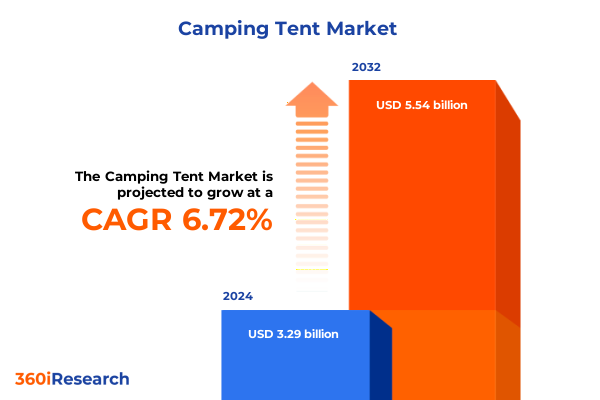

The Camping Tent Market size was estimated at USD 3.50 billion in 2025 and expected to reach USD 3.72 billion in 2026, at a CAGR of 6.79% to reach USD 5.54 billion by 2032.

Unveiling the Transformative Forces and Consumer Aspirations Shaping the Modern Camping Tent Landscape

The camping tent market has undergone an impressive metamorphosis as outdoor pursuits continue to captivate a growing audience of adventure seekers, families, and environmental enthusiasts. Today’s consumers demand versatile, durable shelters that seamlessly blend functionality, style, and sustainability, reflecting a broader societal shift toward experiential recreation. Simultaneously, manufacturers are harnessing cutting-edge materials and automated production processes to deliver lighter, stronger tents without compromising on weather protection or assembly convenience.

In conjunction with evolving product innovation, distribution channels are expanding to meet the expectations of a digitally empowered customer base. Traditional retail environments remain vital, but the rise of e-commerce and direct-to-consumer portals has revolutionized how individuals research, compare, and purchase camping gear. This introduction lays the groundwork for understanding the core drivers catalyzing growth in the camping tent sector, from demographic trends and lifestyle aspirations to technological breakthroughs and retail transformation. By unpacking these foundational elements, we set the stage for a comprehensive examination of market dynamics and strategic imperatives.

Exploring the Intersection of Eco Innovation Digital Integration and Highly Personalized Outdoor Experiences Revolutionizing the Camping Tent Sector

In recent years, the camping tent market has experienced a cascade of transformative shifts that extend far beyond incremental improvements in fabric strength or pole configuration. Leading manufacturers have embraced eco-friendly materials such as recycled polyester and bio-resins to reduce environmental footprints, aligning product development with broader sustainability goals. This commitment to greener innovation is coupled with digital integration, where features like smartphone-compatible lighting systems, integrated solar charging ports, and Wi-Fi mesh compatibility are becoming standard enhancements.

Meanwhile, consumer preferences are fragmenting. Urban dwellers seeking weekend retreats prioritize compact, ultra-lightweight shelters they can carry on public transportation, while family campers prioritize capacious, multi-room cabin tents that simplify group setups. At the same time, glamping providers demand premium aesthetics and modular designs to elevate outdoor living experiences. Industry stakeholders have responded with modular tents that convert from single-room shelters into multi-room complexes and inflatable structures that drastically reduce setup time. These converging trends underscore a market in flux, driven by the interplay of sustainability, digital integration, and highly personalized outdoor experiences.

Analyzing How Early 2025 Tariff Adjustments on Imported Tent Components and Finished Shelters Are Reconfiguring Global Supply Chains

The institution of new tariffs in early 2025 on imported tent components and finished shelters has introduced a fresh set of challenges and opportunities for industry participants. Tariffs on aluminum poles and synthetic fabrics sourced from key manufacturing hubs in Asia have increased landed costs, prompting a reassessment of sourcing strategies. In response, some tent producers have diversified their supplier base, shifting a portion of production to manufacturers in South America and Eastern Europe to maintain cost competitiveness.

Furthermore, the added cost burden has spurred investment in domestic manufacturing capabilities, with select players accelerating automation and lean production methodologies to offset tariff-induced price increases. Meanwhile, retailers have adopted tiered pricing strategies, absorbing a share of increased costs for entry-level models to preserve accessibility, while passing adjusted prices to niche segments willing to invest in premium features. Ultimately, the cumulative impact of these 2025 tariffs extends beyond immediate pricing pressure; it has catalyzed a broader realignment of global supply chains, fostering regional manufacturing clusters and driving innovation in cost-effective, high-performance materials.

Decoding the Multidimensional Segmentation Framework That Illuminates Consumer Preferences and Channel Dynamics in Camping Tents

An in-depth segmentation framework illuminates the nuanced structure of the camping tent market across multiple dimensions that influence purchasing decisions. When examining distribution channels, the market divides into offline and online categories. Offline encompasses hypermarkets and supermarkets, specialty retailers, and sports goods stores, each catering to different shopper profiles and price sensitivities. Conversely, the online landscape spans direct sales and e-commerce platforms, with brand websites offering curated experiences and marketplace platforms providing extensive product variety and competitive pricing.

Product type segmentation reveals distinct submarkets for backpacking tents, cabin tents, dome tents, pop-up tents, and tunnel tents, each engineered to address unique use cases and consumer preferences. Occupant capacity further refines this landscape, with offerings tailored to two-person outings, four-person family excursions, six-person collaborative camping, or larger group experiences accommodating more than six individuals. Seasonality classification distinguishes between three-season shelters designed for temperate conditions, convertible models that adapt to changing weather, and rugged four-season tents engineered to withstand extreme cold and high winds.

Price range segmentation segments tents into budget, midrange, and premium tiers, with luxury and ultra-premium options offering high-end aesthetics and advanced functionality. Material choice plays a pivotal role as well, with canvas, nylon, and polyester meeting different demands for durability, weight, and weather resistance. Setup type divides offerings into instant and manual assemblies, the latter requiring multi-pole or single-pole configurations. Finally, end-use classification differentiates between personal recreational applications and commercial deployments, such as campsite rental programs or outdoor event infrastructure.

This comprehensive research report categorizes the Camping Tent market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Occupant Capacity

- Seasonality

- Material

- Setup Type

- Distribution Channel

- End Use

Unraveling the Complex Regional Dynamics Driving Product Innovation and Distribution Strategies Across the Global Camping Tent Market

Regional dynamics play a crucial role in shaping product innovation, pricing strategies, and distribution priorities across the global camping tent market. In the Americas, particularly the United States and Canada, demand is driven by a strong culture of national park visitation and festival culture, fostering robust demand for both entry-level and specialized expedition tents. Leading retailers and e-commerce platforms in North America emphasize streamlined online shopping experiences bolstered by extensive customer feedback loops.

The Europe, Middle East, and Africa region presents a tapestry of diverse regulatory environments and seasonal weather patterns. Western European countries prioritize sustainability and often adhere to strict eco-certification protocols that influence material sourcing. In contrast, markets in the Gulf states and North Africa show growing interest in high-performance tents capable of withstanding desert climates, propelling demand for thermal insulation and UV-resistant coatings.

Asia-Pacific is characterized by rapid urbanization and rising disposable incomes, driving growth in recreational camping as well as commercial glamping operations. Countries such as China, Japan, and Australia lead innovation in lightweight, foldable designs that cater to space-constrained lifestyles and adventure tourism. Across these regions, local manufacturing capabilities and trade policies intersect to create a dynamic landscape where multinationals and regional specialists vie for leadership.

This comprehensive research report examines key regions that drive the evolution of the Camping Tent market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing How Established Outdoor Brands and Disruptive Innovators Are Shaping Competitive Dynamics Through Collaboration and Data-Driven Innovation

Among the leading players in the camping tent space, a handful of innovators have distinguished themselves through strategic partnerships, proprietary material development, and targeted marketing initiatives. Legacy outdoor brands continue to leverage their heritage reputation, introducing premium collections that blend classic aesthetics with advanced polymer fabrics and smart ventilation systems. These incumbents often engage in partnerships with textile research institutes to co-develop high-strength, lightweight materials that resist wear and environmental stressors.

Emerging companies have carved out niche positions by focusing on single-use scenarios, such as ultralight shelters for endurance athletes or modular pop-ups for urban backyard camping experiences. These challengers frequently utilize direct digital channels to cultivate engaged communities, gathering real-time feedback to iterate product design faster than traditional models. Joint ventures between established retailers and creative startups have also proliferated, combining extensive distribution networks with fresh design approaches to boost market penetration.

Across the spectrum, successful companies are investing in data analytics platforms to capture customer preferences, maintenance feedback, and lifecycle performance metrics. This data-driven mindset informs product roadmaps, marketing personalization, and supply chain resilience efforts, ensuring that each new launch aligns with evolving consumer expectations and regulatory requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Camping Tent market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Clarus Corporation

- Columbia Sportswear Company

- Decathlon SA

- Hilleberg AB

- Johnson Outdoors Inc.

- Marmot Mountain LLC

- Newell Brands Inc.

- Recreational Equipment, Inc.

- VF Corporation

- Vista Outdoor Inc.

Formulating Integrated Strategies That Leverage Channel Diversification Material Innovation and Agile Manufacturing for Market Leadership

To navigate this rapidly evolving landscape, industry leaders should prioritize strategic diversification across distribution channels, balancing robust offline partnerships with a seamless online presence that includes both brand-owned storefronts and curated marketplace listings. Simultaneously, companies ought to intensify efforts in sustainable material development, forging alliances with textile innovators to reduce carbon footprints and meet stringent regulatory standards.

Moreover, organizations should implement advanced analytics to capture nuanced consumer behavior data, enabling hyper-personalized marketing campaigns and iterative design processes. Expanding regional manufacturing footprints can mitigate tariff exposure while shortening lead times and enhancing responsiveness to local consumer preferences. In parallel, cultivating direct feedback loops through extended warranties, virtual reality product trials, and field testing programs will deepen brand loyalty and inform continuous improvement.

Ultimately, by embracing an integrated approach that unites channel diversification, material innovation, data intelligence, and agile manufacturing, industry participants can strengthen competitive positioning and deliver differentiated value in a crowded marketplace.

Detailing the Robust Blend of Primary Interviews Quantitative Surveys and Secondary Data Triangulation Underpinning the Report’s Market Insights

This report’s findings are underpinned by a rigorous blend of primary and secondary research methodologies designed to ensure data integrity and actionable clarity. Primary research encompassed in-depth interviews with industry executives, supply chain specialists, and field sales representatives across key regions. These insights were complemented by quantitative market surveys targeting end consumers, capturing purchase drivers, feature preferences, and willingness to pay across diverse demographic cohorts.

Secondary research involved meticulous analysis of company filings, product catalogs, patent databases, and regulatory frameworks to validate supply chain structures and technological advancements. Trade association publications and academic journals provided further context around material science breakthroughs and environmental compliance standards. Data triangulation was achieved by cross-referencing multiple sources to reconcile discrepancies and identify convergent trends.

Finally, our analytic framework included scenario modeling to assess the impact of policy shifts, such as the 2025 tariff adjustments, and to map potential evolutions in channel dynamics. This blended methodology ensures that conclusions and recommendations rest on a solid evidentiary foundation, delivering a comprehensive perspective for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Camping Tent market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Camping Tent Market, by Product Type

- Camping Tent Market, by Occupant Capacity

- Camping Tent Market, by Seasonality

- Camping Tent Market, by Material

- Camping Tent Market, by Setup Type

- Camping Tent Market, by Distribution Channel

- Camping Tent Market, by End Use

- Camping Tent Market, by Region

- Camping Tent Market, by Group

- Camping Tent Market, by Country

- United States Camping Tent Market

- China Camping Tent Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Summarizing the Convergence of Consumer Trends Technological Innovation and Supply Chain Realignment That Defines Tomorrow’s Camping Tent Market

As the camping tent market continues to expand and fragment in response to shifting consumer lifestyles, technological breakthroughs, and regulatory developments, industry stakeholders must remain vigilant and adaptive. The convergence of sustainability imperatives, digital integration, and supply chain realignment presents a fertile ground for innovation, yet demands agility to capitalize on fleeting opportunities and navigate cost pressures.

Companies that succeed will be those capable of synthesizing rich consumer insights with advanced material science, while leveraging diversified manufacturing footprints to mitigate geopolitical and tariff risks. Cultivating direct engagement channels and fostering transparent customer feedback mechanisms will further enhance product relevance and brand equity. In this dynamic environment, the balance between tradition and disruption serves as the crucible for tomorrow’s market leaders.

This synthesis of market evolution underscores the critical role of strategic foresight, cross-functional collaboration, and data-driven decision-making. By aligning operational capabilities with emerging consumer needs and regulatory landscapes, organizations will be well positioned to thrive in an era defined by rapid transformation and heightened competition.

Empower Your Strategic Decisions by Connecting with the Associate Director to Secure the Comprehensive Camping Tent Market Research Report

If you’re ready to elevate your strategic decision-making with a deeper understanding of the camping tent market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your comprehensive market research report. By engaging directly, you will gain exclusive access to in-depth analyses, expert insights, and tailored data that empower your organization to navigate evolving regulations, emerging consumer demands, and competitive pressures with confidence. Don’t miss this opportunity to leverage robust, actionable intelligence and stay ahead of the curve in a market defined by rapid innovation and shifting global dynamics. Contact Ketan Rohom to begin your journey toward smarter investments and market leadership.

- How big is the Camping Tent Market?

- What is the Camping Tent Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?