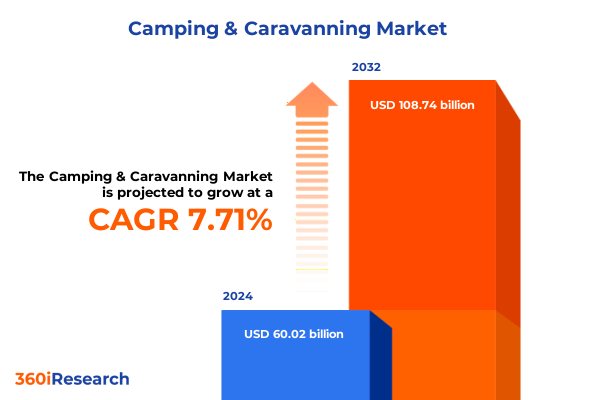

The Camping & Caravanning Market size was estimated at USD 64.38 billion in 2025 and expected to reach USD 69.06 billion in 2026, at a CAGR of 7.77% to reach USD 108.74 billion by 2032.

Exploring the Evolving Tapestry of Camping and Caravanning Trends to Illuminate Growth Drivers and Emerging Consumer Preferences Across Diverse Experiences

The contemporary landscape of outdoor leisure is undergoing an unprecedented evolution, catalyzed by shifting consumer preferences and pioneering innovations in camping and caravanning experiences. What was once a niche pursuit driven by utility and basic shelter requirements has blossomed into a vibrant ecosystem where experiential travel, sustainability, and digital integration intersect. Enthusiasts now seek a spectrum of experiences that range from minimalist backpacking adventures in remote wilderness to luxurious glamping retreats that blend comfort with immersion in nature.

As the market expands, stakeholders are challenged to comprehend the intricate web of drivers that underlie this growth. From the proliferation of eco-conscious materials in tent manufacturing to the integration of smart technologies in RV design, the industry is redefining what it means to connect with the outdoors. This introduction lays the groundwork for a comprehensive exploration of the forces shaping camping and caravanning, establishing the context for understanding how consumer expectations, regulatory environments, and supply chain dynamics will coalesce to define the future of outdoor recreation.

Uncovering the Transformative Shifts Redefining Camping and Caravanning through Technological Advancements Sustainable Mobility and Evolving Service Models

In recent years, technological advancements have unleashed a wave of transformation that has permeated every facet of camping and caravanning. Manufacturers have harnessed lightweight composites and modular design techniques to deliver more versatile products, while the widespread adoption of solar charging systems and off-grid power solutions has expanded the geographical horizons for campers and caravanners. Concurrently, digital platforms have revolutionized the way enthusiasts plan, book, and share their outdoor experiences, forging communities and amplifying peer-driven inspiration.

Sustainability has emerged as a pivotal axis of change. Brands are increasingly integrating recycled fabrics, low-impact processing methods, and carbon-neutral logistics into their operations. This shift not only resonates with eco-aware travelers but also reflects broader societal imperatives to minimize environmental footprints. Meanwhile, mobility trends-such as the rise of electric RV prototypes and hybrid caravans-are redefining how outdoor enthusiasts traverse landscapes, enabling longer journeys with reduced reliance on fossil fuels.

Together, these transformative shifts underscore a new paradigm in which innovation and stewardship converge. The camping and caravanning ecosystem is no longer a collection of disparate products and services; it is an interconnected value network, driven by an ethos of exploration, personalization, and responsibility.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Camping and Caravanning Supply Chains Component Costs and Manufacturer Strategies

The United States’ tariff landscape in 2025 has exerted significant pressure on the camping and caravanning supply chain, particularly through heightened duties on steel, aluminum, and specialty components. In March, a 25 percent tariff on imported steel and aluminum increased material costs for chassis, body panels, and structural reinforcements in caravans and RVs, compelling manufacturers to reassess sourcing strategies and adjust production processes to absorb or mitigate the added expenses.

An Executive Order issued on April 29, 2025, introduced relief for certain products previously subject to overlapping IEEPA and Section 232 tariffs, streamlining the duty structure for automotive parts and related components. Despite this intervention, steel and aluminum levies remain cumulative when both are applied, sustaining pressure on margins and potentially delaying product launches as companies evaluate the long-term viability of domestic versus imported inputs.

Beyond metals, tariffs on electronic modules, solar panels, and specialized HVAC systems-often sourced from China under Section 301 measures-have further elevated the cost base for value-added features that today’s consumers expect in premium caravanning offerings. In response, leading OEMs are exploring strategic partnerships with domestic suppliers, investing in vertical integration, and leveraging duty drawback programs to recoup a portion of tariffs over successive years. These adaptive strategies illustrate the industry’s resilience, yet the enduring impact on pricing, supply chain agility, and competitive positioning remains a central concern for stakeholders.

Revealing Key Insights Driven by Camping Type Product Innovations Activity Preferences End-User Behaviors and Distribution Channel Dynamics

Insights into the camping and caravanning market become most vivid when examined through the lens of diverse segmentation parameters that reflect consumer motivations and product usage. By camping type, four distinct modalities-backpacking, caravanning, glamping, and RV camping-cater to ascending tiers of comfort, amenity integration, and journey complexity, illuminating how travelers prioritize freedom, accessibility, or luxury. This spectrum is mirrored in product type segmentation, where traditional tent designs coexist alongside sophisticated caravans, motorhomes, and fifth wheel configurations, each variant further differentiated by trailer construction, class designation, and tent architecture to satisfy everything from lightweight explorations to family-scale retreats.

Activity type segmentation brings into focus the behavioral dimensions of outdoor engagement. Enthusiasts pursuing climbing, fishing, hiking, or water sports seek specialized gear and support services that dovetail with their adventure profiles, often demanding modular storage, terrain-adapted vehicles, and tailor-made itineraries. End-user segmentation adds another layer of nuance, differentiating corporate groups orchestrating team-building retreats from families seeking multi-generational bonding, solo campers aiming for deep wilderness immersion or social campsites, and youth groups engaged in educational expeditions. Distribution channel segmentation completes the picture by contrasting direct-to-consumer sales, which facilitate bespoke offerings, with the convenience and curated packages available through online travel agencies or established traditional travel intermediaries.

This multifaceted segmentation framework highlights how granular consumer insights drive product innovation, channel strategies, and marketing approaches. Understanding the interplay of camping type, product complexity, activity preferences, end-user objectives, and distribution touchpoints equips decision-makers with a holistic view of demand drivers and competitive differentiators.

This comprehensive research report categorizes the Camping & Caravanning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Camping Type

- Product Type

- Activity Type

- End-User

- Distribution Channel

Illuminating Regional Variations Shaping the Camping and Caravanning Landscape across the Americas Europe Middle East Africa and Asia-Pacific Corridors

Regional dynamics exert a profound influence on how camping and caravanning evolve across global markets. In the Americas, expansive landscapes and well-developed highway networks have catalyzed the proliferation of RV ownership and caravan rentals, underpinned by robust infrastructure investments in campgrounds and service stations. Demand here is fueled by cultural affinities for road trips, cross-country exploration, and the integration of eco-tourism initiatives that encourage sustainable trail maintenance and wildlife conservation.

In Europe, Middle East & Africa, compact geographies and rich historical sites have given rise to glamping estates in rural France, caravan-based vineyard tours in Italy, and desert camping experiences across the Middle East. Regulatory harmonization in the European Union facilitates freer movement of caravanning units, while emerging markets in North Africa leverage regional tourism programs to promote cross-border itineraries. Geopolitical complexities in parts of EMEA, however, underscore the importance of localized risk mitigation and partnerships with governments to ensure traveler safety and resource management.

Asia-Pacific stands out for its accelerated domestic tourism revival, driven by rising disposable incomes in Australia, New Zealand, China, and Southeast Asian countries. The popularity of short-stay caravan parks and pop-up family tent resorts has accelerated digital booking adoption, mobile payment integration, and AI-driven recommendation engines for itinerary planning. Supply chains here are evolving rapidly, as manufacturers partner with local assemblers to meet specific regulatory and cultural requirements, setting the stage for next-generation caravanning solutions optimized for diverse terrains and climates.

This comprehensive research report examines key regions that drive the evolution of the Camping & Caravanning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation Market Consolidation and Strategic Partnerships in the Camping and Caravanning Segments

The competitive landscape of camping and caravanning is defined by a blend of heritage players and disruptive newcomers. Established manufacturers of caravans and motorhomes have leveraged decades of engineering expertise to refine chassis durability and onboard comfort, while tent specialists have innovated with breathable, weather-resistant materials and modular floor plans. Technology firms have entered the fray with IoT-based monitoring systems that optimize energy consumption and predictive maintenance for RV platforms.

Strategic alliances are reshaping market positions, as component suppliers with advanced solar and energy storage capabilities integrate into traditional OEM ecosystems. Simultaneously, private equity investments are consolidating fragmented tent and caravan brands to achieve economies of scale in procurement and distribution. Startups focusing on subscription-based access models and peer-to-peer sharing platforms are challenging conventional ownership paradigms, driving incumbents to explore flexible rental networks and digital loyalty programs.

These company-level dynamics-spanning innovation cycles, mergers, and cross-industry partnerships-reveal an ecosystem in flux. Success hinges on balancing core competencies in manufacturing and service delivery with the agility to adopt emerging technologies, navigate regulatory shifts, and address the nuanced preferences of distinct consumer segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Camping & Caravanning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADAC Camping GmbH

- CAMP MONK LLP

- Campervan Norway

- Camping Co.

- Campnab

- Countryside Adventure Holidays Pvt. Ltd.

- Cruise America, Inc.

- Escapod Trailers LLC.

- European Camping Group

- Forest River, Inc

- Happier Camper, Inc

- Harvest Hosts Opco LLC.

- Hipcamp, Inc.

- INDIE CAMPERS USA, INC.

- Japan Campers Co., Ltd.

- Kampgrounds of America, Inc.

- Knaus Tabbert AG

- Lance Camper Mfg. Corp. by REV Group Inc

- MakeMyTrip (India) Private Limited

- McRent by Rental Alliance GmbH

- Overa Tours Private Limited

- Red Chilli Adventure Sports Pvt. Ltd.

- Roadsurfer GmbH

- RVshare, LLC

- Snow Leopard Adventures

- Sun Camp Holidays by ACSI

- THOR Industries, Inc.

- Trigano S.A.

Delivering Actionable Recommendations for Industry Leaders to Navigate Market Disruptions Policy Changes and Evolving Consumer Expectations

To thrive amid rapid transformation and policy complexities, industry leaders should prioritize investments in modular platform design that support multiple camping modalities-from lightweight backpacks to luxury motorhomes-enabling swift adaptation to evolving consumer tastes. Cultivating robust partnerships with domestic steel and component suppliers can mitigate tariff exposure, while leveraging duty drawback and tariff offset mechanisms will preserve margin flexibility.

Digital ecosystems must also be expanded, integrating mobile booking, contactless check-in at campgrounds, and real-time itinerary customization powered by AI-driven consumer insights. Embedding sustainability at the core of product development-whether through carbon-neutral manufacturing, recyclable materials, or energy-efficient appliance packages-will resonate with eco-aware travelers and align with tightening environmental regulations. Moreover, piloting electric or hybrid RV prototypes in collaboration with automakers and energy providers will showcase commitment to decarbonization and unlock incentives in key markets.

Finally, crafting cross-border alliances with tourism boards, adventure travel operators, and outdoor lifestyle influencers will amplify brand visibility, inform product roadmaps, and generate differentiated offerings. By holistically addressing supply chain resilience, digital transformation, and sustainability imperatives, leaders will position themselves to capture emerging opportunities and buffer against future disruptions.

Detailing the Rigorous Research Methodology Underpinning the Analysis of Camping and Caravanning Markets with Transparent Data Triangulation and Validation

This analysis combines primary and secondary research methodologies to ensure comprehensive coverage and rigorous validation. Primary data was obtained through in-depth interviews with senior executives from leading caravan and RV manufacturers, specialty tent designers, outdoor activity tour operators, and distribution partners. These conversations provided firsthand insights into manufacturing challenges, market dynamics, and consumer behaviors. Concurrently, a series of expert roundtables with regulatory authorities and trade associations delivered critical context on tariff regulations, safety standards, and emerging policy frameworks.

Secondary research encompassed an extensive review of government publications, trade journals, and industry reports, alongside real-time monitoring of tariff announcements and environmental directives. Quantitative data points were cross-referenced against authoritative sources such as national automotive associations, campsite infrastructure databases, and tourism boards. A structured triangulation process reconciled insights across data streams, while bespoke segmentation models were applied to map correlations between consumer profiles, product features, and distribution channels.

Rigorous quality checks, peer reviews, and sensitivity analyses were conducted to verify data integrity and minimize bias. This methodological rigor underpins the reliability of the findings, ensuring that the insights presented accurately reflect the current state and future trajectory of the camping and caravanning arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Camping & Caravanning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Camping & Caravanning Market, by Camping Type

- Camping & Caravanning Market, by Product Type

- Camping & Caravanning Market, by Activity Type

- Camping & Caravanning Market, by End-User

- Camping & Caravanning Market, by Distribution Channel

- Camping & Caravanning Market, by Region

- Camping & Caravanning Market, by Group

- Camping & Caravanning Market, by Country

- United States Camping & Caravanning Market

- China Camping & Caravanning Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Future Trajectory of Camping and Caravanning in Light of Emerging Trends Policy Shifts and Market Dynamics

In sum, the camping and caravanning domain stands at an inflection point defined by converging technological, environmental, and policy forces. The industry has demonstrated resilience in the face of heightened tariffs, leveraging strategic supply chain adaptations and tariff relief mechanisms to maintain product innovation and cost efficiency. Simultaneously, shifting consumer preferences are driving an expansive segmentation landscape, underscored by distinct needs across camping types, activity pursuits, end-user groups, and distribution channels.

Regional disparities, from the expansive road networks of the Americas to the glamping estates of EMEA and the digital-first reservation models of Asia-Pacific, underscore the necessity for localized strategies. Moreover, the competitive terrain, shaped by legacy manufacturers, disruptive startups, and cross-industry alliances, demands a balanced approach to growth-one that harmonizes core competencies with agile experimentation.

Looking forward, success in this arena will hinge on a commitment to sustainability, digital innovation, and strategic partnerships. Industry stakeholders who embrace these imperatives will be poised to deliver compelling experiences, foster brand loyalty, and secure long-term value in the dynamic world of outdoor leisure.

Take the Next Step to Gain In-Depth Intelligence on Camping and Caravanning Trends by Connecting with Ketan Rohom for the Comprehensive Market Research Report

Embark on a journey toward unparalleled market intelligence by partnering with Associate Director of Sales & Marketing, Ketan Rohom. His deep expertise in camping and caravanning will connect you to the strategic insights necessary for navigating complex market dynamics, emerging policy landscapes, and transformative consumer behaviors. Secure access to comprehensive analysis covering everything from shifting tariff regimes and regional demand patterns to segmentation breakthroughs and innovative product trends. Elevate your decision-making with tailored recommendations, cutting-edge research methodologies, and a clear understanding of the competitive landscape. Act now to leverage this exclusive opportunity and position your organization for sustained growth in the evolving world of outdoor leisure.

- How big is the Camping & Caravanning Market?

- What is the Camping & Caravanning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?