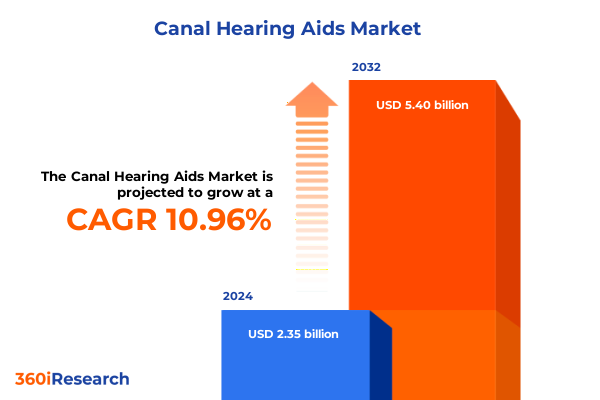

The Canal Hearing Aids Market size was estimated at USD 2.58 billion in 2025 and expected to reach USD 2.85 billion in 2026, at a CAGR of 11.08% to reach USD 5.40 billion by 2032.

Emerging Demand for Discreet Canal Hearing Devices Driven by Aging Lifestyles, Regulatory Reforms, and Rapid Technological Convergence

An unprecedented convergence of demographic shifts and technological breakthroughs is reshaping the hearing health landscape. Globally, more than 1.5 billion people live with some degree of hearing loss, with approximately 430 million experiencing disabling impairment, underscoring a profound and growing societal need for rehabilitative solutions. The prevalence of hearing decline accelerates markedly beyond the age of 60, affecting nearly a quarter of older adults and contributing to significant personal, social, and economic challenges. Within this context, discreet in-canal hearing devices have emerged as a critical innovation for addressing mild to moderate hearing deficits in a cosmetically appealing form factor, offering users enhanced comfort and social confidence

Recent regulatory and market developments have further amplified the appeal of canal hearing aids. The introduction of over-the-counter hearing aid regulations in the United States has democratized access to self-fitting devices, while simultaneous advancements in miniaturized components and digital signal processing have enabled models to incorporate adaptive noise reduction, wireless connectivity, and biometric monitoring in ever-smaller shells. These combined forces have created a fertile environment for canal hearing aids to transform from niche specialty items into mainstream consumer health products, aligning with evolving user expectations for discreet, digitally integrated wellness solutions

Rapid Industry Transformation Fueled by Miniaturized Canal Form Factors, AI-Enhanced Sound Processing, and Omni-Channel Distribution Evolution

Across the last two years, the canal hearing aid sector has undergone transformative shifts driven by digitalization and convergence with consumer electronics. Artificial intelligence and machine learning algorithms are now embedded in signal processors, enabling devices to automatically adapt to fluctuating acoustic environments and enhance speech intelligibility amid background noise. Meanwhile, wireless protocols are evolving beyond traditional Bluetooth Low Energy to include broadcast-centric standards such as Auracast that support simultaneous streaming to multiple endpoints, elevating accessibility in home entertainment, public venues, and collaborative settings

Distribution models have also transformed dramatically in response to changing consumer behaviors and the necessity for remote care. Clinics are increasingly complementing in-person fittings with tele-audiology services that leverage cloud-based platforms for real-time adjustments, while manufacturer direct channels and third-party e-commerce platforms have emerged as vital conduits for over-the-counter and prescription devices alike. This omnichannel evolution is redefining service delivery, requiring providers to master both high-touch clinical expertise and seamless digital experiences to meet the expectations of tech-savvy and convenience-driven consumers

Assessing the Ripple Effects of 2025 U.S. Tariff Measures on Canal Hearing Aid Supply Chains, Pricing Strategies, and Market Accessibility

Recent U.S. trade actions have raised critical questions about the cost and supply chain stability of hearing aids. In early 2025, the administration enacted a 10 percent tariff on imports from China, alongside a postponed 25 percent levy on products from Canada and Mexico, subject to periodic extensions. Although hearing aids themselves are traditionally categorized under Chapter 98 of the Harmonized Tariff Schedule and enjoy exemptions via the Nairobi Protocol, uncertainty persists regarding the treatment of components and accessories. Industry stakeholders are vigilantly monitoring regulatory clarifications as they assess potential ripple effects on manufacturing costs and inventory allocation

Despite broad exemptions for medical devices, experts anticipate that indirect cost pass-through could affect final pricing structures. Survey data suggests that healthcare facilities expect supplies, including diagnostic equipment and accessories, to become approximately 15 percent more expensive in the months following tariff implementation. Over-the-counter hearing aids could see price increases of up to 50 percent, while prescription devices may incur incremental adjustments of $100 to $200 per unit depending on absorption strategies. Providers are weighing options between absorbing these expenses or selectively passing them to consumers, underscoring the importance of strategic sourcing and tariff mitigation planning

Decoding Key Segmentation Insights into Product Types, Distribution Pathways, Technological Variants, and Consumer Performance Preferences

The canal hearing aid market encompasses a diverse array of form factors tailored to distinct user preferences and clinical needs. Devices range from Completely In Canal variants, prized for maximal discretion and direct acoustic delivery, to Full Shell configurations that provide robust amplification for severe loss. Intermediate designs such as In The Canal and Invisible In Canal models achieve a balance between battery longevity and unobtrusiveness, whereas Mini Canal options optimize size for moderate hearing deficits. These distinctions reflect engineering trade-offs in component miniaturization, battery capacity, and acoustic output, enabling precise alignment with individual hearing profiles and lifestyle expectations

Equally pivotal is the choice of distribution pathway, technology platform, and performance tier. Clinical settings remain a cornerstone for fitting and customization, with audiology and ENT practices facilitating professional consultations and precision programming. Simultaneously, direct-to-consumer channels-including manufacturer websites and third-party e-commerce-cater to digitally engaged buyers seeking convenience, while retail pharmacies and specialty stores address walk-in customers with immediate product availability. Analog models coexist with digital counterparts, the latter encompassing Bluetooth-enabled systems that allow smartphone control and wireless streaming. Within digital offerings, segments differentiate further between Bluetooth Connectivity and Non-Bluetooth Connectivity, underscoring the premium placed on seamless device interoperability and remote adjustability, as evidenced by the growth of the U.S. Bluetooth hearing aids market to USD 5.5 billion in 2023

Additional layers of segmentation refine market targeting, including performance and price stratification alongside power and amplification requirements. Economy, Standard, and Premium lines delineate varying levels of sound processing sophistication, noise management capabilities, and warranty support. Corresponding price ranges span Budget, Mid Price, and High Price brackets to align with consumer budgets and perceived value propositions. Battery preferences bifurcate between Disposable and Rechargeable designs, the latter gaining traction for sustainability and ease of use. Finally, degree-of-hearing-loss segmentation-from mild through moderate to severe and profound-drives device specifications such as maximum output, feedback suppression, and specialized fittings, ensuring that each user receives an optimized solution for their unique audiological condition.

This comprehensive research report categorizes the Canal Hearing Aids market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Performance Level

- Price Range

- Battery Type

- Degree Of Hearing Loss

- Distribution Channel

Unearthing Regional Market Dynamics in the Americas, EMEA, and Asia-Pacific That Shape Canal Hearing Aid Adoption and Innovation

The Americas region continues to lead global adoption of canal hearing devices, underpinned by robust healthcare infrastructure, widespread insurance coverage, and a tech-savvy consumer base. In the United States, hearing aid penetration among adults with hearing loss reached approximately 38 percent in 2023, significantly outpacing global averages and reinforcing North America’s position as the largest regional market. This leadership is further amplified by early regulatory moves such as over-the-counter hearing aid regulations, which have lowered barriers to entry and fueled interest among first-time users and price-sensitive segments, validating the effectiveness of accessible direct-to-consumer channels

In Europe, Middle East & Africa, the market environment is shaped by heterogeneous reimbursement frameworks and a concentration of leading manufacturers, particularly in Denmark and Germany. Comprehensive national health plans in many European countries provide substantial subsidies for canal hearing aids, driving high adoption rates across diverse consumer income levels. Moreover, the region benefits from a strong R&D ecosystem, where collaboration between regulatory bodies and industry consortia has accelerated the development of next-generation digital and AI-enabled devices, positioning EMEA as both a innovation hub and a critical export base for global distribution

Asia-Pacific represents the fastest-growing market for canal hearing devices, propelled by rapidly aging populations in Japan, South Korea, and China, as well as improving per-capita healthcare expenditures. Japan’s Bluetooth-enabled canal hearing aid segment is projected to grow at a CAGR of 8.3 percent, reflecting high digital literacy among seniors and strong consumer demand for seamless integration with personal devices. In emerging economies such as India and Southeast Asia, growing awareness of hearing health and expanding primary care networks are creating new opportunities for both premium and budget-friendly models, underscoring the strategic importance of customized distribution strategies and local partnerships

This comprehensive research report examines key regions that drive the evolution of the Canal Hearing Aids market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Pressures and Collaborative Opportunities Among Leading Canal Hearing Aid Manufacturers and Innovators

The canal hearing aid industry remains highly consolidated, with the top five global manufacturers-Sonova, Demant, GN Store Nord, Starkey, and Widex-controlling nearly 99 percent of the market. This oligopolistic structure is underpinned by substantial R&D investments, long-standing clinical relationships, and comprehensive service networks that reinforce brand loyalty and economies of scale. Despite their dominance, these legacy players are actively pursuing agile product lines, integrating AI-driven features, and expanding direct-to-consumer digital platforms to capture emerging segments and defend against new entrants

New entrants and technology ecosystem players are reshaping competitive dynamics by emphasizing affordability, aesthetics, and multifunctionality. Consumer electronics giants and startups alike are partnering with healthcare specialists to introduce hybrid solutions, such as smart earbuds with programmable hearing profiles and tele-audiology support. Notably, Apple’s introduction of hearing assistance features in the AirPods Pro illustrates the potential for cross-industry alliances to broaden market reach and normalize hearing technology within mainstream wearable categories, signaling a transformative shift in consumer perception and product convergence

This comprehensive research report delivers an in-depth overview of the principal market players in the Canal Hearing Aids market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amplifon S.p.A.

- Audina Hearing Instruments, Inc.

- Beltone Hearing Aid Company

- Bernafon AG

- Demant A/S

- Eargo, Inc.

- GN Hearing A/S

- Hansaton Akustik GmbH

- MED‑EL Medical Electronics GmbH

- Oticon A/S

- Siemens Audiologische Technik AG

- Sonic Innovations, Inc.

- Sonova Holding AG

- Starkey Hearing Technologies, Inc.

- Unitron Hearing Inc.

- Widex A/S

- WS Audiology

Strategic Roadmap with Actionable Recommendations to Navigate Tariffs, Technology Disruptions, and Shifting Consumer Demands

Industry leaders should prioritize proactive supply chain strategies to buffer against tariff volatility and component shortages. By diversifying production footprints and negotiating advanced tariff advisory services, companies can mitigate potential cost inflations and maintain stable pricing for consumers. Simultaneously, strategic stocking of critical components ahead of regulatory changes will safeguard manufacturing continuity and enable timely product launches.

Leaders must also implement robust digital and telehealth capabilities to enhance patient engagement and service delivery. Leveraging AI-powered remote fitting platforms and mobile apps for real-time adjustments can extend clinical reach into underserved and rural areas. Aligning customer service models with omnichannel expectations will elevate user satisfaction and foster long-term loyalty among digitally adept demographics.

Finally, accelerating collaborative innovation through strategic partnerships will distinguish market participants. Forming alliances with consumer electronics firms, health technology developers, and academic institutions can expedite the integration of advanced features such as biometric monitoring, environmental sensing, and immersive audio experiences. Cultivating these synergies will not only differentiate product portfolios but also unlock new revenue streams through service-based offerings and subscription models.

Comprehensive Research Methodology Outlining Multi-Source Data Collection, Validation Techniques, and Analytical Frameworks

To inform these insights, a rigorous mixed-methods research approach was employed, combining extensive secondary data analysis with targeted primary interviews. Secondary sources included peer-reviewed journals, regulatory filings, industry publications, and public health databases to ensure comprehensive contextual understanding.

Primary data collection involved structured interviews with leading audiologists, supply chain experts, and senior executives from major hearing aid manufacturers, capturing firsthand perspectives on market dynamics, technological trends, and strategic priorities. Responses were systematically coded and triangulated against quantitative data to validate findings and identify areas of consensus.

Quantitative modeling utilized a bottom-up framework, segmenting device shipments and revenue by form factor, technology, and geography. Qualitative insights enriched this model by integrating stakeholder feedback on regulatory impacts, consumer behavior, and distribution shifts. Together, these methodologies provided a robust analytical foundation for generating actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Canal Hearing Aids market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Canal Hearing Aids Market, by Product Type

- Canal Hearing Aids Market, by Technology

- Canal Hearing Aids Market, by Performance Level

- Canal Hearing Aids Market, by Price Range

- Canal Hearing Aids Market, by Battery Type

- Canal Hearing Aids Market, by Degree Of Hearing Loss

- Canal Hearing Aids Market, by Distribution Channel

- Canal Hearing Aids Market, by Region

- Canal Hearing Aids Market, by Group

- Canal Hearing Aids Market, by Country

- United States Canal Hearing Aids Market

- China Canal Hearing Aids Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesis of Key Findings and Forward-Looking Conclusion Highlighting Opportunities and Imperatives for Canal Hearing Aid Stakeholders

In summary, canal hearing aids are at the forefront of a pivotal inflection in hearing healthcare, driven by demographic needs, digital enhancements, and evolving market regulations. The confluence of miniaturized form factors, AI-driven signal processing, and omnichannel distribution has transitioned these devices from specialized clinical tools to mainstream consumer health solutions.

However, ongoing uncertainties-most notably potential adjustments in U.S. tariff policies and shifting reimbursement landscapes-require industry stakeholders to remain agile and strategically vigilant. By embracing supply chain resilience, digital capabilities, and collaborative innovation, manufacturers and service providers can not only navigate emerging challenges but also capitalize on expanding opportunities.

Ultimately, the future of canal hearing aids will be defined by those who seamlessly integrate clinical efficacy with consumer-centric design and technology, paving the way for broader accessibility and enhanced quality of life for individuals with hearing loss.

Secure Your Competitive Advantage Today by Engaging Ketan Rohom for Exclusive Market Research Insights and Report Acquisition

To gain a comprehensive understanding and actionable market intelligence for canal hearing aids, connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings deep expertise in audiology market analysis and strategic insights tailored to your business objectives.

Secure your copy of the full market research report today to access granular segmentation data, regional forecasts, and competitive benchmarking. Reach out directly to Ketan Rohom to discuss customized report offerings, sample executive summaries, and partnership opportunities suited to your organization’s growth goals.

Don’t miss the opportunity to leverage exclusive data and expert recommendations that can inform your product strategy and unlock new market potentials in the canal hearing aid sector.

- How big is the Canal Hearing Aids Market?

- What is the Canal Hearing Aids Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?