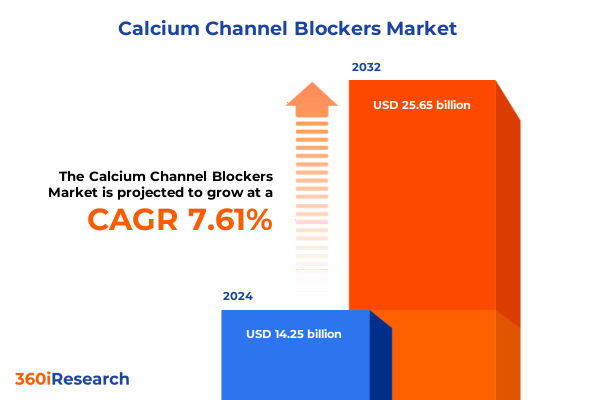

The Calcium Channel Blockers Market size was estimated at USD 15.20 billion in 2025 and expected to reach USD 16.21 billion in 2026, at a CAGR of 7.76% to reach USD 25.65 billion by 2032.

Understanding the Vital Role and Evolving Importance of Calcium Channel Blockers in Contemporary Cardiovascular Treatment Strategies Across Diverse Clinical Settings and Patient Populations

Calcium channel blockers represent a cornerstone in cardiovascular pharmacotherapy, owing to their mechanism of inhibiting L-type calcium channels in vascular smooth muscle and cardiac tissue. By reducing calcium influx, these agents effect vasodilation and modulate myocardial contractility, delivering therapeutic benefits in hypertension, angina, and select arrhythmias. Over decades, the classification into dihydropyridine and non-dihydropyridine subclasses has guided clinical choice, with amlodipine and nifedipine dominating the former and diltiazem and verapamil leading the latter. Beyond mechanistic diversity, these agents feature distinct pharmacokinetic profiles-amlodipine’s prolonged half-life supports once-daily dosing, whereas ultra–short-acting intravenous options like clevidipine enable precise perioperative blood pressure control.

Exploring the Major Transformative Shifts Driving Innovation, Personalized Therapies, and Next-Generation Delivery Systems in the Calcium Channel Blocker Landscape

The landscape of calcium channel blocker development is experiencing paradigm-shifting momentum fueled by precision medicine and technological integration. Genetic profiling initiatives now enable clinicians to tailor antihypertensive regimens to specific patient subgroups, as pharmacogenomic insights demonstrate differential efficacy of calcium channel blockers among diverse ethnicities and comorbidity profiles. Concurrently, the incorporation of digital health platforms-ranging from AI-enabled remote blood pressure monitoring to smartphone-based adherence reminders-has fortified long-standing efforts to optimize therapeutic outcomes and minimize adverse events.

Analyzing the Cumulative Effects of Proposed United States Trade Tariffs in 2025 on Supply Chains, Cost Structures, and Access to Calcium Channel Blocker Therapies

In early 2025, the U.S. administration’s invocation of Section 232 investigations into pharmaceutical imports signaled a potential imposition of trade tariffs on medicines and active pharmaceutical ingredients, including calcium channel blockers. These probes, grounded in national security prerogatives, initiated public comment deadlines and the prospect of tariffs as high as 25 percent, raising concerns across the supply chain. Generic manufacturers, operating on narrow margins, have warned that additional levies could exacerbate existing access challenges and heighten medicine shortages throughout the United States.

Revealing Key Market Segmentations by Drug Type, Clinical Indication, Distribution Channels, Administration Routes, and End User Characteristics Shaping Industry Dynamics

Segmentation by drug type reveals two principal classes: dihydropyridine calcium channel blockers such as amlodipine and nifedipine, prized for their potent vasodilatory action in hypertension, and non-dihydropyridine agents including diltiazem and verapamil, distinguished by combined vasodilatory and chronotropic effects. Clinical practice guidelines emphasize the selection of dihydropyridines to manage systolic hypertension in elderly patients, while reserving non-dihydropyridines for supraventricular rate control in arrhythmic presentations.

When examined across indications, calcium channel blockers serve as first-line therapies for stable and variant angina, leveraging coronary vasodilatory properties to alleviate ischemic pain. Their anti-arrhythmic utility extends to atrial fibrillation and supraventricular tachycardia, where they modulate conduction through the atrioventricular node. Hypertensive management divides into primary and secondary forms, with calcium channel blockers demonstrating robust efficacy in both settings and displaying particular advantages in populations with comorbid diabetes or kidney disease.

Distribution channels further delineate market behavior, as hospital pharmacies-encompassing inpatient and outpatient units-cater to acute care demands and high-cost intravenous formulations, while retail pharmacies, spanning both chain and independent outlets, dominate chronic oral therapy dispensing. Traditional healthcare distribution networks channel the majority of cardiovascular drugs through wholesalers to chain drug stores, hospitals, and independent pharmacies, reflecting a complex ecosystem that balances convenience, reimbursement structures, and regulatory compliance.

Routes of administration offer additional strategic differentiation: intravenous agents like clevidipine provide titratable, ultra–short-acting blood pressure control during surgical procedures and emergencies, benefiting from rapid ester-based metabolism that minimizes rebound hypertension. Oral formulations span immediate-release tablets for flexible dosing and extended-release designs for sustained therapeutic levels, optimizing patient convenience and adherence through consistent plasma concentrations over 24 hours.

Finally, end-user segmentation underscores the diverse settings in which calcium channel blockers deliver value. Hospitals remain critical for acute interventions and complex drug monitoring, while outpatient clinics integrate these agents into long-term cardiovascular risk management programs. Home care settings, supported by telemonitoring and automated medication dispensers, facilitate adherence and enable remote titration, reflecting a broader shift toward patient-centric care delivery models that reduce hospital readmissions and improve quality of life.

This comprehensive research report categorizes the Calcium Channel Blockers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Indication

- Route

- Distribution Channel

- End User

Highlighting Distinctive Regional Insights on Demand Drivers, Healthcare Infrastructure, and Regulatory Trends Impacting the Calcium Channel Blocker Market in the Americas, EMEA, and Asia-Pacific

In the Americas, advanced healthcare infrastructure and robust reimbursement mechanisms underpin widespread adoption of calcium channel blockers. High rates of cardiovascular disease diagnosis and prescription of guideline-recommended therapies drive demand, particularly in the United States, where managed care protocols and direct-to-payer negotiations shape pricing strategies. Market dynamics are influenced by emerging initiatives to onshore API production and hedging against tariff risks, as industry leaders invest in domestic manufacturing facilities to secure supply continuity and cost predictability.

Europe, Middle East & Africa exhibit pronounced heterogeneity. Western Europe’s comprehensive public health systems and liberal generics policies have facilitated significant market penetration for both branded and off-patent calcium channel blockers. By contrast, in the Middle East & Africa, escalating awareness campaigns and increased primary care investments are gradually expanding access in urban centers, though disparities persist in rural areas. Regulatory harmonization efforts by the European Medicines Agency continue to streamline approvals, supporting both innovative formulations and generic competition within the region’s diverse markets.

Asia-Pacific stands as the fastest-growing region, propelled by demographic shifts, rising hypertension prevalence, and governmental expansions of basic healthcare coverage. China and India lead consumption volumes, bolstered by aggressive generic manufacturing and competitive pricing, while Japan’s aging population sustains demand for both established and novel calcium channel blockers. Continued investments in rural healthcare delivery and digital health platforms are driving market expansion, as regional stakeholders prioritize improved cardiovascular outcomes through broader therapeutic access.

This comprehensive research report examines key regions that drive the evolution of the Calcium Channel Blockers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Critical Competitive Strategies, Investment Patterns, and Portfolio Innovations from Leading Pharmaceutical Companies Shaping the Calcium Channel Blocker Market

Global pharmaceutical leaders are calibrating competitive strategies to navigate the calcium channel blocker sector’s evolving terrain. Multinationals such as Pfizer, Novartis, Bayer, AstraZeneca, and Sanofi continue to dominate innovation pipelines and marketing channels, while generics specialists including Teva, Mylan, and Sandoz exert pricing pressure and drive volume growth. Resource allocation to lifecycle management-encompassing fixed-dose combinations, extended-release patents, and authorized generics-remains central to sustaining profitability amid patent expirations and intensifying cost containment initiatives.

Pfizer has leveraged its cardiovascular expertise to enhance patient adherence, launching an extended-release formulation of amlodipine designed for once-daily dosing with minimized peak-to-trough variability. This innovation seeks to differentiate its branded portfolio amid a crowded generic landscape, aligning with patient demand for simplified regimens and improved tolerability profiles.

AstraZeneca’s strategic response to trade policy uncertainty includes a landmark $50 billion U.S. investment plan aimed at expanding domestic R&D and manufacturing capacity by 2030. This initiative not only secures supply chains against potential tariffs but also reinforces the company’s commitment to the U.S. cardiovascular market, underpinning future launches of both small-molecule and biologic anti-hypertensive agents.

Novartis continues to fortify its cardiovascular portfolio through both pharmaceutical innovation and strategic acquisitions. The FDA’s approval of Tekamlo™, a single-pill combination of aliskiren and amlodipine, represents a notable evolution in fixed-dose therapy, while the acquisition of Anthos Therapeutics enhances late-stage pipeline assets in stroke prevention and atrial fibrillation management, reflecting a broader push into next-generation cardiovascular treatments.

Roche is exploring direct-to-consumer distribution models to circumvent traditional intermediaries, a move aimed at reducing costs and improving patient access. By bypassing pharmacy benefit managers and leveraging digital platforms, the company envisions a streamlined channel for its small-molecule cardiovascular medicines, potentially reshaping conventional pharmacy networks and patient engagement paradigms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Calcium Channel Blockers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bayer AG

- Daiichi Sankyo Company, Limited

- Dr. Reddy's Laboratories Ltd.

- INTAS PHARMACEUTICALS LTD.

- Kyowa Kirin Co., Ltd.

- Lupin Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Novartis AG

- OTSUKA PHARMACEUTICAL CO., LTD

- Pfizer Inc.

- Sandoz International GmbH

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Presenting Actionable Strategic Recommendations for Industry Leaders to Navigate Policy, Innovation, and Market Access Challenges in the Calcium Channel Blocker Space

Industry leaders should intensify investment in precision medicine initiatives to align calcium channel blocker development with genetic and phenotypic patient profiles. By integrating pharmacogenomic data into product lifecycle strategies, companies can secure premium positioning and enhance clinical differentiation. Collaborative partnerships with genomic diagnostics firms and academic consortia will accelerate the identification of biomarkers predictive of therapeutic response and adverse event risk.

To mitigate potential tariff disruptions, stakeholders must diversify API sourcing and invest in dual-sourcing strategies that span domestic and international manufacturing footprints. Engaging proactively with policymakers and participating in industry coalitions will support balanced trade outcomes. Concurrently, expanding onshore production capabilities serves as a strategic hedge against supply chain volatility and supports national drug security objectives.

Digital health integration remains a vital enabler of patient adherence and outcome optimization. Companies should deploy comprehensive eHealth ecosystems encompassing mobile applications, remote monitoring devices, and telepharmacy services. Evidence from network meta-analyses underscores the superior efficacy of combined telemonitoring and telephone support to elevate adherence rates, thereby amplifying real-world impact and fostering differentiated value propositions in payer negotiations.

Lastly, pursuing strategic collaborations and channel innovations-including direct-to-consumer models and value-based contracting-can unlock new market segments. By aligning commercial objectives with patient affordability and healthcare system sustainability, companies can pioneer alternative distribution frameworks that improve access, reinforce brand loyalty, and deliver measurable health outcomes.

Outlining the Rigorous Research Methodology Involving Primary Expert Interviews, Secondary Data Sources, and Qualitative and Quantitative Analysis Employed in This Report

This report leverages a multi-methodological approach, combining primary interviews with industry veterans-including regulatory affairs executives, clinical thought leaders, and commercial strategists-with extensive secondary research from peer-reviewed journals, government filings, and credible news outlets. Data triangulation protocols ensured consistency across multiple evidence streams, enhancing the validity of market observations.

Secondary sources encompassed comprehensive searches of medical databases such as PubMed, MedRxiv, and PMC for clinical trial outcomes and pharmacoeconomic analyses, alongside regulatory frameworks from FDA and EMA public records. Proprietary datasets and real-world evidence contributed to qualitative insights on prescription trends, while thematic coding of interview transcripts facilitated identification of emerging market imperatives.

Analytical techniques included comparative scenario modeling to assess tariff impact under Section 232 parameters, segment-level opportunity mapping informed by hierarchical analysis of type, indication, distribution, route, and end-user factors, and regional segmentation validated through cross-referencing industry reports and trade association statistics. Adherence to PRISMA guidelines in systematic literature reviews ensured methodological rigor in synthesizing clinical efficacy and safety data.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Calcium Channel Blockers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Calcium Channel Blockers Market, by Type

- Calcium Channel Blockers Market, by Indication

- Calcium Channel Blockers Market, by Route

- Calcium Channel Blockers Market, by Distribution Channel

- Calcium Channel Blockers Market, by End User

- Calcium Channel Blockers Market, by Region

- Calcium Channel Blockers Market, by Group

- Calcium Channel Blockers Market, by Country

- United States Calcium Channel Blockers Market

- China Calcium Channel Blockers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Drawing Conclusive Insights on Industry Trends, Market Dynamics, and Future Opportunities for Calcium Channel Blockers in Cardiovascular Care Strategies

The comprehensive examination of calcium channel blockers underscores their enduring clinical relevance and evolving market complexities. Strategic segmentation insights illuminate how drug type, indication, channel, route, and end-user interactions converge to shape competitive dynamics. Regional analyses confirm variegated growth trajectories, with Asia-Pacific ascending rapidly amid demographic pressures, while mature markets adapt to policy reforms and pricing constraints.

Leading companies’ responses to innovation demands, policy uncertainties, and digital transformation illustrate the sector’s resilience and capacity for reinvention. Future opportunities will emerge at the intersection of precision pharmacotherapy, integrated care delivery, and data-driven decision frameworks. Sustained leadership in this therapeutic category will require agility in anticipating regulatory shifts, creativity in commercial models, and steadfast commitment to patient outcomes.

As the cardiovascular landscape continues to expand and diversify, stakeholders equipped with targeted intelligence and actionable recommendations-such as those outlined in this report-will be well positioned to capture growth, optimize portfolios, and contribute to improved global health metrics.

Engage with Ketan Rohom to Acquire Comprehensive Market Intelligence and Leverage Strategic Insights from Our Calcium Channel Blockers Research Report

Ketan Rohom, Associate Director of Sales & Marketing, extends an exclusive invitation to engage directly for deeper strategic conversations and access to tailored insights. By partnering with Ketan, stakeholders will gain privileged entry to a comprehensive market research report that synthesizes industry expertise, regulatory analysis, and actionable intelligence on calcium channel blockers. Ketan’s personalized support ensures clarity on potential market opportunities, customization of data to specific corporate objectives, and guided navigation through the report’s findings. Reach out today to secure your copy of the definitive calcium channel blockers research, unlock competitive advantages, and inform your next strategic decisions with confidence. Let Ketan facilitate your journey toward data-driven growth in this dynamic therapeutic category.

- How big is the Calcium Channel Blockers Market?

- What is the Calcium Channel Blockers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?