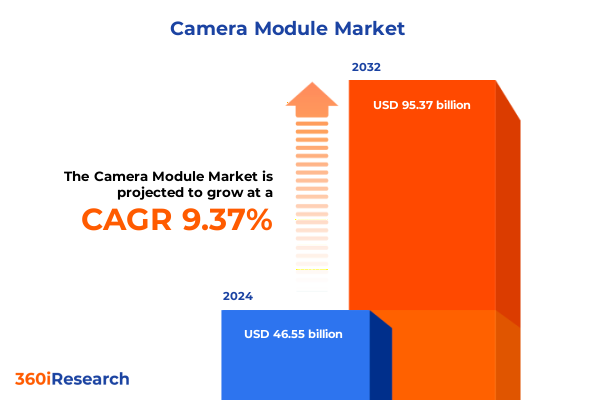

The Camera Module Market size was estimated at USD 50.81 billion in 2025 and expected to reach USD 55.50 billion in 2026, at a CAGR of 9.41% to reach USD 95.37 billion by 2032.

Unveiling the Foundational Forces Shaping the Current State of Camera Modules and Their Pivotal Impact on Tomorrow’s Connected Devices in an Evolving Ecosystem

The camera module has become an indispensable component in modern electronic systems, enabling a wide array of applications from capturing images in smartphones to facilitating advanced driver assistance systems on the road. As the bridge between optical sensors and electronic processing units, camera modules integrate lenses, image sensors, actuators, and processors into compact packages that meet demanding performance and form-factor requirements. Their evolution has been driven by relentless innovation in sensor technology, lens design, and signal processing algorithms, transforming a simple imaging function into a versatile enabler of computer vision, augmented reality, and autonomous operations.

In recent years, the convergence of multiple technological trends has elevated the camera module from a peripheral accessory into a central pillar of digital ecosystems. High-resolution imaging, coupled with computational photography techniques, has redefined user expectations for visual quality in consumer electronics. Meanwhile, the proliferation of artificial intelligence and machine learning has unlocked new capabilities in scene recognition, depth mapping, and low-light performance. In automotive markets, advanced driver assistance systems now rely on camera modules for object detection, lane-keeping, and pedestrian recognition. Simultaneously, industrial robotics and factory automation leverage machine vision solutions for inspection and assembly tasks, underscoring the module’s expanding role across sectors.

This executive summary provides a concise yet comprehensive overview of the camera module landscape, setting the stage for in-depth exploration of transformative shifts, the cumulative impact of United States tariffs implemented in 2025, key segmentation insights, regional dynamics, leading company strategies, and actionable recommendations. It concludes by outlining the rigorous methodology employed in our research and presents a coherent synthesis of findings to guide decision-makers navigating the rapidly evolving visual sensing market.

Exploring Transformative Forces of AI-Enabled Imaging, Computational Photography, Miniaturization, and Automotive Sensor Innovations Redefining Camera Modules

The past few years have witnessed a paradigm shift in the camera module industry, propelled by the integration of artificial intelligence, breakthroughs in computational photography, and the relentless pursuit of miniaturization. AI-enabled imaging platforms now perform real-time scene detection, noise reduction, and depth estimation within the module itself, delivering enhanced image quality under challenging lighting conditions. This on-device processing capability has not only reduced reliance on powerful central processors but has also unlocked new applications in areas such as augmented reality glasses and wearable devices, where low latency and power efficiency are critical.

Concurrently, computational photography techniques-such as multi-frame super resolution, portrait mode bokeh simulation, and high dynamic range merging-have redefined photo-capture quality benchmarks. These capabilities have spurred end users to expect professional-grade results from consumer electronics, driving module manufacturers to incorporate more sophisticated optics and processing chips. In parallel, the trend toward miniaturization has spurred the development of periscope and folded optics designs that offer optical zoom functionality without compromising device thinness, satisfying both consumer and industrial demands for high performance in confined spaces.

Additionally, the automotive sector has emerged as a fertile ground for innovation, with demand shifting from single-camera parking assist systems to multi-camera surround-view architectures that support 360-degree sensing and advanced driver assistance functions. Industrial domains have followed suit, integrating time-of-flight sensors and event-based imaging into robotics and machine vision platforms for real-time quality control and adaptive automation. Taken together, these transformative forces underscore a fundamental evolution: camera modules have transcended their role as passive image collectors to become intelligent, application-specific sensing hubs that drive new use cases and revenue streams.

Analyzing the Cumulative Impact of United States 2025 Tariff Measures on Camera Module Supply Chains, Pricing, and Strategic Sourcing Decisions

With the introduction of expanded tariff measures on a broad range of imported electronic components in early 2025, camera module manufacturers and OEMs have confronted heightened cost pressures and supply chain complexities. These duties, affecting modules, lenses, and sensor substrates originating from several key markets, have cumulatively elevated landed costs and prompted many stakeholders to reassess sourcing strategies. In turn, companies have accelerated efforts to diversify their supplier base across Asia, North America, and Europe, seeking to mitigate exposure to concentrated tariff risk and ensure stable component availability.

The immediate consequence of these tariff adjustments was a discernible shift in procurement dynamics: manufacturers began negotiating longer-term contracts with domestic fabricators in an effort to lock in prices and avoid spot-market volatility. Some end users absorbed incremental cost increases to preserve feature roadmaps, while others initiated design reengineering to accommodate alternative component types less affected by duties. Over time, this environment has spurred investment in automation and localized assembly lines, enabling more agile responses to regulatory changes and reducing reliance on a single geographical footprint.

Looking ahead, the cumulative impact of the 2025 tariff landscape extends beyond near-term cost management. As supply chain resilience becomes a strategic imperative, industry leaders are exploring partnerships with local technology firms and government-backed initiatives to bolster domestic production capabilities. While these measures may elevate capital expenditure in the short run, they promise to create a more flexible and transparent value chain, capable of adapting to future policy shifts and safeguarding uninterrupted innovation.

Illuminating Critical Market Segmentation Insights across Applications, Module Types, Technology Platforms, End Users, Sensor Resolutions, and Autofocus Mechanisms

A nuanced understanding of market segmentation is essential to align product development with evolving end-user requirements. The camera module market is categorized by application across automotive functions such as advanced driver assistance systems, cabin monitoring, parking assist, and surround view; consumer electronics including augmented reality and virtual reality devices as well as wearable technologies, with AR/VR further differentiated into glasses and headsets; industrial applications encompassing machine vision and robotics, where machine vision itself spans assembly line inspections and quality control tasks; medical diagnostic equipment; security surveillance solutions; and smartphone imaging modules. Each application horizon demands tailored performance characteristics, whether that involves automotive-grade durability, wearable-level power efficiency, or industrial-grade environmental resilience.

Module type offers another axis of differentiation, with dual, front-facing, periscope, quad, rear-facing, time-of-flight, and triple configurations each addressing distinct design and functional objectives. Periscope and time-of-flight systems are particularly sought after in premium smartphones and robotics, where precision depth mapping and zoom capabilities confer competitive advantages.

Technology selection further segments the landscape, dividing demand between CCD and CMOS sensor platforms; within the CMOS category, a split exists between global shutter architectures, which eliminate motion artifacts for high-speed imaging, and rolling shutter designs that offer cost and power benefits for general-purpose applications. End-user channels bifurcate into aftermarket retrofit solutions and OEM integrations, reflecting differing procurement cycles and technical support requirements. Sensor resolution choices range from below 8 megapixels for entry-level applications to the 8-13 megapixel sweet spot common in mid-tier devices, up to above 13 megapixels for flagship smartphones and advanced machine vision tasks. Autofocus capabilities also vary, with fixed focus retained for ultra-low-cost designs, while autofocus modules employ contrast detection, laser detection, or phase detection mechanisms to achieve rapid and accurate focusing across diverse scenarios.

By mapping product roadmaps against these segmentation dimensions, manufacturers and suppliers can identify white-space opportunities, optimize cost-performance trade-offs, and accelerate time-to-market for segment-specific solutions.

This comprehensive research report categorizes the Camera Module market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Types

- Component

- Resolution

- Focus Type

- Application

- End User

Deciphering Distinct Regional Market Dynamics and Growth Drivers across the Americas, Europe Middle East Africa, and Asia Pacific Territories

Regional dynamics exert a profound influence on camera module innovation, adoption cycles, and competitive intensity. In the Americas, the automotive industry’s rapid shift toward advanced driver assistance and autonomous vehicle prototypes has generated robust demand for multi-camera arrays and high-precision depth-sensing modules. At the same time, the United States and Mexico serve as important manufacturing hubs for major OEMs, fostering localized supply chains that emphasize compliance with stringent quality and safety regulations.

Across Europe, Middle East, and Africa, the convergence of smart city initiatives and heightened security concerns has elevated the importance of surveillance and access control systems. European automakers are also at the forefront of integrating surround-view and cabin-monitoring technologies, while emerging markets in the Middle East and Africa are witnessing accelerated smartphone penetration, driving growth in consumer-grade imaging solutions.

Asia-Pacific remains the largest epicenter for camera module production and consumption. China, South Korea, and Taiwan host key sensor and module assembly facilities, benefiting from established electronics ecosystems and government incentives for high-tech manufacturing. India’s expanding smartphone market and the rise of local component fabrication initiatives are beginning to shift some production inland, while Southeast Asian countries are gaining traction as lower-cost assembly bases. Collectively, these regional nuances inform strategic decisions around capacity investment, joint ventures, and go-to-market tactics tailored to each territory’s regulatory environment and end-user demands.

This comprehensive research report examines key regions that drive the evolution of the Camera Module market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Competitive Advantages of Leading Entities in the Camera Module Industry Embracing Innovation and Partnerships

A cadre of established and emerging players is shaping the competitive contours of the camera module market. Legacy sensor manufacturers have fortified their positions by vertically integrating optics, sensor fabrication, and image processing units, leveraging economies of scale and decades of design expertise. In parallel, specialized module assemblers are forging strategic partnerships with smartphone OEMs, automotive tier-one suppliers, and industrial automation providers, enabling tailored solutions that align with proprietary hardware and software ecosystems.

Recent collaborations between leading optics designers and AI-software firms have accelerated the development of smart modules capable of on-chip image analytics, while joint ventures between module makers and automotive component suppliers are creating end-to-end sensing packages for autonomous driving platforms. Start-ups focused on niche segments, such as event-based imaging for low-latency industrial inspection or bio-compatible modules for medical endoscopy, are injecting further dynamism into the competitive landscape, challenging incumbents to innovate beyond traditional performance metrics.

To maintain differentiation, top-tier companies are investing heavily in next-generation sensor technologies-ranging from stacked CMOS architectures to integrated neuromorphic processors-aiming to reduce latency, boost dynamic range, and extend battery life. Alliances with software platforms that enable cloud-based image processing and firmware-over-the-air updates underscore the strategic shift toward holistic, software-driven hardware models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Camera Module market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams-OSRAM AG

- Arducam

- CAMEMAKE Technology Co.,Ltd

- Canon Inc.

- Chicony Electronics Co., Ltd.

- Cowell e Holdings Inc.

- Fujifilm Holdings Corporation

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Immervision Inc.

- JENOPTIK AG

- KYOCERA Corporation

- Leica Camera AG

- LG Corporation

- LITE-ON Technology Corp.

- Luxvisions Innovation Limited

- Mcnex Co., Ltd.

- OFILM by Shenzhen Castle Light Technology Co., Ltd

- OmniVision Technologies, Inc.

- Panasonic Corporation

- Partron Co., Ltd.

- Photonfocus AG

- Primax Electronics Ltd.

- Rayprus by Foxconn Group

- Samsung Electronics Co., Ltd.

- Semiconductor Components Industries, LLC

- Shenzhen ChuangMu Technology Co., Ltd

- Shenzhen Sinoseen Technology Co., Ltd.

- SK Hynix Inc.

- Sony Group Corporation

- STMicroelectronics N.V.

- Sunny Optical Technology (Group) Co., Ltd.

- Teledyne FLIR LLC

- Toshiba Corporation

- Truly International Holdings Limited

- Vision Components GmbH

Driving Success through Strategic Investments in Technology Innovation, Supply Chain Resilience, Collaborative Alliances, and Market Diversification Initiatives

To navigate this complex and rapidly evolving market, industry leaders should prioritize a multifaceted strategy rooted in technology, supply chain, partnerships, and market expansion. First, allocating R&D resources to artificial intelligence and computational photography research will yield modules that consistently outperform legacy designs in real-world conditions. Embedding machine learning accelerators directly onto imaging chips can reduce system-level power consumption and deliver real-time advanced analytics, setting new benchmarks for image fidelity and functionality.

Simultaneously, establishing a diversified supplier network across multiple geographies will mitigate tariff and geopolitical risks. By combining domestic contract manufacturers with strategically located offshore partners, companies can balance cost efficiency with regulatory compliance, ensuring uninterrupted production even when trade policies shift. Investing in modular line architectures and flexible automation equipment will further enhance agility, enabling rapid reconfiguration to accommodate new module types and sensor variants.

Forge close collaborative ties with automotive OEMs, smartphone brands, and enterprise software providers to co-develop end-to-end solutions that integrate hardware, firmware, and cloud services. Such alliances can accelerate the adoption of emerging applications like edge AI, mixed reality, and autonomous robotics. Finally, expanding into adjacent verticals-such as smart agriculture, telemedicine, and consumer drones-will unlock incremental revenue streams, leveraging core competencies in optical design and sensor integration to capture white-space opportunities.

Outlining a Methodological Framework Built on Primary Interviews, Expert Surveys, Secondary Data Analysis, and Quantitative Validation for Credible Market Insights

Our research framework is built on a combination of primary and secondary data sources meticulously validated through quantitative methods. We conducted in-depth interviews with senior executives, product engineers, and supply chain managers at leading camera module manufacturers, component suppliers, and end-user organizations to capture real-time perspectives on technology roadmaps, procurement strategies, and application requirements. Expert surveys provided structured insight into market priorities and anticipated industry challenges, while workshop sessions with domain specialists facilitated rigorous debate around emerging use cases and competitive dynamics.

Secondary data inputs comprised technical whitepapers, patent filings, regulatory filings, industry conference proceedings, and corporate financial disclosures. Each data point was cross-referenced against multiple independent sources to ensure consistency and mitigate bias. Our modelling approach employed statistical validation techniques, including sensitivity analysis and scenario testing, to confirm the robustness of thematic conclusions. This methodological rigor underpins the impartiality of our insights and provides the analytical depth required to inform strategic decision-making in a high-velocity market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Camera Module market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Camera Module Market, by Types

- Camera Module Market, by Component

- Camera Module Market, by Resolution

- Camera Module Market, by Focus Type

- Camera Module Market, by Application

- Camera Module Market, by End User

- Camera Module Market, by Region

- Camera Module Market, by Group

- Camera Module Market, by Country

- United States Camera Module Market

- China Camera Module Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Key Takeaways on Market Trends, Strategic Imperatives, and Growth Opportunities in the Evolving Camera Module Landscape

The camera module market stands at a crossroads of innovation, policy shifts, and evolving application demands. Key takeaways highlight the transformative power of AI and computational photography in elevating module functionality, the pressing need for supply chain resilience amid new tariff regimes, and the importance of precise segmentation across applications, module types, technologies, end-user channels, resolutions, and autofocus systems. Regionally, localized manufacturing and targeted partnerships will determine market leadership, with the Americas driving automotive and smartphone initiatives, EMEA focusing on security and industrial automation, and Asia-Pacific continuing to anchor volume production and consumer device integration.

Competitive success will hinge on companies’ ability to invest in advanced sensor designs, forge collaborative ecosystems, and leverage flexible manufacturing networks that adapt to geopolitical and regulatory shifts. By aligning R&D, procurement, and go-to-market strategies with these insights, organizations can capture emerging opportunities in smart mobility, immersive computing, and intelligent automation. This convergence of technology, regulation, and market demand defines a pivotal moment for stakeholders to differentiate, innovate, and lead.

Unlock In-Depth Camera Module Market Intelligence with Expert Guidance from Ketan Rohom to Empower Strategic Decision Making Today

Embarking on strategic conversations can transform uncertainty into opportunity. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure comprehensive insights and tailored guidance that address your organization’s unique challenges. By leveraging expert analysis and market intelligence, you can gain a competitive edge, optimize investment priorities, and align your roadmap with emerging technology demands. Don’t navigate the complexities of the camera module landscape alone-initiate a dialogue today and empower your team with the clarity and confidence needed to drive sustainable growth.

- How big is the Camera Module Market?

- What is the Camera Module Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?