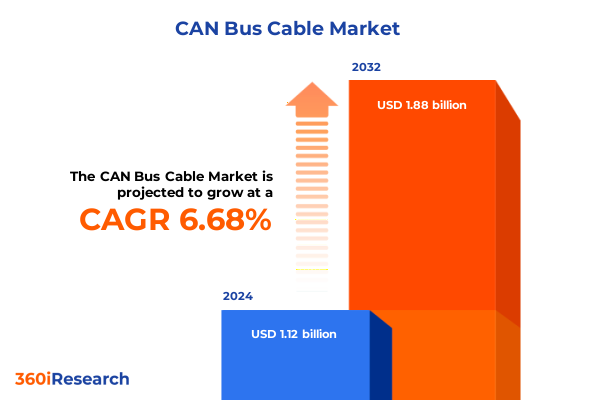

The CAN Bus Cable Market size was estimated at USD 1.19 billion in 2025 and expected to reach USD 1.28 billion in 2026, at a CAGR of 6.75% to reach USD 1.88 billion by 2032.

Revealing the Integral Backbone of Real-Time Data Exchange through Advanced CAN Bus Cabling Solutions

The modern landscape of machine-to-machine communication relies heavily on robust, reliable cabling solutions, and Controller Area Network (CAN) Bus cables have emerged as the backbone of these critical connections. As the demand for precise real-time data exchange continues to accelerate, industries across the spectrum lean on CAN Bus cabling to enable fault-tolerant, noise-resistant, and high-integrity signal transmission. These cables underpin the operational efficiency of vehicles, industrial automation systems, and mission-critical defense platforms, ensuring seamless interoperability between sensors, controllers, and actuators.

Amid exponential growth in electrification and automation, CAN Bus cables have transcended their original automotive roots to find applications in a range of high-stakes environments. Advances in material science, shielding techniques, and conductor construction have expanded performance envelopes, supporting both legacy standard CAN protocols and emerging higher-throughput CAN FD implementations. The evolving demands of electric vehicles, autonomous machinery, and smart infrastructure place a premium on cable assemblies that can deliver uncompromising reliability under extreme temperatures, mechanical stress, and electromagnetic interference.

In this report, we embark on a holistic exploration of the CAN Bus cable market, examining transformative shifts in technology, regulatory headwinds such as 2025 US tariff changes, nuanced segmentation insights spanning applications to insulation materials, and regional dynamics shaping competitive positioning. Through a detailed assessment of leading industry players and pragmatic recommendations for stakeholders, this analysis equips decision-makers with a clear roadmap to navigate a rapidly evolving ecosystem.

Navigating the Convergence of Technological Innovation, Regulatory Evolution, and Mobility Trends Shaping CAN Bus Cable Applications

In recent years, the CAN Bus cable ecosystem has undergone seismic shifts catalyzed by converging technological innovation and changing end-market requirements. The transition toward electric mobility has compelled cable manufacturers to reengineer conductor alloys and insulation compounds to withstand higher voltages and elevated thermal cycles. Simultaneously, the proliferation of autonomous capabilities has driven the adoption of CAN FD, necessitating cables with enhanced bandwidth and lower latency profiles.

Regulatory measures aimed at enhancing vehicle safety and reducing electromagnetic emissions have further influenced material selection and shielding methodologies. Compliance with stringent automotive and aerospace standards has become a non-negotiable prerequisite, prompting more rigorous testing protocols and the integration of advanced braided or foil shielding layers. These shifts reflect an industry recalibrating its core value proposition from simple connectivity to comprehensive signal integrity assurance.

Moreover, digital transformation initiatives in manufacturing and smart infrastructure projects have elevated the importance of network resilience. Industrial control systems rely increasingly on CAN Bus architectures for monitoring critical equipment, making uptime and data fidelity paramount. This evolution has accelerated collaborative efforts between cable producers and system integrators, as stakeholders co-develop turn-key solutions that bundle cables with connectors, termination modules, and diagnostic software utilities.

These transformative shifts underscore a market at the nexus of electrification, autonomy, and digitalization, where adaptive cable architectures are central to unlocking the next generation of performance and reliability.

Assessing the Far-Reaching Effects of 2025 US Tariff Adjustments on Supply Chains, Costs, and Competitive Dynamics in the CAN Bus Cable Industry

In 2025, the United States implemented a series of tariff adjustments targeting a range of electronic components and raw materials integral to CAN Bus cable manufacturing. These measures have imposed incremental duties on copper and tinned copper alloys, as well as on certain thermoplastic insulation resins imported from key supplier regions. The resulting cost inflation has reverberated across global supply chains, compelling manufacturers to reassess sourcing strategies and renegotiate supplier contracts to mitigate margin erosion.

This tariff environment has also triggered a realignment of production footprints. To avoid punitive duties, several manufacturers have expedited the establishment of assembly operations within tariff-exempt zones or have partnered with local fabricators in the Americas. While this reshoring trend bolsters supply chain resilience and reduces lead times, it requires substantial capital investment and recalibration of logistics networks. Consequently, companies are weighing the trade-off between higher unit costs and the strategic benefits of proximity to end markets.

Competitive dynamics have also intensified, as tariff-induced pricing pressures amplify the significance of value-added services and technical differentiation. Firms that can demonstrate superior material innovations, enhanced shielding performance, or integrated cable assemblies gain a decisive edge in procurement negotiations. Furthermore, ongoing dialogue between industry associations and regulatory bodies seeks to refine tariff classifications, potentially carving out exemptions for critical automotive and defense applications.

Overall, the cumulative impact of the 2025 US tariffs has reshaped cost structures, accelerated localization initiatives, and sharpened the focus on technical leadership within the CAN Bus cable sector.

Deep Dive into Segmentation Dynamics Revealing the Impact of Applications, Protocols, Speeds, Vehicle Types, Shielding, Materials, and Construction

A nuanced understanding of the CAN Bus cable landscape emerges through a multifaceted segmentation framework. Based on Application, the market is studied across aerospace and defense, automotive with further delineation between aftermarket and OEM, industrial controls, and specialized medical equipment. Meanwhile, the protocol segmentation highlights the growing prominence of CAN FD’s enhanced data rate capabilities alongside the enduring adoption of standard CAN in legacy systems.

Speed-oriented segmentation underscores the divergence between high-speed CAN Bus cables that facilitate rapid data throughput in critical control loops and low-speed variants employed in secondary monitoring or body electronics. When examined through the lens of Vehicle Type, distinctions become clear between heavy-duty commercial vehicles with demanding vibration and temperature profiles, electric vehicles requiring robust high-voltage dielectric properties, and passenger vehicles that prioritize cost-effective mass deployment.

Shielding options, segmented into shielded and unshielded designs, reflect a strategic balance between electromagnetic protection and pricing considerations, with shielded assemblies favored in electrically noisy environments. The choice of conductor material-aluminum for lightweight applications and copper for superior conductivity-further differentiates performance and cost matrices. Insulation materials such as PVC, TPE, and XLPE each offer unique trade-offs in flexibility, thermal endurance, and chemical resistance.

Finally, conductor type segmentation distinguishes between solid cores for minimal signal attenuation over short runs and stranded constructs for enhanced flexibility in dynamic routing scenarios. Collectively, these segmentation dimensions provide a holistic lens through which stakeholders can identify target applications, optimize design parameters, and align product portfolios with evolving market requirements.

This comprehensive research report categorizes the CAN Bus Cable market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Protocol

- Speed

- Vehicle Type

- Shielding

- Conductor Material

- Insulation Material

- Conductor Type

Regional Differentiation in CAN Bus Cable Adoption Driven by Diverse Industrial Profiles and Regulatory Imperatives across Americas EMEA and Asia-Pacific

Regional dynamics play a pivotal role in shaping the competitive landscape of CAN Bus cable procurement and deployment. In the Americas, a robust automotive manufacturing base and burgeoning electric vehicle adoption drive demand for both standard and advanced cable assemblies. Reliability standards in aerospace and defense further underpin growth, prompting established players to invest in localized production and close collaboration with Tier 1 integrators to meet stringent quality benchmarks.

Across Europe, the Middle East, and Africa, regulatory emphasis on vehicle emissions and safety has led to widespread modernization of network architectures, spurring demand for CAN FD–compatible cables. The region’s diverse industrial ecosystem, spanning from heavy machinery in Germany to oil and gas applications in the Middle East, fuels demand for tailored solutions that address varied thermal and mechanical load profiles, while compliance with unified EU directives ensures interoperability and streamlined certification.

In the Asia-Pacific region, rapid industrialization and smart infrastructure investments position the market as a high-growth frontier. China’s expansive automotive manufacturing sector and Japan’s precision engineering hubs both contribute to a voracious appetite for high-performance CAN Bus cables. Concurrently, Southeast Asian markets are emerging as key assembly centers, benefiting from competitive labor rates and favorable trade agreements that bolster export competitiveness.

These regional insights underscore a global market characterized by localized innovation imperatives, regulatory influences, and logistical considerations, guiding strategic decisions around production, distribution, and after-sales support.

This comprehensive research report examines key regions that drive the evolution of the CAN Bus Cable market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Pioneering CAN Bus Cable Manufacturers Emphasizing Innovation, Collaboration, and Market Diversification

Leading manufacturers in the CAN Bus cable arena distinguish themselves through technical prowess, strategic partnerships, and diversified product portfolios. Industry pioneers with longstanding expertise in conductor metallurgy have introduced next-generation aluminum-copper composites that strike an optimal balance between weight reduction and electrical performance. Others have charted new ground in insulation technology, leveraging advanced thermoplastic elastomers to deliver superior flexibility and thermal stability.

Strategic alliances between cable fabricators and automotive OEMs have accelerated the co-development of bespoke assembly kits, complete with integrated connectors and diagnostic harnesses. This trend toward solution-centric models underscores the increasing importance of service differentiation in an environment where raw cable offerings are becoming commoditized. Companies that invest in in-house testing facilities and rapid prototyping capabilities can offer shorter development cycles, further solidifying their competitive standing.

On the innovation front, a select group of players has embraced digital tools such as embedded sensors for real-time health monitoring of cable networks. These predictive maintenance solutions not only reduce downtime but also unlock opportunities for recurring revenue through subscription-based analytics platforms. Meanwhile, aggressive merger and acquisition activity reflects ambitions to expand geographic reach and accelerate entry into adjacent markets like fiber-optic and high-voltage power cabling.

Collectively, these insights highlight a competitive field where engineering excellence and customer-centric service models are key differentiators for market leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the CAN Bus Cable market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amphenol Corporation

- Belden Inc.

- Continental AG

- Furukawa Electric Co., Ltd.

- HUBER+SUHNER AG

- Leoni AG

- Nexans S.A.

- Prysmian S.p.A.

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

Strategic Imperatives for Industry Leaders to Harness Innovation, Reinforce Supply Chain Resilience, and Elevate Value-Added Services

Industry leaders seeking to capitalize on the evolving CAN Bus cable landscape should prioritize a forward-looking approach to material and design innovation. Strengthening R&D partnerships with resin suppliers and connector specialists will accelerate the development of high-performance insulation systems and robust termination assemblies. Concurrently, diversifying conductor sourcing to include both copper and lightweight aluminum alloys can provide a hedge against raw material cost volatility and tariff exposure.

Supply chain resiliency must also be elevated as a strategic priority. Establishing regional manufacturing hubs in tariff-exempt zones and cultivating secondary supplier relationships will mitigate disruptions and compress lead times. Coupled with digital inventory management platforms, these measures ensure rapid responsiveness to demand spikes, particularly in high-growth applications such as electric vehicle production and advanced industrial automation.

On the commercialization front, embracing value-added service models-ranging from on-site custom harness assembly to subscription-based cable diagnostics-can unlock new revenue streams and deepen customer loyalty. Tailoring go-to-market strategies to the specific regulatory and performance requirements of each region will further reinforce market penetration efforts.

Finally, active engagement with standards bodies and industry alliances will enable companies to influence emerging specifications, particularly around next-generation CAN FD protocols and shielding efficacy. By aligning product roadmaps with evolving regulatory frameworks, leaders can secure early mover advantages and solidify their roles as trusted technology partners.

Comprehensive Research Framework Leveraging Qualitative Interviews, Secondary Data Scrutiny, and Rigorous Validation for Trusted CAN Bus Cable Insights

This research employs a robust mixed-methodology framework to ensure comprehensive and reliable insights. The analysis began with extensive secondary research, drawing on proprietary and publicly available technical publications, industry standards documentation, and regulatory filings to establish a foundational understanding of CAN Bus cable technologies and market drivers.

Primary research efforts included in-depth interviews with key stakeholders across the value chain, encompassing cable fabricators, connector manufacturers, system integrators, and end-user organizations in automotive, aerospace, industrial automation, and medical sectors. These interviews provided qualitative insights into product development trends, cost structures, and regional market dynamics.

Quantitative data points were aggregated through data triangulation, synthesizing figures from supply chain databases, trade associations, and proprietary shipment indicators to validate assumptions around production footprints and material flows. Each data element underwent rigorous cross-verification to ensure accuracy and consistency.

Finally, the findings were subjected to stakeholder validation workshops, where industry experts reviewed and refined the strategic implications of the analysis. This iterative validation process enhances the credibility of the recommendations and ensures alignment with real-world operational and regulatory considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our CAN Bus Cable market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- CAN Bus Cable Market, by Application

- CAN Bus Cable Market, by Protocol

- CAN Bus Cable Market, by Speed

- CAN Bus Cable Market, by Vehicle Type

- CAN Bus Cable Market, by Shielding

- CAN Bus Cable Market, by Conductor Material

- CAN Bus Cable Market, by Insulation Material

- CAN Bus Cable Market, by Conductor Type

- CAN Bus Cable Market, by Region

- CAN Bus Cable Market, by Group

- CAN Bus Cable Market, by Country

- United States CAN Bus Cable Market

- China CAN Bus Cable Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Synthesis of Strategic Insights and Forward-Looking Outlook Guiding Stakeholders through Technological, Regulatory, and Regional Dynamics

In conclusion, the CAN Bus cable market stands at a crossroads of technological innovation, regulatory evolution, and supply chain realignment. The shift toward electrified and autonomous systems is accelerating requirements for high-throughput, low-latency cabling solutions, while emerging tariffs and material constraints are reshaping cost and sourcing strategies. Nuanced segmentation insights across application domains, protocol variants, speed grades, vehicle types, shielding options, conductor and insulation materials, and cable constructions provide a detailed lens for product portfolio optimization.

Regional dynamics further underscore the importance of localized manufacturing and compliance strategies, as the Americas, EMEA, and Asia-Pacific regions each present unique growth catalysts and regulatory landscapes. Leading companies are differentiating through advanced material innovations, integrated service offerings, and strategic partnerships that anticipate future network demands.

By adopting the actionable recommendations outlined in this analysis-ranging from supply chain diversification to value-added service expansion-industry participants can secure competitive advantages. As stakeholders navigate this dynamic ecosystem, the insights and strategic imperatives presented herein serve as a roadmap for sustained innovation and market leadership in the CAN Bus cable domain.

Unlock the Full Potential of CAN Bus Cable Market Research by Engaging with Ketan Rohom for Tailored Insights and Strategic Guidance

Elevate your strategic decision-making with comprehensive analysis and bespoke guidance on the CAN Bus cable market by connecting directly with Ketan Rohom, Associate Director of Sales & Marketing. By leveraging this research, you gain unparalleled clarity on industry dynamics, supply chain optimization strategies, and emerging growth pathways. Engage with Ketan to explore customized intelligence packages, tailor-made competitor benchmarking, and scenario planning that align with your organizational objectives. This partnership will empower your team to respond swiftly to regulatory shifts, technological advancements, and tariff implications. Reach out to secure your access to the full market research report and initiate a dialogue that transforms data into actionable insights, fueling your market leadership and innovation roadmap

- How big is the CAN Bus Cable Market?

- What is the CAN Bus Cable Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?