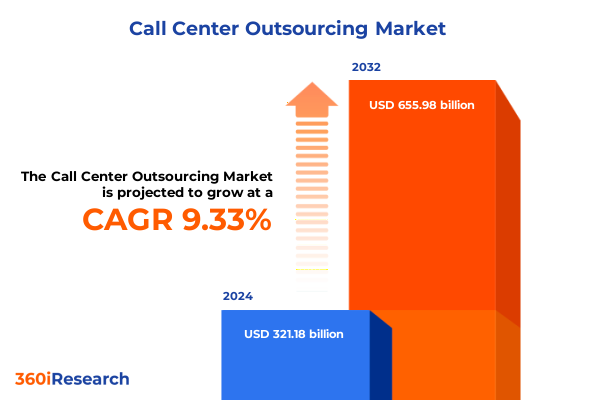

The Call Center Outsourcing Market size was estimated at USD 351.24 billion in 2025 and expected to reach USD 381.53 billion in 2026, at a CAGR of 9.33% to reach USD 655.98 billion by 2032.

Unveiling the Pillars and Evolutionary Journey of Modern Call Center Outsourcing Services in a Digital-Driven Era

Call center outsourcing stands as a cornerstone of modern customer engagement strategies, encompassing both voice-based interactions and an expanding array of digital touchpoints. Over time, this facet of business process outsourcing has matured from basic inbound and outbound calling services into a sophisticated, multi-channel support ecosystem. Today, organizations increasingly rely on specialized third-party providers to deliver seamless interactions that align with evolving customer expectations and technological advancements

The industry’s trajectory reflects a continuous push toward innovation, with providers integrating artificial intelligence, analytics, and cloud-based solutions to enhance efficiency and service quality. Alongside these technological shifts, demographic changes and regulatory pressures have spurred the emergence of remote and hybrid workforce models, enabling access to a broader talent pool while maintaining operational resilience and compliance with data protection frameworks

Exploring the Deep Technological and Structural Shifts Redefining Call Center Outsourcing and Customer Engagement Dynamics

The call center outsourcing landscape is undergoing profound transformation as artificial intelligence and automation technologies reshape traditional workflows. Leading providers now deploy intelligent virtual agents to handle routine inquiries, while human agents dedicate their expertise to complex, value-added interactions. This shift is driving operational efficiencies and enabling providers to scale personalized services across diverse communication channels, setting a new standard for customer experience delivery

Simultaneously, omnichannel strategies have become imperative, as customers demand consistent support across voice, email, chat, and social media. Forward-looking organizations are consolidating customer data on unified platforms and leveraging analytics to gain real-time insights, optimize agent performance, and anticipate customer needs. By embracing these digital and hybrid models, call center services are transitioning from cost-centers to strategic growth drivers that strengthen brand loyalty and business agility

Assessing the Far-Reaching Ramifications of 2025 U.S. Tariff Reforms on Global Call Center Outsourcing Models and Cost Structures

In 2025, United States trade policy introduced sweeping tariff reforms that raised average import duties from just above 2% to roughly 15%, marking the highest rates since the 1940s. These measures, aimed at reshoring manufacturing and addressing national security priorities, have extended their influence beyond goods to the broader service delivery ecosystem. Although direct tariffs on services remain limited, the resultant cost pressures and supply chain realignments are prompting organizations to reassess their outsourcing partnerships and delivery models

As a consequence, many companies are diversifying offshore locations and shifting toward nearshore hubs in Latin America, Eastern Europe, and Southeast Asia to mitigate compliance burdens and currency volatility. Additionally, there is a growing emphasis on process automation and AI-driven solutions to offset rising operational costs. Strengthening trade compliance frameworks and leveraging digital platforms for real-time regulatory updates have become essential strategies for maintaining continuity in global call center operations under the new tariff regime

Unraveling Multidimensional Segmentation Insights That Drive Service Customization and Strategic Outsourcing Decisions

The call center outsourcing market can be viewed through multiple lenses, beginning with the distinction between voice and nonvoice services. While traditional voice interactions remain vital for complex, emotionally nuanced support, nonvoice functions-such as back office operations, chat support, email management, and social media engagement-are experiencing accelerated adoption as customers increasingly favor digital channels. This duality underscores the need for providers to deliver integrated solutions that balance conversational quality with digital efficiency

Industry verticals also shape outsourcing strategies, with regulated sectors such as banking, financial services, and insurance demanding secure, compliant frameworks for high-volume account inquiries and technical assistance. Healthcare and life sciences require HIPAA-aligned processes and specialized medical terminology expertise, while retail and e-commerce focus on order management and omnichannel sales support. Telecom, IT, travel, and hospitality segments drive further diversification, each presenting unique service expectations and technological requirements.

Moreover, delivery models-ranging from cost-efficient offshore centers to culturally aligned nearshore hubs and compliance-sensitive onshore sites-enable organizations to optimize time-zone coverage, data security, and operational agility. Finally, the split between large enterprises and small to medium businesses reflects varying adoption speeds and integration complexities, as larger organizations pursue bespoke, globally integrated platforms while SMEs prioritize scalability and cost-effectiveness

This comprehensive research report categorizes the Call Center Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Delivery Model

- Organization Size

- Industry Vertical

Highlighting Critical Regional Dynamics That Influence Outsourcing Footprints and Service Delivery Models Globally

Geographic dynamics play a pivotal role in shaping call center outsourcing strategies. The Americas region, anchored by the United States and Canada, leads in digital transformation adoption and cloud-enabled support services. Mature market infrastructures and advanced regulatory frameworks foster innovation, making North America a hub for omnichannel and AI-driven customer engagement solutions. Meanwhile, Latin American nearshore destinations are gaining traction for their cultural affinity and favorable time-zone alignments, providing a strategic balance between cost and proximity

Across Europe, the Middle East, and Africa, diverse linguistic capabilities and robust data protection regimes drive demand for multilingual support and compliance-focused services. Western Europe’s emphasis on GDPR compliance has elevated the adoption of secure outsourcing partnerships, while emerging markets in Eastern Europe are carving out niches in IT-enabled BPO offerings. In the Asia-Pacific region, established centers in the Philippines and India continue to deliver large-scale offshore capacity, complemented by rising hubs in Indonesia and Vietnam that offer competitive labor costs and evolving technology ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Call Center Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Moves and Technological Advancements Shaping Key Players in the Outsourced Customer Support Ecosystem

The competitive landscape is dominated by global leaders and innovative challengers. Teleperformance remains at the forefront, leveraging advanced AI tools and accent-altering software to enhance cross-border voice interactions and maintain high customer satisfaction levels. Capgemini’s strategic acquisition of WNS underscores the emphasis on combining AI capabilities with deep process expertise to deliver intelligence-driven service platforms. These moves reflect a broader industry trend toward integrated, technology-enabled offerings that meet complex enterprise requirements

Tata Consultancy Services has signaled a future where generative AI and virtual assistants could substantially reduce traditional call center volumes, reinforcing the need for providers to pivot toward high-value, analytics-driven services. Other key players, such as Concentrix, TTEC, Genpact, and Sitel, are intensifying investments in cloud-based omnichannel platforms and data analytics to differentiate on customer experience and operational agility. Meanwhile, regional specialists and midsize providers are focusing on vertical-specific excellence-particularly in healthcare, finance, and telecom-to capture niche opportunities and deliver customized, high-touch solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Call Center Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acticall Sitel Group

- Alorica Inc.

- Arvato Bertelsmann GmbH

- Atento S.A.

- Comdata Group

- Concentrix Corporation

- Convergys Corporation

- Genpact Limited

- Hinduja Global Solutions Limited

- ibex Holdings Limited

- Intelenet Global Services

- Qualfon Corporation

- ResultsCX

- Sitel Group

- Startek Inc.

- Sykes Enterprises Incorporated

- Teleperformance SE

- Televerde

- Transcom Worldwide AB

- TTEC Holdings Inc.

- VXI Global Solutions LLC

- Webhelp Group

Implementing Strategic and Technological Initiatives to Enhance Resilience, Compliance, and Omnichannel Excellence in Customer Support

Leaders in the call center outsourcing industry should accelerate the integration of AI-powered automation, while concurrently investing in workforce reskilling programs that enable agents to focus on empathetic, complex problem-solving tasks. By embedding co-pilot systems alongside human experts, organizations can enhance first-contact resolution rates and drive service consistency across channels. It is crucial to partner with technology vendors to develop scalable automation roadmaps that align with evolving customer expectations

Additionally, diversifying delivery models across offshore, nearshore, and onshore centers can mitigate geopolitical and tariff-related risks. Strengthening compliance protocols through digital trade-compliance platforms and regular audit processes will safeguard operations amid shifting regulatory landscapes. Finally, adopting cloud-native omnichannel platforms and advanced analytics will yield deeper insights into customer journeys, enabling hyper-personalized engagement strategies that boost loyalty and lifetime value.

Detailing Our Robust Mixed-Method Research Framework Aligned with Global Ethical Standards and Data Quality Protocols

Our research methodology encompassed rigorous primary and secondary approaches in line with international best practices. Primary data were collected through structured interviews and consultations with senior executives at leading outsourcing providers and enterprise end users, ensuring firsthand insights into strategic priorities and operational challenges. Secondary research involved comprehensive review of industry reports, trade publications, regulatory filings, and credible news sources, guided by ESOMAR standards to maintain data quality and transparency

Data triangulation and cross-validation techniques were employed to reconcile diverse information streams and verify emerging trends. Qualitative analyses were complemented by thematic coding of interview transcripts, while secondary data were synthesized to establish contextual benchmarks. The segmentation framework-encompassing service type, industry vertical, delivery model, and organization size-provided a structured lens for comparative analysis, with validation workshops conducted to refine insights and ensure robustness.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Call Center Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Call Center Outsourcing Market, by Service Type

- Call Center Outsourcing Market, by Delivery Model

- Call Center Outsourcing Market, by Organization Size

- Call Center Outsourcing Market, by Industry Vertical

- Call Center Outsourcing Market, by Region

- Call Center Outsourcing Market, by Group

- Call Center Outsourcing Market, by Country

- United States Call Center Outsourcing Market

- China Call Center Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Market Dynamics and Strategic Imperatives for Sustainable Growth in the Outsourced Customer Service Domain

In summary, the call center outsourcing market is experiencing a paradigm shift driven by AI-enabled automation, omnichannel integration, and dynamic workforce models. These transformative forces, coupled with evolving trade policies and tariff implications, are reshaping how organizations approach global service delivery. Strategic segmentation by service type, industry vertical, delivery model, and organization size reveals nuanced opportunities for tailored solutions and value creation across regions and market segments

As competitive pressures intensify, providers and buyers alike must prioritize technology investments, compliance enhancements, and flexible partnership models to unlock resilience and growth. By leveraging the insights and recommendations outlined in this executive summary, industry leaders can confidently navigate uncertainties and position themselves for sustained success in a rapidly evolving outsourcing ecosystem

Connect Directly with Our Associate Director to Secure Your In-Depth Call Center Outsourcing Market Insights Report

Are you ready to gain a competitive edge and navigate the evolving call center outsourcing landscape with confidence? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how our in-depth market research report can inform your strategic decisions. Connect with him today to secure your copy and equip your organization with the insights needed to drive growth, optimize operations, and stay ahead of industry disruptions

- How big is the Call Center Outsourcing Market?

- What is the Call Center Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?