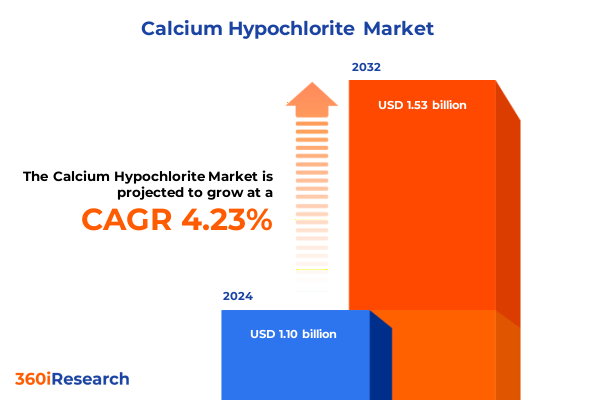

The Calcium Hypochlorite Market size was estimated at USD 1.14 billion in 2025 and expected to reach USD 1.18 billion in 2026, at a CAGR of 4.35% to reach USD 1.53 billion by 2032.

Unveiling the Pivotal Role of Calcium Hypochlorite in Modern Water Treatment and Public Health Safeguarding Across Critical Sectors

Calcium hypochlorite has emerged as an indispensable sanitizer and oxidizer across multiple industrial and municipal domains, ensuring safe drinking water, effective pool maintenance, and robust disinfection protocols within food and pulp operations. With its high chlorine content and solid-state stability, this compound continues to underpin critical public health initiatives, enabling municipalities to meet stringent regulatory thresholds and food processors to maintain hygiene standards. Beyond its traditional applications, the molecule’s versatility has attracted attention in emerging uses such as algae control in aquaculture and remediation projects aimed at mitigating biofilm formation in cooling towers.

The introduction sets the stage for understanding not only the fundamental chemical characteristics but also the strategic relevance of calcium hypochlorite in addressing global water security challenges. Driven by increased urbanization, aging infrastructure, and heightened awareness around waterborne pathogens, demand is shifting toward formulations that offer prolonged stability, controlled solubility, and reduced handling risks. Moreover, the growing emphasis on sustainable disinfection solutions is prompting innovators to explore eco-friendly production routes and packaging options that minimize plastic waste, thereby aligning performance requirements with environmental stewardship.

Identifying the Transformative Shifts Reshaping the Calcium Hypochlorite Landscape Through Technological Advances Regulatory Trends and Market Dynamics

Innovations in calcium hypochlorite manufacturing and formulation have set in motion transformative shifts throughout the supply chain, redefining the parameters of product performance and user safety. Technological advances in granulation techniques, for example, have yielded consistent particle size distributions that enhance dissolution rates and reduce dust emissions during handling. Concurrently, proprietary stabilizers are enabling extended shelf life under variable storage conditions, a development that significantly diminishes logistical waste and operational downtime.

Regulatory frameworks are also evolving, steering producers toward more rigorous environmental compliance and worker safety standards. Recent updates in permissible residual chlorine levels for potable water have spurred manufacturers to refine purity specifications and invest in advanced monitoring equipment. At the same time, market dynamics-particularly the volatility of upstream chlorine gas and lime feedstocks-are influencing cost structures and prompting strategic alliances between chemical producers and end-user facilities. These shifts collectively underscore a landscape in which innovation, regulation, and collaboration serve as the primary catalysts for continued growth.

Assessing the Cumulative Impact of New United States Tariff Measures on Calcium Hypochlorite Trade Flows Supply Chains and Competitiveness in 2025

In 2025, newly enacted United States tariffs on imported chlorinated compounds have introduced a pivotal inflection point for domestic calcium hypochlorite trade and supply chains. The measure, aimed at addressing concerns over unfair trade practices, has elevated the cost of imported flakes and granules, compelling water utilities and industrial processors to reassess procurement strategies. Consequently, local producers are experiencing heightened demand, yet simultaneously facing pressure to scale production without compromising product quality or delivery timelines.

This tariff-driven realignment is extending beyond immediate cost implications, prompting broader shifts in competitive positioning and investment trends. Domestic manufacturers are accelerating capital projects to expand capacity, while import-dependent distributors are exploring alternative sourcing partnerships and negotiating longer-term agreements to mitigate price volatility. Meanwhile, end-users are evaluating in-house generation capabilities and blended disinfectant portfolios to balance efficacy against total cost of ownership. These strategic responses underline how tariff policy has not only altered trade flows but also reshaped market dynamics, reinforcing the imperative for stakeholders to remain agile amid evolving regulatory environments.

Unlocking Critical Segmentation Insights Revealing How Diverse Applications Forms Grades and Channels Drive Calcium Hypochlorite Demand

Examining calcium hypochlorite through the lens of application reveals that its role in water treatment is multifaceted, encompassing everything from municipal purification to specialized usage in cooling towers and wastewater management. This complexity is mirrored by the form in which the compound is delivered: while flake grades facilitate precise dosing in large-scale installations, granular and powder formats are favored by swimming pool operators for their ease of dispersion and rapid dissolution. Tablets, meanwhile, have carved out a niche in residential water treatment systems where user convenience and safety are paramount.

Diving deeper, the grade of calcium hypochlorite-ranging from technical and industrial to food and pharmaceutical-dictates stringent purity and contaminant thresholds, aligning each specification to the unique demands of diverse end-user industries. Distribution channels further influence market trajectories, with direct sales dominating large institutional contracts, distributors and retail networks expanding reach into regional markets, and e-commerce platforms emerging as a fast-growing conduit for small-quantity purchases. Across end-user segments such as agriculture, where algae control and crop-wash applications prevail, and commercial venues requiring rigorous pool maintenance, understanding the interplay of application, form, grade, distribution, and industry context is critical to unlocking differentiated value propositions and capturing market share.

This comprehensive research report categorizes the Calcium Hypochlorite market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Application

- Distribution Channel

- End User Industry

Delineating Key Regional Insights to Illustrate Differing Growth Drivers Challenges and Opportunities for Calcium Hypochlorite Across Major Geographies

Geographic factors shape demand patterns for calcium hypochlorite on a regional scale, beginning with the Americas, where aging water infrastructure in North America and expansion of sanitation facilities in Latin America are generating robust procurement pipelines. Regulatory reforms in municipal water standards are prompting utilities to upgrade disinfection systems, while agronomic uses in key agricultural zones are driving uptake of specialized granular formulations for field irrigation.

Across Europe, the Middle East, and Africa, the regulatory landscape is increasingly harmonized at the European Union level, emphasizing traceability and limiting byproducts in drinking water applications. Meanwhile, rapid urbanization and industrialization in Middle Eastern and African markets are fuelling investments in desalination and wastewater recycling, positioning calcium hypochlorite as a cost-effective choice for brine treatment and biofouling control. In the Asia-Pacific region, high-growth economies like China and India are expanding municipal water networks and enforcing stricter discharge regulations, which, coupled with a flourishing aquaculture sector, are driving strong demand for both industrial and food-grade products. The resulting regional mosaic underscores a spectrum of opportunity, contingent on localized infrastructure priorities, regulatory trajectories, and end-use requirements.

This comprehensive research report examines key regions that drive the evolution of the Calcium Hypochlorite market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Company Insights Highlighting Strategic Positioning Competitive Strategies and Innovation Profiles of Leading Hypochlorite Producers Globally

Leading chemical manufacturers are differentiating through integrated value chain strategies, with several top-tier producers leveraging captive chlorine-alkali operations to secure reliable feedstock supply and manage input cost volatility. These fully integrated players often prioritize large-scale capital investments in capacity expansion and process automation, seeking to enhance yield consistency and reduce per-unit production costs. In parallel, specialized companies with narrower portfolios are emphasizing formulation innovation, introducing proprietary stabilizers and dust-suppression technologies to cater to premium segments.

Strategic partnerships also feature prominently, as equipment suppliers collaborate with end-users to deliver turnkey water treatment solutions that integrate calcium hypochlorite dosing systems with real-time monitoring and control platforms. Some market participants are forging alliances along the supply chain to offer blended disinfectant packages, combining hypochlorite with alternative agents to optimize efficacy under varying water quality conditions. Together, these competitive strategies highlight a dynamic ecosystem where operational scale, product differentiation, and collaborative engineering converge to shape the future market landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Calcium Hypochlorite market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuro Organics Limited

- Aditya Birla Chemicals (India) Ltd.

- Advance Inorganics

- Anjanee Chemical Industries

- Asmi Chem

- China Petroleum & Chemical Corporation

- DCM Shriram Ltd.

- Grasim Industries Ltd.

- Kashyap Industries

- Lonza Group Ltd.

- Nankai Chemical Co., Ltd.

- Nikunj Chemicals Limited

- Nippon Soda Co., Ltd.

- Sihauli Chemicals Pvt. Ltd.

- Sree Rayalaseema Hi‑Strength Hypo Ltd.

- Suvidhi Chemicals Pvt. Ltd.

- Tianjin Kaifeng Chemical Co., Ltd.

- Tianjin Ruifuxin Chemical Co., Ltd.

- Tosoh Corporation

- Vinipul Inorganics Pvt. Ltd.

- Westlake Chemical Corporation

- Yuzhoushi Weilite Chemical Co., Ltd.

Formulating Actionable Recommendations for Industry Leaders to Navigate Market Headwinds Capitalize on Emerging Opportunities and Enhance Operational Resilience

To navigate tariff-induced cost pressures and evolving regulatory landscapes, industry leaders should prioritize building resilient supply chains through diversified sourcing strategies and investments in local production capabilities. Emphasizing formulation innovation-such as next-generation granulation and stabilizing additives-will enable product premiumization and open access to segments with stringent quality demands while supporting sustainability objectives through reduced waste and lower transport emissions.

In addition, forging deeper collaborative ties with end-users by offering integrated dosing and monitoring solutions can strengthen customer loyalty and create upselling pathways for value-added services. Companies should also proactively engage with regulatory bodies to anticipate shifts in disinfection standards and influence policy development. Finally, tapping into digital channels, including e-commerce and data-driven account management platforms, can broaden market reach and enhance agility in responding to localized demand fluctuations. These targeted actions will collectively help stakeholders maintain competitiveness and unlock growth in the dynamic calcium hypochlorite arena.

Outlining Rigorous Research Methodology Employed to Gather Primary and Secondary Data Ensure Reliability Validity and Triangulation in Calcium Hypochlorite Analysis

This analysis relied on a comprehensive research framework that commenced with an extensive review of industry publications, patent filings, and regulatory documents to map the current market landscape and emerging technological trends. In tandem, primary interviews were conducted with senior executives, technical directors, and procurement managers across key end-user verticals to validate market requirements and capture strategic priorities firsthand.

Quantitative data were collected from industry trade associations, government agencies, and customs databases to ascertain trade flows, tariff schedules, and pricing benchmarks. The data were then triangulated against internal proprietary databases and publicly available financial reports to enhance reliability and minimize variance. Segmentation analysis was performed using a bottom-up approach, cross-referencing application matrices, form factor usage, grade specifications, distribution channel performance, and end-user adoption rates. Finally, insights were synthesized through scenario modeling to evaluate the impact of tariffs, regulatory changes, and technological innovations on future market trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Calcium Hypochlorite market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Calcium Hypochlorite Market, by Form

- Calcium Hypochlorite Market, by Grade

- Calcium Hypochlorite Market, by Application

- Calcium Hypochlorite Market, by Distribution Channel

- Calcium Hypochlorite Market, by End User Industry

- Calcium Hypochlorite Market, by Region

- Calcium Hypochlorite Market, by Group

- Calcium Hypochlorite Market, by Country

- United States Calcium Hypochlorite Market

- China Calcium Hypochlorite Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Synthesis of Core Findings Reinforcing the Strategic Imperatives and Future Outlook for Calcium Hypochlorite Stakeholders and Decision Makers

In closing, the multifaceted landscape of calcium hypochlorite is characterized by innovation in product formulation, evolving regulatory frameworks, and shifting trade dynamics driven by new tariff structures. The interplay among application areas, form factors, grade specifications, distribution methods, and end-user demands reveals a market poised for continued transformation. Key regional variances further accentuate the need for localized strategies that align with infrastructure imperatives and policy objectives.

End-users and suppliers alike must remain vigilant to technological advances in granulation and stabilization, leverage collaborative partnerships for integrated solution delivery, and adopt flexible sourcing models to mitigate supply chain risks. By synthesizing these strategic imperatives, stakeholders can position themselves to not only withstand near-term market headwinds but also to capture long-term growth opportunities in a rapidly evolving environment.

Engage with Our Expert Associate Director to Access the Comprehensive Calcium Hypochlorite Market Report and Gain Unparalleled Strategic Insights

For tailored insights and bespoke support in navigating the evolving calcium hypochlorite market landscape, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how the full research report can inform strategic decisions and address specific organizational needs. Ketan Rohom combines deep industry expertise with a consultative approach to ensure that decision makers receive actionable intelligence, from regulatory analyses and tariff impacts to segmentation and regional growth drivers. Contacting the Associate Director grants access to executive briefings, data visualizations, and customized scenario planning tailored to your unique market context. Secure your access to comprehensive competitive profiling, detailed segmentation breakdowns, and forward-looking assessments that empower your teams to optimize supply chains, refine product portfolios, and capitalize on emerging market opportunities. Reach out today to initiate your personalized consultation and unlock unparalleled strategic guidance for sustained growth and operational excellence in the calcium hypochlorite domain

- How big is the Calcium Hypochlorite Market?

- What is the Calcium Hypochlorite Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?