic monomers and feedstocks.

Decoding the Market Fabric: In-Depth Insights into Application, Grade, Form, Technology, Purity, and Distribution Segments Shaping Butyl Acrylate Demand

The butyl acrylate market’s intricacies are best understood through a multifaceted segmentation lens that spans applications, grades, forms, technologies, purity tiers, and distribution channels. In architectural coatings, decorative and protective formulations are driving demand for specialty butyl acrylate emulsions, while the flexible foam sector-particularly in automotive seating, bedding, and furniture-relies on tailored liquid-grade monomers to achieve specific mechanical and comfort properties. Meanwhile, pressure-sensitive adhesives for graphic films, labels, and tapes leverage both industrial and polymer-grade variants to balance tack and cohesion requirements.

Textile finishing applications further exemplify the monomer’s versatility, with butyl acrylate-based systems enabling enhancements in coating, dyeing, and print durability. At the production level, emulsion polymerization remains the dominant technology for high-volume waterborne applications, whereas solution polymerization is often preferred for specialized high-purity grades. This diversity in technological pathways underpins the availability of high-purity and standard-grade offerings, distributed through both direct sales relationships and specialized distributor networks that cater to form and performance specifications.

This comprehensive research report categorizes the Butyl Acrylate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Form

- Technology

- Purity

- Application

- Distribution Channel

Regional Dynamics Driving Growth: Unraveling the Distinctive Demand Patterns Across Americas, EMEA and Asia-Pacific for Butyl Acrylate

Distinct regional dynamics are profoundly influencing butyl acrylate consumption patterns and growth trajectories. In the Americas, robust infrastructure investment and a stable regulatory climate underpin steady demand for waterborne coatings and adhesives, with key North American producers adjusting capacity to serve both domestic and export markets. Meanwhile, Latin America’s expanding construction and automotive sectors are creating new avenues for monomer suppliers seeking diversification beyond mature markets.

This comprehensive research report examines key regions that drive the evolution of the Butyl Acrylate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Landscape: Profiling Leading Butyl Acrylate Producers and Their Market Strategies Amid Intensifying Global Competition

A concentrated competitive landscape characterizes the global butyl acrylate market, with leading chemical producers strategically expanding capacity and innovating to maintain differentiation. Industry incumbents are investing in regional assets to secure feedstock integration and expedite product delivery, while also forging partnerships to accelerate development of bio-based acrylate variants. Collaborative R&D initiatives and targeted M&A activity underscore a quest for scale and technological edge, as companies align portfolios with evolving performance and sustainability criteria.

This comprehensive research report delivers an in-depth overview of the principal market players in the Butyl Acrylate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Bharat Petroleum Corporation Limited

- China National Offshore Oil Corporation

- Evonik Industries AG

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Haihang Industry Co.,Ltd.

- KH Chemicals BV

- KURARAY CO., LTD.

- LG Chem Ltd.

- Loba Chemie Pvt Ltd

- Merck KGaA

- Mitsubishi Chemical Corporation

- Nippon Shokubai Co., Ltd

- Oswal Udhyog

- Prasol Chemicals Ltd.

- Sasol Limited

- Shanghai Huayi Acrylic Acid Co. Ltd.

- SIBUR International GmbH

- Tasnee

- The Dow Chemical Company

- Toagosei Co., Ltd.

- Tokyo Chemical Industry Co., Ltd.

- WANHUA Chemical Group Co. Ltd.

Strategic Imperatives to Navigate Market Volatility: Actionable Recommendations for Butyl Acrylate Industry Leaders to Capitalize on Emerging Trends

To navigate the volatile trade environment and capitalize on shifting demand paradigms, industry leaders should consider a suite of strategic initiatives. Prioritizing flexible manufacturing platforms will allow rapid pivoting between emulsion and solution polymerization processes, optimizing for cost and performance. Concurrently, forging alliances with renewable feedstock suppliers can mitigate raw material volatility and reinforce sustainability credentials. In parallel, establishing regional supply hubs close to end-use markets will reduce lead times and exposure to tariff fluctuations. Finally, investing in advanced analytics to fuel demand forecasting and supply chain visibility will empower decision-makers to proactively manage risk and seize growth opportunities.

Rigorous and Transparent Research Framework: Methodological Approach Underpinning the Butyl Acrylate Industry Analysis and Insights

This analysis is underpinned by a rigorous research framework combining primary and secondary methodologies. Detailed interviews with key stakeholders-including producers, distributors, and formulators-have been complemented by extensive review of patent databases, regulatory filings, and industry publications. Secondary data sources were triangulated to validate emerging trends and regional outlooks. Quality control measures, such as cross-referencing trade statistics and consulting subject-matter experts, ensure the integrity and relevance of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Butyl Acrylate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Butyl Acrylate Market, by Grade

- Butyl Acrylate Market, by Form

- Butyl Acrylate Market, by Technology

- Butyl Acrylate Market, by Purity

- Butyl Acrylate Market, by Application

- Butyl Acrylate Market, by Distribution Channel

- Butyl Acrylate Market, by Region

- Butyl Acrylate Market, by Group

- Butyl Acrylate Market, by Country

- United States Butyl Acrylate Market

- China Butyl Acrylate Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Critical Insights: Concluding Reflections on the Market Outlook and Strategic Pathways for Butyl Acrylate

In summary, the butyl acrylate market stands at a pivotal juncture, shaped by environmental imperatives, supply chain realignments, and a surge in application-specific innovations. As industry participants navigate complex trade landscapes and intensifying regulatory pressures, agile strategies centered on sustainability, technological differentiation, and regional resilience will be paramount. The cumulative effect of these forces will define the next phase of butyl acrylate adoption, positioning it as a hallmark monomer for high-performance, eco-conscious polymer solutions.

Secure Your Competitive Edge and Unlock Comprehensive Butyl Acrylate Market Intelligence with Personalized Guidance from Ketan Rohom

Are you prepared to turn insights into action and secure a strategic advantage in the evolving butyl acrylate market? Engage with Ketan Rohom, Associate Director, Sales & Marketing, to gain full access to our comprehensive market research report that delves deeper into technology innovations, regional dynamics, and competitive strategies. Reach out today to discuss tailored solutions, arrange a detailed briefing, and discover how this indispensable market intelligence will empower your organization to drive growth, optimize supply chains, and capitalize on emerging opportunities.

- How big is the Butyl Acrylate Market?

- What is the Butyl Acrylate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?