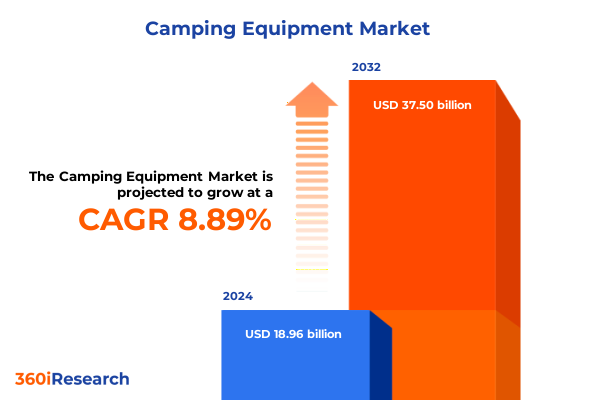

The Camping Equipment Market size was estimated at USD 26.78 billion in 2025 and expected to reach USD 28.13 billion in 2026, at a CAGR of 5.58% to reach USD 39.18 billion by 2032.

Unveiling the Strategic Importance and Contextual Foundation Setting the Stage for In-Depth Exploration of Camping Equipment Market Dynamics

The camping equipment ecosystem has entered a period of rapid evolution driven by technological advancements, heightened consumer environmental awareness, and the shifting dynamics of global trade. As industry stakeholders navigate these multifaceted forces, it becomes imperative to establish a clear framework for understanding current market realities. This executive summary aims to deliver a concise yet comprehensive orientation to the critical factors shaping the camping equipment sector, setting a foundation for deeper exploration.

By grounding readers in the broader context, this introduction clarifies the purpose and scope of subsequent analysis. It delineates the strategic relevance of examining transformative shifts, tariff implications, segmentation patterns, regional distinctions, and competitive strategies-all through a lens that balances market intelligence with actionable takeaways. As decision-makers seek to optimize product portfolios, refine distribution strategies, and future-proof supply chains, this segment offers a navigational beacon to orient their efforts effectively.

Examining the Key Disruptive Transformations Reshaping the Camping Equipment Landscape Across Technology, Consumer Preferences, and Sustainability

In recent years, the camping equipment landscape has undergone profound transformation under the influence of digital technology, sustainability imperatives, and evolving consumer expectations. Digital integration has transcended simple online sales, extending into immersive virtual product demonstrations and AI-driven personalization that tailor gear recommendations to individual adventurers’ preferences. This technological infusion has not only heightened brand engagement but also accelerated innovation cycles, compelling manufacturers to iterate more rapidly on performance and material enhancements.

Simultaneously, a growing consciousness around environmental stewardship has catalyzed demand for eco-conscious product lines, from lightweight recycled fabrics to solar-powered lighting solutions. Leading brands have increasingly prioritized circular design principles, integrating recyclable components and take-back programs to address end-of-life concerns. As a result, sustainability has become a core differentiator, influencing both purchasing decisions and retailer assortment strategies.

Moreover, consumer demographics are shifting, with younger outdoor enthusiasts seeking immersive experiences over mere equipment acquisition. This trend has prompted a realignment of marketing narratives toward lifestyle storytelling, social community building, and experiential value. Taken together, these transformative shifts underscore a market in flux-one where agility, innovation, and purpose-driven branding are indispensable to competitive advantage.

Understanding the Multifaceted Impact of Recent United States 2025 Tariffs on Importation, Supply Chain Adaptation, and Cost Structures in Camping Equipment

The imposition of expanded tariffs on imported camping equipment in 2025 has introduced a new layer of complexity to the supply chain, compelling brands and distributors to reassess sourcing strategies and pricing structures. Elevated duties on key inputs such as technical fabrics, aluminum frames, and integrated electronics have increased landed costs, squeezing margins for manufacturers that rely heavily on offshore production hubs. In response, firms have pursued dual-track strategies, including nearshoring initiatives and renegotiation of supplier contracts, to mitigate exposure to tariff volatility.

This tariff environment has also influenced inventory planning, as distributors face the challenge of balancing stock levels against the risk of further regulatory adjustments. Companies with robust demand forecasting capabilities have been better equipped to absorb short-term cost inflation by optimizing order cycles and preserving cash flow. Conversely, smaller players have encountered capital constraints, prompting strategic collaborations to share distribution networks and consolidate import volumes for tariff relief.

The ripple effects extend to end consumers, where retailers have debated the merits of price pass-through versus margin compression as a competitive positioning lever. While some premium brands have elected to absorb incremental costs to maintain price point consistency, economy-tier offerings have experienced more pronounced retail price increases. As market participants continue to adapt, the 2025 tariff landscape underscores the criticality of supply chain resilience and proactive regulatory monitoring.

Revealing Critical Insights Derived from Comprehensive Segmentation Across Product Types, Distribution Channels, Pricing Tiers, and Consumer Profiles

Insight into consumer purchasing patterns emerges through a nuanced examination of product type, distribution channel, price range, and consumer segment. Consumers seeking high-performance backpacking solutions increasingly gravitate toward specialized packs tailored for extended excursions, whereas casual day hikers favor lightweight daypacks that prioritize comfort and durability. Among cooking equipment, demand is bifurcated between compact stoves for minimalist backcountry use and premium grills for car-camping enthusiasts.

Distribution channels also reveal distinct dynamics: hypermarkets and supermarkets serve as the entry point for economy-tier lighting and basic tents, whereas online retail channels drive discovery of innovative features across premium sleeping bags and technical cookware. Specialty stores cater to professional users who require expert guidance and hands-on product trials, and sporting goods merchants address a spectrum of mid-range offerings that balance performance with accessibility. Price range segmentation highlights that consumers will trade incremental features for cost savings at the economy level, while premium purchasers demonstrate willingness to invest in advanced materials and integrated technology. Finally, professional users, including outdoor guides and expedition teams, prioritize equipment reliability and certification standards, while recreational campers emphasize user experience and social sharing possibilities. This multifaceted segmentation informs product development, marketing positioning, and channel optimization strategies for industry stakeholders.

This comprehensive research report categorizes the Camping Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Consumer Type

Highlighting Regional Variations and Unique Market Characteristics Across Americas, Europe Middle East Africa, and Asia Pacific in Camping Equipment Demand

Regional nuances in camping equipment demand underscore the importance of tailored market approaches across Americas, Europe Middle East Africa, and Asia Pacific. In the Americas, a mature outdoor culture with extensive trail networks drives robust interest in high-capacity backpacks and technical lighting solutions, supported by a developed retail infrastructure that spans big-box stores to specialty outfitters. Seasonality patterns influence product launches, with winter camping gear introductions timed to capitalize on holiday demand cycles.

The Europe Middle East Africa region presents a mosaic of consumer preferences, as densely populated urban centers contrast with expansive natural reserves. Multi-day trekking in Alpine regions fuels demand for durable tents and high-insulation sleeping bags, while Middle Eastern adventure tourism cohorts emphasize compact, portable cooking kits. Retail fragmentation necessitates strategic alliances with regional distributors and an emphasis on multilingual digital platforms to enhance brand accessibility.

Asia Pacific has emerged as a high-growth frontier, where nascent adventure tourism in Southeast Asia and established outdoor cultures in Japan and South Korea converge. E-commerce penetration is particularly strong, enabling direct-to-consumer channels for premium lighting equipment and designer outdoor furniture. Cross-border logistics improvements are facilitating faster delivery times, prompting brands to invest in localized customer service and regional warehousing solutions. Collectively, these regional insights advocate for flexible go-to-market frameworks that align with distinct consumer behaviors and infrastructural realities.

This comprehensive research report examines key regions that drive the evolution of the Camping Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players’ Strategies Innovations and Competitive Positioning in the Evolving Global Camping Equipment Market

Industry leaders have distinguished themselves through a blend of product innovation, strategic partnerships, and brand storytelling. Several prominent players have invested heavily in next-generation materials, such as high-tenacity recycled polymers for ultra-light tents and phase-change fabrics for temperature-regulating sleeping bags. Others have forged collaborations with outdoor adventure platforms to integrate user-generated content into product development cycles, thereby fostering a community-driven ethos that resonates with younger demographics.

Retailers and manufacturers alike have pursued omni-channel integration, combining brick-and-mortar experiential zones with sophisticated online configurators that allow customization of backpacks and cooking kits. Subscription models for consumables, such as replaceable stove cartridges and portable lantern batteries, have begun to surface as recurring-revenue streams, enhancing customer lifetime value and loyalty. Meanwhile, select brands have established in-house environmental impact assessment teams to quantify carbon footprints and water usage, signaling a commitment to transparency that influences purchasing decisions.

Competitive positioning also hinges on agile supply chain networks; leaders have cultivated multi-source supplier portfolios and strategically located distribution centers to ensure rapid replenishment and minimize tariff-risk exposure. This operational resilience, coupled with targeted marketing campaigns emphasizing functionality and sustainability, has reinforced their market share in a landscape characterized by both established giants and nimble innovators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Camping Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Big Agnes, Inc.

- Clarus Corporation

- Coleman Company, Inc.

- Dometic Group AB

- Exxel Outdoors, LLC

- Hilleberg the Tentmaker, Inc.

- Johnson Outdoors, Inc.

- Mont‑Bell Co., Ltd.

- MountCraft

- NEMO Equipment, Inc.

- Newell Brands, Inc.

- Nordisk Co. A/S

- Oase Outdoors ApS

- Pinnacle Tents

- Simex Outdoor International GmbH

- The North Face

- Vaude Sport GmbH & Co. KG

- VF Corporation

- Western Mountaineering, Inc.

- Zempire Camping Equipment

Delivering Actionable Strategic Recommendations for Industry Leaders to Thrive Amidst Market Disruptions and Evolving Consumer Expectations

To capitalize on emerging opportunities and counteract lingering tariff pressures, industry leaders should prioritize diversification of manufacturing footprints by expanding nearshore capabilities and investing in automation technologies that offset rising input costs. Establishing strategic alliances with textile innovators and advanced materials research institutions can accelerate time-to-market for high-performance gear while reinforcing sustainability credentials. Moreover, deploying advanced analytics platforms can refine demand forecasting accuracy, enabling proactive inventory management and cost optimization.

In tandem, brands must deepen engagement through immersive digital experiences that bridge the physical and virtual realms. Leveraging augmented reality tools for virtual tent walkthroughs and interactive cooking tutorials can strengthen emotional connections and reduce return rates. Expanding subscription-based product care services for cleaning and repairs not only fosters customer loyalty but also underscores environmental responsibility by extending product lifecycles.

Finally, fostering regional adaptability through localized marketing campaigns and co-development agreements with regional distributors will ensure resonance with diverse consumer sensibilities. By balancing innovation with operational robustness and targeted consumer engagement, industry leaders can secure a resilient foothold in an increasingly competitive camping equipment arena.

Detailing the Rigorous Research Methodology Employed to Ensure Validity Reliability and Comprehensive Coverage of Camping Equipment Market Insights

The research methodology for this market analysis integrates a blend of qualitative and quantitative approaches to ensure comprehensive and balanced insights. Primary research encompassed structured interviews with senior executives at leading manufacturing firms, in-depth discussions with distribution channel heads across hypermarkets, specialty stores, and online retail platforms, and targeted surveys of professional and recreational campers to capture evolving user needs and preferences. This direct engagement facilitated the validation of observed trends and the uncovering of latent market drivers.

Secondary research involved systematic review of industry trade publications, publicly accessible corporate financial disclosures, regulatory filings related to tariff enactments, and technical journal articles on material science innovations. Publicly available import-export databases and customs documentation provided context on trade flow adjustments following the 2025 tariff changes. Data synthesis was conducted through triangulation methods, cross-referencing multiple information sources to enhance the reliability of key findings.

Analytical techniques included thematic content analysis for qualitative interview transcripts, regression-based correlation studies to identify relationships between distribution channel performance and consumer demographics, and scenario mapping to explore potential outcomes of ongoing regulatory and technological developments. This multifaceted approach underpins the robustness of the insights presented throughout this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Camping Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Camping Equipment Market, by Product Type

- Camping Equipment Market, by Distribution Channel

- Camping Equipment Market, by Consumer Type

- Camping Equipment Market, by Region

- Camping Equipment Market, by Group

- Camping Equipment Market, by Country

- United States Camping Equipment Market

- China Camping Equipment Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Drawing Cohesive Conclusions on Market Dynamics Opportunities and Challenges to Inform Future Strategic Decision Making in Camping Equipment

The camping equipment market is at a strategic inflection point, shaped by digital innovation, sustainability mandates, and geopolitical shifts in trade policy. A granular understanding of segmentation across product categories, distribution networks, pricing tiers, and consumer demographics reveals pathways to differentiation and growth. Simultaneously, regional insights underscore the importance of locally attuned go-to-market strategies that respect cultural and infrastructural diversity.

Competitive analysis highlights that leadership will accrue to those who deftly integrate advanced materials science with agile supply chain practices and immersive consumer engagement models. The cumulative effect of 2025 tariff adjustments reiterates the need for proactive risk management and dynamic sourcing strategies. Ultimately, organizations that align product innovation with environmental stewardship and operational resilience will be best positioned to capture the loyalty of both professional and recreational adventurers.

By synthesizing these elements into cohesive strategic imperatives, industry stakeholders can navigate complexity with confidence, harness emerging trends, and chart a course toward sustained market leadership in the evolving landscape of camping equipment.

Engaging Industry Stakeholders with a Compelling Call To Action to Secure the Complete Market Research Report from Associate Director Ketan Rohom

Ready to transform your strategic approach to the camping equipment market with unparalleled data-driven insights and expert guidance from Ketan Rohom, Associate Director of Sales & Marketing, who stands poised to facilitate your acquisition of the full market research report and empower your organization’s growth trajectory.

- How big is the Camping Equipment Market?

- What is the Camping Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?