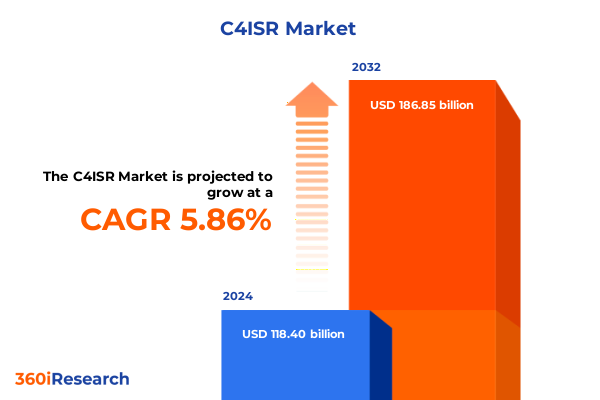

The C4ISR Market size was estimated at USD 125.24 billion in 2025 and expected to reach USD 131.58 billion in 2026, at a CAGR of 5.88% to reach USD 186.85 billion by 2032.

Setting the Stage for Next-Generation C4ISR Excellence through Comprehensive Strategic Frameworks and Emerging Technological Synergies

The modern defense landscape is undergoing rapid transformation as technological advances converge with evolving geopolitical dynamics. Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) systems have become the backbone of decision-making processes across military and security operations. These integrated capabilities enable real-time situational awareness, precise targeting, and rapid response to emerging threats. Moreover, the blurred boundaries between conventional conflict arenas and hybrid warfare contexts have elevated the strategic importance of resilient and interoperable C4ISR architectures.

Against this backdrop, this executive summary offers a concise yet thorough introduction to the critical factors shaping the C4ISR domain. The report examines how breakthroughs in artificial intelligence, autonomous platforms, and cyber-resilient networks are redefining operational paradigms. It also explores the cumulative impact of United States tariff policies implemented in 2025 on defense procurement and supply chains. By synthesizing segmentation insights across platform, component, solution, and end-user dimensions, and by highlighting key regional and corporate developments, this overview equips decision-makers with a clear line of sight into emerging opportunities and challenges. Ultimately, it lays the groundwork for strategic planning, investment prioritization, and competitive differentiation.

Navigating Transformative Shifts as Artificial Intelligence Autonomous Systems and Cyber Resilience Redefine Modern Defense Landscapes

The C4ISR landscape is being reshaped by a confluence of transformative trends that promise to redefine how defense forces plan, operate, and sustain missions. Foremost among these shifts is the integration of advanced artificial intelligence and machine learning algorithms into data fusion processes. This evolution enables autonomous threat detection and predictive modeling, reducing the human burden and accelerating decision cycles. In parallel, autonomous systems-ranging from unmanned aerial vehicles to ground and maritime drones-are increasingly interoperable with core C4ISR networks, extending sensor reach while mitigating risk to personnel.

Equally significant is the hardening of cyber-resilient architectures in response to sophisticated electronic warfare tactics. Defense organizations are investing heavily in encryption, anti-jamming technologies, and multi-domain communication links to ensure integrity and availability under contested conditions. Meanwhile, the adoption of cloud-native infrastructures and edge computing frameworks ensures that processing power and analytics capabilities are distributed across the battlespace. Taken together, these developments are driving a shift toward distributed, agile, and software-defined C4ISR systems that can adapt to rapidly evolving threat environments.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on C4ISR Procurement and Supply Chain Dynamics Across Defense Ecosystems

In 2025, the United States enacted a series of tariff adjustments targeting semiconductors, specialized optics, and high-performance communications equipment-components integral to C4ISR systems. These measures, intended to protect domestic manufacturing and secure critical supply chains, have generated cascading effects across global procurement strategies. On one hand, defense contractors and system integrators have accelerated collaboration with domestic suppliers to mitigate exposure to import duties. On the other hand, allied nations have pursued localized sourcing and co-development agreements to maintain operational readiness without incurring prohibitive costs.

Furthermore, the tariff landscape has prompted a surge in dual-use technology investments within North America, as companies seek to offset incremental expenses through diversification into commercial sectors. Yet the policy shifts have also introduced scheduling complexities for multinational programs, necessitating dynamic risk assessments and contractual realignments. Consequently, stakeholders are prioritizing supply-chain transparency, multi-tiered sourcing strategies, and inventory buffering. These adaptations underscore the resilience of the defense industrial base, while highlighting the delicate balance between national economic objectives and allied interoperability imperatives.

Uncovering Key Segmentation Insights by Platform Component Solution and End-User Perspectives Driving Investment Priorities

A nuanced examination of market segmentation reveals distinct investment patterns across platform categories. Airborne solutions remain at the forefront of innovation, driven by the proliferation of stealth reconnaissance aircraft and high-altitude unmanned systems. Simultaneously, land-based command posts and sensor networks are evolving with modular architectures that facilitate rapid deployment in austere environments. Naval platforms, for their part, are integrating multi-spectral surveillance suites and resilient communications arrays to address expanding maritime domains.

Component segmentation insights further illuminate the competitive landscape. Within hardware, communication systems, electronic warfare modules, and networking solutions are receiving elevated budgets as end users demand seamless connectivity. Services such as consulting, integration, and support have become indispensable for managing complex system upgrades and sustaining lifecycle performance. On the software front, analytics platforms, command and control applications, and specialized ISR software are increasingly designed to operate on open architectures, promoting plug-and-play interoperability. Moreover, solution categorization underscores the convergence of command and control with intelligence surveillance and reconnaissance functionalities, where intelligence analysis, reconnaissance tasking, and continuous surveillance cycles intertwine to form a cohesive operational picture. Finally, end-user segmentation highlights divergent procurement drivers: commercial sectors are harnessing C4ISR methodologies for critical infrastructure protection, defense forces are prioritizing mission-critical capability enhancements, and homeland security agencies emphasize rapid threat detection and crisis response protocols.

This comprehensive research report categorizes the C4ISR market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Component

- Solution

- End User

Distilling Critical Regional Dynamics Across the Americas Europe Middle East & Africa and Asia-Pacific Defense Innovation Hubs

The Americas region continues to anchor global C4ISR advancements through robust research and development ecosystems, led by major defense budgets and public-private collaboration models. North American defense agencies champion next-generation sensor fusion and resilient communications, while Latin American nations explore cost-effective surveillance solutions tailored to border security and disaster response. Pan-regional cooperation frameworks are gaining traction as interoperability standards evolve across multinational exercises and joint operations.

In Europe, Middle East & Africa, a mosaic of strategic drivers is at play. European Union member states are deepening defense integration under collaborative procurement programs, emphasizing sovereign capabilities in secure communications and intelligence sharing. Meanwhile, Middle Eastern governments are accelerating acquisitions of cutting-edge C4ISR platforms to address complex security challenges, from counterterrorism to maritime security. African nations, constrained by limited budgets, often pursue dual-use systems that can support both civilian infrastructure protection and military surveillance, giving rise to innovative public-sector partnerships.

Across Asia-Pacific, the competitive dynamics between major powers have injected urgency into C4ISR modernization efforts. Leading defense forces in East Asia are investing heavily in networked sensor grids, resilient satellite links, and cyber-hardened command centers. In Southeast Asia, emerging economies balance indigenous development programs with foreign partnerships to upgrade coastal surveillance and air defense systems. Australasia’s defense planners, meanwhile, focus on integrating distributed maritime domain awareness with allied interoperability protocols, reinforcing regional stability through shared technological roadmaps.

This comprehensive research report examines key regions that drive the evolution of the C4ISR market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pivotal Company Strategies and Competitive Movements Shaping the C4ISR Market through Collaborative and Proprietary Innovations

Industry leaders are advancing distinctive strategies to secure market positions and accelerate capability development. Large defense prime contractors are forging strategic alliances with specialized technology firms to integrate AI-enabled analytics and advanced sensor payloads into established C4ISR platforms. At the same time, mid-tier systems integrators are differentiating through rapid prototyping methodologies and agile delivery models, enabling faster fielding cycles and continuous software updates.

Concurrently, emerging entrants are leveraging cloud-native architectures and open-systems standards to challenge traditional value chains. These companies often partner with academia and government research labs to co-develop novel electronic warfare modules and resilient comm-links. Moreover, ecosystem collaboration is gaining momentum, as consortiums established by defense agencies bring together primes, SMEs, and non-traditional vendors to coalesce around common standards and accelerate adoption. Such competitive movements underscore the expanding complexity of the C4ISR market, where intellectual property partnerships, M&A activity, and platform-agnostic software suites are reshaping how capabilities are conceived, produced, and maintained.

This comprehensive research report delivers an in-depth overview of the principal market players in the C4ISR market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- BAE Systems plc

- CACI International Inc.

- Elbit Systems Ltd.

- General Dynamics Corporation

- Kongsberg Gruppen ASA

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Palantir Technologies Inc.

- Peraton, Inc.

- QinetiQ Group plc

- Raytheon Technologies Corporation

- Rheinmetall AG

- Thales S.A.

- The Boeing Company

Formulating Actionable Recommendations to Propel Industry Leadership in C4ISR Integration Partnerships and Capability Expansion

To maintain a competitive edge, industry leaders should accelerate the adoption of open-architecture frameworks that facilitate seamless integration of emerging sensors and software modules. By prioritizing modular system designs, organizations can reduce both upgrade cycles and sustainment costs, while enabling rapid insertion of next-generation capabilities. In addition, strengthening partnerships across the supply chain-from component manufacturers to system integrators-will enhance resilience against tariff-driven disruptions and global sourcing challenges.

Furthermore, embracing digital engineering practices, including model-based systems engineering and virtual testing environments, will shorten design-to-deployment timelines and improve interoperability validation. Organizations must also invest in talent development, equipping technical teams with expertise in AI, cybersecurity, and multi-domain operations. Finally, establishing cross-sector collaboration between defense firms and civilian technology leaders can unlock dual-use innovations, expanding market opportunities and fostering continuous improvement in C4ISR performance.

Explaining Research Methodology Combining Primary Expert Consultations and Secondary Data Analysis for Robust C4ISR Market Insights

This analysis synthesizes insights derived from a rigorous research methodology that blends primary expert consultations with comprehensive secondary data analysis. Primary input was gathered through in-depth interviews with C4ISR program managers, defense procurement officials, and leading systems architects, providing direct visibility into evolving requirements and procurement strategies. Complementing these perspectives, secondary research encompassed scrutiny of government policy documents, regulatory filings, and open-source defense journals to validate market dynamics and technology trajectories.

Additional methodological layers included the evaluation of patent trends and competitive intelligence derived from corporate annual reports, as well as the assessment of trade-show presentations and technology roadmaps published by leading suppliers. Data synthesis followed a structured framework that aligned segmentation, regional, and competitive parameters with strategic imperatives. Quality assurance measures such as cross-validation of interview findings against published sources ensured the reliability of the final insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our C4ISR market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- C4ISR Market, by Platform

- C4ISR Market, by Component

- C4ISR Market, by Solution

- C4ISR Market, by End User

- C4ISR Market, by Region

- C4ISR Market, by Group

- C4ISR Market, by Country

- United States C4ISR Market

- China C4ISR Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Perspectives and Strategic Imperatives to Capitalize on Emerging Opportunities within the Evolving C4ISR Ecosystem

The evolving C4ISR landscape presents a multitude of opportunities for organizations poised to navigate emerging technological shifts and geopolitical complexities. Breakthroughs in AI, autonomy, and cyber-hardened communications are driving a transition toward distributed, software-defined architectures capable of real-time adaptation. The 2025 tariff policies have underscored the importance of resilient supply-chain strategies and agile sourcing frameworks, while segmentation analysis has revealed clear distinctions in platform, component, solution, and end-user requirements.

Regionally, the Americas, Europe, Middle East & Africa, and Asia-Pacific each exhibit unique innovation drivers and procurement priorities, shaping competitive dynamics across national and multinational programs. Leading companies are responding through strategic alliances, open-systems approaches, and digital engineering investments. By embracing the actionable recommendations outlined above-ranging from modular designs to cross-sector talent cultivation-defense and security stakeholders can position themselves to capitalize on emerging trends. These strategic imperatives will be vital for those seeking to maintain relevance and achieve operational superiority in an increasingly contested global environment.

Taking the Next Step to Engage with Associate Director Sales & Marketing for Customized C4ISR Research and Purchasing Opportunities

To obtain the comprehensive analysis, detailed data visualizations, and strategic guidance contained within the full C4ISR market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He will provide tailored information on licensing options and advisory services to ensure that your organization secures the insights necessary for confident decision-making in an evolving defense environment.

- How big is the C4ISR Market?

- What is the C4ISR Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?