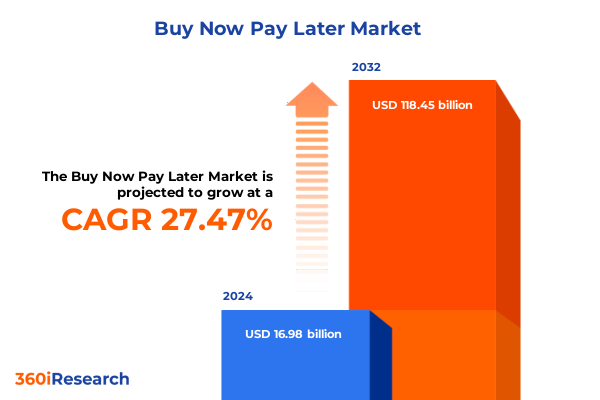

The Buy Now Pay Later Market size was estimated at USD 21.32 billion in 2025 and expected to reach USD 26.77 billion in 2026, at a CAGR of 27.75% to reach USD 118.45 billion by 2032.

Exploring the Dynamic Emergence and Strategic Significance of Buy Now Pay Later Solutions in the Modern Retail Finance Ecosystem

Buy Now Pay Later (BNPL) has rapidly evolved from a niche payment option into a pivotal component of the global retail finance ecosystem. Originally conceived to extend flexible credit to consumers, BNPL platforms now span digital, mobile, and point-of-sale channels, reshaping the way individuals and merchants interact. As consumer expectations for seamless, transparent financing grow, the industry has responded with technological innovation, intricate partnerships, and novel regulatory frameworks aimed at ensuring responsible adoption.

This executive summary provides a concise yet comprehensive entry point into the BNPL market’s current trajectory. It highlights the forces propelling rapid adoption, examines the shifting competitive landscape, and contextualizes emerging risks and opportunities. The insights herein are designed to equip decision-makers with a clear understanding of market drivers, segmentation dynamics, and regional nuances, thus facilitating strategic planning and investment prioritization.

Unveiling the Technological, Consumer Behavior, and Regulatory Drivers Redefining the Buy Now Pay Later Landscape Worldwide

The BNPL sector is undergoing profound transformations driven by advances in seamless digital integration, evolving consumer preferences, and heightened regulatory scrutiny. On the technology front, artificial intelligence and machine learning algorithms are refining credit risk assessment in real time, enabling platforms to offer increasingly tailored payment options while mitigating fraud. Concurrently, partnerships between BNPL providers, established card networks, and major merchants are deepening, yielding co-branded solutions that blend loyalty incentives with financing convenience.

Parallel to these technological shifts, consumer behavior is reshaping growth trajectories. Younger demographics-accustomed to instant gratification and digital wallets-are driving demand for flexible payment schedules that align with cash flow needs. Retailers, in turn, are embracing BNPL as a conversion booster, integrating it seamlessly at checkout across mobile apps and web platforms. At the same time, regulatory bodies in key markets are crafting guidelines to balance consumer protection with innovation, introducing measures such as clear disclosure requirements and caps on late-fee structures. Together, these elements form a dynamic interplay that is redefining the contours of the global BNPL landscape.

Analyzing the Ripple Effects of 2025 United States Tariff Measures on Buy Now Pay Later Provider Economics and Merchant Partnerships

Recent adjustments to U.S. tariff policies have reverberated across the BNPL sector, impacting device manufacturers, merchant import costs, and consumer pricing structures. Higher duties on consumer electronics have translated into increased base prices for installment-purchased smartphones and tablets, subtly altering both merchant margins and available financing terms. For BNPL providers, the recalibrated cost bases necessitate recalibrated underwriting models to account for inflation-driven price shifts and potential consumer resistance to steeper purchase prices.

Moreover, merchants have responded by renegotiating partnerships with BNPL platforms to share incremental costs, introducing promotional amortization of tariffs across payment schedules. Some providers have launched limited-time fee waivers on tariff-affected goods to sustain consumer uptake, while others focus on diversifying portfolios toward services and experiences less vulnerable to import duties. Regulatory oversight of cross-border payments and foreign exchange adjustments further complicates this environment, compelling BNPL stakeholders to enhance compliance capabilities and maintain transparent communication on tariff-induced cost variations.

Illuminating Core Market Segmentation Layers from Platform Types to End-Use Verticals Driving Buy Now Pay Later Adoption Trends

Market segmentation in the BNPL arena reveals a multi-layered tapestry of channel, model, and end-use distinctions that collectively shape adoption dynamics. Platforms encompass mobile applications-where Android and iOS variants compete on user experience and credit integration-alongside traditional point-of-sale terminals, both physical and virtual, and browser-based or progressive web interfaces tailored for omnichannel merchants. Each platform subtype presents distinct technical requirements, partnership opportunities, and user engagement strategies.

Diving deeper, business models bifurcate into enterprise-facing offerings, structured by bulk purchase or service-level agreements, and direct-to-consumer plans that span on-demand and subscription-based approaches. The former segment relies on negotiated fee schedules and volume guarantees, while the latter emphasizes agile onboarding and consumer retention through loyalty mechanisms. Payment types further delineate market contours, as fee-based or interest-free deferred payments coexist with structured installment plans-weekly, bi-weekly, or monthly-enabling providers to tailor solutions for varying consumer incomes and spending patterns.

Finally, purchase channels and end-use verticals anchor the segmentation landscape. In-store experiences, digital commerce platforms, and mobile app checkouts demand bespoke integration architectures, while end-use categorizations-from education and healthcare to media, entertainment, retail, and travel-drive vertical-specific feature sets. Within retail, consumer electronics financing must address high-ticket durability risk, whereas fashion purchases focus on rapid transaction flows and returns management. Recognizing these segmentation layers empowers stakeholders to refine targeting, optimize partnerships, and innovate product roadmaps.

This comprehensive research report categorizes the Buy Now Pay Later market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Business Model

- Payment Type

- End-use

- Purchase Channel

Comparative Perspectives on Buy Now Pay Later Market Dynamics Across the Americas, EMEA, and Asia-Pacific Regions Influencing Strategy

Regional market dynamics exhibit pronounced variations in consumer behavior, regulatory landscapes, and merchant adoption rates across the Americas, EMEA, and Asia-Pacific. In the Americas, mature digital infrastructures and high consumer credit awareness have fostered mainstream BNPL acceptance, with North America leading through integration with major credit card networks and Latin America emerging via mobile-first solutions tailored to underbanked populations. Regulatory focus in this region centers on fair lending practices and transparent disclosures to safeguard consumer interests.

Across Europe, the Middle East, and Africa, heterogeneous regulatory regimes and diverse economic conditions propel differentiated growth paths. Western Europe’s stringent financial oversight has prompted BNPL firms to partner with licensed banks and adhere to consumer credit directives; meanwhile, emerging markets within EMEA leverage BNPL to bridge credit access gaps, often through mobile-centric partnerships combining local payment wallets and telecom infrastructure.

In Asia-Pacific, rapid e-commerce proliferation and smartphone penetration underpin some of the fastest BNPL adoption rates globally. Regional giants are integrating financing offers directly within super-apps and digital ecosystems, capitalizing on ingrained mobile payment habits. Yet, compliance requirements are evolving swiftly, with governments in Australia and Southeast Asia rolling out guidelines to ensure responsible lending and data privacy. This varied regional mosaic underscores the necessity for tailored strategies that align compliance, technology, and consumer engagement in each market.

This comprehensive research report examines key regions that drive the evolution of the Buy Now Pay Later market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Contenders Shaping the Competitive Landscape of Buy Now Pay Later Services Globally

Leading BNPL providers continue to expand service footprints, forge strategic alliances, and invest in proprietary underwriting technologies. Global incumbents are deepening collaborations with large-scale e-retailers and card issuers, co-creating white-label solutions that reinforce brand loyalty and cross-sell capabilities. Meanwhile, emerging challengers are differentiating through niche vertical focus-such as healthcare financing or educational expense coverage-and by embedding real-time credit decisioning within specialized mobile apps.

Partnerships with banking institutions and payment networks are a critical competitive lever, granting providers access to established customer bases and compliance frameworks. Technological innovators are also staking claims through investments in open banking APIs, enabling seamless account aggregation and dynamic affordability assessments. Additionally, some actors are pioneering blockchain-enabled settlement systems to expedite merchant payouts and enhance transparency across cross-border transactions. As digital wallets and super-apps expand, the competitive battleground will increasingly revolve around platform integration depth, risk management sophistication, and value-added consumer experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Buy Now Pay Later market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACI Worldwide, Inc.

- Affirm, Inc.

- Afterpay Limited

- Amazon Pay Later

- Apruve, Inc.

- Bank of America Corporation

- Billie GmbH

- Capgemini SE

- ChargeAfter, Inc.

- ePayLater

- Fidelity National Information Services, Inc.

- Finastra

- Finturf

- Fiserv, Inc.

- Flipkart Pay Later

- Global Payments Inc.

- Hokodo SAS

- humm BNPL Pty Ltd.

- Klarna Inc.

- LazyPay Private Limited

- Mastercard Inc.

- Nucleus Software Exports Ltd.

- Payl8r

- PayPal, Inc.

- Repay Holdings, LLC

- Sezzle Inc.

- Simpl

- Splitit USA Inc.

- Tabby FZ-LLC

- Temenos Headquarters SA

- Visa Inc.

- Worldline Group S.A.

- ZestMoney

- Zinia

- ZoodPay

Strategic Imperatives and Practical Next Steps for Industry Leaders to Capitalize on the Accelerating Buy Now Pay Later Market Opportunities

Industry leaders must prioritize the enhancement of credit risk frameworks by integrating artificial intelligence–powered decisioning engines that continuously refine models based on real-time performance data. Strengthening data partnerships with banks, payment networks, and alternative credit bureaus will enrich consumer profiles and reduce default rates. Concurrently, firms should pursue cross-sector collaborations-linking BNPL with loyalty programs, installment insurance, and value-added services-to elevate customer lifetime value and foster stickier digital ecosystems.

Operational agility is equally paramount. Providers should adopt modular technology stacks that facilitate rapid deployment of new payment types, with configurability to support fee-based, interest-free deferred schedules or flexible installment plans. This approach accelerates responsiveness to regulatory changes and emerging merchant requirements. Moreover, crafting region-specific compliance roadmaps will ensure adherence to evolving guidelines across the Americas, EMEA, and Asia-Pacific. By aligning strategic investments in underwriting, partnerships, and platform architecture, BNPL stakeholders can capture rising demand while mitigating financial and regulatory risks.

Transparent Overview of the Rigorous Qualitative and Quantitative Approaches Underpinning the Buy Now Pay Later Market Research Methodology

The research underpinning this analysis combined extensive primary and secondary methodologies to ensure rigour and relevance. Primary insights were gathered through structured interviews with senior executives across leading BNPL providers, merchants, and payment networks, supplemented by surveys capturing consumer preferences and pain points. Quantitative data collection involved an aggregation of transaction volumes, platform usage metrics, and credit performance indicators sourced from publicly available filings, proprietary industry databases, and leading financial data aggregators.

Secondary research encompassed a comprehensive review of regulatory filings, central bank publications, and fintech association reports, providing contextual depth on policy trends and competitive strategies. Advanced analytics techniques-including time-series analysis for tariff impact assessment and cohort analysis for user behavior segmentation-were applied to identify patterns and forecast growth drivers. Throughout, cross-validation with expert peer reviews and triangulation of multiple data sources reinforced the robustness of key findings and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Buy Now Pay Later market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Buy Now Pay Later Market, by Platform

- Buy Now Pay Later Market, by Business Model

- Buy Now Pay Later Market, by Payment Type

- Buy Now Pay Later Market, by End-use

- Buy Now Pay Later Market, by Purchase Channel

- Buy Now Pay Later Market, by Region

- Buy Now Pay Later Market, by Group

- Buy Now Pay Later Market, by Country

- United States Buy Now Pay Later Market

- China Buy Now Pay Later Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Market Evolution, Strategic Drivers, and Critical Success Factors Defining the Future Trajectory of Buy Now Pay Later Services

The Buy Now Pay Later market stands at a pivotal juncture, characterized by accelerated adoption, technological disruption, and evolving regulatory frameworks. As consumer demand for flexible payment options continues to expand, providers equipped with advanced risk engines, strategic partnerships, and adaptive platform architectures will lead the charge. Embracing nuanced segmentation insights and region-specific strategies will be vital for capturing emerging opportunities and navigating complex compliance landscapes.

Looking ahead, sustaining growth will depend on maintaining the delicate balance between innovation and responsibility. Stakeholders that proactively invest in transparent disclosures, customer education, and dynamic credit models will solidify trust and drive long-term market maturation. This report’s insights offer a strategic compass for executives and investors seeking to engage meaningfully with the BNPL ecosystem and secure a competitive advantage in an increasingly crowded marketplace.

Unlock Exclusive Buy Now Pay Later Market Intelligence by Connecting with Ketan Rohom for Your Comprehensive Research Report

To access the full spectrum of in-depth analysis, proprietary data, and strategic insights covering emerging trends, regulatory impacts, and competitive intelligence within the Buy Now Pay Later arena, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report today and stay ahead of evolving market dynamics.

- How big is the Buy Now Pay Later Market?

- What is the Buy Now Pay Later Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?