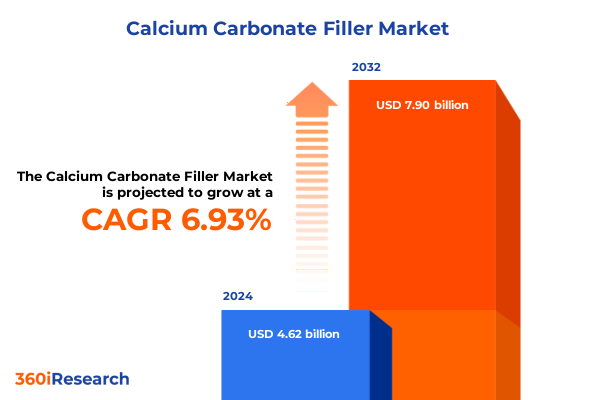

The Calcium Carbonate Filler Market size was estimated at USD 4.94 billion in 2025 and expected to reach USD 5.25 billion in 2026, at a CAGR of 6.92% to reach USD 7.90 billion by 2032.

Establishing the Strategic Foundation for Calcium Carbonate Filler Excellence Through a Comprehensive Overview of Industry Drivers and Applications

Calcium carbonate filler has solidified its position as an indispensable additive across a broad spectrum of industrial applications, delivering enhanced performance and cost efficiency. Recognized for its high whiteness, chemical inertness, and versatility, it fortifies products ranging from plastics and coatings to paper and adhesives. As end users demand greater consistency and functionality from their materials, the role of calcium carbonate filler evolves beyond a simple bulking agent into a strategic ingredient that influences texture, durability, and process optimization.

The accelerating trend toward lightweight construction materials and sustainable manufacturing processes has further elevated the importance of high-performance fillers. In many sectors, replacing more expensive raw materials with calcium carbonate contributes to reduced production expenses and lower environmental impact. Concurrently, advancements in processing technologies enable more precise control over particle size distribution and surface treatment, unlocking improved dispersion and interaction with polymer matrices or coatings.

Moreover, the expanding food and pharmaceutical industries have created a niche for ultra-high-purity variants, where purity levels directly affect product safety and regulatory compliance. This dual demand for both standard grades in industrial settings and specialized grades in sensitive applications underscores the filler’s multifaceted value proposition. Stakeholders must stay informed on evolving supply chain factors, quality benchmarks, and emerging innovations to maintain competitive advantage.

By providing a comprehensive introduction to the calcium carbonate filler landscape, this section lays the groundwork for deeper explorations of industry shifts, tariff impacts, segmentation intricacies, regional dynamics, and strategic recommendations. It sets the stage for data-driven insights that will guide strategic decision-making and support sustainable growth initiatives.

Navigating Transformative Industry Shifts That Are Redefining Calcium Carbonate Filler Production Sustainability Performance and Market Competitiveness

Recent years have witnessed profound transformative shifts reshaping the calcium carbonate filler domain, driven by technological breakthroughs and heightened environmental imperatives. Cutting-edge milling and classification techniques now facilitate the production of ultra-fine granular products that enhance surface smoothness and mechanical strength in coatings and polymers. Simultaneously, novel surface modification processes optimize particle–matrix interactions, delivering superior rheological performance and pigment hiding power in paints and adhesives.

Parallel to these technological advancements, escalating regulatory scrutiny and consumer demand for sustainable materials have steered producers toward greener production methodologies. Carbon capture integration and renewable energy usage in calcination plants exemplify efforts to curb carbon footprints, while the adoption of closed-loop water systems minimizes resource depletion. These eco-conscious initiatives are increasingly viewed as differentiators, influencing procurement decisions and corporate ESG profiles.

Digitalization stands as another pillar of change. Real-time analytics, driven by IoT-enabled processing equipment, empower manufacturers to fine-tune product specifications and respond swiftly to quality deviations. Advanced data modeling also supports predictive maintenance, reducing downtime and operational costs. These digital tools not only enhance production efficiency but also facilitate transparent supply chain traceability, fostering stronger partnerships between suppliers and end users.

Together, these shifts signal a new era where innovation, sustainability, and digital integration converge to redefine competitiveness. Stakeholders equipped with insights into these developments can capitalize on efficiency gains, meet stringent environmental targets, and deliver next-generation calcium carbonate filler solutions that resonate with evolving market expectations.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Calcium Carbonate Filler Supply Chains Costs and Trade Dynamics

The implementation of new United States tariffs on calcium carbonate imports in early 2025 has catalyzed notable adjustments across the value chain. By raising import levies, domestic producers have gained a pricing window to enhance their competitive stance, stimulating investments in capacity expansion and product diversification. At the same time, end users reliant on imported material have encountered budgetary constraints, prompting the exploration of alternative sourcing strategies and cost mitigation tactics.

This tariff regime has reverberated through supply chain dynamics. Import-dependent regions have experienced intermittent supply bottlenecks, pushing procurement teams to secure longer-term contracts with domestic suppliers. Such strategic shifts have fostered closer collaboration between manufacturers and buyers to ensure consistent material availability, while also incentivizing suppliers to optimize logistical networks and warehouse footprints to accommodate variable demand patterns.

From a cost perspective, the higher landed price of imported calcium carbonate has encouraged downstream manufacturers to reevaluate formulation processes, seeking to maintain product performance with reduced filler loadings or by integrating complementary additives. These formulation adjustments underscore the interconnected nature of pricing policies and product innovation, as technical teams strive to balance material economics with stringent quality requirements.

In the longer term, the tariff-induced rebalancing of trade flows may drive increased vertical integration, with players investing in upstream mining or processing assets to secure feedstock reliability. Such strategic realignment highlights the broader impact of tariff measures, influencing capital allocation decisions and shaping the competitive landscape for years to come.

Unlocking Critical Segmentation Insights to Reveal the Nuances of Calcium Carbonate Filler Performance Across Form Grade Type and End Use Industries

Insights into form, grade, type, and end use industries reveal the nuanced performance characteristics and competitive positioning within the calcium carbonate filler segment. When considering form, the distinction between granular and powder shapes informs processing ease and dispersion attributes; granular variants often streamline handling in high-throughput compounding lines, while powders deliver finer control over texture and surface finish. This dichotomy underscores the importance of matching physical form to application requirements.

Grade segmentation further refines product selection, with high purity grades meeting the demands of general industrial applications and ultra-high-purity variants tailored for food and pharmaceutical contexts. Within the ultra-high-purity category, food-grade and pharma-grade subtypes adhere to stringent regulatory criteria, demanding rigorous quality controls and certification processes. Such specialization drives collaborative quality assurance protocols between suppliers and end users to uphold safety and compliance standards.

Type-based differentiation between ground calcium carbonate and precipitated calcium carbonate highlights variations in particle morphology and functional capabilities. Ground calcium carbonate, derived from mechanical milling, tends to exhibit irregular geometries suited for bulk filling applications. In contrast, precipitated variants-rhombohedral, scalenohedral, and spherical-offer targeted benefits such as enhanced gloss enhancement, improved barrier properties, or optimized rheology, depending on crystal structure. Selecting the appropriate precipitated form enables formulators to engineer distinct performance profiles.

Finally, the diverse portfolio of end use industries illustrates the filler’s breadth of application. In adhesives and sealants, calcium carbonate improves viscosity control and dimensional stability. Animal feed formulations leverage its nutritional value. Construction composites benefit from enhanced compressive strength, while paints, coatings, paper, and board capitalize on brightness and opacity. Plastics and rubber compounds exploit the filler’s reinforcement capabilities, and food and beverage producers rely on ultra-pure grades for consistency and safety. Collectively, these segmentation insights emphasize the strategic imperative of aligning product attributes with sector-specific performance demands.

This comprehensive research report categorizes the Calcium Carbonate Filler market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Type

- End Use Industry

Evaluating Regional Dynamics to Identify Growth Opportunities and Challenges for Calcium Carbonate Filler Demand in Americas Europe Middle East Africa and Asia Pacific

A regional lens reveals distinct growth drivers and challenges shaping the calcium carbonate filler landscape across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, robust industrial activity and heightened infrastructure investments have propelled demand for construction-grade fillers. North American producers have responded by expanding capacity and advancing production efficiencies, while Latin American markets show rising interest in lightweight polymers and sustainable building materials, underscoring regional heterogeneity in application focus.

Within Europe, Middle East and Africa, strict environmental regulations and aggressive decarbonization targets have elevated the strategic importance of low-carbon production methods. European manufacturers are pioneering closed-loop recycling initiatives and carbon capture integration to meet net-zero commitments, while Middle Eastern producers capitalize on abundant mineral deposits to secure cost-efficient feedstocks. Africa’s emergent industrialization trend suggests future opportunities for filler suppliers as local manufacturing ecosystems evolve.

The Asia Pacific region stands out for its dynamic consumption patterns, driven by rapid urbanization and expanding automotive, packaging, and electronics sectors. China remains a dominant force, continually refining its processing technologies to supply both domestic and export markets. At the same time, Southeast Asian nations are emerging as alternative sourcing hubs, supported by government incentives for foreign investment and modernization of mining operations.

Together, these regional insights highlight the need for suppliers to adopt differentiated market strategies that reflect local demand profiles, regulatory landscapes, and resource availability. Understanding these geographic distinctions is critical for designing supply chain networks and forging partnerships that deliver sustained commercial success.

This comprehensive research report examines key regions that drive the evolution of the Calcium Carbonate Filler market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Players Driving Innovation Market Positioning and Competitive Strategies for Sustained Leadership in the Calcium Carbonate Filler Space

Key industry participants have demonstrated varied approaches to securing competitive advantage, from strategic alliances to technology-driven innovation. Leading global producers have invested in advanced precipitation reactors and proprietary surface treatment processes, enabling the development of specialized grades with enhanced functional attributes. These initiatives cater to performance-sensitive applications in coatings and pharmaceuticals, reflecting a commitment to product diversification and technical differentiation.

Mid-tier players have sharpened their focus on niche segments, such as ultra-fine particle grades for high-end plastics or tailored surface modifications for ceramics and adhesives. By cultivating close collaborations with end users, these companies accelerate co-development efforts, reduce time to market, and address emerging formulation challenges. Their agility and customer-centric service models contrast with the scale-oriented strategies of larger competitors, illustrating the value of operational flexibility in a dynamic environment.

Several firms have pursued backward integration to secure feedstock reliability and cost stability. Ownership of carbonate rock reserves or minority stakes in mining ventures provides greater control over raw material inputs and supports just-in-time delivery models. These upstream investments complement downstream processing expansions, forming integrated platforms that enhance supply security and margin resilience against price fluctuations.

Additionally, sustainability leadership has emerged as a key differentiator. Select organizations have published carbon footprint assessments for product portfolios, obtained third-party eco-certifications, and implemented circular economy practices to reclaim and recycle spent materials. These efforts resonate with environmentally conscious customers and reinforce corporate responsibility commitments, underscoring the intersection of environmental stewardship and market competitiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Calcium Carbonate Filler market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbey Masterbatch Ltd.

- ADC Plastic., JSC

- Alpha Calcit Füllstoff GmbH & Co. KG

- Bedeko Europe Company

- Bhagyashree Colours Private Limited

- Blend Colours Pvt. Ltd.

- CALCIT d.o.o.

- Calmin India

- Dai A Plastic Joint Stock Company

- Diamond Quantum Biotech Co., Ltd.

- European Plastics Joint Stock Company

- Fillplas Co. Ltd

- Heidelberg Materials AG

- Imerys S.A.

- JJ Plastalloy

- LKAB Minerals AB

- Malson Polymer

- MegaPlast

- Nanjing Cowin Extrusion Machinery Co.,Ltd.

- Omya International AG

- PolyFill Joint Stock Company

- Quarzwerke Group

- Saint-Gobain S.A.

- Shreeji Industries

- SigmaRoc PLC

- Soltex Petro Products Ltd.

- SS Chemical Group

- VH-FB Euro Ltd.

- Vinares Viestnam JSC

Delivering Actionable Recommendations to Guide Industry Leaders in Optimizing Supply Chains Innovating Product Portfolios and Embracing Sustainability in Calcium Carbonate Filler

Industry leaders poised for success should adopt a multi-pronged approach that aligns sustainability objectives with technological innovation and supply chain resilience. By investing in low-carbon calcination methods and water recycling systems, organizations can meet rigorous environmental benchmarks while reducing operational costs. Integrating renewable energy sources in production processes further distinguishes suppliers in procurement evaluations and bolsters long-term viability.

To capture evolving application opportunities, companies must also pursue advanced research into particle engineering and surface functionalization. Collaborating directly with end users in co-development initiatives accelerates time to market for custom formulations and cultivates client loyalty. Leveraging predictive analytics and process simulation tools can optimize production parameters and anticipate quality deviations, ensuring consistent delivery of high-performance grades.

Diversifying supply sources and forging strategic partnerships across continents will mitigate the risks of tariff fluctuations and logistical disruptions. Establishing regional production or distribution hubs enables faster response to local demand shifts and reduces transportation costs. Simultaneously, adopting digital supply chain platforms enhances visibility, facilitates real-time inventory management, and fosters transparent communication between stakeholders.

Finally, embedding sustainability credentials into corporate branding and customer-facing collateral reinforces market differentiation. Publishing life cycle assessments, obtaining recognized environmental certifications, and publicizing circular economy initiatives not only satisfy regulatory requirements but also resonate with end users prioritizing green credentials. Together, these actionable strategies empower leaders to navigate complexity, drive innovation, and secure long-term competitive advantage.

Detailing Robust Research Methodologies Employed to Ensure Data Integrity Comprehensive Analysis and Actionable Insights in Calcium Carbonate Filler Reports

The foundation of this analysis rests on a rigorous research framework combining primary and secondary data sources to ensure comprehensive coverage and analytical depth. Primary insights were gathered through structured interviews with senior executives across leading processing plants, raw material suppliers, and key end user industries, providing firsthand perspectives on operational challenges and emerging trends. These discussions were augmented by detailed surveys distributed to formulation scientists and procurement specialists, capturing quantitative assessments of quality requirements, cost sensitivity, and sustainability priorities.

Complementing these primary efforts, secondary research encompassed a thorough exploration of industry journals, patent filings, technical white papers, and regulatory publications. Trade association reports and governmental statistics informed evaluation of production capacities, import-export flows, and environmental compliance standards across major regions. This multi-source approach facilitated the triangulation of data points, enabling cross-verification and identification of any anomalies.

Analytical rigor was maintained through advanced statistical modeling and benchmarking techniques. Segmentation matrices were applied to parse performance characteristics across form, grade, type, and end use, while scenario analysis assessed the implications of tariff implementations and regional regulatory shifts. Data visualization tools supported the clear depiction of complex relationships, ensuring that findings could be interpreted efficiently by stakeholders.

Quality assurance protocols included peer reviews by industry veterans, iterative validation of assumptions, and sensitivity checks to account for potential data variability. This robust methodology underpins the reliability of the insights presented throughout the report, delivering a trustworthy foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Calcium Carbonate Filler market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Calcium Carbonate Filler Market, by Form

- Calcium Carbonate Filler Market, by Grade

- Calcium Carbonate Filler Market, by Type

- Calcium Carbonate Filler Market, by End Use Industry

- Calcium Carbonate Filler Market, by Region

- Calcium Carbonate Filler Market, by Group

- Calcium Carbonate Filler Market, by Country

- United States Calcium Carbonate Filler Market

- China Calcium Carbonate Filler Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Strategic Perspectives on the Calcium Carbonate Filler Landscape to Inform Decision Making and Future Industry Trajectories

As the calcium carbonate filler industry navigates an era of technological breakthroughs, regulatory pressures, and evolving end use requirements, it stands at a pivotal juncture where strategic foresight is paramount. The convergence of advanced processing techniques, sustainability imperatives, and digital integration signals a shift toward highly differentiated product offerings and streamlined supply chains. Companies that harness these trends through continued innovation and operational excellence will be well positioned to capture emerging opportunities.

Tariff adjustments in the United States have underscored the importance of flexible sourcing strategies and cost optimization measures. The recalibration of trade relationships compels stakeholders to reevaluate procurement frameworks, forge stronger supplier alliances, and consider vertical integration where appropriate. Meanwhile, segmentation insights emphasize the criticality of customizing formulations to meet specific performance benchmarks across industrial, food, and pharmaceutical applications.

Regionally, divergent regulatory landscapes and consumption patterns necessitate tailored market approaches. Suppliers must adapt to the unique environmental mandates in Europe, leverage burgeoning demand in Asia Pacific, and capitalize on infrastructure spending in the Americas. Equipped with these strategic perspectives, decision makers can align investments, partnerships, and product roadmaps with localized growth vectors.

Ultimately, the insights presented coalesce into a coherent blueprint for navigating complexity and driving sustainable value creation within the calcium carbonate filler domain. By blending rigorous research with actionable recommendations, industry leaders can chart a course toward enhanced competitiveness and long-term resilience.

Driving Business Growth Through Access to Actionable Calcium Carbonate Filler Market Intelligence with Support from Ketan Rohom Associate Director

Engaging with our expert support ensures that decision makers gain unparalleled visibility into the evolving dynamics of calcium carbonate filler supply chains, applications, and competitive strategies. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through tailored insights that address specific business challenges and growth objectives. His deep industry expertise and consultative approach guarantee that your organization can leverage actionable intelligence with confidence to drive product development, optimize procurement decisions, and strengthen market positioning.

To secure comprehensive access to the full market research report and unlock these strategic advantages, please reach out directly to Ketan Rohom. Partnering with him will accelerate your understanding of emerging trends, tariff implications, and segmentation nuances, empowering your team to make data-driven choices that deliver measurable results. Take the next step toward transformative growth and competitive differentiation by connecting with Ketan Rohom today.

- How big is the Calcium Carbonate Filler Market?

- What is the Calcium Carbonate Filler Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?