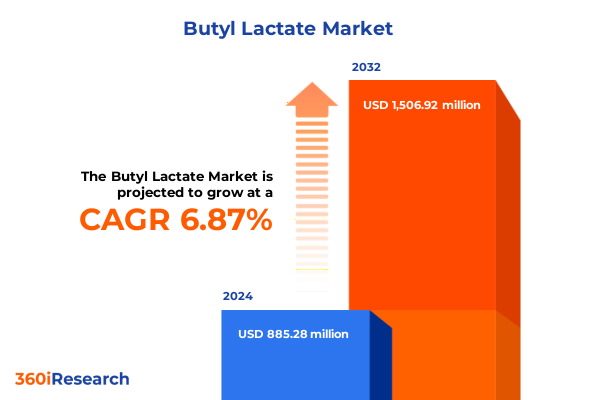

The Butyl Lactate Market size was estimated at USD 946.88 million in 2025 and expected to reach USD 1,015.31 million in 2026, at a CAGR of 6.86% to reach USD 1,506.92 million by 2032.

Unveiling the Pivotal Role of Butyl Lactate in Modern Industrial Applications and the Market Dynamics Driving Its Strategic Importance

Butyl lactate, an ester of lactic acid and butanol, has emerged as a versatile solvent and intermediate across multiple industrial domains. Its biodegradability, low toxicity, and favorable solvency characteristics render it particularly attractive for applications requiring both performance and environmental compliance. Over the past decade, the compound has transcended traditional roles in coatings and inks to become a key enabler in cleaner formulations and precision processes.

Exploring the Sustainability Revolution and Technological Advancements Reshaping Butyl Lactate Production and Driving Market Evolution

The landscape of butyl lactate production and utilization has been profoundly influenced by a convergence of sustainability imperatives and technological innovation. Advances in green chemistry have accelerated the adoption of enzyme-catalyzed manufacturing routes, reducing energy consumption and enhancing process selectivity. At the same time, regulatory frameworks around volatile organic compounds have compelled formulators to seek alternative solvents, elevating butyl lactate from a niche specialty chemical to a mainstream ingredient in eco-friendly products.

Moreover, the shift towards circular economy principles has spurred investment in renewable feedstocks, with research teams optimizing fermentation pathways that leverage agricultural by-products. Digital process controls and real-time analytics have further refined reaction efficiency, while collaborations between industry and academia continue to unlock new performance thresholds. These transformative shifts underscore a broader movement towards resilient, sustainable, and high-performance chemical supply chains.

Assessing the Comprehensive Effects of United States 2025 Tariff Measures on the Butyl Lactate Supply Chain and Pricing Structures

In 2025, the imposition of targeted United States tariffs has exerted a cumulative influence on the butyl lactate supply chain, reshaping cost structures and trade patterns. Intermediate feedstocks subject to increased duties have elevated input costs for domestic producers, prompting some manufacturers to reconfigure sourcing strategies and evaluate alternative import routes. Concurrently, end-use industries have reassessed formulation priorities to mitigate the impact of higher raw material prices on final product economics.

These tariff measures have generated ripple effects across distribution networks, with importers adjusting lead times and logistic partners recalibrating freight agreements. Manufacturers with integrated upstream capabilities have leveraged vertical synergies to cushion margin pressures, while smaller producers have pursued strategic alliances or regional sourcing hubs to maintain competitiveness. The net outcome reflects a nuanced realignment of supply chain resilience and cost optimization in the face of evolving trade landscapes.

Key Segmentation Insights Revealing How Applications, Grades, Processes, Channels and Raw Material Sources Define Market Opportunities

The butyl lactate market exhibits distinct dynamics across applications, grades, manufacturing processes, distribution channels, and raw material sources. Adhesives and sealants benefit from the solvent’s balanced evaporation rate, while cosmetics and personal care formulations capitalize on its low odor profile. Within paints and coatings, architectural applications require long-term durability and UV stability, whereas automotive coatings emphasize rapid curing and high-gloss finish, and industrial coatings demand chemical resistance and adhesion properties suitable for harsh environments.

Grade variations between food-grade and technical-grade butyl lactate dictate compliance thresholds and cost implications, with the former ensuring adherence to stringent purity requirements for flavor encapsulation and pharmaceutical intermediates. Batch manufacturing processes, whether acid-catalyzed or enzyme-catalyzed, offer flexibility for specialty chemistries, in contrast to continuous enzyme-driven production that scales efficiency and consistency. Distribution through direct sales channels fosters bespoke formulation support, while distributor networks expand market reach. Corn-based feedstocks lead the raw material mix due to established supply chains, even as sugarcane-based sources gain traction for their lower carbon footprint.

This comprehensive research report categorizes the Butyl Lactate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Manufacturing Process

- Raw Material Source

- Application

- Distribution Channel

Regional Market Dynamics Highlighting the Diverse Demand Drivers, Regulatory Landscapes and Growth Catalysts Across Key Geographies

Across the Americas, demand for butyl lactate is propelled by robust industrial activity and stringent environmental regulations that favor low-VOC solvents in paints, coatings, and cleaning formulations. Producers in North America have invested in upstream integration and localized distribution hubs to better serve customers and mitigate logistical uncertainties. Latin American markets, while still emerging, are showing early signs of growth as regional healthcare and personal care sectors expand.

In Europe, the Middle East and Africa region, regulatory drivers around sustainability and chemical safety standards continue to elevate butyl lactate’s status as a preferred solvent. Machinery modernization in key European manufacturing centers enables higher throughput of renewable-feedstock-based products. Meanwhile, in the Middle East, petrochemical derivatives compete with bio-based esters, although initiatives around diversification of downstream industries bolster interest. Asia-Pacific remains the fastest-growing region, with coatings, printing inks, and cosmetic manufacturers in China, Japan and India rapidly scaling production and investing in green chemistry capabilities to meet both domestic demand and export requirements.

This comprehensive research report examines key regions that drive the evolution of the Butyl Lactate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Butyl Lactate Producers Showcasing Competitive Strengths, Innovation Pipelines and Collaborative Ventures

Regional and global players alike are strengthening their positions through capacity expansions, product portfolio enhancements, and strategic partnerships. Leading chemical producers have launched proprietary butyl lactate grades that cater to high-performance coatings and specialty adhesives. Investments in enzyme-catalysis platforms illustrate a commitment to sustainable innovation, while joint ventures with biotechnology firms aim to secure long-term access to renewable feedstocks.

Mid-tier companies are carving out niches by offering localized supply solutions and value-added technical services, such as on-site blending and formulation support. Some have pursued backward integration to control raw material costs, whereas others have formed distribution alliances to penetrate underserved markets in emerging economies. Across the competitive landscape, differentiation is achieved through a combination of product customization, regulatory compliance expertise, and end-use application development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Butyl Lactate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Biosynth Ltd

- Chem-Impex International, Inc.

- Chemical Bull Pvt Ltd.

- China National Offshore Oil Corporation

- Corbion NV

- Dow Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Finetech Industry Limited

- Formosa Plastics Corporation

- Galactic S.A.

- Haihang Industry Co., Ltd.

- HENAN KANGYUAN FLAVOR GROUP CO., LTD.

- Huntsman Corporation

- Merck KGaA

- Mitsui Chemicals, Inc.

- Musashino Chemical Laboratory, Ltd.

- Otto Chemie Pvt. Ltd.

- Thermofisher Scientific, Inc.

Pragmatic Recommendations for Industry Stakeholders to Optimize Value, Strengthen Supply Chains and Accelerate Sustainable Growth Trajectories

To capitalize on evolving market conditions, industry stakeholders should prioritize investment in enzymatic process optimization to achieve greater energy efficiency and product purity. Strengthening supplier relationships through long-term contracting or equity stakes in feedstock production can shield against volatility in raw material pricing. Companies should also explore digital twins and advanced analytics to monitor reactor performance and refine process parameters in real time.

Furthermore, collaborative consortiums with regulatory bodies and academic institutions can accelerate the validation of bio-based pathways and drive harmonization of global standards. Diversifying downstream applications by co-developing formulations with end-users will open new revenue streams and deepen customer loyalty. Finally, building flexible manufacturing footprints that integrate both batch and continuous operations will enable rapid response to shifting demand patterns and sustain competitive advantage.

Robust Research Methodology Underpinning Data Integrity Through Comprehensive Secondary and Primary Intelligence Processes

Our research methodology combines exhaustive secondary data collection with rigorous primary engagements to ensure robust insights. We initiated the study by reviewing industry whitepapers, regulatory filings, and technical journals, synthesizing historical trends and technological breakthroughs. This was complemented by in-depth interviews with senior R&D, procurement, and commercial executives across key producing regions to validate findings and uncover emerging opportunities.

Quantitative data underwent multi-tier triangulation, cross-referencing trade statistics, production capacity databases, and company disclosures to uphold accuracy. Qualitative inputs were systematically coded to reveal strategic themes, with iterative feedback loops ensuring alignment with market realities. The resulting analysis reflects a comprehensive perspective that interweaves macro-economic, regulatory, and technological dimensions central to the butyl lactate ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Butyl Lactate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Butyl Lactate Market, by Grade

- Butyl Lactate Market, by Manufacturing Process

- Butyl Lactate Market, by Raw Material Source

- Butyl Lactate Market, by Application

- Butyl Lactate Market, by Distribution Channel

- Butyl Lactate Market, by Region

- Butyl Lactate Market, by Group

- Butyl Lactate Market, by Country

- United States Butyl Lactate Market

- China Butyl Lactate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Perspectives Synthesizing Critical Insights to Inform Strategic Decision Making and Future Directions in Butyl Lactate Markets

In summary, butyl lactate has solidified its role as a cornerstone solvent within environmentally conscious and performance-driven industries. The convergence of sustainability mandates, innovative catalysis, and evolving regulatory frameworks presents both challenges and opportunities for participants across the value chain. Tariff-induced cost pressures underscore the need for agile supply strategies, while segmentation insights unveil avenues for product differentiation and market expansion.

As regional dynamics continue to evolve, companies that embrace renewable feedstocks, leverage advanced manufacturing techniques, and engage in strategic collaborations will emerge as frontrunners. The actionable intelligence presented here equips decision-makers with the clarity needed to navigate complexity and position themselves for long-term success in the dynamic butyl lactate arena.

Engage with Ketan Rohom Associate Director of Sales & Marketing to Discover How to Acquire the Most Comprehensive Butyl Lactate Market Research Report Today

I invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how you can gain immediate access to the full breadth of our butyl lactate market research report. This comprehensive study offers in-depth analytical perspectives, detailed segmentation insights, and actionable recommendations that are designed to equip your organization with the strategic intelligence needed to excel in this evolving sector.

By connecting with Ketan, you can learn about customized intelligence packages, exclusive data add-ons, and tailored advisory services that align with your specific business objectives. Whether you are aiming to refine your product development roadmap, optimize supply chain resilience, or identify new partnership opportunities, his expertise will guide you seamlessly through the purchasing process and ensure that you leverage these insights for sustained competitive advantage.

- How big is the Butyl Lactate Market?

- What is the Butyl Lactate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?