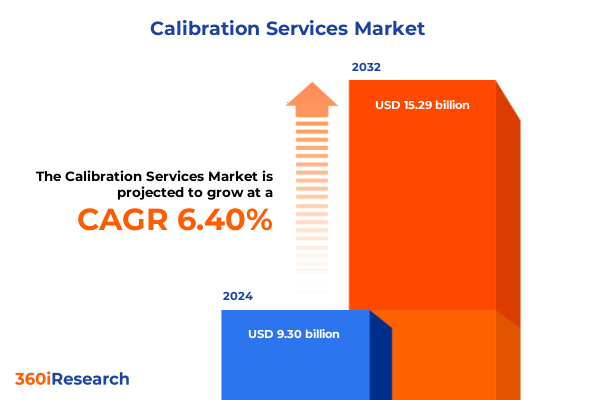

The Calibration Services Market size was estimated at USD 9.86 billion in 2025 and expected to reach USD 10.46 billion in 2026, at a CAGR of 6.46% to reach USD 15.29 billion by 2032.

Introducing Calibration Services Revolutionizing Precision Management and Quality Assurance for Modern Industries Through Advanced Technological Innovation

Calibration services form the bedrock of quality assurance, ensuring that measurement instruments across industries perform within stringent tolerances to guarantee product reliability and regulatory compliance. As manufacturing processes become increasingly automated and equipment complexity grows, maintaining accuracy through periodic calibration has evolved from a regulatory checkbox into a strategic enabler of operational excellence. Calibration labs and service providers now play a pivotal role in supporting industrial clients by delivering high-precision measurements, traceable certifications, and performance validations that underpin critical decision-making.

In recent years, calibration services have expanded beyond traditional on-site and laboratory offerings, embracing innovative service models and advanced technological solutions. From centralized in-house calibration units to independent third-party laboratories, the market structure caters to a wide range of organizational needs. As industries such as aerospace, automotive, healthcare, and energy demand ever-tighter tolerances and faster turnaround times, calibration providers are accelerating service differentiation through digital connectivity, specialized instrumentation capabilities, and compliance expertise. This dynamic backdrop sets the stage for exploring how evolving technologies, regulatory actions, and market segmentation strategies are reshaping the calibration services landscape.

Exploring the Transformative Impact of Industry Four Era Technologies on Calibration Services Embracing Digital Remote Connectivity and Predictive Solutions

The calibration services sector is undergoing a paradigm shift driven by the integration of Industry Four era technologies that unlock new levels of precision and efficiency. Digital calibration platforms, which embed software-defined processes and automated workflows, are streamlining the entire calibration life cycle from data capture to certificate generation. These systems not only reduce manual intervention but also enable real-time analytics that flag deviations and quality trends instantaneously, empowering clients to address compliance risks proactively.

Remote calibration services have emerged as a game-changer for industries operating in dispersed or high-risk environments. Leveraging secure cloud connections and IoT-enabled sensors, technicians can perform validation routines, adjust instrument parameters, and issue digital certificates without setting foot on site. This model significantly cuts travel costs and turnaround times while maintaining rigorous audit trails.

Artificial intelligence and machine learning algorithms are further accelerating service innovation by forecasting instrument drift and scheduling predictive maintenance. By analyzing historical performance data and environmental factors, AI-driven solutions can recommend calibration intervals optimized for equipment usage patterns, reducing unnecessary downtime and extending asset life cycles. As a result, calibration service providers are transitioning from reactive compliance partners to strategic operational advisors, delivering actionable insights that enhance productivity and reduce total cost of ownership.

Analyzing the Cumulative Effects of 2025 United States Tariffs on Calibration Equipment and Supply Chain Dynamics

The United States has rolled out a series of broad-based tariff measures in 2025 that are reshaping the economics of calibration equipment imports and service delivery. In March, a 25% levy on steel and aluminum imports under Section 232 took effect, requiring end-users and service providers to absorb higher costs for calibration benches, tool stands, and structural components in test rigs.

Simultaneously, the administration extended 25% tariffs on machinery and instruments from Mexico and Canada, while raising Chinese import duties from 10% to 20%, directly impacting the price of precision sensors, transducers, and electronic reference standards. Research institutions and industrial laboratories have reported sticker shock as the cost of routine calibrations for scientific devices has risen noticeably, prompting many to re-evaluate sourcing strategies and inventory levels.

Calibration equipment distributors and OEMs have responded by implementing tariff-related surcharges, with notices indicating price adjustments ranging from 4% to 10% on products such as multimeters, torque wrenches, and pressure transmitters. These surcharges, scheduled throughout early 2025, reflect efforts to preserve service margins but also underscore supply chain vulnerabilities. As tariff volatility persists, calibration service leaders must adopt hedging tactics, regional sourcing diversification, and collaborative procurement partnerships to mitigate cost pass-through and maintain competitive service pricing.

Uncovering Key Insights Across Diverse Calibration Market Segments Highlighting Types Providers and Application-Specific Opportunities

A nuanced understanding of market segmentation reveals that calibration demand varies significantly by instrument type and usage context. Dimensional calibration services-covering measurement standards from calipers and dial indicators to gauge blocks and vernier scales-remain foundational for manufacturing quality systems, but providers are increasingly bundling advanced optical metrology and coordinate measuring machine validations to address complex geometry challenges. In the realm of electrical calibration, multimeters, oscilloscopes, power meters, and signal generators constitute the primary service portfolio, yet the highest growth in demand stems from mixed-signal analyzers and emerging RF test gear requiring specialized high-frequency expertise.

High voltage calibration for probes, hipot and insulation testers, and voltage dividers has seen upticks in sectors such as utilities and power generation, driven by tighter grid stability regulations and renewable integration. Meanwhile, mass and balance services have expanded beyond traditional scales to support medical devices like blood pressure monitors, ECG machines, infusion pumps, and ventilators, reflecting the healthcare segment’s intensifying compliance demands. Optical calibration of refractometers, spectrophotometers, and power meters is now critical in pharmaceutical R&D and semiconductor fabrication, where nanometer-level precision ensures product integrity.

Calibration providers also differentiate offerings based on instrument type-benchtop systems versus portable calibrators-with portable units gaining traction in field service applications due to minimal setup requirements and rapid deployment. Service delivery models are similarly stratified: in-house labs cater to large OEMs seeking full control over traceability, OEMs provide calibration bundled within equipment warranties, and third-party specialists offer accredited flexibility across diverse platforms. Application-focused insights indicate that aerospace and defense prioritize extreme accuracy and rapid turnaround; automotive demands high-volume efficiency; chemical, petrochemical, and oil & gas require hazardous environment certifications; electronics and semiconductor clients pursue sub-micron tolerances; energy & utilities call for regulatory alignment; food & beverage emphasize hygienic calibration processes; metrology organizations lead standards development; and healthcare splits needs between medical device performance and pharmaceutical equipment validation.

This comprehensive research report categorizes the Calibration Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Calibration Type

- Instrument Type

- Service Provider

- Application

Revealing Regional Nuances in Calibration Services Demand Across the Americas Europe Middle East and Africa as Well as Asia-Pacific Markets

Each global region exhibits distinct drivers shaping calibration services deployment and growth trajectories. The Americas remain a mature market characterized by rigorous regulatory frameworks, extensive in-house calibration infrastructure, and a high concentration of third-party laboratories offering niche capabilities. North American service providers leverage advanced digital platforms and predictive analytics to maintain competitive differentiation, while Latin American industries often rely on portable calibrators and OEM support to manage cost-constrained operations.

Europe, the Middle East, and Africa (EMEA) present a diverse calibration landscape where stringent EU directives coexist with emerging market demand. Western Europe leads in adopting cloud-based calibration management systems and integrated quality platforms, whereas Middle Eastern and African sectors prioritize basic dimensional and electrical calibration, often facilitated through regional third-party networks and OEM partnerships. Cross-border harmonization initiatives under the African Continental Free Trade Area are fostering standardization, opening new avenues for pan-regional service consortia.

Asia-Pacific stands out for rapid industrialization and vast calibration service expansion in China, India, Southeast Asia, and Oceania. Local laboratories are scaling up to serve automotive, electronics, and energy sectors, with strong government support for metrology institutes driving technology adoption. Portable calibration solutions and remote services are particularly prevalent in regions with widespread manufacturing hubs, ensuring minimal downtime. Across Asia-Pacific, the push toward self-sufficiency and domestic manufacturing incentivizes calibration providers to establish in-country R&D centers and training programs to meet evolving compliance needs.

This comprehensive research report examines key regions that drive the evolution of the Calibration Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Landscapes with Key Company Profiles Shaping the Calibration Services Market Globally Through Innovation and Service Excellence

The calibration services market is fiercely competitive, anchored by global leaders and specialized challengers alike. Fluke Corporation commands significant influence in electrical calibration, renowned for its robust handheld calibrators and calibration management software that integrate seamlessly with industrial automation systems. ABB and Honeywell leverage their broader instrumentation and automation portfolios to deliver end-to-end calibration solutions in power and process industries.

Key players such as Keysight Technologies, Rohde & Schwarz, and Tektronix excel in high-frequency and RF calibration, supported by digitally enabled laboratories and extensive technical support networks. Yokogawa Electric and Endress+Hauser stand out in flow, pressure, and temperature calibration services, capitalizing on deep process industry expertise and global delivery models. Transcat and Bureau Veritas differentiate on accreditation depth and rapid turnaround capabilities, while regional specialists like Beamex and Trescal emphasize integrated software platforms and customized service packages.

Smaller independent providers are intensifying competition by offering niche expertise in life sciences validation, optical instrument calibration, and torque and mass & balance services. Collaboration between calibration labs and instrument manufacturers has become commonplace, enabling bundled service offerings that reduce customer complexity. As digital transformation reshapes service delivery, companies investing in IoT-enabled devices, AI-driven analytics, and remote calibration platforms are best positioned to capture emerging opportunities and maintain market leadership across segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Calibration Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Agilent Technologies Inc.

- Custom Calibration, Inc.

- Danaher Corporation

- Electrical Test Instruments, LLC

- Endress+Hauser AG

- ESSCO Calibration Laboratory

- Fortive Corporation

- General Electric Company

- GMS Instruments BV

- Godrej & Boyce Mfg. Co. Ltd.

- Hottinger Brüel & Kjær

- Intertek Group plc

- Keysight Technologies Inc.

- Micro Precision Calibration Inc.

- MTS Systems Corporation by Illinois Tool Works Inc.

- Optical Test and Calibration Ltd.

- Rohde & Schwarz GmbH & Co KG

- Siemens AG

- Simco Electronics

- SKF Group

- Strainsert, Inc.

- Sulzer AG

- Technical Maintenance Inc.

- Tradinco Instruments

- Transcat Inc.

- Trescal Holdings Inc.

- Viavi Solutions, Inc.

Actionable Recommendations for Industry Leaders to Navigate Digital Transformation Tariff Challenges and Sustainable Growth in Calibration Services

To thrive amid accelerating technological change and regulatory intensity, calibration service leaders must embrace a multi-pronged strategy. First, investing in digital platforms that support remote calibration, predictive maintenance, and real-time compliance reporting will drive operational efficiencies and create new revenue streams through value-added service offerings. Service providers should partner with software developers to integrate AI and machine learning models that forecast instrument drift and automate schedule optimization.

Second, mitigating tariff and supply chain risks requires diversifying manufacturing and sourcing footprints, including establishing regional calibration hubs and qualifying alternative component suppliers. Providers can forge strategic alliances with OEMs and logistics partners to secure preferential access to critical reference standards and calibration equipment.

Third, differentiating through specialized service bundles-such as integrated asset management, training programs, and sustainability-focused calibrations-will strengthen customer loyalty and open cross-sell opportunities. Cultivating expertise in highly regulated industries like aerospace, healthcare, and energy ensures defensible competitive positions. Finally, aligning service infrastructure with sustainability goals-by deploying energy-efficient calibration labs, reducing travel through remote services, and adopting eco-friendly packaging-will resonate with corporate environmental objectives and support long-term business resilience.

Outlining a Rigorous Multimethod Research Methodology Combining Primary Interviews Secondary Data and Data Triangulation to Ensure Analytical Integrity

This study combines primary and secondary research methodologies to ensure a robust and objective analysis of the calibration services market. Primary inputs were gathered through in-depth interviews with calibration service executives, metrology institute leaders, and end-user quality managers across key regions. These discussions provided qualitative insights into emerging service demands, technology adoption barriers, and competitive strategies.

Secondary research encompassed a comprehensive review of industry publications, trade association reports, regulatory directives, and corporate communications. Data triangulation techniques were applied to reconcile divergent estimates, validate key trends, and confirm service provider capabilities. Market participant profiling was augmented by case studies and benchmarking exercises to assess digital platform performance, tariff impact mitigation practices, and regional service delivery models.

Analytical rigor was maintained through iterative validation sessions with subject-matter experts, ensuring that assumptions aligned with current industry practices and emerging regulatory frameworks. The resulting framework delivers actionable intelligence with high confidence levels, empowering stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Calibration Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Calibration Services Market, by Calibration Type

- Calibration Services Market, by Instrument Type

- Calibration Services Market, by Service Provider

- Calibration Services Market, by Application

- Calibration Services Market, by Region

- Calibration Services Market, by Group

- Calibration Services Market, by Country

- United States Calibration Services Market

- China Calibration Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Concluding Strategic Imperatives Highlighting Critical Trends and Key Takeaways to Guide Future Calibration Service Investments and Operational Excellence

The calibration services industry is at a strategic inflection point where digital transformation, tariff volatility, and specialized demand converge to redefine service competition. Providers that harness advanced technologies-such as AI-driven predictive calibration, remote connectivity, and cloud-based management systems-will secure operational efficiencies and create new high-value service tiers. Concurrently, market players must navigate complex trade measures by diversifying their sourcing approaches and building regional capabilities to mitigate cost pressures.

Segment-specific insights highlight that dimensional, electrical, high voltage, mass & balance, optical, pressure, RF & microwave, temperature, and torque calibration services each present unique growth opportunities. Differentiated service models-spanning benchtop systems to portable calibrators, in-house labs to third-party specialists, and application-focused offerings across aerospace, automotive, healthcare, chemical, energy, electronics, food & beverage, metrology, and oil & gas-underscore the need for targeted investment in specialized expertise.

Regionally, mature markets in the Americas and EMEA emphasize compliance rigor and digital platform adoption, while Asia-Pacific’s rapid industrial expansion favors scalable remote and mobile solutions. Leading companies are forging collaborative ecosystems that blend instrumentation excellence with software-defined services, setting a high bar for innovation and customer centricity. As the industry evolves, stakeholders who align technology investments, service diversification, and tariff resilience will capture the most significant value and drive the next wave of calibration services excellence.

Engage with Ketan Rohom to Unlock In-Depth Insights and Drive Strategic Decisions in Calibration Services by Acquiring Your Customized Market Research Report Today

If your organization is poised to capitalize on the transformative trends, competitive dynamics, and regulatory shifts shaping the calibration services industry, a deeper dive into comprehensive market analysis is essential. To gain exclusive access to in-depth data, strategic insights, and tailored recommendations, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By connecting with Ketan Rohom, you will secure guidance on how to leverage this intelligence to refine your service offerings, optimize market entry strategies, and strengthen your value proposition against emerging challenges. Don’t miss the opportunity to empower your decision-making with actionable intelligence; contact Ketan Rohom today to acquire your customized market research report and chart a path toward sustained growth and differentiation in the calibration services landscape

- How big is the Calibration Services Market?

- What is the Calibration Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?