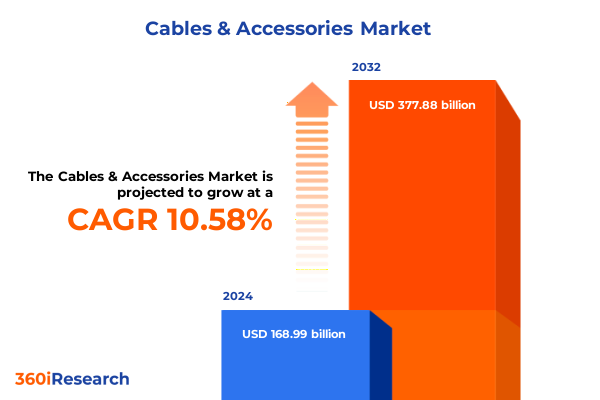

The Cables & Accessories Market size was estimated at USD 185.77 billion in 2025 and expected to reach USD 204.22 billion in 2026, at a CAGR of 10.67% to reach USD 377.88 billion by 2032.

Introduction to the Evolving Cables and Accessories Market Landscape Amidst Accelerating Connectivity Demands and Technological Advancements

Cables and accessories have evolved into the invisible backbone of modern connectivity, facilitating the seamless transmission of data, power, and signals across every corner of the globe. Submarine communication cables, responsible for over ninety-nine percent of international internet traffic, underscore the critical role that cable infrastructure plays in underpinning global digital systems, from financial networks to streaming platforms. On land, the rapid proliferation of data centers-propelled by the exponential growth of artificial intelligence workloads and remote collaboration tools-has driven unprecedented demand for high-performance optical fiber and copper solutions to support low-latency, high-bandwidth requirements.

At the same time, network densification for fifth-generation mobile services and the expansion of broadband access in underserved regions have placed new performance benchmarks on cable technologies. Providers are under pressure to deliver compact form factors that can endure harsh environmental conditions, while maintaining reliability over extended service lifecycles. As a result, cabling systems are transitioning from static conduits to “smart” infrastructures equipped with embedded sensors for real-time condition monitoring and predictive maintenance capabilities. These converging dynamics paint a portrait of an industry in flux, where innovation, resilience, and strategic foresight have become indispensable for market leadership.

How Digitalization Industry 4.0 Integration and Sustainable Innovations Are Driving Transformative Shifts in the Cables and Accessories Ecosystem

The cables and accessories landscape is experiencing transformative shifts driven by digitalization across all industry verticals, challenging traditional design and deployment paradigms. Manufacturers are integrating next-generation fiber optic technologies to meet the insatiable appetite for bandwidth and ultra-low latency, particularly in data-intensive environments like hyperscale data centers and cloud service networks. Similarly, IoT ecosystems in smart manufacturing and building automation have heightened the need for robust, flexible cabling systems that can support frequent motion while preserving signal integrity.

Simultaneously, renewable energy expansions and grid modernization initiatives are redefining power transmission requirements, prompting cable specialists to engineer high-voltage solutions that can withstand elevated thermal and mechanical stresses. Offshore wind megaprojects and cross-border interconnector programs underscore the push toward sustainable energy infrastructures, where undersea power cables and specialized high-voltage connectors play a pivotal role in balancing supply and demand across regions. Moreover, heightened regulatory scrutiny for national security has led to proposals barring foreign-critical technology in submarine cable deployments, illustrating how policy evolution can rapidly reshape infrastructure priorities.

Analyzing the Aggregate Effects of Revised U.S. Trade Policies and Tariff Measures on Cables and Connectivity Component Supply Chains in 2025

The United States’ recalibrated tariff regime in 2025 has introduced layered duties on a spectrum of cable assemblies and constituent components, directly impacting global supply chains and landed costs. Under Section 301 reviews, the USTR harmonized steel wire and wire products at a uniform twenty-five percent duty, encompassing critical inputs used in power, control, and fiber optic cable manufacturing. Concurrently, the suspension of country-specific ad valorem tariffs under Executive Order 14257 replaced previous arrangements with a universal ten percent duty on most imports, excluding China, while China, Hong Kong, and Macau faced reciprocal ad valorem rates of one hundred and twenty-five percent on April 10, 2025.

These duty layers have catalyzed a strategic pivot among OEMs and distributors toward nearshoring and multi-regional procurement, as companies seek to mitigate margin compression and safeguard project timelines. Telecommunications operators recalibrating fiber rollout budgets, along with data center developers adjusting capital allocations, have both encountered direct cost escalations that spur alternate sourcing scenarios. In response, domestic capacity expansions and automation investments have accelerated, aiming to localize production and stabilize pricing. The cumulative impact of these policy measures underscores the imperative for dynamic tariff monitoring and agile trade-compliance practices in an era of geopolitical trade realignment.

Unveiling Strategic Segmentation Insights Across Cable Types End Users Applications Distribution Channels and Connector Variants for Market Clarity

Insights drawn from cable type segmentation reveal that fiber optic cabling, particularly single-mode architectures, is gaining traction in next-generation networks that demand higher bandwidth and longer transmission distances. Within the copper cable segment, power cables in grid and industrial applications have seen increasing deployment as legacy infrastructure undergoes digital upgrades, while coaxial variants serve niche broadcasting and surveillance use cases with cost-effective signal distribution.

End-user segmentation highlights that the industrial sector, spanning energy, manufacturing, mining, and oil and gas, continues to drive demand for ruggedized cables capable of withstanding harsh environmental conditions, whereas the automotive domain embraces specialized connectivity solutions for electric vehicle charging and in-vehicle data networks. Commercial environments-from education and healthcare to hospitality and retail-prioritize structured cabling systems that support converged data and power delivery in smart buildings and campuses.

Application-based analysis underscores that data transmission and telecommunication deployments, inclusive of long-haul, short-haul, wired, and wireless segments, dominate demand due to the proliferation of cloud services, 5G infrastructure, and enterprise networking. In parallel, industrial automation applications, featuring both factory automation and process control, are leveraging high-performance cables with enhanced shielding and reduced EMI to support real-time analytics and machine-to-machine communications.

Distribution channel dynamics point to a balanced interplay between direct sales models-via company websites and field engagement-and third-party networks, encompassing OEM partnerships, offline distributors (retailers and wholesalers), and online retail channels including e-commerce platforms and marketplaces. Finally, connector type specialization, across F-type, LC, RJ45, and SC variants, complements system-level requirements by ensuring optimal signal integrity, ease of installation, and compliance with evolving interface standards.

This comprehensive research report categorizes the Cables & Accessories market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cable Type

- Connector Type

- End User

- Application

- Distribution Channel

Examining Distinct Regional Dynamics in the Americas Europe Middle East Africa and Asia Pacific That Shape the Global Cables and Accessories Market Trajectory

In the Americas, infrastructure revitalization programs fueled by federal incentives and the Inflation Reduction Act have spurred demand for power cabling in renewable energy and grid modernization projects. Domestic manufacturers of high-voltage and medium-voltage cables are expanding capacity to meet localized content requirements, while telecommunication operators accelerate fiber-to-the-home deployments across suburban and rural markets to bridge the digital divide.

Europe, Middle East, and Africa are witnessing a confluence of decarbonization efforts and digital transformation initiatives. Major utilities in France have secured multi-billion-euro cable supply agreements with European producers to support underground and offshore grid expansions, reinforcing the strategic importance of locally manufactured fiber optic and power cables. Concurrent regulatory actions, such as proposed restrictions on Chinese technology in submarine cable networks by the U.S. FCC, also influence regional project specifications and sourcing criteria.

The Asia-Pacific region remains a focal point for undersea fiber-optic connectivity and data center growth, with consortiums in Singapore and Vietnam exploring direct cable links to enhance capacity for AI-driven services and cloud infrastructure. Regional governments continue to invest in smart city frameworks and renewable energy corridors, generating robust pipelines for cable accessories that support high-voltage transmission, medium-voltage distribution, and advanced telecommunications backhaul networks.

This comprehensive research report examines key regions that drive the evolution of the Cables & Accessories market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Player Strategies and Performance Trends Demonstrated by Leading Cable and Connectivity Component Manufacturers in a Competitive Landscape

CommScope’s first-quarter 2025 performance showcased significant year-over-year growth, with net sales surpassing one-point-one billion dollars and adjusted EBITDA margins expanding to twenty-two percent. The company attributed this improvement to strategic price management and a diversified global manufacturing footprint, which provided resilience amid tariff fluctuations and supply chain constraints.

Corning has leveraged surging demand for optical connectivity in AI and 5G network rollouts, reporting a one-hundred-six percent increase in its enterprise optical communications segment in Q2 2025. The company’s Springboard plan, emphasizing new product introductions and capacity expansion, underscores a commitment to capturing growth in high-value markets such as data center interconnects and edge computing equipment.

European leaders like Nexans and Prysmian have sharpened their focus on grid modernization and offshore wind applications, with Nexans outlining over one-point-two billion euros in capital expenditures through 2028 to support clean energy transitions. Prysmian’s diversified portfolio, spanning high-voltage subsea and low-voltage building cabling, has proven advantageous amid shifting policy environments, allowing it to allocate European production to global projects while mitigating potential U.S. policy headwinds.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cables & Accessories market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Belden, Inc.

- CommScope, Inc.

- Eaton Corporation plc

- Elsewedy Electric Co. S.A.E.

- Furukawa Electric Co., Ltd.

- Lapp Group GmbH

- Leoni AG

- LS Cable & System Ltd.

- Nexans S.A.

- NKT A/S

- Prysmian S.p.A.

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

Crafting Actionable Strategic Imperatives for Industry Leaders to Navigate Technological Disruption Supply Chain Complexities and Emerging Market Opportunities

Industry leaders should prioritize the diversification of their manufacturing and sourcing footprints to reduce exposure to concentrated tariff regimes and geopolitical risks. By establishing nearshore assembly operations and fostering strategic partnerships with regional suppliers, companies can maintain operational agility and protect profit margins.

Embracing advanced cable technologies such as bend-insensitive fiber optics, low-halogen insulation, and integrated monitoring capabilities will create differentiated solutions for high-growth segments including edge computing, renewable energy transmission, and industrial automation. Investing in R&D to validate recyclable materials and circular-economy processes will align product portfolios with evolving regulatory standards and customer sustainability mandates.

Building robust digital platforms for distributor engagement and end-user service delivery can enhance supply chain transparency and support tailored configurations for specialized applications. Leveraging analytics for predictive inventory management will mitigate lead-time risks, while cross-functional collaboration in product development will accelerate time-to-market for next-generation connectivity components.

Outline of Rigorous Research Methodology Employed to Derive Insights via Primary Interviews Secondary Research and Comprehensive Data Analysis Frameworks

This study triangulated insights through a multi-tiered research framework combining primary interviews with industry stakeholders and secondary research across reputable regulatory announcements, corporate disclosures, and trade association publications. Primary data collection involved structured discussions with cable manufacturers, distributors, and end-use customers to validate market drivers and operational challenges experienced under 2025 tariff provisions.

Secondary research encompassed analysis of governmental and regulatory documentation, including USTR and FCC notices, complemented by review of press reports and financial disclosures from leading firms. Quantitative data were normalized to align tariff classification codes and applied to project potential supply chain cost impacts, while qualitative inputs informed the segmentation narratives and regional trend assessments.

All findings were subjected to cross-validation through a data synthesis process, ensuring consistency and reliability. Final insights reflect an objective integration of technical, economic, and policy dimensions to deliver a comprehensive executive summary tailored for strategic decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cables & Accessories market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cables & Accessories Market, by Cable Type

- Cables & Accessories Market, by Connector Type

- Cables & Accessories Market, by End User

- Cables & Accessories Market, by Application

- Cables & Accessories Market, by Distribution Channel

- Cables & Accessories Market, by Region

- Cables & Accessories Market, by Group

- Cables & Accessories Market, by Country

- United States Cables & Accessories Market

- China Cables & Accessories Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Summarizing Critical Insights and Concluding Reflections on the Future Outlook of the Cables and Accessories Industry Amid Global Transformations

The global cables and accessories sector stands at an inflection point, navigating a landscape shaped by high-speed network demands, sustainability imperatives, and evolving trade policies. By integrating advanced materials, intelligent monitoring, and diversified sourcing strategies, stakeholders can transform these challenges into competitive advantages.

Companies that align their technological roadmaps with regulatory shifts-anticipating tariff changes and national security requirements-will maintain supply chain resilience and capitalize on market openings. Regional variations in demand underscore the importance of localized strategies, whether it involves expanding capacity for grid and renewable applications in Europe or supporting undersea data connectivity in the Asia-Pacific corridor.

Ultimately, success in this dynamic environment hinges on proactive innovation, agile operations, and data-driven decision-making. Firms that invest in next-generation cable solutions and embrace circular-economy models will be best positioned to lead the market as connectivity becomes ever more critical to global economic growth.

Connect with Associate Director of Sales and Marketing to Secure Your Comprehensive Cables and Accessories Market Intelligence Report Today

To obtain a detailed, authoritative market research report that unpacks the complexities of the global cables and accessories sector, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the report’s key findings and tailor the intelligence to your strategic needs, ensuring you gain a competitive advantage. Secure your copy today to stay ahead in an evolving connectivity landscape and make informed decisions backed by rigorous analysis.

- How big is the Cables & Accessories Market?

- What is the Cables & Accessories Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?