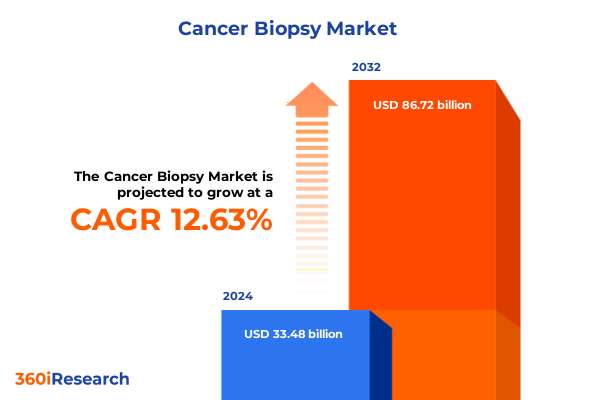

The Cancer Biopsy Market size was estimated at USD 37.76 billion in 2025 and expected to reach USD 42.59 billion in 2026, at a CAGR of 12.98% to reach USD 88.72 billion by 2032.

Pioneering Innovations in Cancer Tissue Sampling and Precision Diagnostics to Accelerate Clinical Decision Making in Diverse Care Environments

The landscape of cancer tissue sampling has undergone a profound evolution as the demand for precise and minimally invasive diagnostic solutions continues to rise. Innovations in biopsy instrumentation and procedural protocols have been catalyzed by advances in imaging modalities, digital pathology, and an unwavering focus on enhancing patient outcomes. As clinical stakeholders strive to reduce procedural risk and improve diagnostic yield, the broader healthcare environment has witnessed a convergence of technological breakthroughs and procedural standardization that collectively redefine best practices in cancer diagnosis. In this context, the role of advanced biopsy solutions has never been more critical for enabling timely, tissue-based decision making.

Against this backdrop, the introduction of fine needle aspiration and core needle systems has been complemented by development of vacuum-assisted and robotic platforms, each designed to address specific clinical requirements and anatomical considerations. Clinicians now navigate a diverse suite of tools to optimize sample quality while modulating patient comfort, procedural duration, and overall safety. Coupled with the integration of real-time imaging guidance, these multidimensional advances empower multidisciplinary care teams to accelerate diagnostic workflows, ultimately translating into more personalized treatment pathways and improved prognoses for individuals facing a cancer diagnosis.

Navigating Groundbreaking Technological and Clinical Paradigm Shifts in Cancer Biopsy to Redefine Diagnostic Accuracy and Patient-Centric Treatment Pathways

Clinical realities and emerging technologies are converging to usher in a new era of cancer biopsy, characterized by unprecedented levels of diagnostic precision and procedural efficiency. The rise of imaging-guided sampling techniques has fundamentally altered the biopsy paradigm, shifting from manual freehand approaches toward methods that leverage real-time ultrasound, MRI, CT, and PET guidance. These imaging innovations not only enhance lesion localization but also reduce sampling variability, enabling clinicians to obtain high-quality specimens from challenging anatomical sites.

At the same time, the integration of robotic assistance is redefining procedural reproducibility and ergonomic performance. By providing stable instrument control with sub-millimeter accuracy, robotic platforms minimize human error and mitigate fatigue during complex interventions. Moreover, synergies between digital pathology software and machine learning algorithms are transforming post-procedure workflows, facilitating rapid tissue characterization and predictive analytics. Taken together, these transformative shifts are painting a future in which biopsy procedures become safer, faster, and more closely aligned with the goals of precision oncology.

Analyzing the Impact of United States Tariff Policies on Cancer Biopsy Equipment Supply Chains, Pricing Structures, and Market Competitive Dynamics

The introduction of revised United States tariff policies in early 2025 represents a pivotal moment for the cancer biopsy device ecosystem, with ripple effects that extend across global supply chains, pricing frameworks, and competitive positioning. Manufacturers reliant on imported raw materials and finished instrument components have confronted incremental cost pressures, compelling procurement teams to reassess supplier relationships and explore alternative sourcing strategies. In response, some leading developers have announced capacity expansions at domestic facilities to offset import duties, while others are strategically diversifying their vendor base to preserve margin integrity.

These adjustments coincide with intensifying scrutiny from healthcare purchasers seeking value-based solutions, creating a complex interplay between cost containment and clinical efficacy. Importers and distributors have absorbed a portion of the tariff burden, in certain instances electing to offer temporary rebates to key accounts to sustain volume momentum. However, the net effect remains an upward shift in end-user pricing, particularly for sophisticated imaging-guided and robotic-compatible biopsy systems. As the market adapts, stakeholders will need to balance regulatory imperatives with investment in innovation to maintain competitive relevance.

Unveiling Critical Biopsy Market Segmentation Perspectives to Illuminate Growth Drivers, Specialty Applications, and Technology Adoption Trends for Strategic Advantage

A nuanced understanding of product type segmentation reveals distinct trajectories for each tissue sampling modality, shaped by evolving clinical preferences and procedural complexity. Core needle biopsy continues to hold prominence for its versatility across a broad range of lesion types, while fine needle aspiration remains a mainstay in cytology-driven workflows. Surgical excision procedures deliver the most comprehensive histological insights but are offset by extended recovery times. Vacuum-assisted systems, on the other hand, are experiencing heightened interest from centers aiming to optimize sample volume and minimize repeat interventions.

Dissecting application-based dynamics highlights the entrenched leadership of breast sampling, owing to established screening programs and well-defined reimbursement pathways. Yet surging demand in hepatic, pulmonary, prostatic, and thyroid biopsy reflects broader oncology trends toward aggressive screening and early-stage intervention. On the technology front, imaging-guided platforms dominate procedure volumes, though manual freehand approaches persist in outpatient settings where cost sensitivity prevails. Robotic-assisted systems are carving out high-acuity niches, particularly for anatomically challenging targets. From an end-user perspective, hospital environments retain the largest procedure share; however, ambulatory surgical centers and diagnostic imaging facilities are rapidly expanding their footprint, championing tailored service models for efficient patient throughput.

This comprehensive research report categorizes the Cancer Biopsy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Mapping Regional Dynamics in Cancer Tissue Sampling Markets to Reveal Key Opportunities, Regulatory Influences, and Infrastructure Maturity across Major Global Zones

North American markets exhibit a robust appetite for innovative biopsy platforms, underpinned by advanced reimbursement frameworks, integrated healthcare delivery models, and a proactive stance toward digital transformation. The United States, in particular, sustains leadership through early technology adoption and substantial clinical trial activity. Shifting focus to Europe, Middle East, and Africa, one observes a heterogeneous environment in which regulatory harmonization under CE marking coexists with variable infrastructure maturity. Western European nations demonstrate high procedural volumes and streamlined pathways, whereas emerging regions within the Middle East are witnessing infrastructure investments that catalyze future uptake.

In the Asia-Pacific corridor, a surge of government-backed healthcare initiatives is fueling capacity expansion in China, India, and Southeast Asia. Japan’s well-established oncology ecosystem embraces cutting-edge biopsy innovations with clinician-driven pilot studies and reimbursement support. Meanwhile, Australia is consolidating its role as a regional innovation hub, integrating telepathology and digital reporting across urban and rural facilities. Collectively, these regional narratives underscore the imperative for tailored market entry strategies that align with divergent regulatory, economic, and clinical landscapes.

This comprehensive research report examines key regions that drive the evolution of the Cancer Biopsy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Landscape Shaping Cancer Biopsy Innovation Trajectories and Strategic Collaborations among Leading Medical Device Manufacturers

The cancer biopsy market is navigated by a constellation of established medical device leaders and agile innovators, each vying to differentiate through technology depth, service integration, and strategic partnerships. Renowned corporations with comprehensive diagnostic portfolios leverage cross-divisional synergies to enhance distribution reach and clinical support services. Their global footprints and capital resources enable sustained investment in R&D initiatives, clinical validation studies, and targeted acquisitions.

Conversely, niche players are driving rapid advancements through focused offerings in imaging-guided needle cartridges, disposable robotic accessories, and proprietary sample preservation reagents. Strategic alliances between these specialists and larger system providers are increasingly common, reflecting a recognition that modular innovation can be paired with global commercialization capabilities. As the market matures, collaboration between platform developers, pathology vendors, and digital health companies will become central to delivering end-to-end solutions that streamline operational workflows and elevate diagnostic confidence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cancer Biopsy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Argon Medical Devices, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Danaher Corporation

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd.

- Guardant Health, Inc.

- Hologic, Inc.

- Illumina, Inc.

- Myriad Genetics, Inc.

- Natera, Inc.

- QIAGEN N.V.

- Thermo Fisher Scientific, Inc.

Offering Strategic Guidance for Industry Executives to Capitalize on Emerging Biopsy Technologies and Navigate Regulatory Pathways with Confidence

Industry leaders can seize growth avenues by deepening investments in next-generation imaging integration, including contrast-enhanced ultrasound and fusion modalities that amplify lesion characterization. At the same time, forging partnerships with artificial intelligence and digital pathology pioneers will enable accelerated diagnostic reporting and predictive risk stratification. Establishing dedicated centers of excellence in key geographic hubs can further reinforce brand visibility and clinician engagement, solidifying referral networks and procedural volumes.

To bolster resilience against supply chain shocks, stakeholders should evaluate dual-sourcing strategies and localized component manufacturing opportunities. Proactive dialogue with payers and policy makers is essential to shape reimbursement pathways that recognize the value of biopsy accuracy in reducing downstream treatment costs. Ultimately, a patient-centric approach-emphasizing comfort, safety, and streamlined care coordination-will differentiate providers and vendors alike in an increasingly value-driven marketplace.

Comprehensive Mixed Methodology Leveraging Expert Interviews, Clinical Data Analysis, and Rigorous Validation for Robust Market Intelligence

This analysis is grounded in a rigorous, mixed-method research design that integrates qualitative and quantitative data sources. Primary insights were derived from in-depth interviews with leading interventional radiologists, surgical oncologists, pathology directors, and procurement specialists. These conversations shed light on procedural workflows, technology preferences, and evolving clinical guidelines. Simultaneously, a systematic review of peer-reviewed journals, regulatory documentation, and conference proceedings was conducted to capture the latest empirical findings and innovation announcements.

To ensure the robustness of our conclusions, data triangulation protocols were applied, cross-checking reported figures against public financial disclosures and regulatory approvals. The research team further convened an external advisory panel to validate assumptions, refine analytical frameworks, and corroborate emerging trends. This comprehensive methodology underscores the credibility of the insights presented and supports actionable recommendations that align with stakeholder priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cancer Biopsy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cancer Biopsy Market, by Product Type

- Cancer Biopsy Market, by Technology

- Cancer Biopsy Market, by Application

- Cancer Biopsy Market, by End User

- Cancer Biopsy Market, by Region

- Cancer Biopsy Market, by Group

- Cancer Biopsy Market, by Country

- United States Cancer Biopsy Market

- China Cancer Biopsy Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Takeaways to Illuminate Strategic Imperatives and Future Prospects for Stakeholders Navigating the Complex Cancer Biopsy Diagnostic Ecosystem

In synthesizing the landscape of cancer biopsy, several strategic imperatives emerge for stakeholders intent on harnessing growth potential. First, the convergence of advanced imaging guidance and robotic assistance heralds a paradigm in which diagnostic precision is no longer a trade-off against procedural efficiency. Second, tariff-driven cost pressures necessitate adaptive supply strategies and domestic manufacturing investments to safeguard margin performance. Third, segmentation analysis underscores the importance of aligning product portfolios with application-specific demands, technology readiness levels, and end-user capabilities.

Looking ahead, the interplay between regional regulatory evolution and infrastructure development will define market access strategies. Collaboration among platform developers, digital pathology innovators, and clinical centers of excellence will be key to delivering integrated solutions that address the entire diagnostic continuum. By embracing these insights, organizations can sharpen their competitive positioning and deliver transformative biopsy solutions that elevate patient experiences and clinical outcomes.

Empower Your Strategic Decisions by Engaging with Associate Director Ketan Rohom to Secure Exclusive Access to In-Depth Cancer Biopsy Market Analysis Today

We appreciate your interest in unlocking the full potential of this comprehensive market intelligence and encourage you to connect directly with Associate Director Ketan Rohom to discuss how this report can inform your strategic roadmap. Engaging with him offers a tailored opportunity to explore specific segments, regional nuances, and emerging technologies in greater depth. By securing access today, you will gain a decisive edge in navigating the evolving cancer biopsy landscape and accelerate your organization’s ability to make data-driven decisions.

Reach out to schedule a personalized briefing, explore bespoke research add-ons, or arrange a demonstration of our analytical framework. Ketan Rohom is ready to guide you through the report’s insights and answer any questions to ensure you extract maximum value from this essential resource. Elevate your decision-making process and position your enterprise for success by purchasing the in-depth market research report without delay

- How big is the Cancer Biopsy Market?

- What is the Cancer Biopsy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?