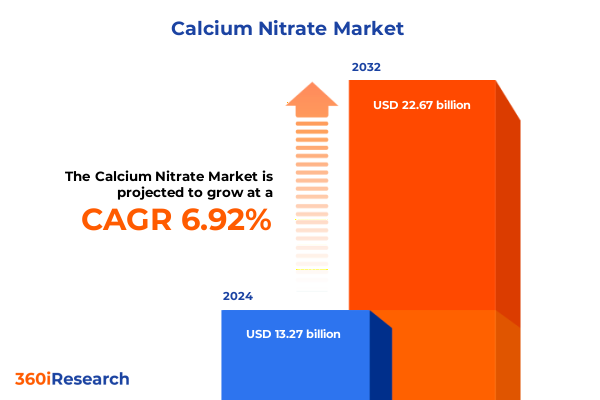

The Calcium Nitrate Market size was estimated at USD 14.15 billion in 2025 and expected to reach USD 15.09 billion in 2026, at a CAGR of 6.96% to reach USD 22.67 billion by 2032.

Unveiling the Indispensable Role of Calcium Nitrate as a High-Efficiency Source of Essential Nutrients in Modern Industrial and Agricultural Applications

Calcium nitrate occupies a unique position at the intersection of agricultural productivity and industrial process optimization, functioning as an efficient dual-nutrient provider with exceptional solubility and pH buffering capacity. In agronomic applications, it delivers readily available calcium and nitrogen, bolstering cell wall integrity in crops while ensuring balanced nutrient intake that directly contributes to enhanced yields and fruit quality. Beyond the field, calcium nitrate’s utility extends to concrete setting acceleration, refrigeration brines, and water treatment operations owing to its ability to control hydration kinetics and inhibit corrosion. This multifaceted profile establishes calcium nitrate as an indispensable material that addresses critical challenges in both plant nutrition and process engineering.

Examining the Transformation of the Calcium Nitrate Landscape Driven by Technological Innovation Environmental Sustainability and Evolving Regulatory Standards

In recent years, the calcium nitrate sector has undergone profound shifts catalyzed by technological breakthroughs, heightened sustainability mandates, and evolving regulatory landscapes. Precision agriculture platforms now integrate fertigation strategies that optimize product placement and utilization, driving the development of customized liquid formulations capable of seamless integration with drip irrigation systems. Concurrently, environmental stewardship initiatives have elevated the importance of low-carbon production routes, prompting innovators to explore renewable feedstocks and waste valorization techniques that reduce lifecycle emissions. Regulatory bodies across key regions have also instituted stricter limits on nitrate leaching and fertilizer runoff, encouraging manufacturers to reformulate products for controlled-release profiles that mitigate ecosystem impact. Taken together, these trends are transforming calcium nitrate from a commodity chemical into a platform for innovation, with cross-industry collaborations unlocking novel applications and enhancing resource efficiency.

Cumulative Reverberations of United States Trade Levies on the Calcium Nitrate Industry Amid Evolving Global Supply Chain Dynamics

The introduction of comprehensive trade levies by the United States has exerted a cumulative ripple effect across the calcium nitrate supply chain, reshaping procurement strategies and cost structures. Import duties imposed on key precursor chemicals have incrementally increased raw material expenses, compelling importers and end users to reevaluate sourcing options and inventory management practices. Domestic producers have gained a relative advantage as buyers shift toward locally manufactured volumes to mitigate tariff exposure, catalyzing capacity expansions and investments in modular production units. However, the transition has not been seamless; supply timing challenges have emerged due to reconfigured logistics routes and administrative complexities associated with compliance. In response, stakeholders are diversifying partnerships with nontraditional suppliers, exploring alternative transport corridors, and accelerating the adoption of digital trade platforms to streamline customs processes and preserve operational agility.

Uncovering the Diverse Segmentation Landscape of Calcium Nitrate Spanning Derivatives Grades Forms Distribution Channels and Application Verticals

A nuanced understanding of the calcium nitrate domain emerges when examining the spectrum of derivative chemistries, grade classifications, physical forms, distribution pathways, and application portfolios. On the derivative front, calcium ammonium nitrate dominates in high-volume agricultural deployments, while calcium nitrate tetrahydrate finds favor in industrial contexts such as concrete acceleration and refrigeration cycle optimization. Calcium potassium nitrate, with its enriched potassium profile, is carving out a niche within specialty horticulture markets. Grade differentiation further segments the space into agricultural, industrial, and pharmaceutical categories, with agricultural grade subdivided into specialized fertigation and horticulture offerings designed for targeted nutrient delivery. Pulverous, granular, and liquid formulations cater to distinct handling and dispersion requirements, where liquids continue to gain traction in precision delivery systems and powders remain entrenched in bulk blending facilities. Traditional offline sales channels preserve their role in established procurement networks, yet a rising proportion of transactions now occur through digital storefronts hosted on brand websites and larger e-commerce platforms. Application segmentation spans field crops, horticulture, and turf management within agriculture; healthcare and pH stabilization in pharmaceutical contexts; concrete setting, explosives manufacturing, and refrigeration in industrial processes; and critical water treatment functions aimed at hardness control and corrosion inhibition.

This comprehensive research report categorizes the Calcium Nitrate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Derivative Type

- Grade

- Form

- Distribution Channel

- Application

Exploring Regional Dynamics Driving Calcium Nitrate Demand and Innovation Across Americas Combined Europe Middle East Africa and the Broader Asia Pacific

The regional outlook for calcium nitrate reflects distinct demand drivers and regulatory frameworks across the Americas, Europe Middle East Africa collective, and Asia Pacific geographies. In the Americas, mechanized large-scale agriculture and turf management industries underpin robust uptake of granular and liquid fertilizers, while stringent water quality mandates drive water treatment adoption in both municipal and industrial facilities. Within the Europe Middle East Africa assemblage, European Union regulations on nitrate run-off and environmental safety are accelerating the development of controlled-release formulations, whereas Middle East industrial projects leverage calcium nitrate’s concrete accelerating properties under arid climate conditions. African markets are emerging, particularly in irrigation-focused agricultural zones. Across Asia Pacific, China leads as both a major producer and consumer, innovating with circular economy practices that convert industrial byproducts into feedstock. India’s expanding precision farming initiatives fuel liquid formulation demand, and Australia’s turf and horticulture sectors continue to elevate specialized calcium potassium-based blends for high-value crops.

This comprehensive research report examines key regions that drive the evolution of the Calcium Nitrate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Movements and Dynamics of Leading Manufacturers in the Calcium Nitrate Industry Emphasizing Collaboration and Diversification

Strategic movements by leading chemical companies underscore a competitive landscape shaped by collaborative R&D, capacity optimization, and vertical integration. Global entities are forming joint ventures to localize production closer to consumption centers, thereby reducing logistical complexity and tariff liabilities. Several players have prioritized investments in green chemistry, deploying electrochemical synthesis and recovering nitric acid from waste streams to enhance sustainability credentials. Partnerships with agricultural technology firms have accelerated the launch of digital application platforms that guide end users on precision dosing and adaptive nutrient management. In parallel, firms active in construction chemicals have acquired or aligned with concrete admixture specialists to integrate calcium nitrate-based accelerators seamlessly into ready-mix frameworks. Such initiatives not only reinforce product portfolios but also establish consultative relationships that extend beyond conventional supply contracts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Calcium Nitrate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aldon Corporation

- Barium and Chemicals, Inc.

- Blue Line Corp. by United Rentals, Inc.

- Dr Paul Lohmann Inc.

- FBSciences

- GFS Chemicals Inc.

- Haifa Chemicals Ltd.

- Jiaocheng Sanxi Chemical Co. Ltd

- Merck KGaA

- Nicolia Ready Mix

- Noah Chemicals Corporation

- Norkem

- Nutrien Ltd.

- Prathista Industries Limited

- ProChem, Inc by RPM International Inc.

- RLF AgTech

- Rural Liquid Fertilisers Pty Ltd.

- SAE Manufacturing Specialties Corp.

- Sasol Limited

- Shanxi Jiaocheng Tianlong Chemical Industry Co., Ltd.

- Shanxi Leixin Chemical Co., Ltd.

- Sterling Chemicals Company by Eastman Chemical Company

- Swiss Formulations

- Uralchem Holding PLC

- Van Iperen International B.V.

- Vardhaman Fertilizers and Seeds Pvt Ltd.

- Yara International ASA

Actionable Strategies Enabling Industry Leaders to Leverage Calcium Nitrate Advancements and Overcome Evolving Challenges in Sustainability and Supply Chains

Industry leaders are advised to prioritize technology-enabled value creation by exploring liquid product innovations tailored for precision irrigation systems and automated nutrient delivery platforms. To counterbalance trade levy impacts, diversifying raw material sources and investing in localized modular production units will safeguard supply continuity and cost stability. Engaging in strategic alliances with agritech and construction software providers can transform calcium nitrate offerings into integrated solutions that deliver actionable agronomic and operational insights. Embracing circular economy models by valorizing industrial byproducts as precursor streams will bolster sustainability credentials and reduce feedstock volatility. Simultaneously, strengthening e-commerce capabilities through dedicated brand portals and partnerships with digital marketplaces will enhance customer reach and foster data-driven demand forecasting insights. Such initiatives will position companies to both manage emerging headwinds and capture upside in a dynamic competitive arena.

Detailing the Research Framework Integrating Data Collection Primary Validation and Analytical Techniques to Generate Insights into Calcium Nitrate Trends

The analysis underpinning this report utilizes a multi-tiered research logic designed to ensure accuracy and relevance. It commenced with a comprehensive review of public regulatory filings, industry white papers, and patent databases to map the full spectrum of calcium nitrate innovations. Secondary data was supplemented by structured interviews with chemical engineers, agronomists, and procurement professionals to validate key drivers and performance metrics. Quantitative inputs were then triangulated against shipment records and customs data, while qualitative insights were synthesized through thematic coding of expert discussions. Throughout this process, a rigorous validation protocol was applied, incorporating cross-functional peer reviews and iterative feedback cycles with domain specialists to refine interpretations and ensure the robustness of conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Calcium Nitrate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Calcium Nitrate Market, by Derivative Type

- Calcium Nitrate Market, by Grade

- Calcium Nitrate Market, by Form

- Calcium Nitrate Market, by Distribution Channel

- Calcium Nitrate Market, by Application

- Calcium Nitrate Market, by Region

- Calcium Nitrate Market, by Group

- Calcium Nitrate Market, by Country

- United States Calcium Nitrate Market

- China Calcium Nitrate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights and Imperatives for Stakeholders to Embrace Opportunities and Navigate Challenges in the Evolving Calcium Nitrate Ecosystem

The collective insights articulated in this summary emphasize the strategic importance of calcium nitrate as both a critical nutrient source and an enabler of efficient industrial processes. Segmentation analysis reveals opportunities to deepen product differentiation across derivative types, grades, forms, channels, and end-use applications. Regional dynamics highlight the need for localized strategies that align with regulatory imperatives and consumption patterns. Competitive intelligence underscores the value of collaborative innovation and supply chain agility. By embracing the recommended strategies-ranging from technological advancements and feedstock diversification to circular economy adoption and digital engagement-stakeholders can convert emerging challenges into sustainable growth pathways. A proactive, data-driven approach will be essential for navigating the evolving calcium nitrate ecosystem and securing long-term resilience.

Connect With Ketan Rohom Associate Director Sales and Marketing to Discover How This Calcium Nitrate Report Can Empower Strategic Decisions and Drive Growth

For customized insights tailored to your strategic imperatives and to explore how the comprehensive calcium nitrate analysis can drive your growth objectives, we invite you to reach out directly to Ketan Rohom, Associate Director, Sales and Marketing. Engaging with Ketan will enable you to access in-depth discussions, detailed report excerpts, and personalized guidance on optimizing calcium nitrate implementation within your operations. Whether you aim to deepen your technical understanding, negotiate licensing or supply agreements, or align your product development roadmaps with emerging trends, Ketan will facilitate a seamless process from inquiry to acquisition. Don’t miss the opportunity to leverage this specialized knowledge to inform your next strategic moves and secure a competitive edge.

- How big is the Calcium Nitrate Market?

- What is the Calcium Nitrate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?