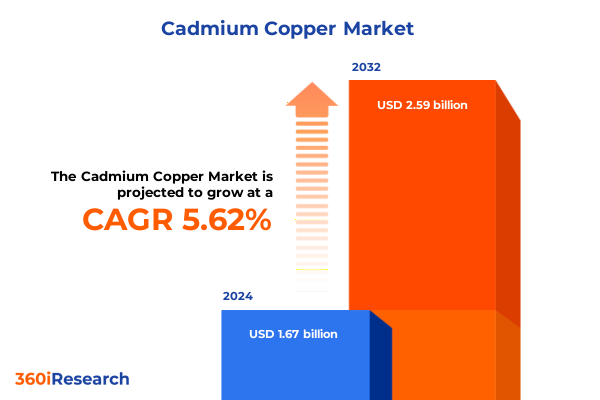

The Cadmium Copper Market size was estimated at USD 1.76 billion in 2025 and expected to reach USD 1.85 billion in 2026, at a CAGR of 5.69% to reach USD 2.59 billion by 2032.

Comprehensive orientation to cadmium copper essentials that aligns metallurgical properties, supply chain realities, and engineering priorities to inform executive material choices

Cadmium copper occupies a distinctive niche in the portfolio of conductive and corrosion-resistant materials due to its combination of mechanical resilience, thermal conductivity, and wear resistance. This executive synthesis frames the material’s technical attributes alongside prevailing supply chain dynamics to inform executive decision-making across procurement, engineering, and compliance functions. The analysis places equal emphasis on metallurgical behavior, downstream manufacturing implications, and end-use performance expectations, thereby creating a bridge between laboratory characteristics and fielded reliability requirements.

Throughout the following sections, the reader will find structured insights into shifting demand drivers, policy influences, and segmentation-specific considerations that affect selection, sourcing, and qualification cycles. The introduction also outlines the methodological approach used to compile primary intelligence and secondary corroboration, ensuring stakeholders understand the provenance of key observations and the practical constraints that inform recommendations. This orientation prepares leaders to navigate trade policy changes, evolving application demands, and supplier consolidation without losing sight of technical fit and lifecycle performance.

How regulatory scrutiny, alloy innovation, and supply chain reconfiguration are reshaping cadmium copper selection, qualification, and sourcing priorities for manufacturers

The landscape for cadmium copper is undergoing a sequence of transformative shifts driven by changes in regulatory scrutiny, alloy engineering, and application-level performance expectations. Regulatory bodies are increasingly attentive to heavy-metal content in components, prompting manufacturers to reevaluate material formulations and invest in substitution strategies while balancing performance trade-offs. Concurrently, advances in specialty alloy development and surface treatments have expanded the feasible application envelope, enabling cadmium-bearing copper alloys to meet tighter electrical contact and wear requirements in demanding environments.

Supply chain configuration is also evolving; upstream consolidation among feedstock suppliers and regional trade realignments have made lead-time management and supplier qualification more central to risk mitigation. At the same time, digitization of material specifications and tighter integration between design and procurement functions are accelerating adoption cycles for alternative formulations and coated products. Taken together, these shifts create both pressure and opportunity: companies that proactively integrate regulatory foresight, alloy optimization, and supplier resilience into product roadmaps will capture performance advantages while maintaining compliance and continuity of supply.

Assessment of the layered operational and strategic consequences of the 2025 United States tariff actions on cadmium copper procurement, supplier diversification, and compliance posture

The tariff environment implemented by the United States in 2025 has produced layered effects across cost structures, procurement strategies, and regional sourcing decisions for cadmium copper stakeholders. At the transactional level, increased duties on select import lines shifted short-term purchasing patterns as buyers weighed landed cost against qualification timelines, especially for components where requalification imposes high engineering or safety overhead. In response, some firms accelerated qualification of domestic or regional suppliers to contain total landed cost volatility, while others extended inventory buffers to smooth production continuity during the initial adjustment period.

Beyond immediate purchasing behavior, the tariff changes prompted strategic reassessments of supply chain topology. Manufacturers with global footprints rebalanced sourcing to favor lower-tariff jurisdictions or to develop local content where feasible, and procurement teams intensified supplier diversification efforts to mitigate concentration risk. Compliance teams also expanded tariff classification reviews and engaged customs counsel to optimize duties through legitimate product classification and origin documentation. In parallel, manufacturers with vertically integrated capabilities explored in-house alloy production and closer collaboration with recyclers to reduce exposure to import-related cost shocks. Moving forward, the cumulative impact of these policy shifts is likely to remain a function of enforcement posture, reciprocal trade measures, and the pace at which alternative sourcing and substitution pathways are implemented.

Holistic segmentation-driven insights that connect product forms, purity levels, alloy formulations, manufacturing processes, and end-use criteria to procurement and qualification imperatives

A rigorous segmentation lens reveals distinct decision criteria and risk profiles across product forms, purity classes, alloy compositions, applications, end-use industries, manufacturing routes, mechanical conditions, surface finishes, packaging formats, sales channels, and customer types. Product type segmentation distinguishes foil, granules, ingot, powder, rod and bar, sheet and plate, strip, and wire, with rod and bar encompassing flat bar and round rod, sheet and plate differentiated into plate and sheet, strip subdivided into cut-to-length and strip coil, and wire including coated wire, solid wire, and stranded wire; each form imposes unique downstream processing and handling requirements that influence supplier selection and logistics. Purity grade considerations range from commercial grade and high purity to recycled or secondary grade, with purity directly affecting electrical performance, solderability, and compatibility with surface treatments.

Alloy composition drives functional performance, with high, medium, and low cadmium content variants serving different balances of conductivity, hardness, and wear resistance, and specialty alloys-such as copper with additive elements and custom alloy formulations-supporting tailored application needs. Application segmentation covers brazing and soldering, contact brushes and slip rings, electrical contacts and connectors, heat transfer components, radiation shielding for specialty use, resistance welding electrodes, and springs and fasteners; each application imposes qualification regimes, lifecycle expectations, and inspection criteria that shape procurement cycles. End-use industries span aerospace and defense, automotive, consumer electronics, electrical and electronics, industrial manufacturing, marine and offshore, and telecommunications, where regulatory compliance, traceability, and long-term reliability requirements differ markedly.

Manufacturing process choices-casting, drawing, electroforming and plating, extrusion, forging, powder metallurgy, and rolling-affect microstructure, surface integrity, and tolerances, with casting further subdivided into continuous and ingot casting, extrusion into direct and indirect types, and rolling into cold and hot rolling techniques. Temper and mechanical condition options such as annealed, cold worked, hard drawn, and precipitation hardened determine formability and springback behavior. Surface treatment decisions between passivated, plated or coated, polished or finished, and uncoated surfaces, with plated/coated variants including nickel, silver, and tin, influence corrosion resistance and contact performance. Packaging modalities range from bars and rods, coils and spools, custom packaging, cut lengths, to drums and boxes, while sales channels include direct sales, distributors and wholesalers, online marketplaces, original equipment manufacturers, and service centers. Lastly, customer type segmentation separates aftermarket and repair, original equipment manufacturers, research and laboratories, and tier suppliers, each with distinct procurement cadences, quality assurance expectations, and contract structures.

These segmentation dimensions intersect to form practical roadmaps for product qualification, supplier audits, and lifecycle management. For instance, a high-purity, silver-plated stranded wire used in aerospace will trigger an entirely different supplier validation process and documentation set than a recycled-grade cut-to-length strip intended for general industrial springs. Recognizing these nuanced intersections enables engineering and procurement teams to tailor specification language, inspection protocols, and contract terms to the actual risk and performance envelope required by the application.

This comprehensive research report categorizes the Cadmium Copper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Alloy Composition

- Manufacturing Process

- Surface Treatment

- Packaging

- Application

- End Use Industry

Regionally attuned sourcing and qualification strategies that align the Americas, Europe Middle East and Africa, and Asia-Pacific strengths with application-specific performance and compliance needs

Regional dynamics continue to exert a decisive influence on sourcing strategies, regulatory exposure, and supplier specialization. In the Americas, a combination of domestic capacity, established recycling networks, and proximity to large industrial end users supports quicker response times and simplified logistics for many buyers. However, regional policy shifts and tariff measures can create episodic cost volatility and necessitate closer supplier performance monitoring, as well as the development of contingency plans that prioritize continuity for critical applications.

Europe, the Middle East & Africa present a heterogeneous environment in which rigorous environmental and chemical compliance regimes coexist with high-value application demand from aerospace, defense, and advanced manufacturing sectors. This region’s emphasis on traceability and documentation drives extensive supplier qualification and certification requirements, while the presence of specialist alloy producers and surface-treatment houses offers opportunities for collaboration on high-performance components. In contrast, Asia-Pacific remains a manufacturing powerhouse with deep processing capability, competitive cost structures, and a dense supplier ecosystem capable of producing a wide range of product forms and alloy variants. The region’s strength in high-volume production and integrated supply chains continues to attract large OEMs, although buyers must navigate variable regulatory regimes and evolving labor and environmental expectations.

Taken together, these regional characteristics suggest that multiregional sourcing strategies, coupled with rigorous supplier qualification and enhanced visibility into origin and process controls, will remain essential. Companies that align regional capabilities to application needs-leveraging proximity for just-in-time critical components while using global partners for specialized alloys and surface finishes-will be best positioned to manage cost, compliance, and performance simultaneously.

This comprehensive research report examines key regions that drive the evolution of the Cadmium Copper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive and capability-focused company insights revealing how metallurgical expertise, digital traceability, and service integration drive supplier differentiation and customer retention

Competitive dynamics among manufacturers and suppliers continue to be shaped by technological differentiation, vertical integration, and service-oriented value propositions. Leading producers distinguish themselves through deep metallurgical expertise, robust quality management systems, and capabilities in specialty surface treatments and custom alloy formulations that shorten qualification cycles for demanding customers. At the same time, smaller niche producers compete by offering rapid prototyping, flexible batch sizes, and close co-development partnerships that are particularly valuable for high-mix, low-volume applications.

Across the supply base, investment in digital traceability and material passports is becoming a differentiator for companies that serve regulated industries. Firms that can demonstrate consistent documentation of composition, processing history, and surface treatments are securing longer-term engagements with customers that prioritize lifecycle assurance. Additionally, service integration-such as kitting, just-in-sequence deliveries, and technical support for application testing-creates stickiness and can offset pure price competition. Strategic partnerships between alloy producers and downstream fabricators are also emerging, enabling faster ramp-up for new product introductions and tighter alignment between material performance and component design requirements. In this environment, companies that combine technical leadership, quality rigor, and customer-focused logistics will maintain competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cadmium Copper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aviva Metals, Inc.

- China Minmetals Corporation

- Dowa Metals & Mining Co., Ltd.

- Hindustan Zinc Limited

- Korea Zinc Co., Ltd.

- Materion Corporation

- Mitsui Mining & Smelting Co., Ltd.

- Nyrstar NV

- Teck Resources Limited

- Vedanta Resources Limited

- Xinjiang Nonferrous Metal Industry (Group) Co., Ltd.

Actionable operational and commercial steps for manufacturers to secure supply resilience, accelerate qualification of alternatives, and institutionalize material governance practices

Industry leaders must act with urgency to translate insights into operational moves that secure supply continuity, ensure regulatory compliance, and preserve performance integrity. First, establishing multi-tier supplier portfolios that combine local capacity for critical fast-turn components with specialized regional partners for complex alloy and surface-treatment requirements will reduce exposure to tariff-induced disruptions and single-source failure. Second, firms should accelerate qualification pathways for approved alternative alloys and coated variants, investing in standardized test protocols, cross-functional sign-off processes, and pre-approved supplier lists to shorten time-to-production when substitution becomes necessary.

Operationally, companies should expand their material governance capabilities by implementing digital material passports, tighter incoming inspection regimes, and expanded traceability for recycled feedstock. This will support compliance reporting and provide the documentation auditors and OEMs increasingly demand. From a product strategy perspective, embedding design-for-material considerations into early-stage engineering decisions will enable more resilient component architectures that tolerate material substitutions without performance degradation. Finally, commercial teams should renegotiate contract terms to include flexible volume commitments, price adjustment clauses tied to cost indices, and collaborative inventory arrangements with key suppliers. By combining these steps, organizations can reduce procurement friction, maintain performance standards, and respond nimbly to policy or market disruptions.

Transparent synthesis of primary interviews, technical literature, and supplier due-diligence methods designed to validate material performance, compliance, and supply chain resilience observations

This research synthesizes qualitative primary interviews, technical literature review, and targeted supplier due-diligence to deliver a comprehensive view of cadmium copper dynamics. Primary input was gathered through structured interviews with metallurgists, procurement leads, compliance officers, and application engineers across multiple end-use industries to capture first-hand perspectives on specification drivers, qualification hurdles, and supplier capabilities. Secondary corroboration drew on peer-reviewed metallurgical studies, standards documentation, and publicly available regulatory materials to validate technical assertions and to ensure consistency with current compliance frameworks.

Analytical methods include cross-segmentation mapping to identify high-risk intersections of product form, alloy composition, and end-use requirements; scenario analysis to explore supply chain alternatives under differing tariff and regulatory postures; and supplier capability profiling to assess the operational and quality controls most relevant to regulated applications. Throughout the process, attention was paid to data provenance and triangulation to minimize bias, and findings were iteratively reviewed with domain experts to refine conclusions. The methodology emphasizes reproducibility and transparency so that readers can understand the evidence base and adapt the approach for internal due diligence and supplier assessments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cadmium Copper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cadmium Copper Market, by Product Type

- Cadmium Copper Market, by Purity Grade

- Cadmium Copper Market, by Alloy Composition

- Cadmium Copper Market, by Manufacturing Process

- Cadmium Copper Market, by Surface Treatment

- Cadmium Copper Market, by Packaging

- Cadmium Copper Market, by Application

- Cadmium Copper Market, by End Use Industry

- Cadmium Copper Market, by Region

- Cadmium Copper Market, by Group

- Cadmium Copper Market, by Country

- United States Cadmium Copper Market

- China Cadmium Copper Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2703 ]

Conclusive perspective on balancing cadmium copper’s technical advantages with regulatory, sourcing, and qualification risks to sustain performance and compliance across critical applications

Cadmium copper remains a critical material where unique combinations of conductivity, wear resistance, and corrosion performance continue to justify its use in specialized applications despite rising regulatory and supply-chain pressures. The interplay of alloy formulation, surface treatment, and manufacturing process determines whether a given product form will meet the operational demands of aerospace, defense, automotive, and high-reliability electronics sectors. In parallel, regional supply characteristics and recent trade actions have underscored the need for strategic sourcing plans, robust supplier qualification, and enhanced material governance.

Executives and engineering leaders must therefore treat material selection as a strategic decision that integrates performance requirements, compliance obligations, and supply continuity considerations. By adopting a segmentation-aware approach to specification, expanding supplier portfolios intelligently, and embedding traceability into procurement and manufacturing workflows, organizations can mitigate risk while preserving the technical advantages that cadmium copper alloys provide. The collective evidence supports a proactive posture: those that prepare substitution pathways, strengthen supplier collaboration, and institutionalize rigorous documentation will protect both performance outcomes and regulatory standing.

Direct engagement with the research lead to secure the full cadmium copper market dossier, briefings, and tailored advisory support for strategic procurement and product teams

For decision-makers ready to convert analysis into strategic advantage, engaging directly with the report author and commercial lead will accelerate procurement, product development, and go-to-market planning. Reach out to Ketan Rohom (Associate Director, Sales & Marketing) to request access to the full research dossier, acquire tailored slide decks, or book a briefing tailored to executive priorities. The report provides the granular technical appendices, supplier due-diligence frameworks, and compliance checklists needed to operationalize recommendations across sourcing, alloy selection, and component qualification.

Prospective purchasers will benefit from a structured onboarding that includes a guided walkthrough of key sections, a Q&A session with the analyst team, and optional custom research modules that align with specific supply chain scenarios or application validation programs. Engage now to secure the analytical support and strategic insights necessary to act decisively in a market where material attributes, regulatory constraints, and application performance converge to shape commercial outcomes.

- How big is the Cadmium Copper Market?

- What is the Cadmium Copper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?