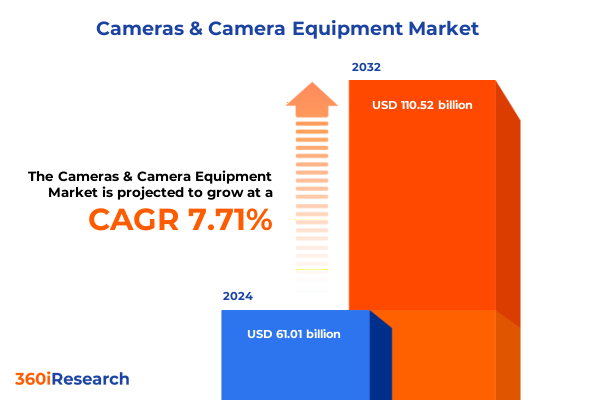

The Cameras & Camera Equipment Market size was estimated at USD 65.44 billion in 2025 and expected to reach USD 70.27 billion in 2026, at a CAGR of 7.77% to reach USD 110.52 billion by 2032.

Navigating the Evolving World of Cameras and Equipment Through a Comprehensive Overview That Sets the Stage for In-Depth Market Insights

The world of photography has undergone profound transformation as smartphones now capture the vast majority of images taken globally, fundamentally reshaping how people document everyday life. Recent estimates indicate that as much as 94 percent of all photographs in 2024 were captured on smartphones, a figure that underscores the extraordinary penetration of mobile devices into the realm once dominated by dedicated cameras. This seismic shift has driven entry-level point-and-shoot and compact cameras toward obsolescence, leaving traditional camera makers to refocus their efforts on high-end gear that delivers performance beyond the reach of any mobile device.

Identifying the Key Technological and Market Transformations That Are Redefining How Photography and Videography Equipment Serves Modern Content Creators

Innovation in imaging technology continues at an unprecedented pace as manufacturers integrate advanced artificial intelligence into both hardware and firmware to meet evolving creative demands. Modern camera systems now feature on-board AI units capable of real-time subject recognition, dynamic exposure adjustments, and scene classification, mimicking professional workflows without tethered post-processing tools. At the same time, the rise of edge computing enables robust image analysis and stabilization to occur directly within the device, alleviating latency concerns and safeguarding privacy by minimizing data transmission to external servers.

Assessing the Full Spectrum of United States Import Tariffs Imposed in 2025 on Camera Equipment and Their Ripple Effects Across the Industry

Recent U.S. trade policies have ushered in a new era of import tariffs for camera equipment, exerting upward pressure on retail prices and compelling industry participants to reevaluate supply chain strategies. Leading brands such as Nikon have publicly acknowledged price adjustments in the U.S. market commencing June 2025, citing the impact of country-specific duties that could reduce profitability by tens of millions of dollars if not passed on to end consumers. Similarly, Blackmagic Design suspended plans for a Texas factory and enacted price hikes after concluding that prevailing tariff structures render domestic production economically untenable.

Unveiling Essential Market Layering Through Product Types, Lens Categories, Distribution Pathways, Application Verticals, and Varied End User Requirements

Market segmentation reveals layered consumer demand that hinges on distinct product categories, lens architectures, and distribution pathways. On one hand, traditional interchangeable-lens mirrorless and DSLR cameras remain the cornerstone of serious photography, while compact, built-in lens units cater to travelers and content creators who prize simplicity. Parallel to this, a comprehensive array of camera accessories-from stabilizers and filters to lighting kits and memory solutions-fuels ancillary spending and enriches the overall ecosystem. Distribution channels further delineate buyer behavior, with brick-and-mortar retailers providing tactile demonstrations for premium purchases even as online marketplaces capture impulse and convenience-driven transactions. Applications range from film and television production studios to hobbyists and surveillance operators, each segment accompanied by unique feature requirements and purchasing criteria. End users span corporate and commercial enterprises, government and law enforcement bodies, healthcare institutions, and individual consumers, underscoring the necessity for tailored product positioning and service offerings within each vertical.

This comprehensive research report categorizes the Cameras & Camera Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Lens Type

- Distribution Channels

- Application

- End User

Distilling Regional Dynamics Across the Americas, Europe Middle East and Africa, and Asia Pacific to Illuminate Diverse Growth Drivers and Market Nuances

Regional nuances shape adoption patterns and competitive dynamics across the global cameras and equipment landscape. In the Americas, elevated per-capita spending on imaging gear reflects a mature market driven by professional content creation, but recent tariff measures have introduced cost headwinds that encourage both consumers and vendors to explore used and refurbished channels as alternatives to newly imported units. Within Europe, Middle East & Africa, regulatory initiatives such as the EU’s 2024 USB-C common charger directive compel manufacturers to standardize port architectures on cameras sold in the region, aligning with broader sustainability and e-waste reduction goals. Meanwhile, the Asia-Pacific region remains the epicenter of production, with Japanese and Southeast Asian facilities supplying advanced mirrorless bodies, and governments from Japan to India introducing film and creative industry incentives that bolster local demand and strengthen export potential as high-end camera brands increasingly leverage regional manufacturing hubs.

This comprehensive research report examines key regions that drive the evolution of the Cameras & Camera Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Positioning of Leading Camera Equipment Manufacturers and Technology Innovators in a Shifting Market Terrain

Industry leaders continue to pursue divergent strategies to navigate cost pressures and technological complexity. Nikon’s acquisition of RED Digital Cinema underscores its commitment to professional video, marrying still-photo expertise with cinematic IP and signaling intensifying convergence between photography and motion picture equipment. Canon has publicly communicated that, while the U.S. market comprises roughly a quarter of its global camera sales, existing inventory buffers will delay the full impact of new duties until late 2025, reflecting a calibrated approach to pricing and logistics. GoPro, by contrast, highlights the efficacy of a diversified manufacturing footprint, noting minimal margin impact from U.S. tariff adjustments owing to proactive realignment of production outside of China. Tamron’s announcement to shift a significant share of lens output to Vietnam illustrates how component-level sourcing decisions can mitigate on-shore import levies while preserving supply chain flexibility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cameras & Camera Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Axis Communications AB

- Blackmagic Design Pty Ltd

- Canon Inc

- Carl Zeiss AG

- FUJIFILM Holdings Corporation

- GoPro Inc

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision

- Honeywell International Inc

- Leica Camera AG

- Nikon Corporation

- OM Digital Solutions Corporation

- Panasonic Holdings Corporation

- Phase One A/S

- RED Digital Cinema LLC

- Ricoh Company Ltd

- Robert Bosch GmbH

- Sigma Corporation

- Sony Group Corporation

- SZ DJI Technology Co Ltd

- Tamron Co Ltd

- Teledyne Technologies Inc

- Victor Hasselblad AB

- VIVOTEK Inc

- Zhejiang Dahua Technology Co Ltd

Proposing Targeted Retail, Supply Chain, and Technological Initiatives to Empower Industry Leaders in Capturing Value Amid Ongoing Market Disruptions

To thrive amid evolving trade landscapes and technological disruptions, industry leaders should prioritize supply chain resilience by diversifying manufacturing beyond high-tariff countries and establishing regional assembly capabilities. Embracing AI and edge computing as differentiators in both professional and consumer product lines will foster stickiness and justify premium pricing for feature-rich equipment. Vendors must deepen partnerships with content platforms and production houses to integrate hardware solutions into end-to-end workflows, delivering software-as-a-service offerings that extend beyond one-time transactions. Omnichannel distribution should be enhanced through experiential retail programs that blend virtual configurators with hands-on demonstrations, capturing both digital-native and traditional buyers. Finally, sustainability and e-waste initiatives aligned with regional regulations will fortify brand reputations and unlock opportunities in rental and refurbished marketplaces.

Detailing the Rigorous Research Approach That Integrates Primary Expert Insights and Robust Secondary Analysis for a Comprehensive Market Understanding

This report synthesizes insights drawn from primary interviews with executive stakeholders across manufacturing, retail, and creative end-users, supplemented by detailed analysis of company releases, regulatory filings, and credible industry news sources. Secondary research incorporated trade data, government directives such as U.S. International Trade Commission tariff schedules and EU common charger mandates, as well as performance disclosures from leading publicly traded camera and accessory firms. Quantitative assessment of import and export volumes was cross-validated against customs records, while qualitative trends were corroborated through expert panels and field surveys within key markets. This blended methodology ensures a comprehensive and balanced view of market drivers, competitive dynamics, and emerging technologies within the cameras and camera equipment domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cameras & Camera Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cameras & Camera Equipment Market, by Product Type

- Cameras & Camera Equipment Market, by Lens Type

- Cameras & Camera Equipment Market, by Distribution Channels

- Cameras & Camera Equipment Market, by Application

- Cameras & Camera Equipment Market, by End User

- Cameras & Camera Equipment Market, by Region

- Cameras & Camera Equipment Market, by Group

- Cameras & Camera Equipment Market, by Country

- United States Cameras & Camera Equipment Market

- China Cameras & Camera Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Critical Takeaways and Forward-Looking Perspectives to Guide Stakeholders in the Cameras and Equipment Sector Toward Informed Decisions

The cameras and camera equipment landscape stands at an inflection point, shaped by the interplay of advanced imaging technologies, shifting trade policies, and divergent consumer preferences. Smartphone photography has redefined mass-market adoption, yet demand for high-performance gear endures among professionals, hobbyists, and commercial users. AI, edge computing, and hybrid hardware designs offer clear pathways for differentiation, while regional regulatory frameworks and incentive programs add layers of complexity to distribution and manufacturing decisions. Companies that excel in supply chain agility, technological innovation, and tailored segment strategies will secure competitive advantage, even as cost pressures and non-traditional entrants reshape value chains. Stakeholders equipped with a holistic view of these interconnected forces will be best positioned to navigate market turbulence and capture growth opportunities.

Encouraging Engagement with Ketan Rohom to Secure Tailored Camera Market Intelligence and Drive Strategic Growth with a Premium Research Report Investment

Engaging with Ketan Rohom will unlock a tailored exploration of critical market dynamics and specialized strategies designed to elevate your positioning in the fiercely competitive camera equipment arena. His expert guidance ensures that you access granular intelligence on supply chain resilience, technological innovation, and targeted segmentation tactics that directly address your unique business challenges. By partnering with Ketan, you can capitalize on emerging opportunities, mitigate regulatory and tariff-related risks, and refine your go-to-market approach with confidence. Reach out today to secure your comprehensive market research report, and empower your organization with actionable insights that drive sustained growth and market leadership.

- How big is the Cameras & Camera Equipment Market?

- What is the Cameras & Camera Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?