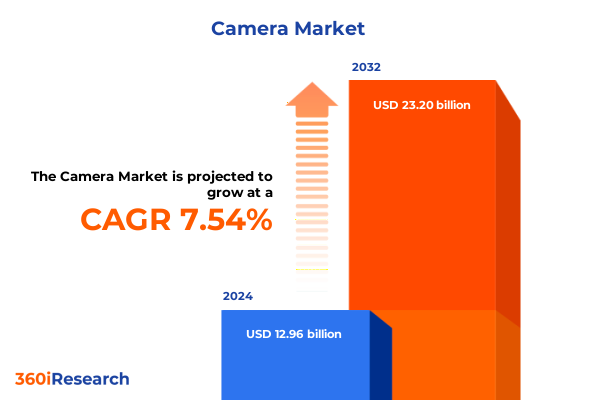

The Camera Market size was estimated at USD 12.96 billion in 2024 and expected to reach USD 13.88 billion in 2025, at a CAGR of 7.54% to reach USD 23.20 billion by 2032.

Unveiling the Transformative Journey of the Global Camera Industry Highlighting Emerging Trends Technological Advances and Strategic Imperatives

The global camera market stands at a pivotal juncture, driven by unprecedented technological advancements and evolving consumer expectations. Amid the expansion of immersive content creation, the convergence of imaging technologies with artificial intelligence and cloud-based workflows has catalyzed the reinvention of camera capabilities. This executive summary offers a concise yet comprehensive view of the factors shaping current dynamics, equipping decision-makers with actionable intelligence to navigate this complex environment.

Drawing on extensive primary interviews with industry leaders, secondary research from proprietary databases, and expert analysis of emerging trends, this introduction sets the stage for a deeper exploration of market transformations. By establishing the context for both macroeconomic forces and granular competitive maneuvers, we provide a strategic lens through which stakeholders can anticipate opportunities and address potential disruptions. Ultimately, this summary distills vast arrays of data into a clear narrative of how technological progress, regulatory shifts, and shifting consumer behaviors converge to define the future of the camera industry.

Mapping the Paradigm Shifts Redefining the Camera Landscape from Content Creation to Immersive Experiences in a Rapidly Changing Ecosystem

Over the past five years, the camera industry has undergone profound transformations, shifting from traditional standalone devices to integrated imaging ecosystems that power everything from professional cinematography to social media content creation. In response to growing demand for hyper-realistic video, sensor manufacturers have accelerated research in high dynamic range and low-light performance, while computational photography algorithms have redefined image processing workflows. Concurrently, the proliferation of cloud-native editing platforms has democratized post-production, enabling users to collaborate in real time and harness machine learning for automated enhancements.

In addition, sustainability considerations have emerged as a key differentiator, with leading brands adopting modular designs to extend product lifecycles and reduce electronic waste. This pivot toward circular economy principles not only addresses regulatory pressures but also aligns with consumer preferences for eco-conscious purchasing. Moreover, the integration of 5G connectivity in camera modules has unlocked new use cases for live remote monitoring, industrial inspections, and autonomous vehicles. Consequently, companies that embrace interoperability standards and open APIs are best positioned to capitalize on these converging innovations, forging strategic partnerships with software developers and telecom operators to deliver comprehensive imaging solutions.

Analyzing the Ripple Effects of 2025 United States Camera Tariffs on Supply Chains Pricing Structures and Cross Border Competitive Dynamics

In early 2025, the United States implemented revised tariff structures on imported imaging components and finished camera equipment, aiming to bolster domestic manufacturing and address trade imbalances. These measures have introduced additional duties on key sensor elements, lens assemblies, and specialized electronic modules, leading to recalibrated cost structures across the supply chain. Manufacturers have responded by reshoring select assembly operations and diversifying supplier networks to mitigate localized disruptions.

As a result, end users have experienced marginal price adjustments, particularly in premium mirrorless and high-resolution video camera segments. At the same time, domestic component producers have gained newfound leverage to negotiate volume contracts, spurring investment in automation and capacity expansion. Retailers and distributors have also reevaluated inventory strategies, opting for leaner stocking models and enhanced predictive analytics capabilities to offset carrying costs. Looking forward, the cumulative effect of these tariffs is expected to catalyze a reconfiguration of sourcing strategies, reinforcing the importance of flexible manufacturing footprints and robust scenario planning to ensure resilience in an increasingly protectionist trade environment.

Decoding Complex Market Segmentation Across Product Types Resolutions Lens Configurations End Users and Distribution Channels for Strategic Clarity

A nuanced understanding of the camera market requires detailed segmentation by product type, resolution, lens configuration, end user, and distribution channel. Within product types, the emergence of 360-degree cameras has unlocked immersive storytelling applications, while compact action models, spanning adventure, sports, and underwater categories, continue to capture the attention of extreme enthusiasts seeking rugged, high-performance solutions. Traditional DSLR and mirrorless systems maintain their stronghold among professionals, offering interchangeable lenses and advanced autofocus capabilities. Meanwhile, point-and-shoot cameras, available in ultra-compact, waterproof, and zoom variants, remain relevant for casual users who prioritize ease of use and portability.

Resolution tiers further delineate market opportunities, as manufacturers vie to deliver 4K UHD and 8K UHD performance for cinematic productions, while Full HD and HD models cater to budget-conscious segments and educational deployments. Lens type distinctions between fixed and interchangeable systems influence purchasing decisions, with fixed-lens devices appealing to entry-level consumers, and interchangeable-lens options commanding premium price points for specialized applications. End-user segmentation, encompassing commercial installers, academic institutions, government agencies, and residential enthusiasts, underscores the importance of tailored feature sets and service agreements. Finally, distribution channels split between offline outlets and online platforms shape customer interactions: traditional camera stores, hypermarkets, and specialty retailers compete alongside direct brand websites and e-commerce marketplaces to capture evolving buyer preferences.

This comprehensive research report categorizes the Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Resolution

- Lens Type

- End User

- Distribution Channel

Exploring Regional Dynamics Shaping Camera Market Growth Patterns in the Americas Europe Middle East Africa and Asia Pacific Ecosystems

Regional dynamics continue to drive divergent growth trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific markets. In the Americas, rising consumer spending on premium content creation tools and increased adoption of live-streaming applications have fueled demand for mirrorless systems and high-durability action cameras. The Americas also exhibit strong aftermarket services, with specialized retailers offering customization and repair solutions to enhance customer loyalty.

Across Europe Middle East & Africa, regulatory emphasis on sustainability and data privacy has influenced product design criteria, prompting vendors to integrate secure firmware and recyclable materials. Moreover, the region’s diverse economic landscapes have created pockets of high-growth opportunities in urban centers, while rural markets rely on cost-effective point-and-shoot cameras for educational and government initiatives. In Asia-Pacific, rapid urbanization and digital infrastructure investments have positioned the region as a global manufacturing and innovation hub. Key markets within Asia-Pacific display robust investor interest in next-generation sensor technologies, and strong e-commerce penetration has accelerated online distribution, driving price transparency and competitive promotions.

This comprehensive research report examines key regions that drive the evolution of the Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Initiatives and Competitive Positioning of Leading Camera Manufacturers Innovators and Emerging Disruptors Driving Industry Momentum

Leading companies in the camera industry are deploying diverse strategies to secure market share and drive innovation. Legacy manufacturers continue to leverage brand equity and extensive dealer networks to introduce modular product lines, while pursuing strategic alliances with software providers to deliver end-to-end imaging workflows. Some established players have expanded into adjacent markets, integrating action camera features into drone platforms to capture aerial footage, thereby broadening their addressable market.

At the same time, disruptors and emerging startups are targeting niche segments such as computational photography, leveraging machine learning to enhance smartphone-grade sensors and develop cloud-based editing suites. Collaboration between traditional optics firms and semiconductor foundries has also intensified, enabling the co-development of bespoke image sensors that optimize low-light performance and dynamic range. Additionally, camera manufacturers are exploring subscription-based models for firmware upgrades and premium feature access, creating new recurring revenue streams and deepening customer engagement. Collectively, these strategic initiatives underscore a competitive landscape defined by technological convergence, partnership ecosystems, and evolving monetization approaches.

This comprehensive research report delivers an in-depth overview of the principal market players in the Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Canon Inc.

- Sony Corporation

- Nikon Corporation

- ARRI GmbH

- Blackmagic Design Pty. Ltd.

- Casio Computer Co., Ltd.

- Dahua Technology Co., Ltd

- Eastman Kodak Company

- Fujifilm Holdings Corporation

- Garmin Ltd.

- GoPro Inc.

- Hasselblad AB

- JVC Kenwood Corporation

- Konica Minolta Business Solutions India Pvt. Ltd.

- Leica Camera AG

- Lomographische GmbH

- MiTAC Digital Technology Corporation

- Olympus Corporation

- Panasonic Corporation

- Polaroid Corporation

- RED Digital Cinema, Inc.

- RICOHPENTAX.IN.

- Sigma Corporation

- SZ DJI Technology Co., Ltd.

- Yuneec International

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Capitalize on Emerging Trends Mitigate Risks and Drive Sustainable Growth

Industry leaders must embrace a dual approach that balances bold innovation with operational resilience. First, investing in modular hardware architectures will enable rapid feature rollouts and streamline manufacturing processes. By adopting interoperable software frameworks and open APIs, companies can foster developer communities and accelerate integration with content creation platforms. Concurrently, diversifying supply chains across multiple geographies will mitigate tariff exposure and reduce single-source dependencies.

Second, executives should prioritize data-driven customer insights to tailor product offerings for distinct end-user segments. Implementing advanced analytics across online and offline channels will uncover usage patterns and enable precision marketing campaigns. Additionally, establishing circular economy initiatives-such as trade-in programs and certified refurbishment services-will not only align with sustainability mandates but also cultivate long-term brand loyalty. Finally, exploring subscription-based models for software enhancements and post-purchase support can unlock new recurring revenue opportunities and reinforce customer engagement in an increasingly competitive market landscape.

Outlining Rigorous Research Methodology Combining Quantitative and Qualitative Approaches to Ensure Robust Data Integrity and Actionable Market Intelligence

This analysis is underpinned by a rigorous methodology that combines qualitative expert interviews, quantitative data triangulation, and comprehensive secondary research. Primary research included in-depth discussions with C-level executives, product engineers, and distribution partners to validate market drivers and challenge prevailing assumptions. Secondary research leveraged proprietary databases, peer-reviewed journals, and regulatory filings to corroborate shipment figures, technology adoption rates, and pricing benchmarks.

Quantitative forecasting models were developed using time-series analyses and scenario planning to assess the potential impacts of tariff changes and supply chain disruptions. Data integrity was further enhanced through cross-validation against company earnings calls, government trade statistics, and third-party logistics reports. Finally, all insights underwent a multistage peer-review process by seasoned industry analysts to ensure accuracy, relevance, and applicability. This methodological framework provides readers with confidence in the robustness of findings and the reliability of strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Camera Market, by Product Type

- Camera Market, by Resolution

- Camera Market, by Lens Type

- Camera Market, by End User

- Camera Market, by Distribution Channel

- Camera Market, by Region

- Camera Market, by Group

- Camera Market, by Country

- Competitive Landscape

- List of Figures [Total: 30]

- List of Tables [Total: 747 ]

Synthesis of Core Findings and Strategic Perspectives Emphasizing Key Takeaways and Future Outlook for the Global Camera Market Landscape

In synthesizing these insights, it becomes clear that the camera market is at the intersection of rapid technological innovation, evolving consumer behaviors, and shifting trade dynamics. Companies that can deftly navigate the complexities of segmentation, adapt to regional nuances, and forge strategic partnerships will emerge as market leaders. Furthermore, a proactive stance toward supply chain diversification and sustainability will serve as a key differentiator in an increasingly competitive environment.

Looking ahead, the convergence of AI-driven imaging, cloud-based workflows, and immersive content experiences presents both opportunities and challenges. Organizations that maintain agility in product development cycles and embrace data-driven decision-making will be best positioned to capture value. Ultimately, the insights outlined in this executive summary provide a strategic roadmap for stakeholders seeking to drive growth, foster innovation, and achieve long-term competitive advantage in the global camera industry landscape.

Connect with Ketan Rohom to Unlock In Depth Insights Gain a Competitive Edge and Secure Your Comprehensive Camera Market Research Report Today

I encourage you to connect directly with Ketan Rohom to discover tailored insights and gain a competitive edge in the rapidly evolving camera market. As Associate Director of Sales & Marketing, he can guide you through the comprehensive research findings, offer demo access to key data points, and discuss bespoke packages that align with your strategic priorities. By engaging with Ketan, you will secure the critical intelligence needed to inform product development, refine go-to-market strategies, and optimize investment decisions. Don’t miss this opportunity to leverage expert counsel and acquire the definitive camera market research report designed to drive your success in an increasingly competitive landscape. Reach out today to schedule a personalized consultation and take the first step toward actionable market intelligence.

- How big is the Camera Market?

- What is the Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?