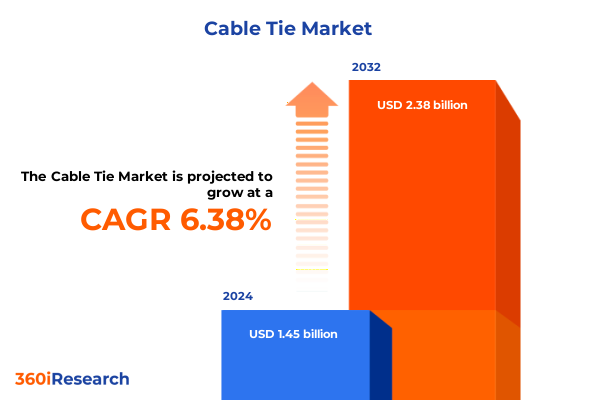

The Cable Tie Market size was estimated at USD 1.59 billion in 2025 and expected to reach USD 1.69 billion in 2026, at a CAGR of 5.91% to reach USD 2.39 billion by 2032.

Navigating the Rapidly Evolving Global Cable Tie Ecosystem: Comprehensive Overview of Market Drivers, Innovative Technologies, and New Growth Opportunities

The global cable tie ecosystem has undergone remarkable evolution, propelled by shifting industrial needs, technological advancements, and heightened focus on operational efficiency. Initially conceived as simple wire management tools, cable ties now play a critical role in diverse applications, from automotive assembly lines to data center infrastructure. Over the past decade, the proliferation of electronic devices, expansion of telecommunications networks, and the rise of renewable energy installations have driven unprecedented demand for durable and versatile fastening solutions. As a result, manufacturers have been compelled to innovate, introducing new materials, designs, and production processes to meet stringent performance and compliance standards.

Amid this dynamic backdrop, market participants are increasingly prioritizing sustainability, supply chain resilience, and digital integration. Advances in material science have enabled the development of UV-stabilized nylon and high-grade stainless steel variants, addressing the need for long-term reliability in outdoor and heavy-duty applications. At the same time, industry stakeholders are leveraging data analytics and smart manufacturing techniques to enhance quality control and optimize cost efficiency. This trend is complemented by the growing influence of regulations governing chemical composition, flammability, and environmental impact, which has elevated compliance to a strategic imperative rather than a mere operational requirement.

As we embark on this executive summary, we will explore the transformative forces reshaping the cable tie market, analyze the cascading effects of recent tariff policies, delve into nuanced segmentation insights, and outline strategic pathways for stakeholders seeking to capitalize on emerging opportunities. By synthesizing these elements, this report underscores the critical importance of agility, innovation, and strategic foresight in navigating the evolving landscape of cable tie manufacturing and distribution.

Revealing Ongoing Profound Technological, Regulatory, and Demand-Driven Transformations Reshaping the Global Cable Tie Market Landscape

Over the past several years, the cable tie landscape has experienced transformative shifts driven by breakthroughs in materials engineering, evolving regulatory frameworks, and intensified demand-side pressures. Technological innovations have accelerated the adoption of advanced polymers and metal alloys, enabling a new generation of cable ties that offer enhanced tensile strength, temperature resistance, and environmental durability. This evolution is particularly evident in applications requiring exposure to ultraviolet radiation, extreme temperatures, or corrosive substances, where UV-stabilized nylon and high-grade stainless steel have supplanted conventional designs.

Concurrently, stricter safety and environmental regulations have compelled manufacturers to reassess their production processes and raw material sourcing. Chemical restrictions under global directives and national mandates have catalyzed the use of recyclable and flame-retardant materials, prompting a shift toward greener alternatives without compromising performance. These regulatory shifts have been complemented by growing interest in circular economy principles, driving industry leaders to explore take-back programs, material recovery initiatives, and closed-loop manufacturing.

On the demand side, the proliferation of industrial automation and smart infrastructure has created new requirements for cable management solutions that integrate seamlessly with sensor networks and intelligent systems. Procurement strategies are increasingly data-driven, emphasizing supplier transparency, traceability, and digital compatibility. As a result, distributors and end users are gravitating toward suppliers capable of offering value-added services, from real-time inventory monitoring to digital ordering platforms. Taken together, these technological, regulatory, and demand-driven transformations are redefining competitive dynamics and setting the stage for sustained innovation in the global cable tie market.

Assessing the Comprehensive Cumulative Impact of United States 2025 Tariffs on Supply Chains, Pricing Strategies, and Competitiveness in the Cable Tie Market

In 2025, the imposition of additional United States tariffs on key raw materials and imported components has had a profound cumulative impact on the cable tie industry. Tariffs targeting polymers such as nylon and polypropylene elevated input costs, compelling manufacturers to reassess their sourcing strategies and renegotiate supplier contracts. This recalibration has led to a marked shift away from certain overseas suppliers, accelerating the diversification of supply chains and the establishment of regional production hubs in North America and Asia.

These tariff measures have introduced greater volatility into pricing strategies across the value chain. Original equipment manufacturers and distributors have implemented tiered pricing models to accommodate cost fluctuations, while some producers have absorbed parts of the tariff burden to preserve market share. Simultaneously, buyers in price-sensitive segments have increased their focus on total cost of ownership, evaluating factors such as logistics, lead times, and risk exposure in addition to unit price.

Beyond pricing adjustments, the tariff-driven realignment has influenced capital investment and capacity expansion decisions. Several players have accelerated the modernization of domestic manufacturing facilities, investing in automation and advanced extrusion technologies to reduce per-unit production costs. At the same time, the strategic imperatives of hedging against future trade policy uncertainty have underscored the importance of agile supply networks and closer partnerships with raw material suppliers. Ultimately, the 2025 tariff landscape has reinforced the critical role of strategic procurement, operational flexibility, and proactive scenario planning in maintaining competitive positioning.

Leveraging Multi-Dimensional Segmentation Insights to Decode Material, Type, Size, Application, and End-Use Industry Dynamics in Cable Tie Market

Material segmentation reveals that the cable tie market is studied across nylon, polypropylene, and stainless steel, with nylon further subcategorized into both standard and UV-stabilized variants, while stainless steel offerings consist of the 304 grade and 316 grade formats. These material distinctions serve as a foundation for performance-driven decision making, as product designers and end users weigh factors such as temperature resilience, chemical resistance, and tensile strength against cost considerations.

Type-based segmentation encompasses heavy duty, releasable, screw mount, and standard variants, each tailored to specific application requirements. This typology reflects the industry’s response to evolving installation environments that range from high-vibration machinery settings to temporary bundling scenarios in field service contexts. The diverse type portfolio allows stakeholders to align product selection with application-critical parameters such as reusability and load-bearing capacity.

From a dimensional perspective, segmentation by size includes 150 to 300 millimeter, 300 to 500 millimeter, above 500 millimeter, and up to 150 millimeter ranges, accommodating a spectrum of bundling and securing needs. These size categories are essential for specifying optimal bundle diameters in sectors that require precise cable management, such as automotive harnessing and data center cabling. Accuracy in size selection contributes to both installation efficiency and long-term reliability.

Application segmentation spans bundling, fixing, harness protection, identification, and organizing functions, underscoring the cable tie’s versatility beyond mere wire consolidation. Bundling remains a core use, but protective and identification roles have gained prominence as systems become more complex and demand clearer maintenance protocols. Lastly, the end-use industry segmentation highlights automotive, construction, electrical and electronics, and telecommunication sectors, each exhibiting unique growth drivers-such as vehicle electrification in automotive and network expansion in telecommunications-that shape product specifications and supply chain strategies.

This comprehensive research report categorizes the Cable Tie market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Length

- Coating Type

- End Use Industry

- Distribution Channel

Unraveling Regional Dynamics in Americas, Europe Middle East and Africa, and Asia-Pacific to Drive Strategic Regional Prioritization for Cable Tie Stakeholders

The Americas region continues to serve as a powerhouse for cable tie innovation and consumption, driven by robust automotive and telecommunications sectors in North America and expanding infrastructure projects in Latin America. Manufacturers in this region benefit from proximity to key end users and streamlined logistics networks, enabling rapid delivery and responsive supply chain management. Adoption of high-performance materials and value-added services, such as just-in-time delivery and on-site customization, has elevated customer expectations and intensified competitive dynamics.

In Europe, Middle East, and Africa, regulatory rigor and sustainability standards shape market development. Stringent chemical usage directives and environmental mandates have prompted suppliers to pioneer recyclable and low-emission material solutions. Concurrently, emerging construction and energy projects across the Middle East and Africa have spurred increased demand for heavy duty and corrosion-resistant stainless steel cable ties, with the EMEA region’s diverse climate conditions necessitating greater product adaptability.

Asia-Pacific remains the fastest-growing region, underpinned by rapid industrialization, urbanization, and the proliferation of digital infrastructure. Southeast Asia’s manufacturing hubs and China’s expansive production base continue to drive cost efficiencies, while markets such as India and Australia exhibit rising demand for application-specific cable ties, particularly in harness protection and identification. Regional trade agreements and investment in advanced manufacturing technologies are further enhancing the competitiveness of Asia-Pacific suppliers on the global stage.

This comprehensive research report examines key regions that drive the evolution of the Cable Tie market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading Cable Tie Manufacturers and Suppliers in a Rapidly Evolving Market

Leading cable tie manufacturers have intensified their focus on strategic initiatives to maintain and expand market leadership amid evolving competitive pressures. One prominent player has accelerated its development of high-performance polymer compounds, integrating UV stabilizers and flame-retardant additives to meet rigorous standards across multiple end-use industries. At the same time, a global conglomerate expanded its stainless steel portfolio by introducing a new 316 grade variant specifically designed for offshore energy applications, signaling a commitment to niche market segments requiring extreme corrosion resistance.

Another key participant has leveraged digital platforms to enhance customer engagement, rolling out an integrated e-commerce portal that offers real-time inventory visibility and predictive restocking alerts for large-scale industrial clients. This digital transformation has been complemented by strategic partnerships with raw material suppliers to secure preferential pricing and ensure supply continuity. A different industry leader has pursued targeted acquisitions of regional specialty distributors, reinforcing its footprint in high-growth markets while diversifying its product mix to include releasable and screw mount cable tie variants.

Across the board, those companies with robust R&D pipelines, agile manufacturing capabilities, and comprehensive value-added services are best positioned to respond to shifting customer requirements and regulatory demands. As competition intensifies, strategic collaboration, vertical integration, and investment in sustainable materials and processes will be key differentiators that define the next wave of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cable Tie market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- HellermannTyton

- Panduit Corp

- Avery Dennison Corporation

- 3M Company

- ABB Ltd

- SapiSelco Srl

- Hua Wei Industrial Co Ltd

- Legrand Group

- Phoenix Contact

- Advanced Cable Ties Inc

- Amphenol Corporation

- Belden Inc

- Cable Ties Unlimited

- Cobra Products Inc

- DIFVAN

- Essentra plc

- Fujikura Ltd

- ITW Group

- KSS KAI SUH SUH ENTERPRISE CO LTD

- Nexans

- NORMA Group SE

- Partex Marking Systems AB

- Prysmian Group

- RS Components Ltd

- Southwire Company LLC

- Sumitomo Electric Industries

- TE Connectivity Ltd

Driving Growth Through Actionable Strategic Recommendations for Cable Tie Industry Leaders to Accelerate Innovation and Improve Operational Excellence

Industry leaders should prioritize the integration of sustainable material alternatives into their core product lines by collaborating with polymer specialists and leveraging circular economy frameworks. This approach not only addresses evolving regulatory requirements but also resonates with end users seeking lower environmental impact and transparent supply chains. By establishing take-back programs and material recovery partnerships, companies can differentiate their offerings while reducing raw material dependency.

Another critical recommendation is to diversify procurement channels and develop multi-regional supplier networks to hedge against trade policy volatility. Investing in regional manufacturing capabilities, particularly in under-served markets, can mitigate logistical complexities and strengthen responsiveness to local demand fluctuations. Operational agility can be further enhanced through the adoption of advanced extrusion technologies and modular production lines that facilitate rapid product changeovers and scale adjustments.

Moreover, stakeholders should embrace digital transformation across the value chain, implementing IoT-enabled quality monitoring and cloud-based inventory management solutions. Such tools improve forecasting accuracy, reduce stockouts, and enable data-driven decision making. Concurrently, a focus on customer-centric business models-such as offering custom design services, technical training, and digital after-sales support-will deepen client relationships and unlock premium revenue streams. By executing these strategic imperatives, industry players can accelerate innovation, enhance operational resilience, and secure sustainable competitive advantages.

Detailing Rigorous Research Methodology and Analytical Frameworks Employed to Ensure Accuracy, Reliability, and Comprehensive Insights in Cable Tie Market Study

The research methodology underpinning this analysis rests on a structured combination of primary and secondary approaches, designed to ensure comprehensive coverage and rigorous validation of findings. Primary research included in-depth interviews with senior executives across manufacturing, distribution, and end-use segments, providing qualitative perspectives on market drivers, technology adoption, and regulatory impacts. These expert insights were augmented by a quantitative survey of procurement professionals to capture real-world purchasing behaviors and prioritization criteria.

Secondary research involved systematic examination of industry publications, regulatory databases, technical standards, and open-source data repositories. Cross-verification of secondary data points through triangulation enhanced the accuracy of the analysis, while comparative benchmarking against analogous metal and polymer fastener markets provided contextual depth. A detailed vendor profiling framework was employed to assess competitive positioning, innovation capability, and strategic initiatives of leading market participants.

Data synthesis and analysis were conducted using advanced statistical tools and custom-built analytical models, enabling segmentation, trend mapping, and scenario planning. The research process adhered to best-practice guidelines for market intelligence, emphasizing data integrity, transparency of sources, and methodical documentation. This methodological rigor ensures that the insights presented herein reflect both current market realities and future-oriented perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cable Tie market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cable Tie Market, by Type

- Cable Tie Market, by Material

- Cable Tie Market, by Length

- Cable Tie Market, by Coating Type

- Cable Tie Market, by End Use Industry

- Cable Tie Market, by Distribution Channel

- Cable Tie Market, by Region

- Cable Tie Market, by Group

- Cable Tie Market, by Country

- United States Cable Tie Market

- China Cable Tie Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Synthesizing Key Insights and Strategic Implications to Drive Informed Decision-Making and Sustainable Competitive Advantage in the Cable Tie Industry

This report has synthesized critical insights into the evolving cable tie market, highlighting the intersection of material innovation, regulatory dynamics, and shifting end-user requirements. By examining the cumulative effects of recent tariff policies, stakeholders gain clarity on how supply chain realignments and pricing strategies are reshaping competitive landscapes. The segmentation analysis provides a granular understanding of material, type, size, application, and industry-specific drivers, enabling more precise targeting and product development.

Regional insights underscore the importance of tailoring strategies to the distinct characteristics of the Americas, EMEA, and Asia-Pacific markets, each exhibiting unique growth trajectories and regulatory landscapes. Furthermore, the competitive review of key industry players illuminates strategic initiatives that are setting new benchmarks in sustainability, digital integration, and customer engagement. These findings collectively form a roadmap for decision-makers to prioritize investments, optimize operations, and cultivate resilience in the face of ongoing market volatility.

Ultimately, success in the cable tie industry will hinge on agility, foresight, and a relentless commitment to innovation. By embracing sustainable materials, diversifying supply chains, and leveraging digital capabilities, companies can secure enduring competitive advantages and drive long-term growth. The insights and recommendations presented herein provide a comprehensive blueprint for industry leaders to navigate the complexities of the market and capitalize on emerging opportunities.

Take Action Now to Secure Comprehensive Cable Tie Market Intelligence and Strategic Edge by Connecting with Ketan Rohom for Personalized Insights and Offers

Unlock unparalleled strategic advantage and clarity by partnering directly with Ketan Rohom, Associate Director of Sales and Marketing, to secure your tailored cable tie market research report. He will guide you through customized research options, provide detailed insights aligned with your unique business objectives, and offer exclusive packages designed to accelerate decision-making. Reach out to initiate a collaborative dialogue that will empower your team with actionable intelligence, ensuring you stay ahead of industry shifts and emerging opportunities. Don’t miss the opportunity to transform your market strategy-connect with Ketan today and take the first step toward informed growth and competitive leadership.

- How big is the Cable Tie Market?

- What is the Cable Tie Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?