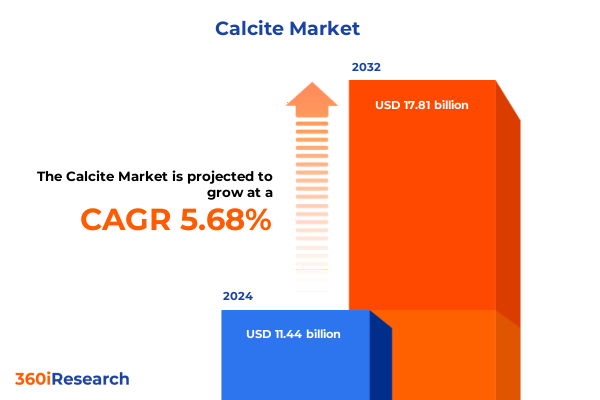

The Calcite Market size was estimated at USD 12.09 billion in 2025 and expected to reach USD 12.77 billion in 2026, at a CAGR of 5.69% to reach USD 17.81 billion by 2032.

Unveiling the Strategic Importance of Calcite: A Comprehensive Overview of Its Role Across Industries and Emerging Market Dynamics

Calcite, a naturally occurring form of calcium carbonate (CaCO₃), is among the most abundant minerals on Earth and serves as a cornerstone across a spectrum of industrial applications. Its trigonal crystal system and versatile physical properties underpin its widespread adoption, ranging from dimension stone in construction to high-purity optical uses in advanced instruments. The mineral’s low hardness, perfect cleavage, and chemical reactivity confer distinct advantages in manufacturing, environmental remediation, and agricultural conditioning.

In recent years, calcite’s prominence has escalated in response to growing infrastructure demands and increasingly stringent environmental regulations. The construction sector continues to consume the largest volumes of calcite-bearing aggregates for cement, road base, and concrete, while the paint and coatings industry leverages calcite’s brightness and filler properties to enhance opacity and durability in architectural and industrial formulations. Simultaneously, emerging applications in water treatment and flue gas desulfurization are driven by the need to meet tighter discharge standards and reduce sulfur dioxide emissions from power plants.

Against this backdrop, this executive summary presents a structured analysis of transformative market shifts, policy impacts, segmentation dynamics, regional nuances, and competitive strategies defining the calcite landscape in 2025. The subsequent sections synthesize primary research, secondary data, and expert interviews to equip decision-makers with actionable insights for navigating a rapidly evolving mineral market.

Mapping Transformative Shifts Altering Calcite Demand: Technological Innovations, Sustainability Imperatives, and Policy Developments Shaping the Future Landscape

The calcite market is undergoing transformative shifts driven by a convergence of sustainability imperatives, technological advancements, and evolving regulatory frameworks. Decarbonization efforts within the cement and lime sectors are prompting producers to explore innovative low-carbon fuels and carbon capture solutions, aiming to mitigate the significant CO₂ footprint associated with calcination. Collaborative pilot programs with energy providers to deploy renewable power solutions, such as Imerys’ 15-year PPA in the United States covering 30% of its electricity needs, exemplify how mineral suppliers are integrating green energy initiatives into their core operations.

Digitalization and integrated supply chain platforms are reshaping operational efficiencies, enabling real-time tracking of quarry-to-end-user shipments and predictive maintenance of crushing and milling equipment. Industry leaders are investing in advanced process control systems and AI-driven mineral characterization tools to optimize particle-size distribution and surface properties, thereby enhancing product consistency for high-growth segments like plastic fillers and specialty coatings.

Finally, the rising emphasis on circular economy principles is catalyzing the development of secondary calcite sources derived from industrial by-products, such as precipitated calcium carbonate recovered from sugar-beet processing. These initiatives not only alleviate raw material dependencies but also align with corporate sustainability targets and regulatory incentives for waste valorization.

Assessing the Cumulative Impact of the 2025 U.S. Tariff Regime on Calcite Supply Chains, Cost Structures, and Domestic Production Realignments

In April 2025, the U.S. administration implemented a sweeping 10% baseline tariff on all imports, coupled with additional duties of up to 50% on goods from approximately 60 countries, marking one of the most extensive trade policy overhauls in decades. While primary targets included manufactured goods, upstream mineral imports such as limestone and marble-key sources of calcite-also experienced heightened cost pressures across port entry points. Parallel measures introduced 25% tariffs on steel and aluminum to bolster domestic production further exacerbated operational costs for calcite users in construction and manufacturing, with ancillary impacts on transportation and processing equipment that rely heavily on these metals.

Cement import tariffs elicited a notable realignment within the broader dimension-stone supply chain. Data estimates indicate that a 10% duty on cement imports from Türkiye, Vietnam, and other key suppliers translated into an added cost burden exceeding US$300 million annually, incentivizing a shift toward domestic cement and aggregate production. This realignment has created opportunities for local calcite producers to capture incremental volumes, while simultaneously intensifying competition for quarry capacity and logistical infrastructure.

Judicial interventions in late May 2025 temporarily suspended certain emergency tariff provisions, including the so-called “Liberation Day” measures, as the U.S. Court of International Trade ruled them ultra vires under the IEEPA. The ruling injected uncertainty into long-term procurement strategies, compelling end users to adopt hedging mechanisms and diversify sourcing across non-U.S. jurisdictions to mitigate legal and policy risks in global calcite supply chains.

Deciphering Critical Segmentation Insights: How Application Domains, Distribution Channels, Purity Grades, and Product Types Define Calcite Market Trajectories

Disaggregating the calcite market by application reveals nuanced growth trajectories shaped by end-use requirements and performance specifications. In agriculture, the bifurcation into animal feed additives and soil conditioners underscores the distinct physicochemical criteria for nutritional versus pH-neutralizing functions. Construction demand divides between cement additives engineered for hydration control and road base aggregates tailored for compressive strength, highlighting how processing and particle grading strategies align with performance benchmarks for each niche. Environmental applications further differentiate into flue gas desulfurization systems requiring high-reactivity calcite powders and water treatment media where porosity and alkalinity buffering are paramount. Meanwhile, paint and coatings formulations leverage calcite as both fillers and pigment extenders, and plastics manufacturers prioritize filler materials engineered for compatibility with polymer matrices, illustrating the spectrum of functional attributes demanded across sectors.

Channel strategies in the distribution network reflect a balance between volume-driven direct sales to key accounts and the breadth of coverage afforded by distributors and online platforms. Key accounts often involve long-term contracts with industrial conglomerates, emphasizing tailored logistics and quality assurance protocols. In contrast, retail and wholesale distributors serve a diverse base of regional contractors and small-scale formulators, while online channels-including company websites and e-commerce marketplaces-facilitate rapid order fulfillment and inventory transparency for smaller buyers and specialty product tiers.

Purity grade segmentation distinguishes high-purity calcium carbonate for pharmaceutical, food, and optical uses from medium and low-purity grades optimized for cost-sensitive bulk applications. Product form further refines market positioning: coarse aggregates dominate heavy construction, granular grades fit specialized filtration beds, while lumps and powder forms cater to chemical feedstock and fine-particle filler markets, each requiring distinct handling and milling processes to achieve target specifications.

This comprehensive research report categorizes the Calcite market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Grade

- Product Type

- Application

- Distribution Channel

Capturing Key Regional Dynamics: How Americas, Europe Middle East Africa, and Asia Pacific Regions Drive Unique Calcite Consumption Patterns and Growth Drivers

In the Americas, robust infrastructure refurbishments in the United States and Canada, combined with agricultural lime programs in Brazil and Argentina, sustain steady calcite consumption. The enforcement of strict water quality standards across North America continues to drive municipal water treatment plants toward calcite-based pH correction systems. Simultaneously, shale gas drilling in the U.S. leverages calcite in drilling mud formulations to optimize borehole stability and pressure control, underscoring regional end-use diversification.

Within Europe, the Middle East, and Africa, regulatory frameworks targeting sulfur dioxide emissions have fueled investments in flue gas desulfurization across coal-fired power plants and heavy-industry facilities, boosting demand for reactive calcite powders. The ongoing decarbonization agenda in the European Union has also incentivized the retrofit of cement kilns with alternative fuels and carbon capture units, indirectly stimulating the use of additive calcite grades tailored to lower-emission clinker production processes.

Asia-Pacific stands out as the fastest-growing regional market, driven by urbanization and megaproject construction in China, India, and Southeast Asia. Rapid expansion of the plastics and coatings industries in these economies has heightened demand for surface-treated calcite fillers, while emerging national water infrastructure programs in Vietnam and Indonesia are increasingly adopting calcite-amended filter media to meet escalating potable water treatment requirements.

This comprehensive research report examines key regions that drive the evolution of the Calcite market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders: Strategic Initiatives, Technological Advancements, and Market Positions of Key Players Governing the Calcite Ecosystem

Imerys S.A. has anchored its growth strategy on decarbonization and renewable energy integration within its calcite operations. The company’s U.S. renewable PPA agreement ensures that a significant share of its electricity consumption is sourced from renewables by 2026, reducing annual GHG emissions by an estimated 67 kt. Imerys’ investment in micronization technologies and global processing plant upgrades underpins its competitive edge in high-purity and specialty calcite segments.

Omya AG remains a preeminent supplier of precipitated calcium carbonate, leveraging its patented purification platforms to deliver pharmaceutical-grade products with CaCO₃ purities exceeding 99.8%. Operating over 35 production facilities worldwide, Omya’s strategic rail-connected quarries in North America and Europe secure stable supply chains for paper, coatings, and food additive markets, reinforcing its market leadership.

Minerals Technologies Inc. continues to innovate across its Consumer & Specialties and Engineered Solutions segments. Despite Q1 2025 sales facing modest headwinds, the company reported a 6% year-over-year increase in ground calcium carbonate volumes for the construction sector, alongside growing demand for PFAS remediation and renewable fuel purification in its Engineered Solutions portfolio. MTI’s extensive R&D network and crystal engineering expertise drive ongoing product differentiation .

Graymont, a global leader in lime and limestone products, has refreshed its brand to spotlight low-carbon calcium-based solutions. With a renewed mission to support decarbonization across industries, Graymont’s environmental care strategy focuses on air emissions abatement, energy efficiency improvements, and investment in emerging carbon capture technologies, positioning the company at the forefront of sustainable calcite supply.

This comprehensive research report delivers an in-depth overview of the principal market players in the Calcite market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anmol Chemicals Group

- Ascom Carbonate and Chemicals Manufacturing

- Brenntag

- Calcinor Servicios S.A.

- Carmeuse Holding SA

- CIECH S.A.

- Columbia River Carbonates

- Esen Mikronize Maden

- Gulshan Polyols Ltd.

- Imerys S.A.

- J.M. Huber Corporation

- Jay Minerals

- Lhoist SA

- Maruo Calcium Co., Ltd.

- Minerals Technologies Inc.

- Mississippi Lime Company

- Omya AG

- Sibelco Group NV

- Tarmac Holdings Limited

Formulating Actionable Recommendations: Strategic Pathways for Industry Leaders to Optimize Supply Chains, Enhance Sustainability, and Capture Emerging Calcite Market Opportunities

To navigate the evolving calcite market, industry leaders should diversify their raw material sourcing by establishing multi-regional supplier agreements that mitigate exposure to tariff disruptions. Strategic partnerships with logistics providers specializing in FTZ operations can optimize landed costs and maintain supply chain resilience under fluctuating trade regimes.

Investment in advanced milling and particle-engineering technologies will enable producers to deliver highly tailored calcite grades for growth segments such as bioplastics and ultra-white coatings. By collaborating with academic and industry research centers on novel surface-modification techniques, companies can capture premium pricing and expand into emerging high-value applications like battery binders and pharmaceutical excipients.

Finally, embedding sustainability targets into corporate performance metrics-such as GHG reduction per ton of calcite produced-will align operational efficiencies with regulatory incentives. Companies that proactively deploy renewable energy PPAs and carbon capture pilot projects will not only reduce environmental liabilities but also differentiate their brands and access green financing opportunities that can underwrite capital expenditures for next-generation processing assets.

Outlining Rigorous Research Methodology: A Detailed Explanation of Data Sources, Triangulation Techniques, and Expert Validation Ensuring Robust Calcite Market Insights

This analysis integrates qualitative and quantitative insights derived from a multi-phase research approach. Secondary data sources include U.S. Geological Survey mineral commodity summaries, peer-reviewed academic publications on mineral processing, and publicly available financial and sustainability reports from leading calcite producers. Trade policy impacts were assessed using data from the U.S. Court of International Trade, Federal Register notices, and economic briefs published by the Federal Reserve Bank of Richmond.

Primary research encompassed structured interviews with senior executives at major calcite operations, supply chain managers at end-use manufacturers, and technical experts in materials science. These insights were triangulated with shipping and customs data to quantify tariff-induced cost variances and supply chain reconfiguration trends. Regional market dynamics were further validated through on-the-ground consultations with infrastructure development agencies in Asia-Pacific and environmental regulators in EMEA.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Calcite market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Calcite Market, by Purity Grade

- Calcite Market, by Product Type

- Calcite Market, by Application

- Calcite Market, by Distribution Channel

- Calcite Market, by Region

- Calcite Market, by Group

- Calcite Market, by Country

- United States Calcite Market

- China Calcite Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Concluding Perspectives: Integrating Core Findings to Illuminate the Future Trajectory and Strategic Imperatives of the Calcite Market Landscape

Calcite’s strategic role across construction, manufacturing, environmental remediation, and agriculture underscores its enduring market relevance. The confluence of robust infrastructure spending, sustainability mandates, and evolving end-use technologies will continue to drive demand for both traditional limestone-derived products and advanced precipitated grades. Trade policy fluctuations in 2025 have catalyzed supply chain realignments, accelerating investments in domestic capacity and diversification strategies.

Looking ahead, the transition toward low-carbon production processes and digitalized supply networks will define the competitive battleground for calcite suppliers. Companies that effectively integrate renewable energy, carbon capture, and data-driven operations will secure resilient growth pathways and enhanced stakeholder value. With the market poised for steady expansion across regions and segments, strategic alignment with emerging regulatory frameworks and technological innovations will be paramount for sustained leadership.

Take the Next Step: Engage with Ketan Rohom to Access Premium Calcite Market Research, Uncover Personalized Insights, and Propel Strategic Decision Making

To secure a comprehensive and data-driven perspective on the calcite market-including granular regional analyses, company benchmarking, and in-depth tariff impact studies-reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a deep understanding of mineral value chains and can tailor the report to your specific strategic priorities and operational requirements. Don’t miss this opportunity to gain a competitive edge and inform critical investment and operational decisions with actionable insights.

- How big is the Calcite Market?

- What is the Calcite Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?