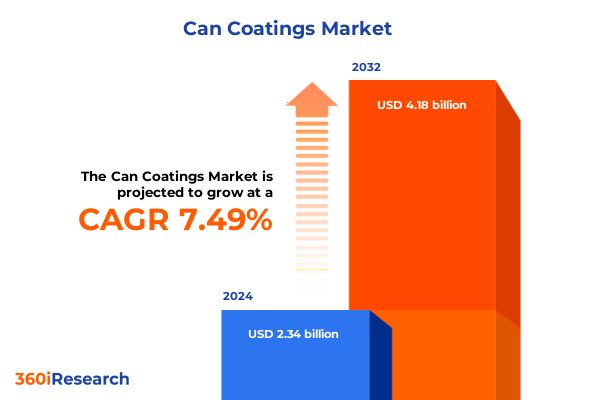

The Can Coatings Market size was estimated at USD 2.50 billion in 2025 and expected to reach USD 2.68 billion in 2026, at a CAGR of 7.57% to reach USD 4.18 billion by 2032.

Positioning Can Coatings at the Forefront of Packaging Sustainability and Performance in a Dynamic Global Market Environment

The evolution of can coatings has become a focal point in the global packaging landscape, driven by mounting regulatory mandates, consumer demand for sustainability, and rapid technological innovation. As businesses navigate complex requirements around food safety, recyclability, and environmental impact, the coatings applied to metal cans have transcended their traditional role of corrosion protection to become critical enablers of brand differentiation and circular economy objectives. Moreover, the shift from conventional epoxy-based systems to advanced BPA-free, water-based, and bio-based technologies underscores the industry’s commitment to meeting stringent global standards while maintaining performance integrity.

Against this backdrop of transformation, stakeholders across the value chain-ranging from resin producers and coating formulators to can manufacturers and consumer brands-must continuously adapt to emerging challenges and opportunities. Collaboration has emerged as a key success factor, as evidenced by joint development initiatives between major players and the rapid deployment of next-generation coatings in production lines ahead of regulatory deadlines. In parallel, the rise of digital printing and nanotechnology-infused barrier layers highlights the sector’s pursuit of enhanced functionality, consumer engagement, and operational efficiency.

Transitioning from foundational definitions, the subsequent sections will delve into the pivotal shifts reshaping the can coatings market, the quantitative and qualitative impact of recent U.S. tariffs, segmentation dynamics, regional nuances, competitive landscapes, strategic recommendations, research approaches, and concluding perspectives.

Emerging Sustainability Mandates and Technological Breakthroughs Redefining Can Coatings for Future-Ready Packaging Solutions

Regulatory imperatives have emerged as the primary catalyst driving a paradigm shift in the can coatings arena. In Europe, the effective ban on Bisphenol A (BPA) and PFAS in food-contact materials by mid-2026 has spurred an industry-wide transition to BPA-non-intent and PFAS-non-intent alternatives. This accelerated timeline has compelled can makers and coating suppliers to collaborate intensively, testing and validating new chemistries to ensure compliance without compromising on shelf life or sensory performance. Simultaneously, the Corporate Sustainability Reporting Directive (CSRD) and Extended Producer Responsibility (EPR) frameworks across multiple jurisdictions are imposing more rigorous ESG reporting requirements, prompting brands to quantify and reduce Scope 3 emissions from packaging coatings.

U.S. Trade Policy Shifts Driving Reassessment of Sourcing Strategies and Cost Structures Across the Can Coatings Value Chain

The escalation of U.S. tariffs on imported steel and aluminum under Section 232-from 25% to 50% effective June 4, 2025-has marked a watershed moment for the can coatings value chain. By more than doubling duties on core substrates, these measures have materially increased input costs for both can makers and coating formulators, triggering a reassessment of sourcing strategies and pricing structures across the industry. In response, several leading producers have accelerated engagement with domestic steel and aluminum suppliers, aiming to stabilize supply contracts and mitigate volatility.

Decoding the Complex Interaction of End-Use, Can Type, Substrate, Resin, and Technology Requirements That Shape Coating Formulations

Insights drawn from multiple segmentation dimensions reveal the nuanced requirements that underpin the can coatings landscape. Within the end-use spectrum, aerosol applications in household and personal care demand coatings with superior adhesion, flexibility, and decorative appeal, while industrial aerosol segments prioritize chemical and abrasion resistance. Beverage cans-encompassing carbonated drinks, beer, juice, and water-require internal coatings that preserve flavor stability and comply with food-contact regulations, alongside external finishes optimized for label adhesion and shelf appeal. Food cans, including meat, pet food, ready meals, and vegetable packs, call for internals with robust barrier properties to withstand acidic or high-salt environments. Meanwhile, industrial end uses such as automotive and chemical containers drive demand for custom formulations that resist corrosion under extreme temperatures and stresses.

Delineation by can type further accentuates design considerations. Three-piece side-seamed constructions necessitate coatings that accommodate curved seams while maintaining uniform coverage, whereas two-piece draw-redraw and drawn-and-ironed bodies require low-viscosity formulations capable of sealing intricate geometry with minimal waste. Substrate selection-whether aluminum or steel-introduces its own set of adhesion and corrosion challenges, with aluminum’s oxide layer demanding specialized primers and steel’s inherent porosity influencing formulation viscosity and crosslinker selection. Across resin families, acrylics deliver UV stability and rapid cure, epoxies offer outstanding chemical resistance, polyesters balance hardness and flexibility, polyurethanes impart toughness and elasticity, and vinyls serve niche decorative and barrier roles. Finally, technology platforms ranging from powder and radiation-curable systems to solvent-based and water-based liquids each present unique trade-offs across VOC compliance, cure energy, and application efficiency.

This comprehensive research report categorizes the Can Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Can Type

- Substrate

- Resin Type

- Technology

- End Use

Unearthing Regional Nuances in Regulatory Dynamics, Supply Chain Strategies, and Sustainability Priorities Across the Americas, EMEA, and APAC

Regional dynamics play a pivotal role in shaping can coatings strategies and priorities. In the Americas, shifting state-level regulations in the United States, combined with renewed emphasis on domestic manufacturing through tariff protections, have driven growth in BPA-free and water-based coatings. North American producers are investing in localized production capacity and supply chain resilience, while end-users emphasize streamlined approval processes to align new coatings with FDA and Canadian Food Inspection Agency standards.

Europe, Middle East & Africa (EMEA) is distinguished by some of the world’s most rigorous sustainability mandates, including the EU’s Packaging and Packaging Waste Regulation (PPWR) and CSRD. The imminent phase-out of BPA by July 2026, accompanied by PFAS restrictions, has catalyzed collaborative testing programs and pilot lines across multiple countries. In parallel, emerging Extended Producer Responsibility schemes in select African nations are fostering early adoption of recyclable and low-carbon coatings.

Asia-Pacific markets represent a dynamic landscape driven by rising consumer demand for canned foods and beverages in China, India, and Southeast Asia. Rapid urbanization and evolving retail channels are fueling investments in coatings that combine environmental credentials with high-speed line performance. Leading suppliers have established or expanded facilities in key hubs such as Shanghai to meet regional demand while navigating diverse regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Can Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Key Multinational and Regional Innovators Shaping the Competitive Terrain of Can Coatings

A handful of multinational corporations anchor the global can coatings ecosystem, each bringing distinctive strengths and strategic focus. AkzoNobel’s Packaging Coatings division has led the charge on BPA-non-intent and PFAS-non-intent technologies, leveraging its EMEA pilot lines and new mid-2025 plant in Villafranca to secure supply during the European transition. Sherwin-Williams, through its valPure V70 non-BPA epoxy innovation, has demonstrated the viability of next-generation chemistries across beverage, food, household, and personal care sectors, underpinned by a 10-year R&D effort and early global approvals. PPG has notably expanded its easy-open end coatings portfolio, introducing BPA-NI solutions within its Innovel and iSense series to optimize high-speed beverage can operations while reducing VOC emissions and film weights. BASF continues to advance sustainability through its biomass-balanced coatings, extending a 250-product portfolio across Europe, Asia, and North America to lower carbon footprints via renewable feedstocks. Beyond these leaders, regional specialists and emerging players are making targeted inroads by offering bespoke formulations tailored to niche end-uses and local regulatory regimes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Can Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- ALTANA AG

- Asian Paints Limited

- Axalta Coating Systems Ltd.

- Ball Corporation

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Toyochem Co., Ltd.

Strategic Roadmap for Executives to Harmonize Sustainability Priorities with Operational Excellence and Technological Leadership

To thrive amid escalating regulatory scrutiny and market complexity, industry leaders must prioritize a multifaceted strategy that balances sustainability, innovation, and operational resilience. First, accelerating investment in zero-VOC and bio-based resin systems will align product portfolios with tightening global mandates and evolving consumer expectations. Early engagement with brands and regulators can streamline qualification timelines and reduce time-to-market. Next, enhancing supply chain agility through diversified sourcing and localized production footprints will mitigate input price volatility driven by tariffs and geopolitical shifts. Forming strategic alliances with steel and aluminum suppliers to secure preferential contracts can further stabilize raw material costs.

Moreover, embedding digital platforms and data analytics into manufacturing operations will enable predictive quality control and resource optimization. Adopting Industry 4.0 practices-such as real-time viscosity monitoring and digital batch tracking-can minimize waste and enhance consistency across multiple production sites. Finally, fostering open collaboration across the entire value chain, including can makers, coatings formulators, and brand owners, will catalyze co-development of advanced functionalities like antimicrobial barriers and smart coatings. Industry consortia and joint testing programs can accelerate validation of next-generation technologies and support broader adoption.

Employing a Hybrid Research Framework That Combines Expert Interviews, Secondary Data Review, and Rigorous Segmentation Analysis

This report’s insights are underpinned by a rigorous, multi-tiered research framework integrating both qualitative and quantitative methodologies. Primary research involved in-depth interviews with senior executives, R&D scientists, and procurement leads from leading coatings producers, can manufacturers, and major brand owners across key regions. Expert roundtables and validation workshops were convened to test hypotheses and refine segmentation models.

Secondary research encompassed a comprehensive review of industry publications, regulatory filings, patent databases, technical white papers, and sustainability reports from coating suppliers and can makers. Data sources included government trade statistics, CSR disclosures, and proprietary databases tracking material flows and production capacities. The segmentation analysis synthesized five critical dimensions-end-use, can type, substrate, resin, and technology-to unveil application-specific requirements and growth drivers. Potential biases were mitigated through data triangulation, ensuring that primary insights were corroborated by multiple independent sources.

Market dynamics were further examined through case studies of recent technology launches, regulatory milestone impacts, and corporate investment announcements. This mixed-methods approach guarantees robust conclusions grounded in empirical evidence and industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Can Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Can Coatings Market, by Can Type

- Can Coatings Market, by Substrate

- Can Coatings Market, by Resin Type

- Can Coatings Market, by Technology

- Can Coatings Market, by End Use

- Can Coatings Market, by Region

- Can Coatings Market, by Group

- Can Coatings Market, by Country

- United States Can Coatings Market

- China Can Coatings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Sustainability Drivers, Technological Imperatives, and Strategic Imperatives to Shape the Future of Can Coatings Market

The can coatings market stands at a pivotal juncture, driven by the confluence of strict regulatory mandates, rapidly evolving consumer preferences, and accelerating technological breakthroughs. As the phase-out of legacy chemistries like BPA and PFAS unfolds across Europe and beyond, stakeholders are challenged to adopt next-generation solutions that reconcile performance, safety, and sustainability. Meanwhile, U.S. tariff escalations and regional policy shifts underscore the urgency for agile sourcing and supply chain strategies.

Segment-specific insights reveal that the diverse applications-from high-speed beverage ends to industrial aerosol containers-necessitate tailored formulations that embrace advanced resins, optimized cure processes, and emerging platform technologies. With leading companies investing heavily in R&D and production capacity, the competitive landscape is primed for further consolidation and strategic partnerships. In this environment, industry leaders who champion cross-value-chain collaboration, digital transformation, and proactive engagement with regulatory bodies will be best positioned to capture new growth opportunities.

In conclusion, the intersection of sustainability imperatives and technological innovation offers a clear path for differentiation and market leadership. By harnessing the detailed insights and recommendations presented herein, decision-makers can navigate complexity, preempt compliance risks, and drive long-term value creation.

Connect with Associate Director Ketan Rohom to Unlock Customized Can Coatings Insights and Strategic Growth Opportunities

To explore how these insights can translate into tangible growth and sustainable advantage for your organization, we invite you to engage with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. With deep expertise in metal packaging coatings and a track record of guiding industry leaders through strategic decision-making, Ketan stands ready to tailor the comprehensive report to your specific business objectives and operational requirements.

By initiating a dialogue with Ketan, you will gain access to exclusive analysis, detailed segmentation matrices, and actionable recommendations that align perfectly with your market positioning and growth ambitions. Secure your competitive edge today by arranging a confidential briefing and demonstration of the full can coatings market research report. Reach out to Ketan to schedule your personalized consultation and chart your path toward innovation, resilience, and market leadership.

- How big is the Can Coatings Market?

- What is the Can Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?